Weekly Newsletter: https://www.quantseeker.com/

www.quantseeker.com/p/weekly-res...

www.quantseeker.com/p/weekly-res...

➢ Predicting Crypto Using Sentiment

➢ A Strategy Based on FX Mispricings

➢ Option-Based Return Predictors

➢ A Regime-Switching Model

➢ ...and much more.

👉 Join 5,000+ investors and quants:

www.quantseeker.com/p/weekly-res...

➢ Predicting Crypto Using Sentiment

➢ A Strategy Based on FX Mispricings

➢ Option-Based Return Predictors

➢ A Regime-Switching Model

➢ ...and much more.

👉 Join 5,000+ investors and quants:

www.quantseeker.com/p/weekly-res...

➢ Macro Announcement Risk Premia

➢ A Mean-Reversion Strategy

➢ Complex or Simple Models?

➢ Diversifying with Listed Real Estate

➢ Great Blogs, Repositories, and Podcasts

➢ ...and much more.

www.quantseeker.com/p/weekly-res...

➢ Macro Announcement Risk Premia

➢ A Mean-Reversion Strategy

➢ Complex or Simple Models?

➢ Diversifying with Listed Real Estate

➢ Great Blogs, Repositories, and Podcasts

➢ ...and much more.

www.quantseeker.com/p/weekly-res...

www.aqr.com/Insights/Res...

www.aqr.com/Insights/Res...

www.quantseeker.com/p/what-works...

www.quantseeker.com/p/what-works...

Some of the topics covered:

➢ Bond Return Predictability

➢ Timing Momentum

➢ Stock Return Predictability

➢ Disagreement in Option Markets

➢ Great blogs, repositories, and podcasts

➢ ...and much more

www.quantseeker.com/p/weekly-res...

Some of the topics covered:

➢ Bond Return Predictability

➢ Timing Momentum

➢ Stock Return Predictability

➢ Disagreement in Option Markets

➢ Great blogs, repositories, and podcasts

➢ ...and much more

www.quantseeker.com/p/weekly-res...

➢ Sector Exposure in Commodity Signals

➢ Earnings and Price Momentum

➢ Sector Allocation with LLMs

➢ Macro News Attention

➢ ...

Read more here:

www.quantseeker.com/p/weekly-res...

➢ Sector Exposure in Commodity Signals

➢ Earnings and Price Momentum

➢ Sector Allocation with LLMs

➢ Macro News Attention

➢ ...

Read more here:

www.quantseeker.com/p/weekly-res...

➢ Currency Anomalies

➢ Improving Momentum Strategies

➢ Finance Applications of LLMs

➢ Volatility Forecasting

➢ Great blogs, repositories, and podcasts

➢ ...

www.quantseeker.com/p/weekly-res...

➢ Currency Anomalies

➢ Improving Momentum Strategies

➢ Finance Applications of LLMs

➢ Volatility Forecasting

➢ Great blogs, repositories, and podcasts

➢ ...

www.quantseeker.com/p/weekly-res...

- Economic Uncertainty and Expected Returns

- Emerging Market Debt

- Predicting Overnight Returns

www.quantseeker.com/p/weekly-res...

- Economic Uncertainty and Expected Returns

- Emerging Market Debt

- Predicting Overnight Returns

www.quantseeker.com/p/weekly-res...

Topics:

➢ X-Asset Momentum

➢ Political Risk and Return Predictability

➢ LLMs and News Sentiment Trading

➢ Great blogs and podcasts

➢ ...

www.quantseeker.com/p/weekly-res...

Topics:

➢ X-Asset Momentum

➢ Political Risk and Return Predictability

➢ LLMs and News Sentiment Trading

➢ Great blogs and podcasts

➢ ...

www.quantseeker.com/p/weekly-res...

www.quantseeker.com/p/timing-vol...

www.quantseeker.com/p/timing-vol...

- Properties of Drawdowns

- News-Driven Commodity Trading

- Extracting Alpha from Crowding

www.quantseeker.com/p/weekly-res...

- Properties of Drawdowns

- News-Driven Commodity Trading

- Extracting Alpha from Crowding

www.quantseeker.com/p/weekly-res...

Topics:

➢ Overnight Stock Returns

➢ Factor Exposures and Quantile Regressions

➢ Asset Allocation and Macro Regimes

➢ Great blogs, repos, podcasts

➢ ...

www.quantseeker.com/p/weekly-res...

Topics:

➢ Overnight Stock Returns

➢ Factor Exposures and Quantile Regressions

➢ Asset Allocation and Macro Regimes

➢ Great blogs, repos, podcasts

➢ ...

www.quantseeker.com/p/weekly-res...

www.quantseeker.com/p/short-term...

www.quantseeker.com/p/short-term...

Generating Alpha from Analysts

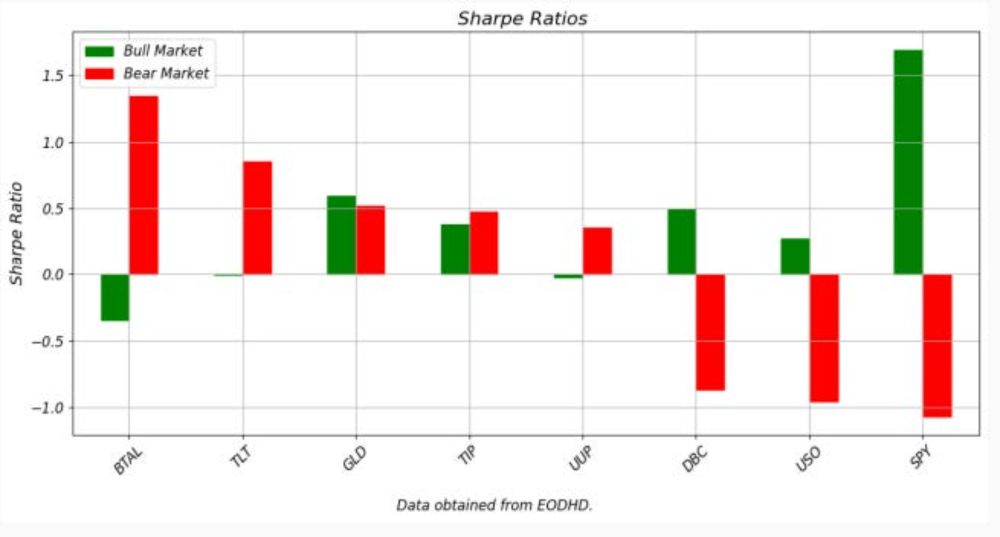

Protecting Against Inflation

Profiting from Macro Announcements

www.quantseeker.com/p/weekly-res...

Generating Alpha from Analysts

Protecting Against Inflation

Profiting from Macro Announcements

www.quantseeker.com/p/weekly-res...

Topics Covered:

➢ Predicting Commodity Returns

➢ Restoring the Value Premium

➢ ETF Momentum

➢ Great blogs, repositories, and podcasts

➢ ...

Join fellow investors:

www.quantseeker.com/p/weekly-rec...

Topics Covered:

➢ Predicting Commodity Returns

➢ Restoring the Value Premium

➢ ETF Momentum

➢ Great blogs, repositories, and podcasts

➢ ...

Join fellow investors:

www.quantseeker.com/p/weekly-rec...

www.quantseeker.com/p/trading-th...

www.quantseeker.com/p/trading-th...

www.quantseeker.com/p/exploiting...

www.quantseeker.com/p/exploiting...

Topics:

➢ Tail risk in oil markets

➢ Extracting sentiment with FinGPT

➢ The impact of gamma on volatility

➢ Portfolio construction

➢ Great blogs, repositories, and podcasts

➢ ...

www.quantseeker.com/p/weekly-rec...

Topics:

➢ Tail risk in oil markets

➢ Extracting sentiment with FinGPT

➢ The impact of gamma on volatility

➢ Portfolio construction

➢ Great blogs, repositories, and podcasts

➢ ...

www.quantseeker.com/p/weekly-rec...

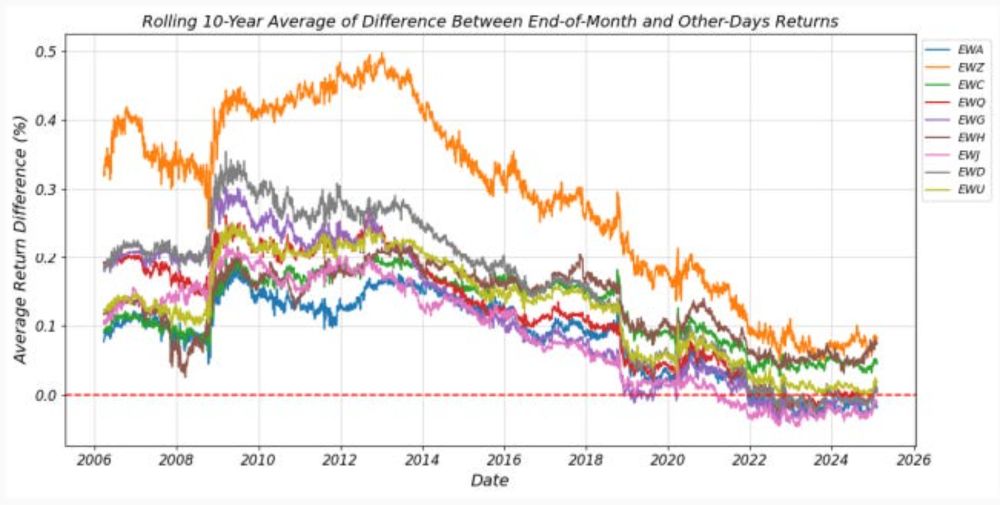

I explore key academic findings and test strategies across a range of ETFs. Are the returns still there?

www.quantseeker.com/p/turn-of-th...

I explore key academic findings and test strategies across a range of ETFs. Are the returns still there?

www.quantseeker.com/p/turn-of-th...

Topics Covered:

➢ Alpha in Premier League Betting

➢ Crypto

➢ Value Investing

➢ Seasonalities in Option Returns

➢ Large Language Models

➢ ...and much more

Read and join the community:

www.quantseeker.com/p/weekly-rec...

Topics Covered:

➢ Alpha in Premier League Betting

➢ Crypto

➢ Value Investing

➢ Seasonalities in Option Returns

➢ Large Language Models

➢ ...and much more

Read and join the community:

www.quantseeker.com/p/weekly-rec...

www.quantseeker.com/p/exploring-...

www.quantseeker.com/p/exploring-...

Read and join the community:

www.quantseeker.com/p/weekly-rec...

Read and join the community:

www.quantseeker.com/p/weekly-rec...