Quantifiable Edges

@quantifiableedges.bsky.social

Assessing Market Action Through Indicators & History

$NYSE volume is very light today. That is normal on days the stock market is open an the bond market is closed (Veteran's Day, Columbus Day). Don't make the mistake of reading into the low volume and thinking it is an indication of something more.

November 11, 2025 at 6:29 PM

$NYSE volume is very light today. That is normal on days the stock market is open an the bond market is closed (Veteran's Day, Columbus Day). Don't make the mistake of reading into the low volume and thinking it is an indication of something more.

This is the 3rd day in a row that we are seeing $VIX and $VX futures rise along with $SPX. Unusual action.

September 23, 2025 at 2:16 PM

This is the 3rd day in a row that we are seeing $VIX and $VX futures rise along with $SPX. Unusual action.

A bunch of Fed Day studies to help you prep for tomorrow... quantifiableedges.com/category/fed...

September 16, 2025 at 7:24 PM

A bunch of Fed Day studies to help you prep for tomorrow... quantifiableedges.com/category/fed...

Since the 9/11/2001 attacks and tragedy, September 11th has been a very strong day for the market. See study below, which will be included in tonight's subscriber letter. $SPX $SPY

September 11, 2025 at 1:46 AM

Since the 9/11/2001 attacks and tragedy, September 11th has been a very strong day for the market. See study below, which will be included in tonight's subscriber letter. $SPX $SPY

The Reversal Tendency of Labor Day Week: quantifiableedges.com/the-reversal... $SPX $SPY $QUANT $STUDY #seasonality

September 1, 2025 at 2:56 PM

The Reversal Tendency of Labor Day Week: quantifiableedges.com/the-reversal... $SPX $SPY $QUANT $STUDY #seasonality

First trading day of the month has generally been strong...except August: quantifiableedges.com/first-tradin... $SPX $SPY #seasonality $QUANT $STUDY

First trading day of the month has generally been strong…except August. | Quantifiable Edges

quantifiableedges.com

July 31, 2025 at 7:38 PM

First trading day of the month has generally been strong...except August: quantifiableedges.com/first-tradin... $SPX $SPY #seasonality $QUANT $STUDY

$SPX 21-day realized vol closing at lowest level (6.24) since July 2024. $VIX may seem low at 15, but it is almost 9 points above realized. Opportunities for real vol this week with earnings, $FED and jobs report. But if realized stays low through this, $VIX could be a good bit lower next week.

July 28, 2025 at 8:01 PM

$SPX 21-day realized vol closing at lowest level (6.24) since July 2024. $VIX may seem low at 15, but it is almost 9 points above realized. Opportunities for real vol this week with earnings, $FED and jobs report. But if realized stays low through this, $VIX could be a good bit lower next week.

$FED Day coming Wednesday. A few notes about Wed odds for you to prep as we approach... edge has been stronger with selling ahead of announcement. 3 examples: quantifiableedges.com/action-mon-t... and quantifiableedges.com/why-a-new-hi... and quantifiableedges.com/strong-selli...

July 28, 2025 at 12:52 AM

$FED Day coming Wednesday. A few notes about Wed odds for you to prep as we approach... edge has been stronger with selling ahead of announcement. 3 examples: quantifiableedges.com/action-mon-t... and quantifiableedges.com/why-a-new-hi... and quantifiableedges.com/strong-selli...

I really liked this recent paper, by Tom Carlson. It presents a interesting approach to a Defense First strategy. papers.ssrn.com/sol3/papers.... $QUANT $STUDY

July 16, 2025 at 12:59 PM

I really liked this recent paper, by Tom Carlson. It presents a interesting approach to a Defense First strategy. papers.ssrn.com/sol3/papers.... $QUANT $STUDY

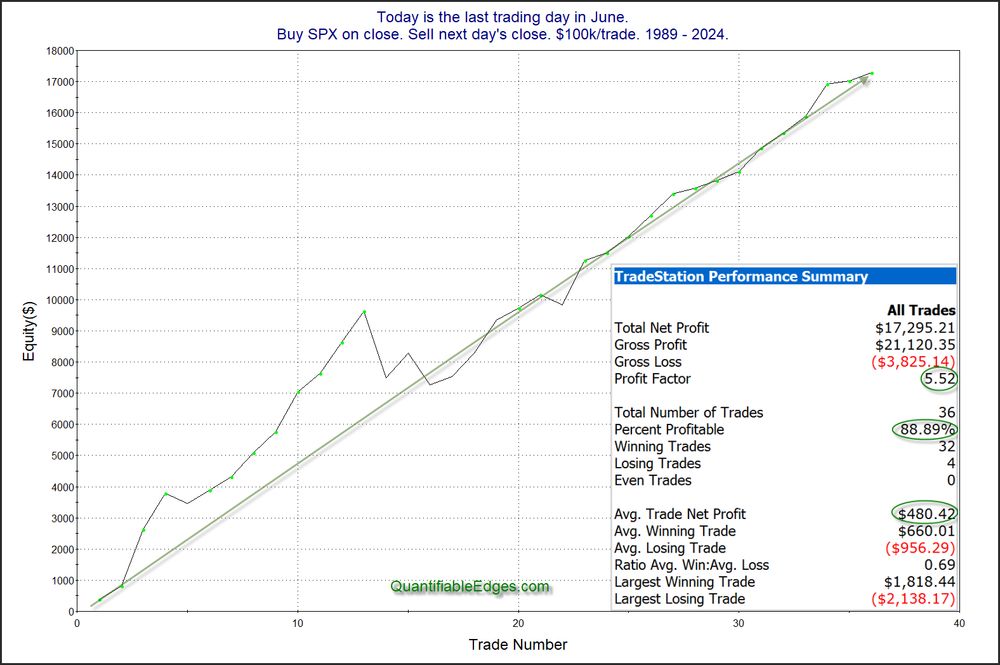

July has historically seen the best 1st day of any month. Performance from 1989 - 2024 can be seen in the attached chart. Note the last 14 years in a row have closed higher!

July 1, 2025 at 12:30 PM

July has historically seen the best 1st day of any month. Performance from 1989 - 2024 can be seen in the attached chart. Note the last 14 years in a row have closed higher!

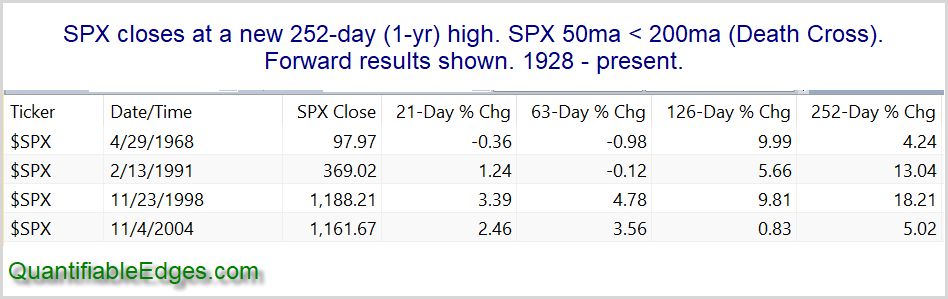

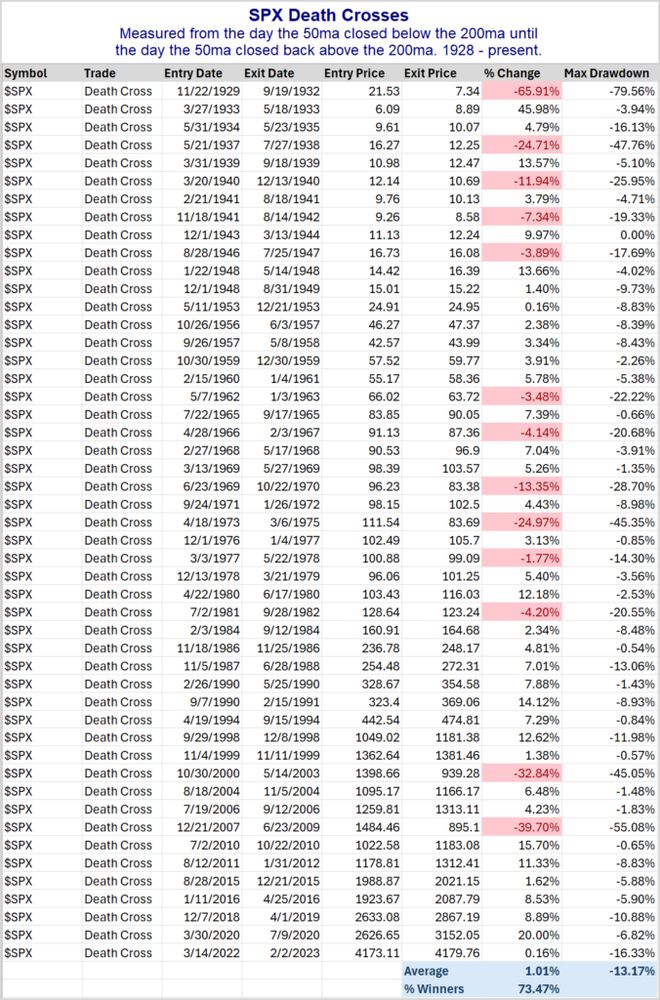

$SPX is very close to a new all-time high. Interestingly, the 50ma is still below the 200ma (Death Cross formation). It takes a sharp rally to accomplish that. I looked back and found only 4 previous instances where $SPX closed at a new high while Death Cross was still in effect. $SPY $QUANT $STUDY

June 26, 2025 at 3:35 PM

$SPX is very close to a new all-time high. Interestingly, the 50ma is still below the 200ma (Death Cross formation). It takes a sharp rally to accomplish that. I looked back and found only 4 previous instances where $SPX closed at a new high while Death Cross was still in effect. $SPY $QUANT $STUDY

One interesting aspect of Monday's action was how large the rally was compared to the recent range. $SPX moved from a 10-day low close on Fri to closing > 10ma. Only 10th time since 1961. Previous 9 showed no short-term edge. (Basically coinflip next few days.) Still interesting to me. $SPY $STUDY

June 23, 2025 at 9:29 PM

One interesting aspect of Monday's action was how large the rally was compared to the recent range. $SPX moved from a 10-day low close on Fri to closing > 10ma. Only 10th time since 1961. Previous 9 showed no short-term edge. (Basically coinflip next few days.) Still interesting to me. $SPY $STUDY

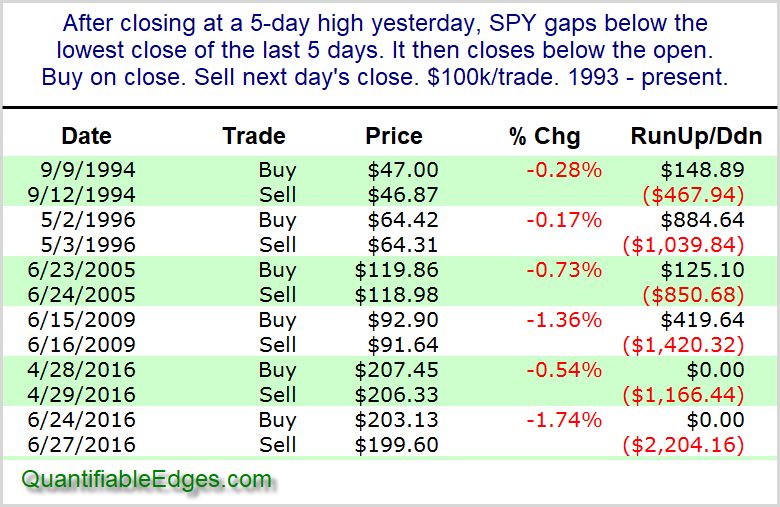

Here's an interesting little study that popped up while I was doing my research this weekend... $SPY $SPX $QUANT $STUDY

June 15, 2025 at 4:06 PM

Here's an interesting little study that popped up while I was doing my research this weekend... $SPY $SPX $QUANT $STUDY

Interesting podcast conversation between @menlobear and @McClellanOsc this weekend: youtu.be/8uysmVS66zg?...

Current Bear Market Rally To Bring "More Pain This Year" | Tom McClellan

WORRIED ABOUT THE MARKET? SCHEDULE YOUR FREE PORTFOLIO REVIEW with Thoughtful Money's endorsed financial advisors at https://www.thoughtfulmoney.comWall Stre...

youtu.be

May 27, 2025 at 1:12 PM

Interesting podcast conversation between @menlobear and @McClellanOsc this weekend: youtu.be/8uysmVS66zg?...

$TYX (30-yr treasury rate) currently at 5.07%. Hasn't closed above 5% since Oct 23 when it peaked at 5.1%.

May 21, 2025 at 2:25 PM

$TYX (30-yr treasury rate) currently at 5.07%. Hasn't closed above 5% since Oct 23 when it peaked at 5.1%.

$SPX gain currently is 2.5%. $VIX down almost 3 points to 19.2. $SPX 2.5% daily moves equate to $VIX about 40. So why is $VIX down so much? Answer: Perceived risk is gone. Trade war is "over". Nobody wants to pay up for SPX options 30-days out. I don't think $VIX will melt all summer... 1/2

May 12, 2025 at 4:02 PM

$SPX gain currently is 2.5%. $VIX down almost 3 points to 19.2. $SPX 2.5% daily moves equate to $VIX about 40. So why is $VIX down so much? Answer: Perceived risk is gone. Trade war is "over". Nobody wants to pay up for SPX options 30-days out. I don't think $VIX will melt all summer... 1/2

$VIX $VX futures (front 2 months) have not closed in contango since March 27th. Threatening to do so today with May just slightly above June as I type.

May 8, 2025 at 7:40 PM

$VIX $VX futures (front 2 months) have not closed in contango since March 27th. Threatening to do so today with May just slightly above June as I type.

During the 70s and 80s you might see moves persist for several days while $SPX was below its 200ma. 90s - now it has been rare. Since 1989, 3/20/2003 is the only other time until today $SPX has closed up 7 days in a row but < 200ma. $SPY

May 1, 2025 at 1:57 AM

During the 70s and 80s you might see moves persist for several days while $SPX was below its 200ma. 90s - now it has been rare. Since 1989, 3/20/2003 is the only other time until today $SPX has closed up 7 days in a row but < 200ma. $SPY

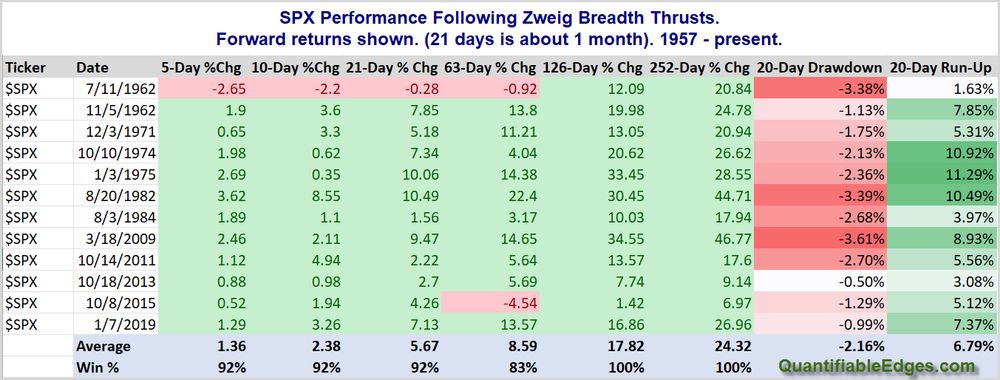

Thursday saw 2 strong breadth thrust signals trigger. I discussed them in the sub letter last night, but also in blog in recent past:

Zweig Breadth Thrust: quantifiableedges.com/a-look-at-zw...

Triple 70: quantifiableedges.com/triple-70-br... $SPX $SPY

Zweig Breadth Thrust: quantifiableedges.com/a-look-at-zw...

Triple 70: quantifiableedges.com/triple-70-br... $SPX $SPY

A Look At Zweig Thrust Signals | Quantifiable Edges

The strong breadth we have seen recently has caused the 10-day exponential moving average of the Up Issues % to rise up to 63.6%. A move through 61.5% after being below 40% within the last 10trading…

quantifiableedges.com

April 25, 2025 at 1:52 PM

Thursday saw 2 strong breadth thrust signals trigger. I discussed them in the sub letter last night, but also in blog in recent past:

Zweig Breadth Thrust: quantifiableedges.com/a-look-at-zw...

Triple 70: quantifiableedges.com/triple-70-br... $SPX $SPY

Zweig Breadth Thrust: quantifiableedges.com/a-look-at-zw...

Triple 70: quantifiableedges.com/triple-70-br... $SPX $SPY

$SPX will complete a "Death Cross" formation today. I updated my research in this blog post this morning: quantifiableedges.com/97-years-of-... $SPY $QUANT $STUDY

97 Years of Death Crosses | Quantifiable Edges

The SPX is going to experience a Death Cross today at the close. I’ve written many times in the past about “Death Crosses”. A Death Cross is when the 50ma crosses below the 200ma. It is confirmation…

quantifiableedges.com

April 14, 2025 at 3:26 PM

$SPX will complete a "Death Cross" formation today. I updated my research in this blog post this morning: quantifiableedges.com/97-years-of-... $SPY $QUANT $STUDY

May futures 6 points < Apr, so they are unlikely to drop much today.

VIX ETFs move with futures. Even big $SPX rally can't swim against this current, and $SVIX $VXX $UXVY not acting as they would with VIX contango in bull market environment when $SPX rallies.

2/2

VIX ETFs move with futures. Even big $SPX rally can't swim against this current, and $SVIX $VXX $UXVY not acting as they would with VIX contango in bull market environment when $SPX rallies.

2/2

Today is great example of poor environment for short-vol ETF trading:

Realized vol > $VIX. (VIX "undervalued" and less inclined to go down.)

VIX 4-5 points > front month (roll yield), so Apr futures unlikely to drop, since these will collide Wed morning with VIX.

1/2

Realized vol > $VIX. (VIX "undervalued" and less inclined to go down.)

VIX 4-5 points > front month (roll yield), so Apr futures unlikely to drop, since these will collide Wed morning with VIX.

1/2

April 11, 2025 at 6:34 PM

May futures 6 points < Apr, so they are unlikely to drop much today.

VIX ETFs move with futures. Even big $SPX rally can't swim against this current, and $SVIX $VXX $UXVY not acting as they would with VIX contango in bull market environment when $SPX rallies.

2/2

VIX ETFs move with futures. Even big $SPX rally can't swim against this current, and $SVIX $VXX $UXVY not acting as they would with VIX contango in bull market environment when $SPX rallies.

2/2

Today is great example of poor environment for short-vol ETF trading:

Realized vol > $VIX. (VIX "undervalued" and less inclined to go down.)

VIX 4-5 points > front month (roll yield), so Apr futures unlikely to drop, since these will collide Wed morning with VIX.

1/2

Realized vol > $VIX. (VIX "undervalued" and less inclined to go down.)

VIX 4-5 points > front month (roll yield), so Apr futures unlikely to drop, since these will collide Wed morning with VIX.

1/2

April 11, 2025 at 6:33 PM

Today is great example of poor environment for short-vol ETF trading:

Realized vol > $VIX. (VIX "undervalued" and less inclined to go down.)

VIX 4-5 points > front month (roll yield), so Apr futures unlikely to drop, since these will collide Wed morning with VIX.

1/2

Realized vol > $VIX. (VIX "undervalued" and less inclined to go down.)

VIX 4-5 points > front month (roll yield), so Apr futures unlikely to drop, since these will collide Wed morning with VIX.

1/2

Market on Wednesday: Yea! Tariffs delayed 90 days! Immediate uncertainty gone! All countries eager to negotiate?!? Risk is over! To the moon!

Market on Thursday: Wait...(sinking in)...you mean we have at least 90 more days of this crap?

Market on Thursday: Wait...(sinking in)...you mean we have at least 90 more days of this crap?

April 10, 2025 at 2:40 PM

Market on Wednesday: Yea! Tariffs delayed 90 days! Immediate uncertainty gone! All countries eager to negotiate?!? Risk is over! To the moon!

Market on Thursday: Wait...(sinking in)...you mean we have at least 90 more days of this crap?

Market on Thursday: Wait...(sinking in)...you mean we have at least 90 more days of this crap?

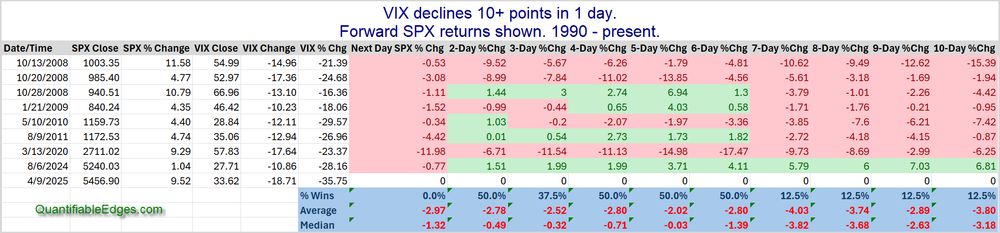

@vixologist pointed out that the $VIX 18-point drop Wed was the biggest ever. Here are all instances of 10+ point drops. Maybe it'll be different this time... $SPX $SPY

April 10, 2025 at 6:12 AM

@vixologist pointed out that the $VIX 18-point drop Wed was the biggest ever. Here are all instances of 10+ point drops. Maybe it'll be different this time... $SPX $SPY

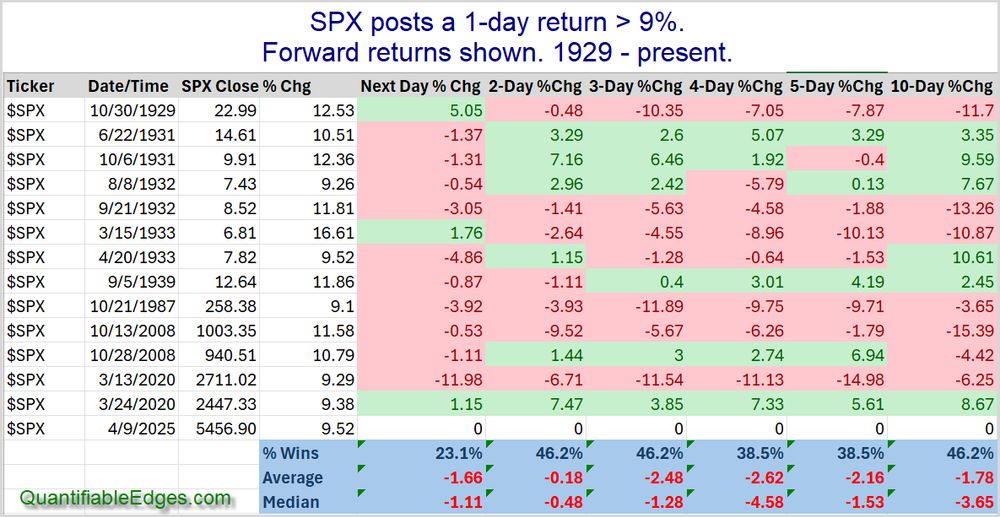

Here's a look at short-term returns following all other 1-day $SPX gains of 9% or more. $SPY

April 10, 2025 at 2:00 AM

Here's a look at short-term returns following all other 1-day $SPX gains of 9% or more. $SPY