Hopefully this can push perpetuals DEX-CEX market share to over 15%!

Hopefully this can push perpetuals DEX-CEX market share to over 15%!

1. Optimal arbitrage is easy

2. Pools are easy to delta hedge

3. Choosing fees to make a healthy equilibrium between lenders and traders is possible

2) and 3) together explain the empirical observation that these pools are easier to hedge than CFMMs

1. Optimal arbitrage is easy

2. Pools are easy to delta hedge

3. Choosing fees to make a healthy equilibrium between lenders and traders is possible

2) and 3) together explain the empirical observation that these pools are easier to hedge than CFMMs

We write optimization problems that represent arbitrageurs trying to maximize yield by creating and redeeming LP shares, akin to interest rate arb

We write optimization problems that represent arbitrageurs trying to maximize yield by creating and redeeming LP shares, akin to interest rate arb

In the paper, we formalize a model that encompasses *all* of these pools and construct a simple iterative model for how they function and what they payout

In the paper, we formalize a model that encompasses *all* of these pools and construct a simple iterative model for how they function and what they payout

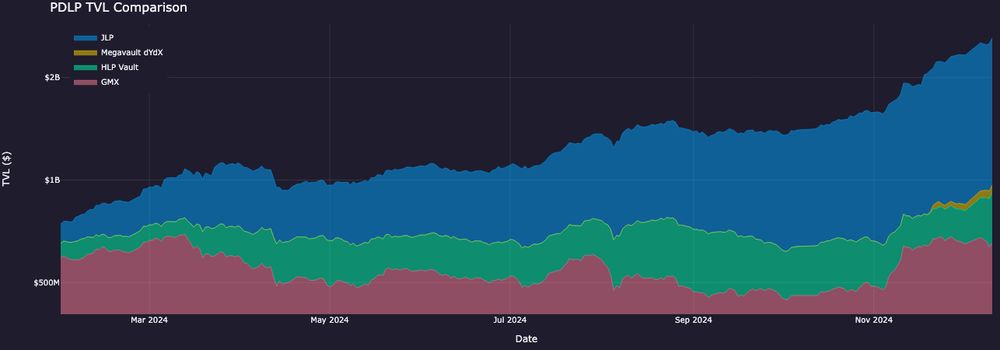

They’ve grown to >$2b, earning ~$750m in 2024 (37% yield!)

They’ve grown to >$2b, earning ~$750m in 2024 (37% yield!)

CEXs often provide short term loans that can only be used on their exchange — a form of margin lending that improves capital efficiency and indirectly tightens spreads

CEXs often provide short term loans that can only be used on their exchange — a form of margin lending that improves capital efficiency and indirectly tightens spreads

There is not hope for “hurr durr let’s do an AlphaFold token to fund research”

There is not hope for “hurr durr let’s do an AlphaFold token to fund research”

But without any form of accountability on the part of the recipient, this turns into the usual crypto grant grift game (c.f. OP governance)

But without any form of accountability on the part of the recipient, this turns into the usual crypto grant grift game (c.f. OP governance)