Real macro insights aren't overwhelming—they're focused, actionable, & P&L-boosting.

👉 pinebrookcap.com/subscribe

#Macro #Investing

https://x.com/maitian99/status/1969159462221975963

Real macro insights aren't overwhelming—they're focused, actionable, & P&L-boosting.

👉 pinebrookcap.com/subscribe

#Macro #Investing

https://x.com/maitian99/status/1969159462221975963

Institutional Level Results, Retail Price

👉 pinebrookcap.com/subscribe

#investing #trading #macro #gold

https://x.com/EconstratPB/status/1985754753540718630/photo/2

Institutional Level Results, Retail Price

👉 pinebrookcap.com/subscribe

#investing #trading #macro #gold

https://x.com/EconstratPB/status/1985754753540718630/photo/2

Find out why pros subscribe to our service: 👉 pinebrookcap.com/subscribe

#macro #investing #trading #NiceCallDavid

https://x.com/mark_dow/status/1991164397322920072

Find out why pros subscribe to our service: 👉 pinebrookcap.com/subscribe

#macro #investing #trading #NiceCallDavid

https://x.com/mark_dow/status/1991164397322920072

真正的宏观洞见并不令人应接不暇——它们专注、可操作,并提升损益。

👉 pinebrookcap.com/subscribe

#宏观 #投资

https://x.com/maitian99/status/1969159462221975963

真正的宏观洞见并不令人应接不暇——它们专注、可操作,并提升损益。

👉 pinebrookcap.com/subscribe

#宏观 #投资

https://x.com/maitian99/status/1969159462221975963

No weekly fluff—just high-impact analysis.

Join for premium content: 👉 pinebrookcap.com/subscribe

#Macro #Investing

https://x.com/wallyspop/status/1965776860643770690

No weekly fluff—just high-impact analysis.

Join for premium content: 👉 pinebrookcap.com/subscribe

#Macro #Investing

https://x.com/wallyspop/status/1965776860643770690

We released an institutional level US Economic Update stating "Pinebrook is back in risk-on mode".

Institutions pay 6 figs for analysis like ours. You can get it for a fraction of that price.

Prepare for 2026 by subscribing today - pinebrookcap.com

We released an institutional level US Economic Update stating "Pinebrook is back in risk-on mode".

Institutions pay 6 figs for analysis like ours. You can get it for a fraction of that price.

Prepare for 2026 by subscribing today - pinebrookcap.com

Subscribe for exclusive analysis: 👉 pinebrookcap.com/subscribe

#Macro #Investing 🙏 stevehou0

https://x.com/stevehou0/status/1796641316702495193

Subscribe for exclusive analysis: 👉 pinebrookcap.com/subscribe

#Macro #Investing 🙏 stevehou0

https://x.com/stevehou0/status/1796641316702495193

Dive into expert financial analysis and stay ahead of the market.

👉 Pinebrookcap.com/subscribe and get insights that matter.

#Finance #Investing

https://x.com/TexasOncologist/status/1985755503020867853

Dive into expert financial analysis and stay ahead of the market.

👉 Pinebrookcap.com/subscribe and get insights that matter.

#Finance #Investing

https://x.com/TexasOncologist/status/1985755503020867853

"The only sub I can say I made the right decision. David analysis is worth more than what the price tag."

Institutional Analysis at Retail Prices.

👉 pinebrookcap.com/subscribe

https://x.com/tnguy093/status/1831792860351623612

"The only sub I can say I made the right decision. David analysis is worth more than what the price tag."

Institutional Analysis at Retail Prices.

👉 pinebrookcap.com/subscribe

https://x.com/tnguy093/status/1831792860351623612

Real results, true transparency.

Ready to level up your portfolio? Subscribe now at pinebrookcap.com and see why our analysis is a game-changer. 🚀💼

https://x.com/coelhorenato/status/1831797011936637398

#macro #investing

Real results, true transparency.

Ready to level up your portfolio? Subscribe now at pinebrookcap.com and see why our analysis is a game-changer. 🚀💼

https://x.com/coelhorenato/status/1831797011936637398

#macro #investing

You? Just $80/mo.

Same edge: Fed pivots called early, live blotter, no-noise filters.

Retail investors welcome — level up now.

👉 https://www.pinebrookcap.com/p/start-here

#Macro #Investing

You? Just $80/mo.

Same edge: Fed pivots called early, live blotter, no-noise filters.

Retail investors welcome — level up now.

👉 https://www.pinebrookcap.com/p/start-here

#Macro #Investing

Subscribe to pinebrookcap.com to find out.

Receipts attached.

#investing #macro

Subscribe to pinebrookcap.com to find out.

Receipts attached.

#investing #macro

Mon: Empire Mfg

Tue: Import Prices, Industrial Prod

Wed: Housing Starts & Permits

Thu: Philly Fed

Fri: Michigan Sentiment

What news do you think will surprise us?

Get institutional analysis at a retail price: 👉 https://www.pinebrookcap.com/p/start-here

#investing

Mon: Empire Mfg

Tue: Import Prices, Industrial Prod

Wed: Housing Starts & Permits

Thu: Philly Fed

Fri: Michigan Sentiment

What news do you think will surprise us?

Get institutional analysis at a retail price: 👉 https://www.pinebrookcap.com/p/start-here

#investing

Are you bullish or bearish?

...or something crazier? #macro #investing

Are you bullish or bearish?

...or something crazier? #macro #investing

Finally, over the past decade gold basically hugs and reverts back to the 50dma. We have a few hundred points to go.

Finally, over the past decade gold basically hugs and reverts back to the 50dma. We have a few hundred points to go.

Here's a chart with price action from the last 10-days.

Classic lower highs, weakening bounce.

Whatever. It's a chart.

Here's a chart with price action from the last 10-days.

Classic lower highs, weakening bounce.

Whatever. It's a chart.

Made Substack’s “Top 20 rising in finance”.

Made Substack’s “Top 20 rising in finance”.

The narrow window for a cut was in June.

Oh see that 6500? 😂

The narrow window for a cut was in June.

Oh see that 6500? 😂

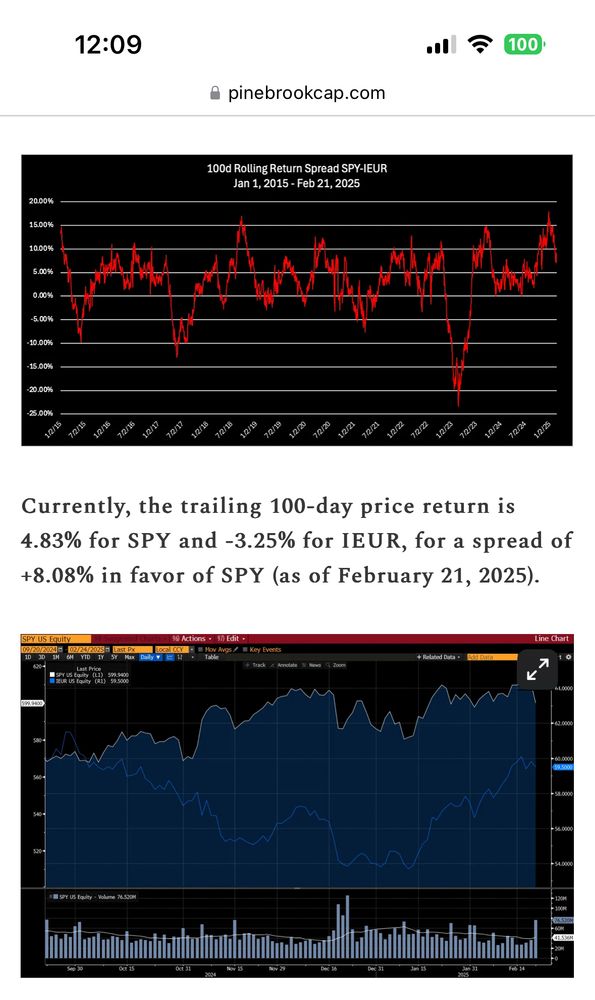

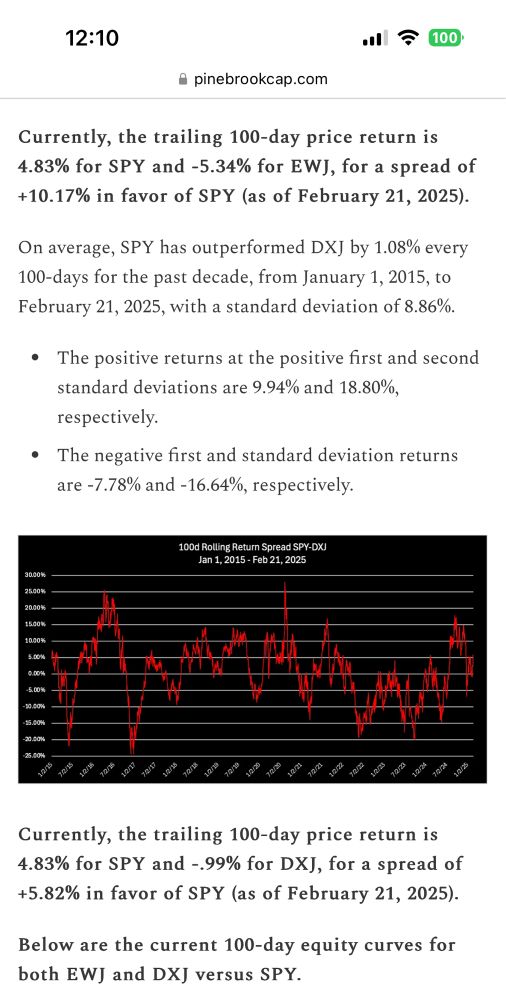

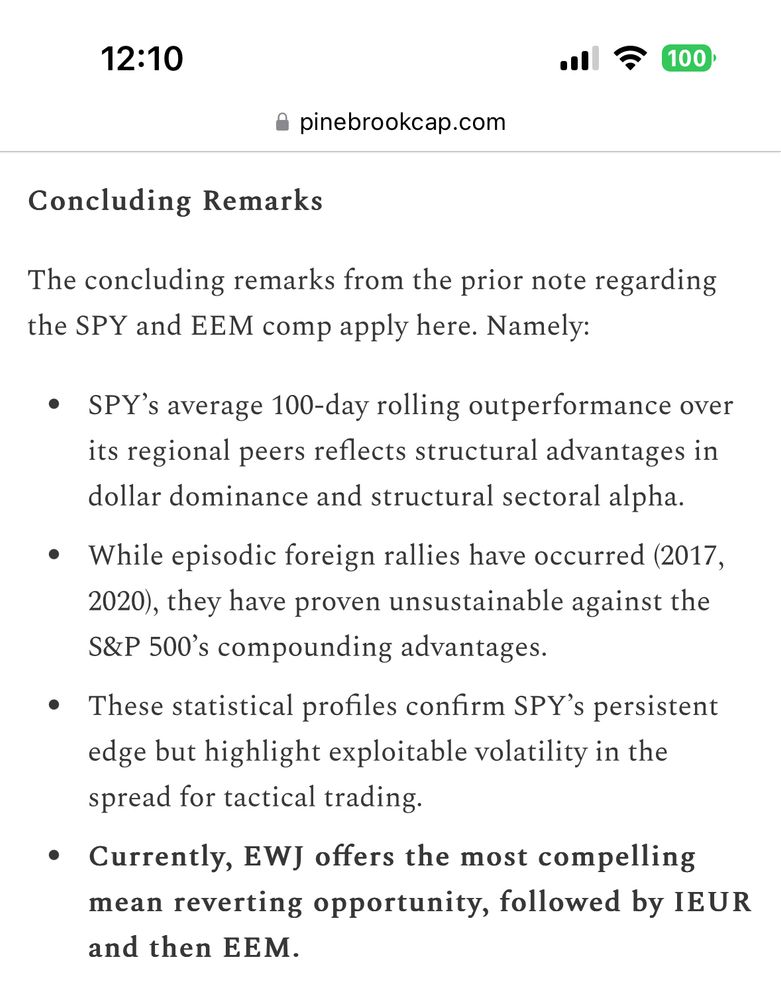

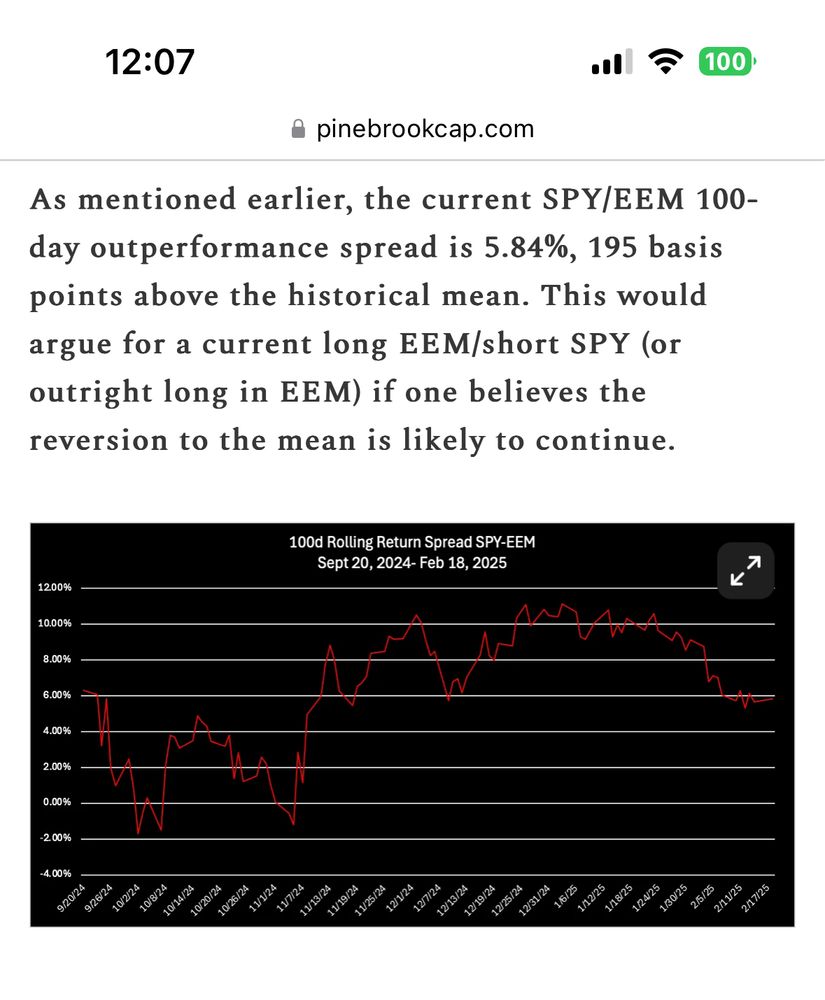

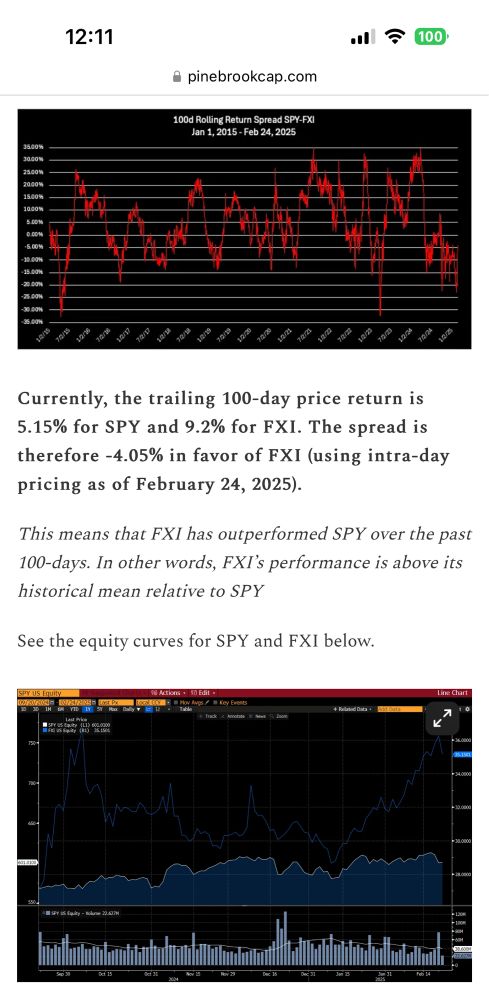

China and Europe are at negative 2 standard deviations compared to short USA.

Japan over 1-sigma. And EMM is approaching 1-sigma.

China and Europe are at negative 2 standard deviations compared to short USA.

Japan over 1-sigma. And EMM is approaching 1-sigma.