Pierre-Olivier Gourinchas

@pgourinchas.bsky.social

Research Director and Economic

Counsellor, International Monetary Fund

Counsellor, International Monetary Fund

To secure growth, countries must focus on what works: clear trade rules, fiscal discipline, robust policy frameworks, and investments in productivity. The alternative is slower, more volatile economic activity. www.imf.org/en/Publicati...

October 14, 2025 at 4:31 PM

To secure growth, countries must focus on what works: clear trade rules, fiscal discipline, robust policy frameworks, and investments in productivity. The alternative is slower, more volatile economic activity. www.imf.org/en/Publicati...

Our WEO analysis also shows that reducing policy uncertainty and lowering tariffs could lift global output by up to 0.7% in the near term. Clear trade rules and cooperation are more critical than ever. www.imf.org/en/Publicati...

World Economic Outlook, October 2025: Global Economy in Flux, Prospects Remain Dim

The latest World Economic Outlook reports a slowdown in global growth with risks remaining tilted to the downside. As new policies slowly come to focus, adjustment to the emerging landscape should be ...

www.imf.org

October 14, 2025 at 4:31 PM

Our WEO analysis also shows that reducing policy uncertainty and lowering tariffs could lift global output by up to 0.7% in the near term. Clear trade rules and cooperation are more critical than ever. www.imf.org/en/Publicati...

Other forces are at play: AI investment is booming, echoing the dot-com era, while China's property sector struggles and fiscal pressures mount. These dynamics create a complex, uneven recovery.

October 14, 2025 at 4:31 PM

Other forces are at play: AI investment is booming, echoing the dot-com era, while China's property sector struggles and fiscal pressures mount. These dynamics create a complex, uneven recovery.

Six months on, the tariff shock's impact has been smaller than expected thanks to agile supply chains and easy financial conditions. But with US tariffs still at almost 20% and tensions unresolved, the full effects will take time to unfold.

October 14, 2025 at 4:31 PM

Six months on, the tariff shock's impact has been smaller than expected thanks to agile supply chains and easy financial conditions. But with US tariffs still at almost 20% and tensions unresolved, the full effects will take time to unfold.

Despite these shifts, the international monetary system remains solidly anchored by the US dollar, which continues to provide global stability, even if the excess return on US foreign assets (the US 'exorbitant privilege') has declined over time. imf.org/en/Blogs/Art...

July 22, 2025 at 5:37 PM

Despite these shifts, the international monetary system remains solidly anchored by the US dollar, which continues to provide global stability, even if the excess return on US foreign assets (the US 'exorbitant privilege') has declined over time. imf.org/en/Blogs/Art...

Our policy recommendations call for prudence and improved collaboration. The first priority should be to restore a clear stable and predictable trade environment. Monetary policy must remain agile; rebuilding fiscal buffers is crucial, and structural reforms remain needed.

April 22, 2025 at 3:58 PM

Our policy recommendations call for prudence and improved collaboration. The first priority should be to restore a clear stable and predictable trade environment. Monetary policy must remain agile; rebuilding fiscal buffers is crucial, and structural reforms remain needed.

In the US, tariffs constitute a negative supply shock, with growth revised down and inflation revised up. For trading partners like China, tariffs are mostly a negative demand shock, with growth and inflation both revised down. www.imf.org/en/Publicati...

April 22, 2025 at 3:58 PM

In the US, tariffs constitute a negative supply shock, with growth revised down and inflation revised up. For trading partners like China, tariffs are mostly a negative demand shock, with growth and inflation both revised down. www.imf.org/en/Publicati...

Our report presents a range of global growth outlooks: Compared to the reference forecast, growth would have been higher under the pre-April 2 alternative, while the pause on April 9, even if permanent, does not significantly alter the negative impact on global growth.

April 22, 2025 at 3:58 PM

Our report presents a range of global growth outlooks: Compared to the reference forecast, growth would have been higher under the pre-April 2 alternative, while the pause on April 9, even if permanent, does not significantly alter the negative impact on global growth.

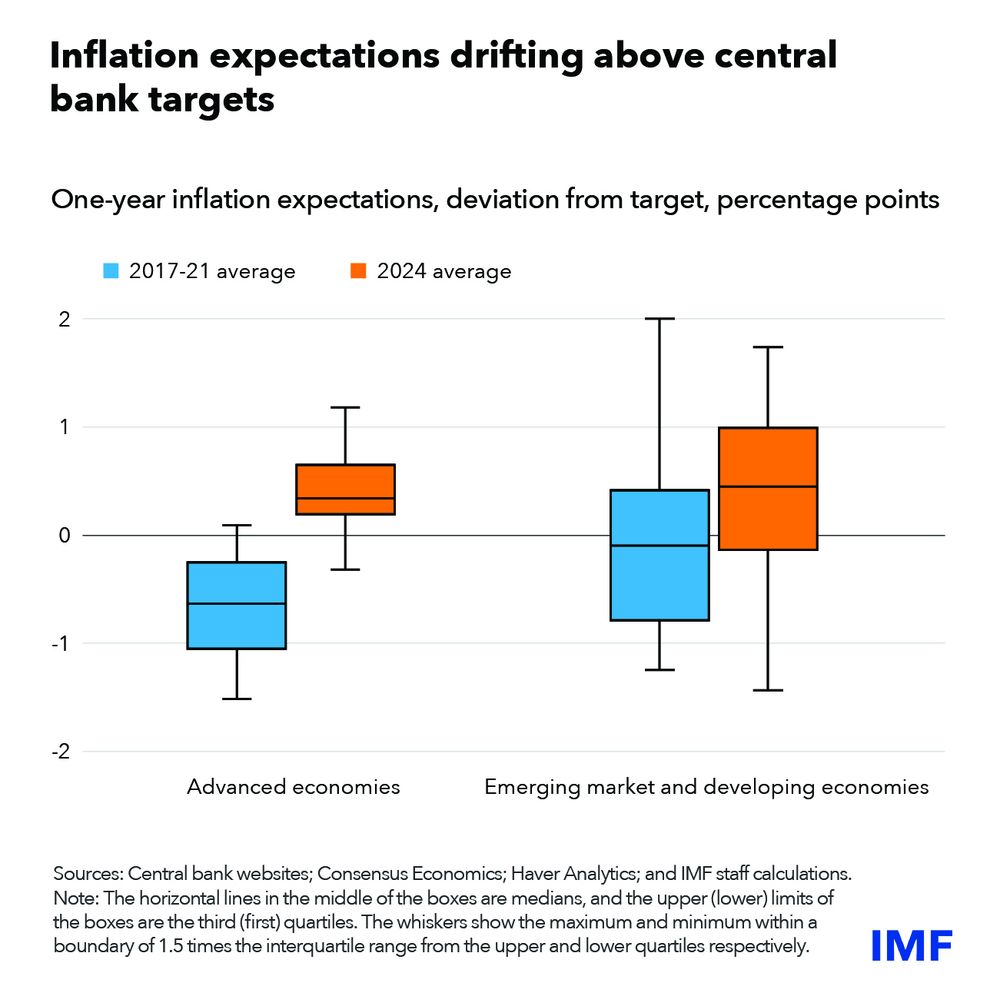

Policymakers should prioritize urgent fiscal policy adjustments and targeted structural reforms while maintaining price stability in an environment of fragile inflation expectations. Success in achieving sustainable global growth will require international cooperation. www.imf.org/en/Publicati...

January 17, 2025 at 6:41 PM

Policymakers should prioritize urgent fiscal policy adjustments and targeted structural reforms while maintaining price stability in an environment of fragile inflation expectations. Success in achieving sustainable global growth will require international cooperation. www.imf.org/en/Publicati...

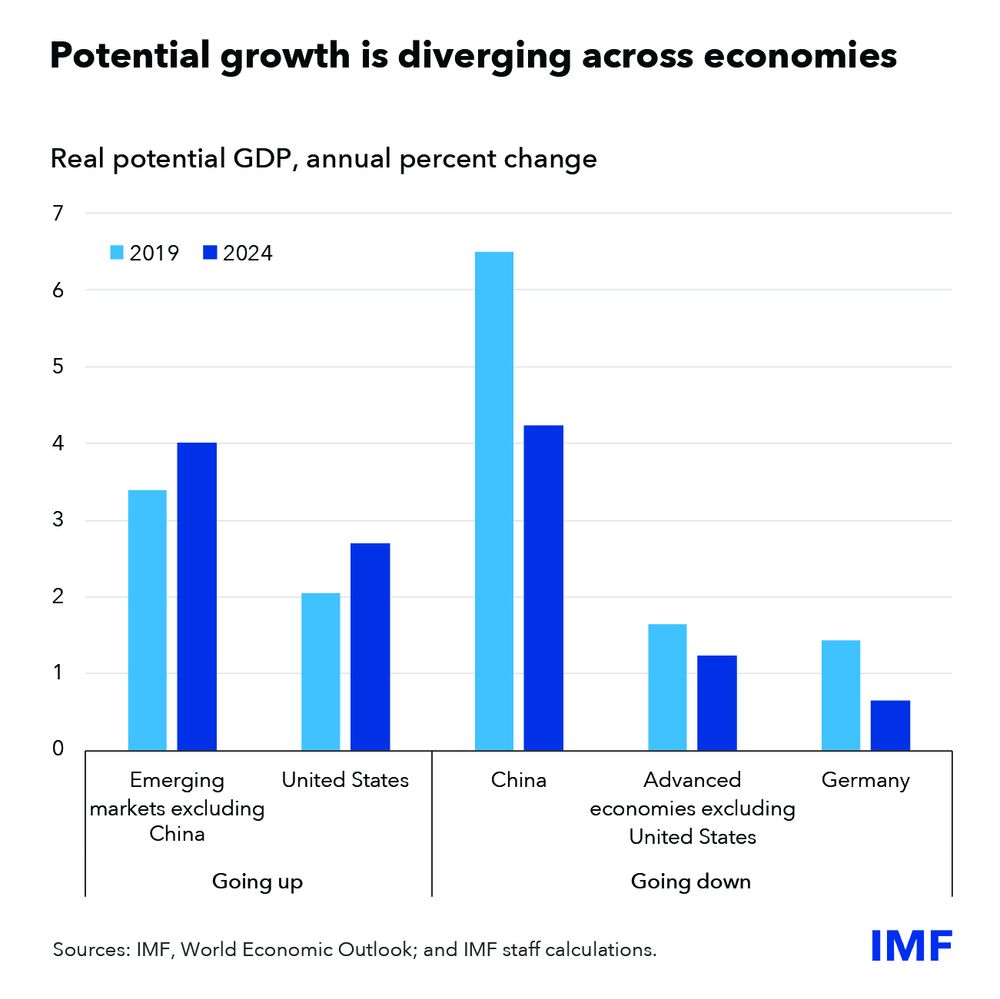

Persistent divergence between economies, reflects in part structural factors. The US shows stronger productivity growth, which has helped raise its potential growth compared to other countries. www.imf.org/en/Blogs/Art...

January 17, 2025 at 6:41 PM

Persistent divergence between economies, reflects in part structural factors. The US shows stronger productivity growth, which has helped raise its potential growth compared to other countries. www.imf.org/en/Blogs/Art...

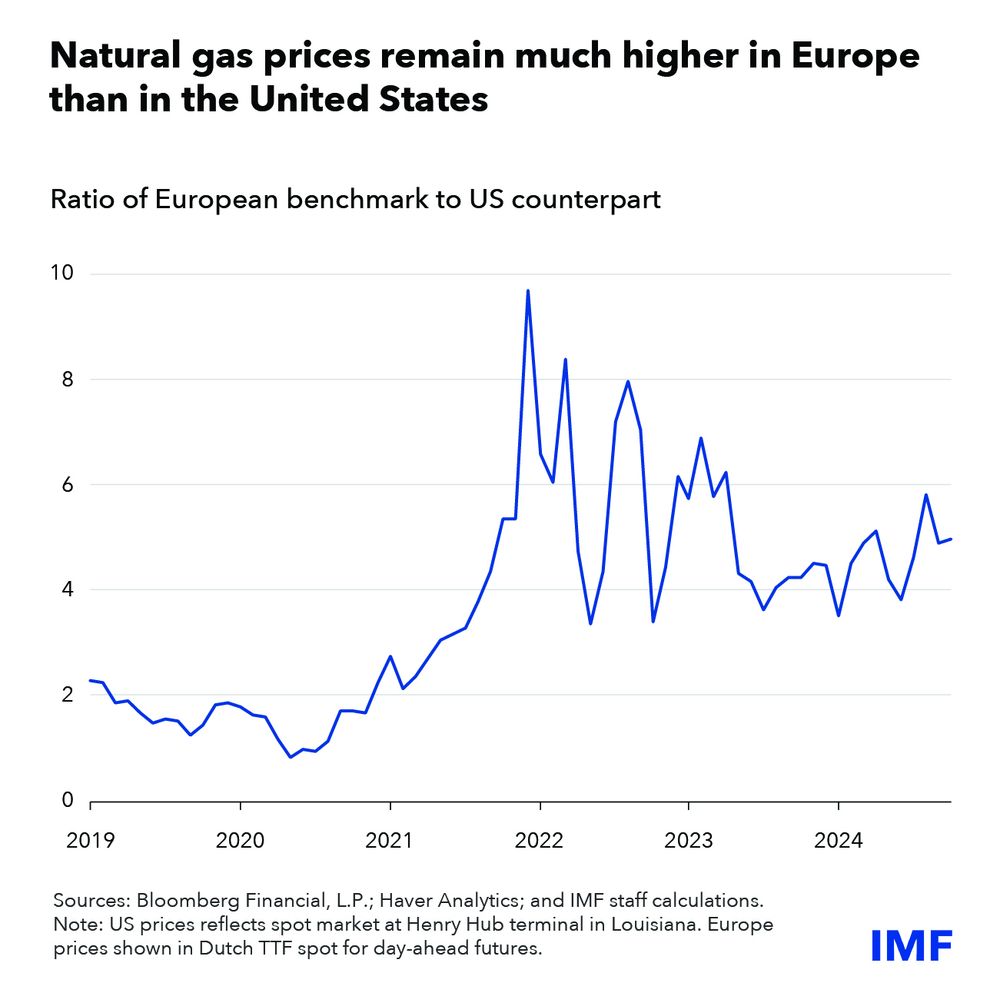

We have revised US growth up while the euro area faces headwinds from low consumer confidence and the persistence of the energy price shock. www.imf.org/en/Publicati...

January 17, 2025 at 6:41 PM

We have revised US growth up while the euro area faces headwinds from low consumer confidence and the persistence of the energy price shock. www.imf.org/en/Publicati...

The likelihood of a 'soft landing', disinflation without a major slowdown in economic activity, has increased. This is particularly the case in the United States, where we now forecast a modest increase in unemployment from 3.6% to 3.9% by 2025. 3/6

October 14, 2023 at 2:43 PM

The likelihood of a 'soft landing', disinflation without a major slowdown in economic activity, has increased. This is particularly the case in the United States, where we now forecast a modest increase in unemployment from 3.6% to 3.9% by 2025. 3/6

Our advice to policymakers? - Remain focused on price stability - Rebuild fiscal buffers - Reforms to boost productivity and fight dimming MT growth prospects - Improve international cooperation - Prevent costly geoeconomic fragmentation bit.ly/3Q4BMFc 6/6

October 14, 2023 at 2:42 PM

Our advice to policymakers? - Remain focused on price stability - Rebuild fiscal buffers - Reforms to boost productivity and fight dimming MT growth prospects - Improve international cooperation - Prevent costly geoeconomic fragmentation bit.ly/3Q4BMFc 6/6

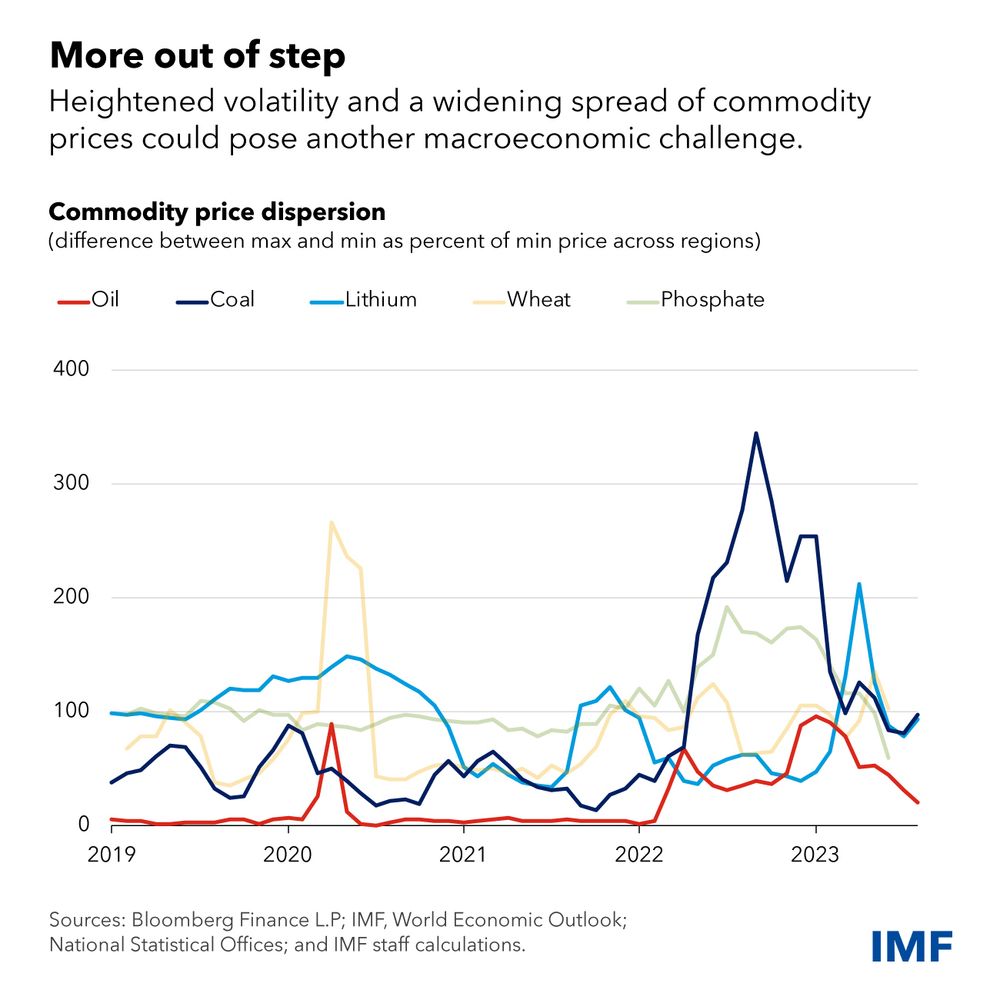

Commodity prices could become more volatile amid climate and geopolitical shocks, posing a serious risk to the disinflation path. Higher energy & food prices would bring greater hardship to low-income countries. Economic decoupling could also affect the climate transition. 5/6

October 14, 2023 at 2:41 PM

Commodity prices could become more volatile amid climate and geopolitical shocks, posing a serious risk to the disinflation path. Higher energy & food prices would bring greater hardship to low-income countries. Economic decoupling could also affect the climate transition. 5/6

Risks to the global economy persist. China's real estate crisis could intensify, posing a complex policy challenge. But it is important for China's economy to pivot away from growth driven by credit to the real estate sector. bit.ly/3PPpm2H 4/6

October 14, 2023 at 2:39 PM

Risks to the global economy persist. China's real estate crisis could intensify, posing a complex policy challenge. But it is important for China's economy to pivot away from growth driven by credit to the real estate sector. bit.ly/3PPpm2H 4/6

The likelihood of a 'soft landing', disinflation without a major slowdown in economic activity, has increased. This is particularly the case in the United States, where we now forecast a modest increase in unemployment from 3.6% to 3.9% by 2025. 3/6

October 14, 2023 at 2:38 PM

The likelihood of a 'soft landing', disinflation without a major slowdown in economic activity, has increased. This is particularly the case in the United States, where we now forecast a modest increase in unemployment from 3.6% to 3.9% by 2025. 3/6

Inflation is on a downward trend. Headline inflation continues to decline. Underlying 'core' inflation declines too, albeit more slowly. Most countries aren't likely to return to target inflation until 2025. bit.ly/3Q4BMFc 2/6

October 14, 2023 at 2:35 PM

Inflation is on a downward trend. Headline inflation continues to decline. Underlying 'core' inflation declines too, albeit more slowly. Most countries aren't likely to return to target inflation until 2025. bit.ly/3Q4BMFc 2/6