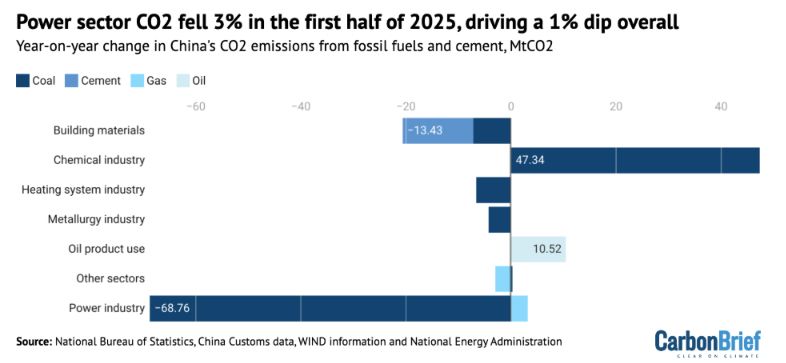

China's chemical industry, largely reliant on coal, remains the problem child.

www.carbonbrief.org/analysis-rec...

China's chemical industry, largely reliant on coal, remains the problem child.

www.carbonbrief.org/analysis-rec...

www.transportenvironment.org/uploads/file...

www.transportenvironment.org/uploads/file...

www.methanesat.org/project-upda...

www.methanesat.org/project-upda...

www.eib.org/attachments/...

www.eib.org/attachments/...

Overall, 28% of global GHG emissions are subject to direct carbon pricing, up from 24% a few years ago.

Overall, 28% of global GHG emissions are subject to direct carbon pricing, up from 24% a few years ago.

The EU ETS alone represented around 40% of total revenues in 2024, and it raised a cumulative $247.4 billion during the period 2010-2024.

The EU ETS alone represented around 40% of total revenues in 2024, and it raised a cumulative $247.4 billion during the period 2010-2024.

In contrast, climate adaptation terms have remained steady, more than doubling in usage from a decade prior.

In contrast, climate adaptation terms have remained steady, more than doubling in usage from a decade prior.

EUA’s drop below trend line that’s offered support since February 2024.

EUA’s drop below trend line that’s offered support since February 2024.

⬆️defence spending 🔫+ ⬆️coal-fired generation 🔥= ⬆️emissions 🏭

The upshot is that European business is pretty excited about it.

carbonrisk.substack.com/p/vollgas

⬆️defence spending 🔫+ ⬆️coal-fired generation 🔥= ⬆️emissions 🏭

The upshot is that European business is pretty excited about it.

carbonrisk.substack.com/p/vollgas

The decline in CO2 emissions under California's carbon market is also associated with a decline in air pollutants such as nitrous oxide (NOx) and sulphur dioxide (SOx).

The decline in CO2 emissions under California's carbon market is also associated with a decline in air pollutants such as nitrous oxide (NOx) and sulphur dioxide (SOx).

According to Carbon Brief, annual US emissions are likely to be around 1Gt CO2e higher in 2030 than under Biden, resulting in a cumulative addition of around 4Gt CO2e by the end of the decade.

According to Carbon Brief, annual US emissions are likely to be around 1Gt CO2e higher in 2030 than under Biden, resulting in a cumulative addition of around 4Gt CO2e by the end of the decade.

Spending your way to achieve net zero by 2050 could create unsustainably high levels of debt relative to GDP, according to the International Monetary Fund (IMF).

Spending your way to achieve net zero by 2050 could create unsustainably high levels of debt relative to GDP, according to the International Monetary Fund (IMF).

Worldwide natural disasters caused losses of $320bn in 2024, considerably higher than the inflation-adjusted average observed over the past 10 years ($236bn).

Worldwide natural disasters caused losses of $320bn in 2024, considerably higher than the inflation-adjusted average observed over the past 10 years ($236bn).