Peter Andre

@peterandre.bsky.social

Behavioral Economist, SAFE Frankfurt

https://www.peter-andre.com/

https://www.peter-andre.com/

📄 Dive into the paper for the full story:

Quick-Fixing: Near-Rationality in Consumption Savings Behavior

with Joel Flynn, George Nikalakoudis (who is on the job market!), and Karthik Sastry

papers.ssrn.com/sol3/papers....

Quick-Fixing: Near-Rationality in Consumption Savings Behavior

with Joel Flynn, George Nikalakoudis (who is on the job market!), and Karthik Sastry

papers.ssrn.com/sol3/papers....

November 15, 2024 at 4:31 PM

📄 Dive into the paper for the full story:

Quick-Fixing: Near-Rationality in Consumption Savings Behavior

with Joel Flynn, George Nikalakoudis (who is on the job market!), and Karthik Sastry

papers.ssrn.com/sol3/papers....

Quick-Fixing: Near-Rationality in Consumption Savings Behavior

with Joel Flynn, George Nikalakoudis (who is on the job market!), and Karthik Sastry

papers.ssrn.com/sol3/papers....

68% of households follow one of four simple quick-fix consumption rules for small shocks:

Consumption fixers: MPC = 0 (save everything)

Savings fixers: MPC = 1 (spend everything)

Consumption prioritizers: MPC = 1 for gains but 0 for losses

Savings prioritizers: MPC = 0 for gains but 1 for losses

Consumption fixers: MPC = 0 (save everything)

Savings fixers: MPC = 1 (spend everything)

Consumption prioritizers: MPC = 1 for gains but 0 for losses

Savings prioritizers: MPC = 0 for gains but 1 for losses

November 15, 2024 at 4:31 PM

68% of households follow one of four simple quick-fix consumption rules for small shocks:

Consumption fixers: MPC = 0 (save everything)

Savings fixers: MPC = 1 (spend everything)

Consumption prioritizers: MPC = 1 for gains but 0 for losses

Savings prioritizers: MPC = 0 for gains but 1 for losses

Consumption fixers: MPC = 0 (save everything)

Savings fixers: MPC = 1 (spend everything)

Consumption prioritizers: MPC = 1 for gains but 0 for losses

Savings prioritizers: MPC = 0 for gains but 1 for losses

Survey evidence from 5,000 US households reveals what these quick-fixes look like.

Most households choose extreme MPCs of 0 or 1 for small shocks but transition to moderate and stable interior MPCs for larger shocks, generating the “bowtie” shape of the MPC distribution below.

Most households choose extreme MPCs of 0 or 1 for small shocks but transition to moderate and stable interior MPCs for larger shocks, generating the “bowtie” shape of the MPC distribution below.

November 15, 2024 at 4:31 PM

Survey evidence from 5,000 US households reveals what these quick-fixes look like.

Most households choose extreme MPCs of 0 or 1 for small shocks but transition to moderate and stable interior MPCs for larger shocks, generating the “bowtie” shape of the MPC distribution below.

Most households choose extreme MPCs of 0 or 1 for small shocks but transition to moderate and stable interior MPCs for larger shocks, generating the “bowtie” shape of the MPC distribution below.

🚨 New paper for #EconSky 🚨

Do you rethink your entire consumption-saving strategy every time your income fluctuates? Or do you prefer …

Quick-Fixing: Near-Rationality in Consumption Savings Behavior, w/ Joel Flynn, George Nikalakoudis, and Karthik Sastry

papers.ssrn.com/sol3/papers....

🧵 below.

Do you rethink your entire consumption-saving strategy every time your income fluctuates? Or do you prefer …

Quick-Fixing: Near-Rationality in Consumption Savings Behavior, w/ Joel Flynn, George Nikalakoudis, and Karthik Sastry

papers.ssrn.com/sol3/papers....

🧵 below.

November 15, 2024 at 4:31 PM

🚨 New paper for #EconSky 🚨

Do you rethink your entire consumption-saving strategy every time your income fluctuates? Or do you prefer …

Quick-Fixing: Near-Rationality in Consumption Savings Behavior, w/ Joel Flynn, George Nikalakoudis, and Karthik Sastry

papers.ssrn.com/sol3/papers....

🧵 below.

Do you rethink your entire consumption-saving strategy every time your income fluctuates? Or do you prefer …

Quick-Fixing: Near-Rationality in Consumption Savings Behavior, w/ Joel Flynn, George Nikalakoudis, and Karthik Sastry

papers.ssrn.com/sol3/papers....

🧵 below.

Hello world! We can share some good news today.

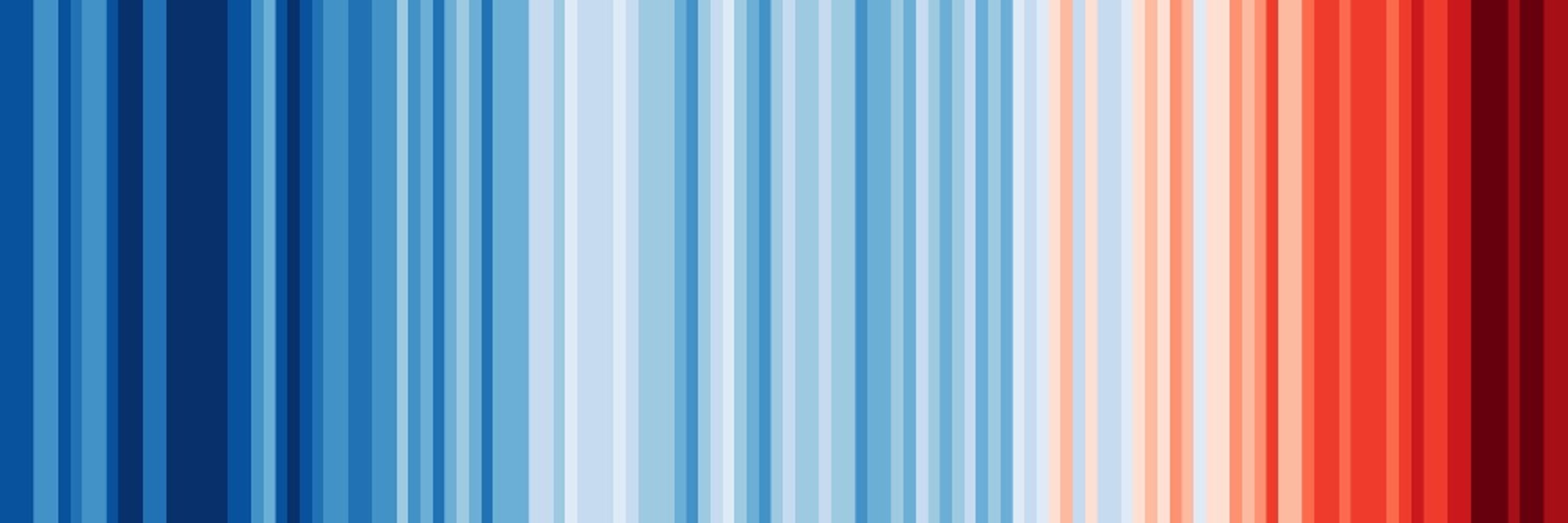

🌍 Support for climate action is widespread across the globe and much larger than it is perceived. 🌍

Our new article is out in Nature Climate Change: www.nature.com/articles/s41...

w/ Teodora Boneva, @felixchopra.bsky.social, Armin Falk

🌍 Support for climate action is widespread across the globe and much larger than it is perceived. 🌍

Our new article is out in Nature Climate Change: www.nature.com/articles/s41...

w/ Teodora Boneva, @felixchopra.bsky.social, Armin Falk

February 9, 2024 at 3:10 PM

Hello world! We can share some good news today.

🌍 Support for climate action is widespread across the globe and much larger than it is perceived. 🌍

Our new article is out in Nature Climate Change: www.nature.com/articles/s41...

w/ Teodora Boneva, @felixchopra.bsky.social, Armin Falk

🌍 Support for climate action is widespread across the globe and much larger than it is perceived. 🌍

Our new article is out in Nature Climate Change: www.nature.com/articles/s41...

w/ Teodora Boneva, @felixchopra.bsky.social, Armin Falk

New paper!

w/ Philipp Schirmer @johanneswohlfart.bsky.social

Stock markets revolve around return expectations which traders form in light of their deeper understanding – their mental model – of the market

... which we know very little about.

Time to change this!

drive.google.com/file/d/1-_VP...

w/ Philipp Schirmer @johanneswohlfart.bsky.social

Stock markets revolve around return expectations which traders form in light of their deeper understanding – their mental model – of the market

... which we know very little about.

Time to change this!

drive.google.com/file/d/1-_VP...

October 4, 2023 at 2:46 PM

New paper!

w/ Philipp Schirmer @johanneswohlfart.bsky.social

Stock markets revolve around return expectations which traders form in light of their deeper understanding – their mental model – of the market

... which we know very little about.

Time to change this!

drive.google.com/file/d/1-_VP...

w/ Philipp Schirmer @johanneswohlfart.bsky.social

Stock markets revolve around return expectations which traders form in light of their deeper understanding – their mental model – of the market

... which we know very little about.

Time to change this!

drive.google.com/file/d/1-_VP...