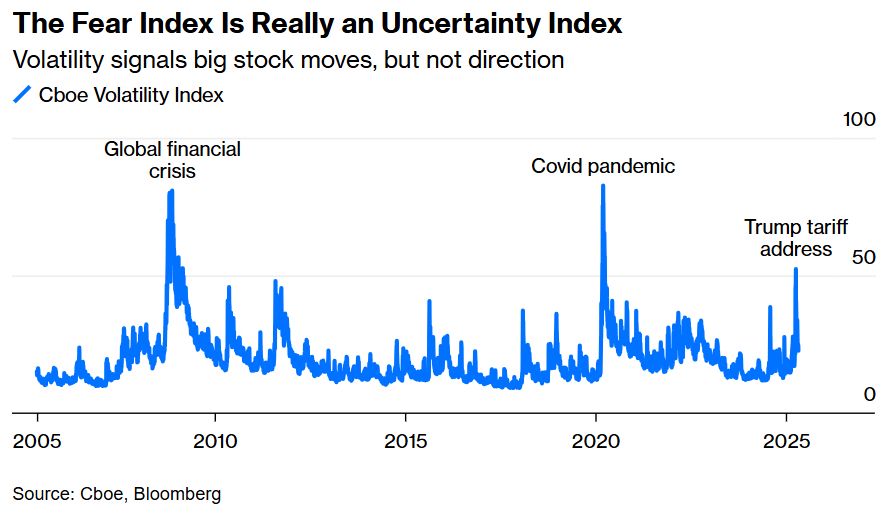

It forecasts the degree of S&P 500 price changes, not directionality.

When it spiked after Trump's tariff announcement, it signaled big gains or losses are likely to follow, and big gains are what we got.

@opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

It forecasts the degree of S&P 500 price changes, not directionality.

When it spiked after Trump's tariff announcement, it signaled big gains or losses are likely to follow, and big gains are what we got.

@opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

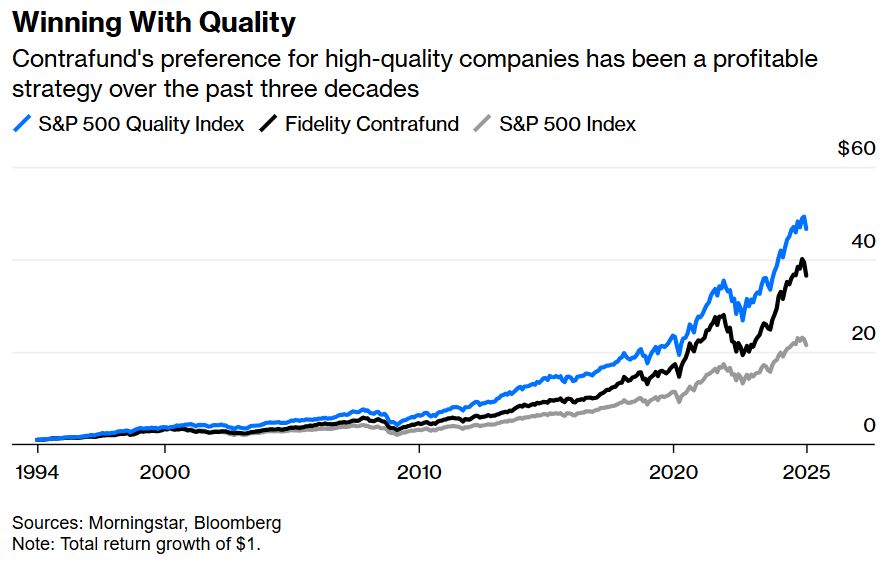

Now they must also beat indexes that mimic their style of stock picking and are probably tracked by a low-cost ETF.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

Now they must also beat indexes that mimic their style of stock picking and are probably tracked by a low-cost ETF.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

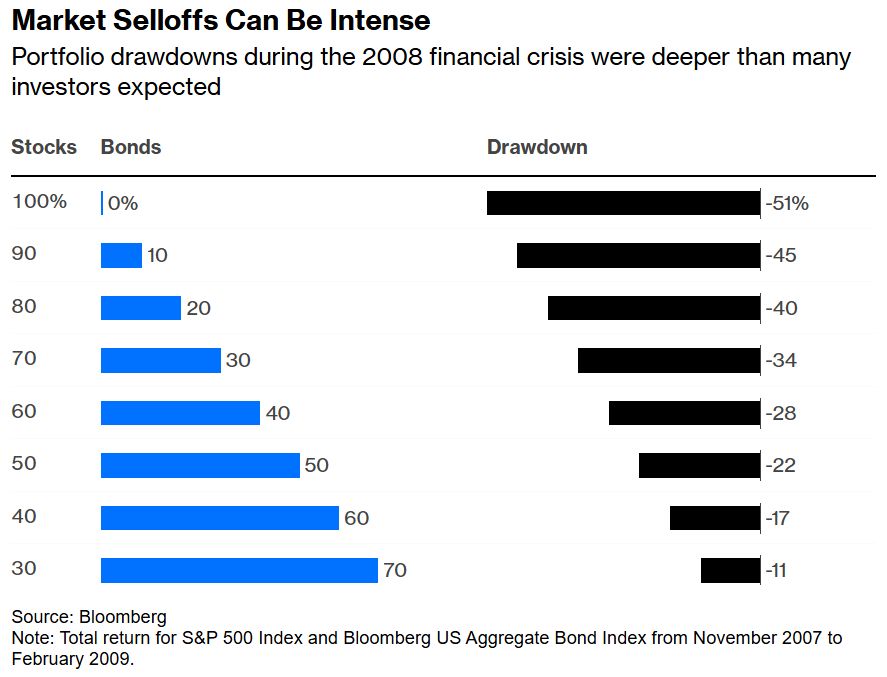

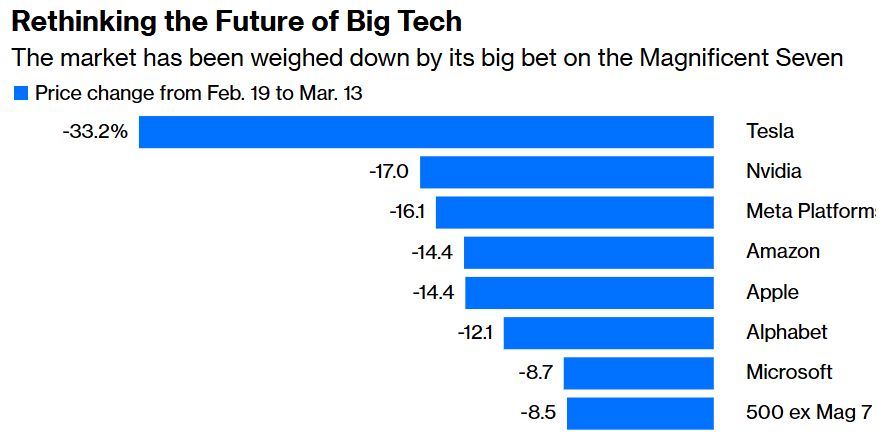

Diversified portfolios can dip lower than people expect before they recover.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

.

Diversified portfolios can dip lower than people expect before they recover.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

.

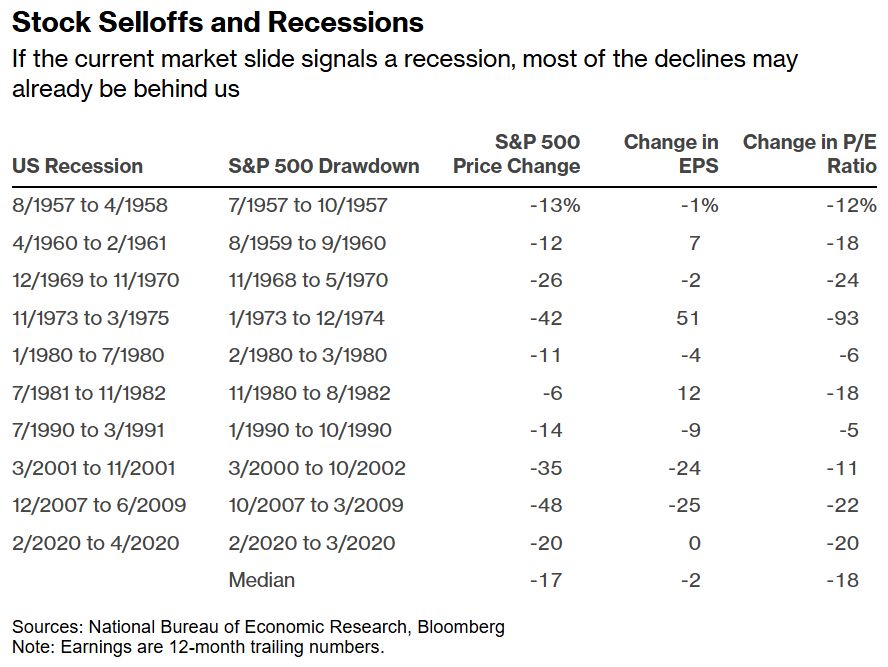

If they're right, history suggests that the worst of the stock market selloff may already be behind us.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

If they're right, history suggests that the worst of the stock market selloff may already be behind us.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

Here's forward P/E for Russell 1000 Growth/Value back to 1995.

Was 2 SD high less than a month ago. Now nearing average.

Here's forward P/E for Russell 1000 Growth/Value back to 1995.

Was 2 SD high less than a month ago. Now nearing average.

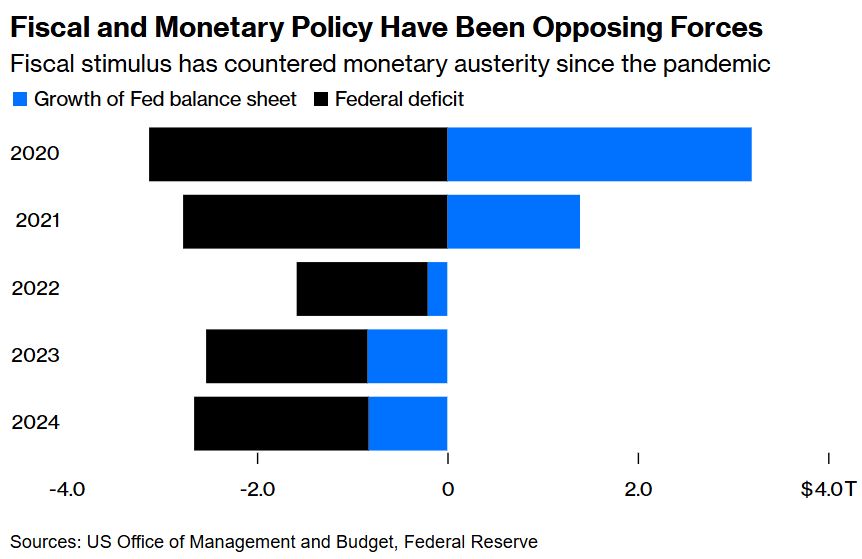

Fiscal stimulus has supported monetary tightening since the pandemic. Now it may be the other way around.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

Fiscal stimulus has supported monetary tightening since the pandemic. Now it may be the other way around.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

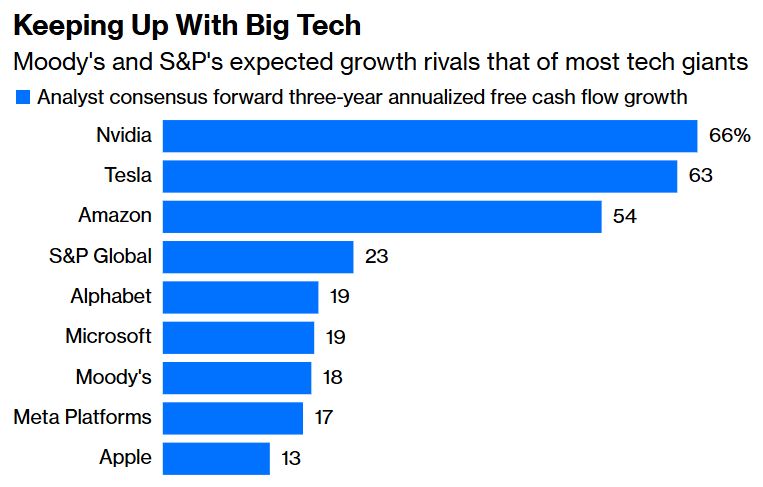

And they're doing it with a major lift from the Mag 7.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

And they're doing it with a major lift from the Mag 7.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

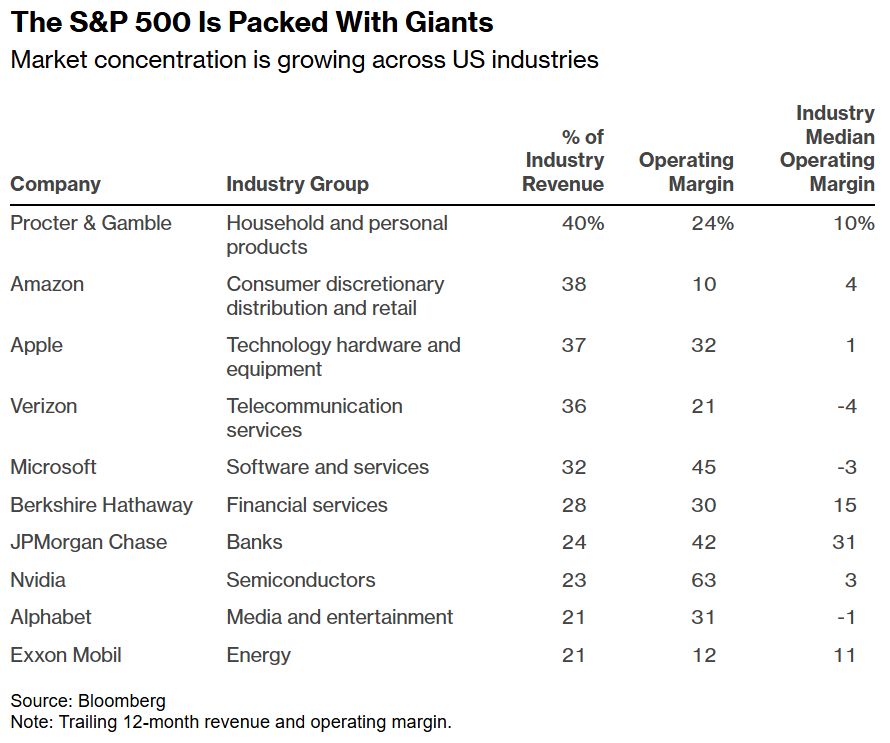

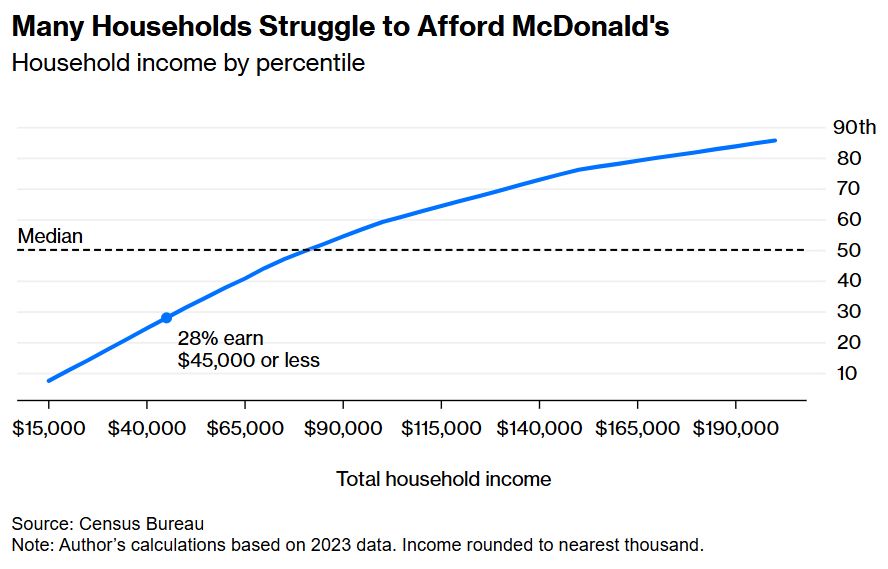

It's dominated by companies that aren't in the path of tariffs or have the pricing power to pass on higher costs to consumers.

An unfazed S&P500 doesn't mean tariffs aren't biting.

www.bloomberg.com/opinion/arti...

It's dominated by companies that aren't in the path of tariffs or have the pricing power to pass on higher costs to consumers.

An unfazed S&P500 doesn't mean tariffs aren't biting.

www.bloomberg.com/opinion/arti...

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

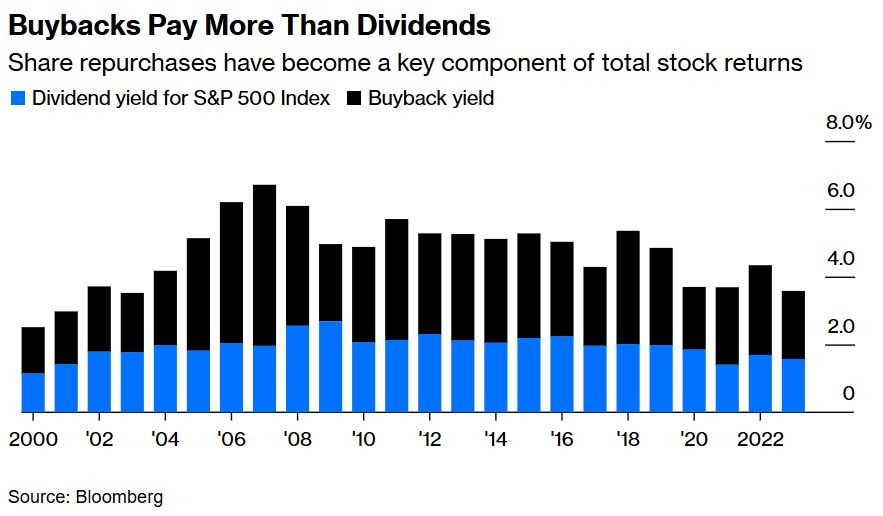

Stock investing would be poorer without them.

www.bloomberg.com/opinion/arti...

Stock investing would be poorer without them.

www.bloomberg.com/opinion/arti...

My latest @opinion.bsky.social.

www.bloomberg.com/opinion/arti...

My latest @opinion.bsky.social.

www.bloomberg.com/opinion/arti...

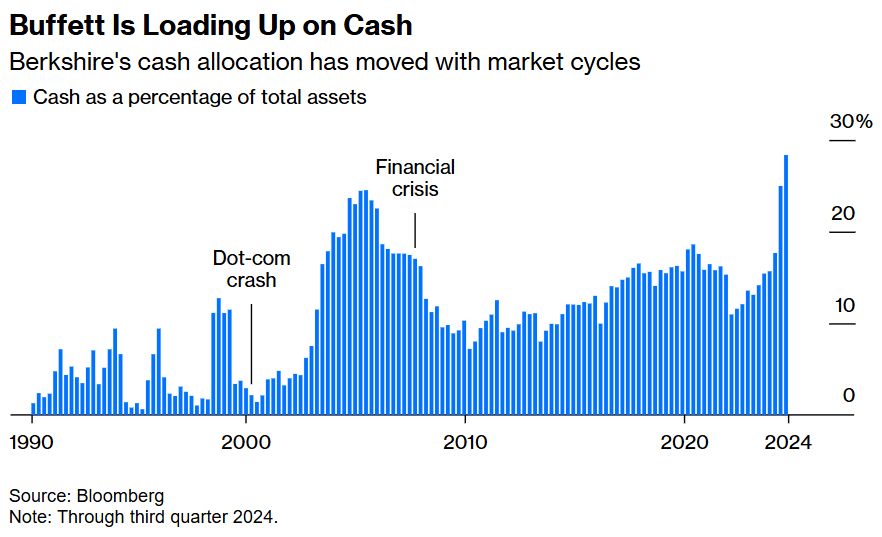

And the current allocation suggests he's bracing for a slowdown.

My latest @opinion.bsky.social.

www.bloomberg.com/opinion/arti...

And the current allocation suggests he's bracing for a slowdown.

My latest @opinion.bsky.social.

www.bloomberg.com/opinion/arti...