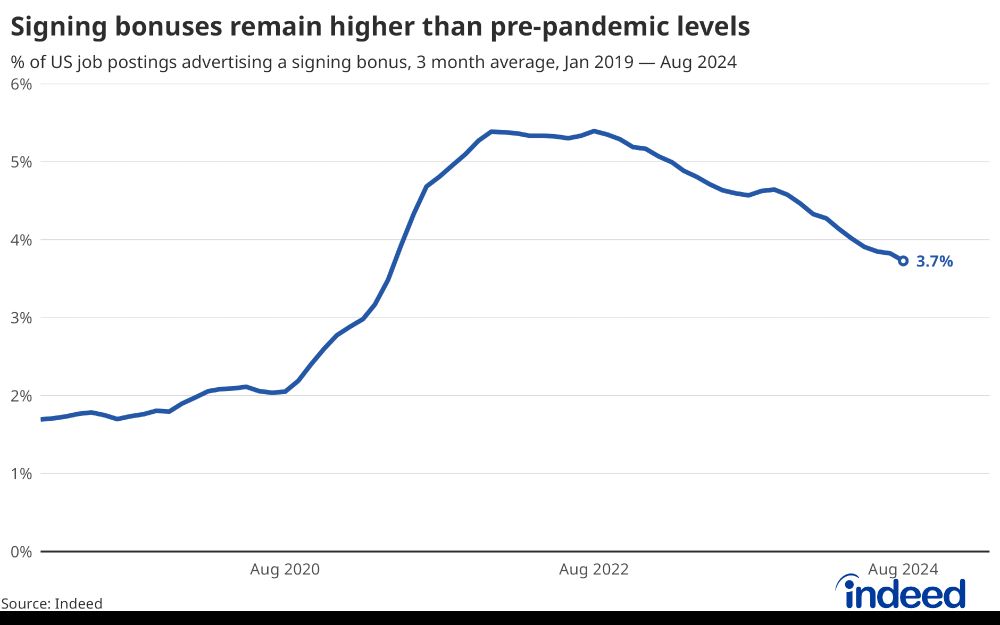

The share of job postings advertising signing bonuses remains more than twice its pre-pandemic level.

The share of job postings advertising signing bonuses remains more than twice its pre-pandemic level.

🧊 Dropped to 0.3% by June 2020

🚀 Rocketed up to 15.4% in Jan 2022

➡️ Now at 2.6% as of Aug 2024

🧊 Dropped to 0.3% by June 2020

🚀 Rocketed up to 15.4% in Jan 2022

➡️ Now at 2.6% as of Aug 2024

Most sectors are still seeing a slow down with about 55% of occupational sectors having slower posted wage growth in February in August. But that's down from 73% back in April.

Most sectors are still seeing a slow down with about 55% of occupational sectors having slower posted wage growth in February in August. But that's down from 73% back in April.

According to the latest data from the Indeed Wage Tracker, wages and salaries advertised in job postings grew at a 3.3% rate in August.

According to the latest data from the Indeed Wage Tracker, wages and salaries advertised in job postings grew at a 3.3% rate in August.

We looked at the share of job postings that advertise this work schedule. Unsurprisingly, it's uncommon, but notably, Production & Manufacturing is the sector with the 4th highest share.

We looked at the share of job postings that advertise this work schedule. Unsurprisingly, it's uncommon, but notably, Production & Manufacturing is the sector with the 4th highest share.

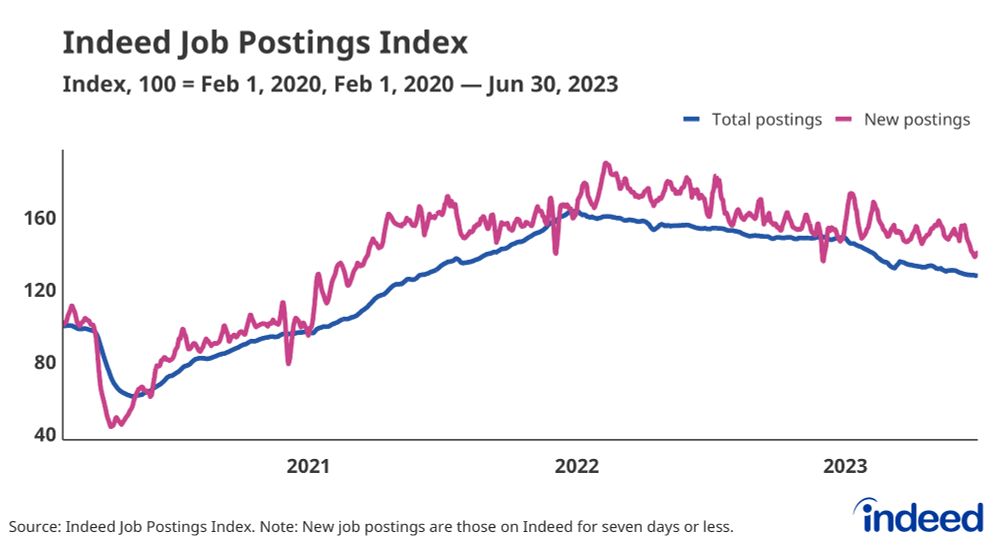

The Indeed Job Postings Index is down 1% since June 16th. Much of that strength is concentrated in sectors least likely to offer remote work (i.e., in-person jobs). They are UP 3% since mid-June.

The Indeed Job Postings Index is down 1% since June 16th. Much of that strength is concentrated in sectors least likely to offer remote work (i.e., in-person jobs). They are UP 3% since mid-June.

Postings are down 14.7% year-to-date, but most of that decline happened during the first half of the year. They are down only 0.9% since June 16th. #NumbersDay

Postings are down 14.7% year-to-date, but most of that decline happened during the first half of the year. They are down only 0.9% since June 16th. #NumbersDay

Atlanta Fed's Wage Growth Tracker ticked down to 5.2% in September.

Job switchers' growth moved sideways, but gains for job stayers ticked down to its slowest pace since Feb 2022.

Atlanta Fed's Wage Growth Tracker ticked down to 5.2% in September.

Job switchers' growth moved sideways, but gains for job stayers ticked down to its slowest pace since Feb 2022.

Year-over-year posted wage growth is running at a 3-month average of 4.3% as of September. It has now retracted more than 80% of its surge from its pre-pandemic pace.

Year-over-year posted wage growth is running at a 3-month average of 4.3% as of September. It has now retracted more than 80% of its surge from its pre-pandemic pace.

According to BLS, there were 8.83 million job openings at the end of July.

If openings grew at the same rate as job postings on Indeed, there were 8.79 million openings at the end of August.

According to BLS, there were 8.83 million job openings at the end of July.

If openings grew at the same rate as job postings on Indeed, there were 8.79 million openings at the end of August.

Get the full download from Allison Shrivastava hiringlab.org/2023/10/02/s...

Get the full download from Allison Shrivastava hiringlab.org/2023/10/02/s...

If job openings grew at the same rate as postings over that period, there were 9.5 million job openings on June 30th

If job openings grew at the same rate as postings over that period, there were 9.5 million job openings on June 30th

As of May 2023, job openings have declined 18% from their March 2022 peak.

And yet . . .

As of May 2023, job openings have declined 18% from their March 2022 peak.

And yet . . .

Indeed data suggests that demand for new hires has declined since then, with the JPI down 2.8% since May 31st.

Indeed data suggests that demand for new hires has declined since then, with the JPI down 2.8% since May 31st.

The level of job postings in this sector is down 19% from its pre-pandemic baseline. Remember, overall postings are up 27% from that same baseline date.

The level of job postings in this sector is down 19% from its pre-pandemic baseline. Remember, overall postings are up 27% from that same baseline date.

Job postings in high-remote sectors are down 37% yoy, compared to 15% for mid-tier and 9.7% for low-remote sectors.

Job postings in high-remote sectors are down 37% yoy, compared to 15% for mid-tier and 9.7% for low-remote sectors.

Postings are down 17.4% from a year prior as of June 30, 2023. Yet the JPI is up 27% from its pre-pandemic baseline level.

Postings are down 17.4% from a year prior as of June 30, 2023. Yet the JPI is up 27% from its pre-pandemic baseline level.