📈 Finance | Personal Growth

Simplifying the complexities of finance, and building wealth.

https://linktr.ee/nategrowswealth

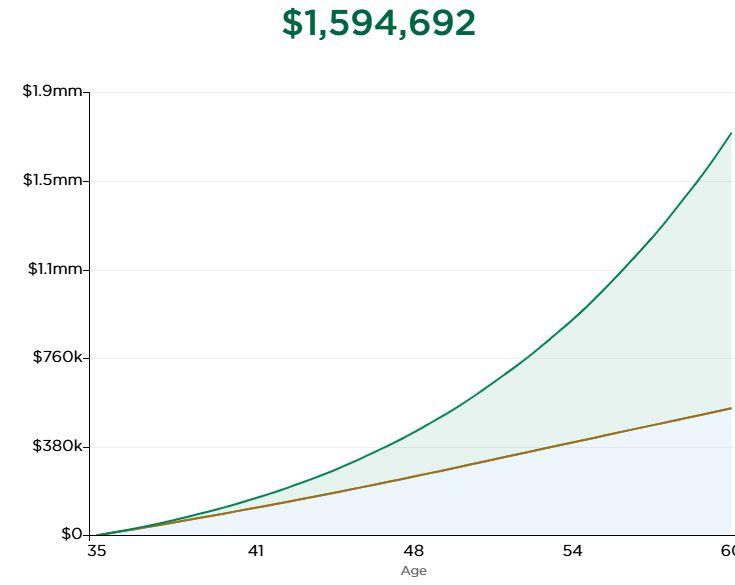

Here's the path:

1. Save 30% of your salary = $18,000/year

2. Invest it in low cost index funds

3. Let it compound over 25 years

4. You will now have ~$1.5M in your portfolio

You don't need a raise — just a strategy.

Here's the path:

1. Save 30% of your salary = $18,000/year

2. Invest it in low cost index funds

3. Let it compound over 25 years

4. You will now have ~$1.5M in your portfolio

You don't need a raise — just a strategy.

In a total market index fund this is what you would return:

• At 6% return: ~ $233K

• At 8% return: ~ $296K

• At 10% return: ~ $378K

The 🔑 is consistency, not timing the market..

#InvestingMadeSimple #CompoundGrowth #FIREMovement

In a total market index fund this is what you would return:

• At 6% return: ~ $233K

• At 8% return: ~ $296K

• At 10% return: ~ $378K

The 🔑 is consistency, not timing the market..

#InvestingMadeSimple #CompoundGrowth #FIREMovement

What if we got crazy and picked up a side hustle which allowed us to contribute $1k a month

Now we're cooking with gas 🔥

We would have $2.3M at retirement following the rule of 4% we could withdraw $92,000 a year without impacting this balance.

What if we got crazy and picked up a side hustle which allowed us to contribute $1k a month

Now we're cooking with gas 🔥

We would have $2.3M at retirement following the rule of 4% we could withdraw $92,000 a year without impacting this balance.

Lets say we have some wiggle room and we can contribute $750/ month. So simply go back to the calculator and change teh contributions.

After we do that we have ..... $1.8M at retirement and now we see that we will have what we need for retirement.

But what if..

Lets say we have some wiggle room and we can contribute $750/ month. So simply go back to the calculator and change teh contributions.

After we do that we have ..... $1.8M at retirement and now we see that we will have what we need for retirement.

But what if..

Based on the information I entered this individual will have $1.3M when they retire.

You can then apply the rule of 4% and estimate your annual retirement income which would be $1.3M *0.04 = $52,000 /year

Don't like the number? lets tweak it!

Based on the information I entered this individual will have $1.3M when they retire.

You can then apply the rule of 4% and estimate your annual retirement income which would be $1.3M *0.04 = $52,000 /year

Don't like the number? lets tweak it!

Once you arrive enter in your information like this:

Once you arrive enter in your information like this:

What if we got crazy and picked up a side hustle which allowed us to contribute $1k a month

Now we're cooking with gas 🔥

We would have $2.3M at retirement following the rule of 4% we could withdraw $92,000 a year without impacting this balance.

What if we got crazy and picked up a side hustle which allowed us to contribute $1k a month

Now we're cooking with gas 🔥

We would have $2.3M at retirement following the rule of 4% we could withdraw $92,000 a year without impacting this balance.

Lets say we have some wiggle room and we can contribute $750/ month. So simply go back to the calculator and change teh contributions.

After we do that we have ..... $1.8M at retirement and now we see that we will have what we need for retirement.

But what if..

Lets say we have some wiggle room and we can contribute $750/ month. So simply go back to the calculator and change teh contributions.

After we do that we have ..... $1.8M at retirement and now we see that we will have what we need for retirement.

But what if..

Based ont he information I entered this individual will ahve $1.3M when they retire.

You can then apply the rule of 4% and estimate your annual retirement income which would be $1.3M *0.04 = $52,000 / year

Don't like the number? lets tweak it!

Based ont he information I entered this individual will ahve $1.3M when they retire.

You can then apply the rule of 4% and estimate your annual retirement income which would be $1.3M *0.04 = $52,000 / year

Don't like the number? lets tweak it!

Once you arrive enter in your information like this:

Once you arrive enter in your information like this:

I better pay for those unpaid tolls…

The state I live in has no tolls and never has 🤔

Be careful out there scammy texts have been up lately for me!

I better pay for those unpaid tolls…

The state I live in has no tolls and never has 🤔

Be careful out there scammy texts have been up lately for me!

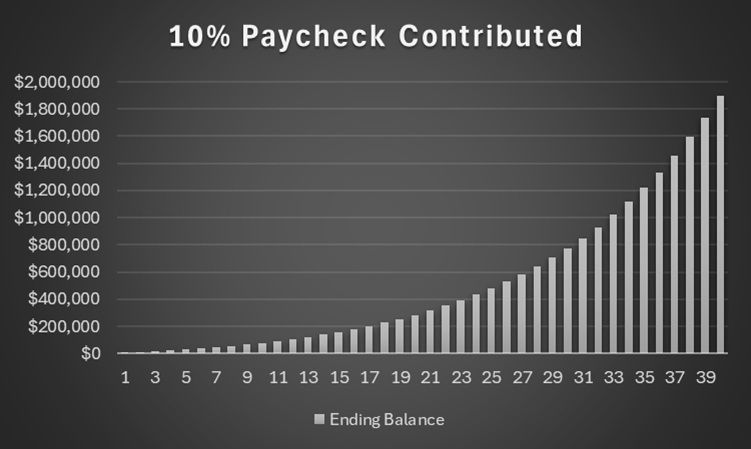

Total Contributed: $811,682

Total Return: $2,978,239

Total for Retirement: $3,789,922

Total Contributed: $811,682

Total Return: $2,978,239

Total for Retirement: $3,789,922

Total Contributed: $401,041

Total Return: $1,493,919

Total for Retirement: $1,894,961

That's double what we saw previously, But would increasing this to 20% of his income make a big difference?

Total Contributed: $401,041

Total Return: $1,493,919

Total for Retirement: $1,894,961

That's double what we saw previously, But would increasing this to 20% of his income make a big difference?

Total Contributed: $202,920

Total Return: $744,759

Total for Retirement: $947,480

Now, let's see what the payoff would be if he increased this to 10% of his income

Total Contributed: $202,920

Total Return: $744,759

Total for Retirement: $947,480

Now, let's see what the payoff would be if he increased this to 10% of his income

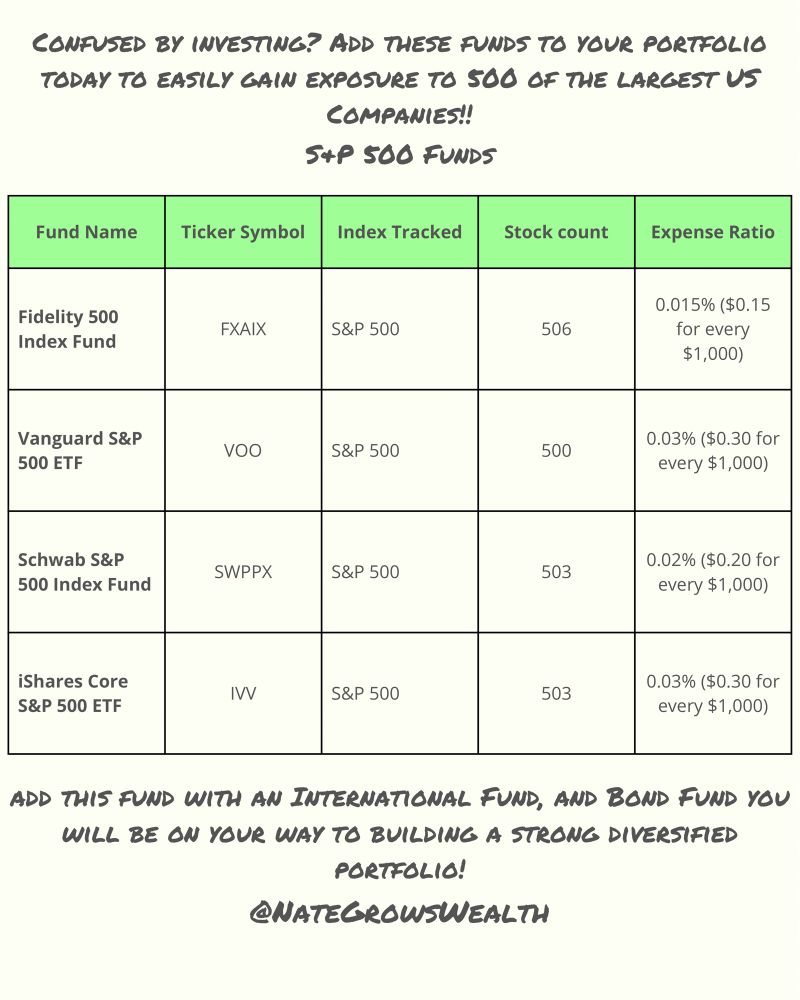

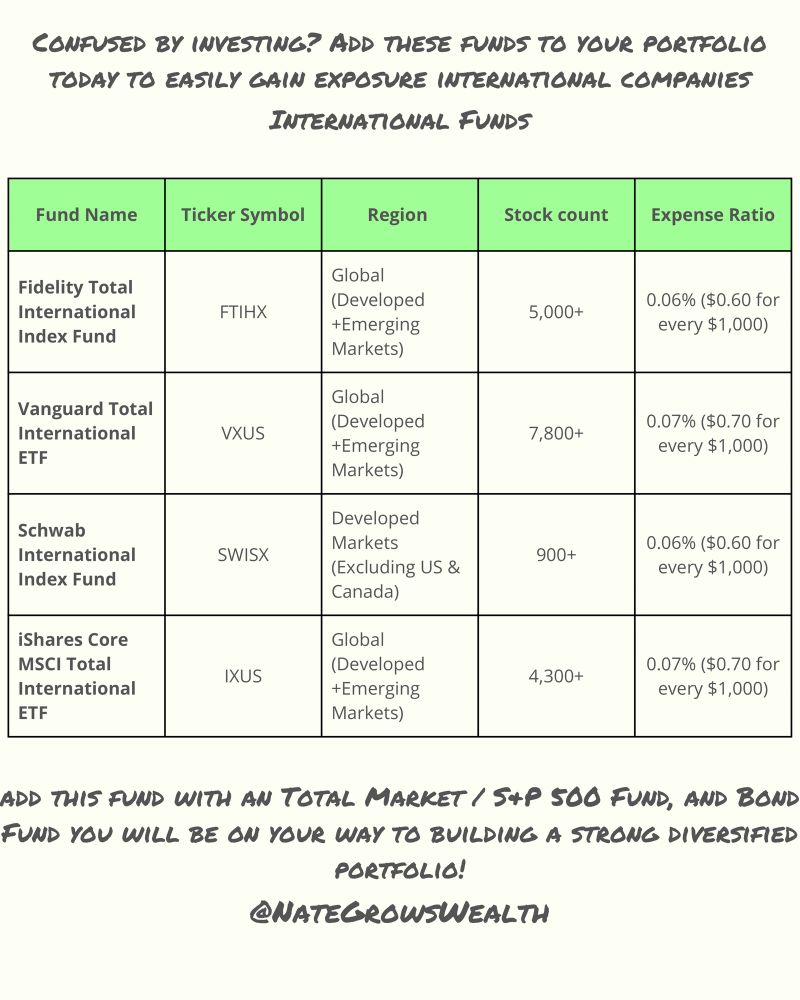

Here’s a simple guide I created to help you decide!

I break down four popular funds for:

- Total Market Index

- S&P 500 Index

- International Index

Here’s a simple guide I created to help you decide!

I break down four popular funds for:

- Total Market Index

- S&P 500 Index

- International Index

Good news—saving just $501 puts you ahead of half the country.

Want to build an emergency fund? Start small:

1️⃣ Plan

2️⃣ Math it out

3️⃣ Act

4️⃣ Don’t get discouraged

#Finance

Good news—saving just $501 puts you ahead of half the country.

Want to build an emergency fund? Start small:

1️⃣ Plan

2️⃣ Math it out

3️⃣ Act

4️⃣ Don’t get discouraged

#Finance

I have broken out the guides to show S&P 500, Total Market, and lastly international index funds from the most popular firms.

You can easily automate regular investments into one or two of these funds and be invested in up to 7,800 stocks!

#finance #indexfunds #invest

I have broken out the guides to show S&P 500, Total Market, and lastly international index funds from the most popular firms.

You can easily automate regular investments into one or two of these funds and be invested in up to 7,800 stocks!

#finance #indexfunds #invest

Allow me to introduce the…

50/30/20 Budget: An guide on how to structure your spending.

Best Practices

1. Track spending

2. Automate your savings

3. Prioritize debt repayment

4. Adjust as lifestyle changes

#budgeting #growwealth #personalfinance

Allow me to introduce the…

50/30/20 Budget: An guide on how to structure your spending.

Best Practices

1. Track spending

2. Automate your savings

3. Prioritize debt repayment

4. Adjust as lifestyle changes

#budgeting #growwealth #personalfinance

1️⃣ 10% to your 401k + 5% match

2️⃣ Max Roth IRA

3️⃣ Max HSA

Invest $1,500/month at an 8% return starting at 18, and by 40, you’ll have $1.1M!

Take control of your future—start now. Follow for more tips!

#SimpleInvesting #FinancialFreedom #WealthBuilding

1️⃣ 10% to your 401k + 5% match

2️⃣ Max Roth IRA

3️⃣ Max HSA

Invest $1,500/month at an 8% return starting at 18, and by 40, you’ll have $1.1M!

Take control of your future—start now. Follow for more tips!

#SimpleInvesting #FinancialFreedom #WealthBuilding

Comment below and follow if you found this helpful or inspiring 😊

#investingtips

Comment below and follow if you found this helpful or inspiring 😊

#investingtips

#InvestingMadeEasy #IndexFunds #FinanceTips

#InvestingMadeEasy #IndexFunds #FinanceTips

Each offers unique tax benefits and growth potential. Learn how to maximize them!

Which of these do you use today? Share your thoughts below!

#PersonalFinance #WealthBuilding #FinanceTips #Guide #RetirementSavings #InvestingTips

Each offers unique tax benefits and growth potential. Learn how to maximize them!

Which of these do you use today? Share your thoughts below!

#PersonalFinance #WealthBuilding #FinanceTips #Guide #RetirementSavings #InvestingTips

I made this guide to break down the Boglehead asset allocation strategy inspired by John Bogle’s Little Book of Common Sense Investing. Simple, low-cost, and focused on long-term growth!

If you find this insightful, please share!

#Bogleheads #InvestingTips #FinancialLiteracy #FIRE

I made this guide to break down the Boglehead asset allocation strategy inspired by John Bogle’s Little Book of Common Sense Investing. Simple, low-cost, and focused on long-term growth!

If you find this insightful, please share!

#Bogleheads #InvestingTips #FinancialLiteracy #FIRE