from the same report

post covid over hiring leads to workforce adjustment, maybe because erratic POTUS actions cooling economy

this could have been the headline🤷🏻

post covid over hiring leads to workforce adjustment, maybe because erratic POTUS actions cooling economy

this could have been the headline🤷🏻

November 7, 2025 at 2:11 AM

from the same report

post covid over hiring leads to workforce adjustment, maybe because erratic POTUS actions cooling economy

this could have been the headline🤷🏻

post covid over hiring leads to workforce adjustment, maybe because erratic POTUS actions cooling economy

this could have been the headline🤷🏻

from the same report, the story could have been "over hiring leads to adjustment"

November 7, 2025 at 2:08 AM

from the same report, the story could have been "over hiring leads to adjustment"

these reports are filed with delay

$DJT was added to two Russel indexes (1000 and 3000) last year and there was a reconstitution of index in June 2025

so that most likely have contributed to change in allocation in Q3 (they have to file within 45 days of quarter ending)

$DJT was added to two Russel indexes (1000 and 3000) last year and there was a reconstitution of index in June 2025

so that most likely have contributed to change in allocation in Q3 (they have to file within 45 days of quarter ending)

November 1, 2025 at 2:01 AM

these reports are filed with delay

$DJT was added to two Russel indexes (1000 and 3000) last year and there was a reconstitution of index in June 2025

so that most likely have contributed to change in allocation in Q3 (they have to file within 45 days of quarter ending)

$DJT was added to two Russel indexes (1000 and 3000) last year and there was a reconstitution of index in June 2025

so that most likely have contributed to change in allocation in Q3 (they have to file within 45 days of quarter ending)

this 5% stake is an aggregate at group level via multiple index funds that Vangaurd operates

Since Vangaurd funds huge in sizes, they tend to have higher allocation on smaller companies even if the company has a very small weight on an index

Since Vangaurd funds huge in sizes, they tend to have higher allocation on smaller companies even if the company has a very small weight on an index

November 1, 2025 at 1:06 AM

this 5% stake is an aggregate at group level via multiple index funds that Vangaurd operates

Since Vangaurd funds huge in sizes, they tend to have higher allocation on smaller companies even if the company has a very small weight on an index

Since Vangaurd funds huge in sizes, they tend to have higher allocation on smaller companies even if the company has a very small weight on an index

the 5% stake is through multiple funds that Vanguard operates, the 'company' need to report an aggregate 5% stake using 13G, even if individual funds own les than that

November 1, 2025 at 1:01 AM

the 5% stake is through multiple funds that Vanguard operates, the 'company' need to report an aggregate 5% stake using 13G, even if individual funds own les than that

after laying off people in the name of anti-DEI, what did they expect!

October 26, 2025 at 7:32 PM

after laying off people in the name of anti-DEI, what did they expect!

bitcoin is the new go.. oh wait, nevermind!

October 10, 2025 at 9:52 PM

bitcoin is the new go.. oh wait, nevermind!

and wants a Nobel for Peace 🤣

September 4, 2025 at 10:56 PM

and wants a Nobel for Peace 🤣

August 21, 2025 at 8:02 PM

I appreciate protesting for anti-choice stance!

the original founder sold off the company back in 1998!

now Dominos is owned by Institutions and Public through different funds!

the original founder sold off the company back in 1998!

now Dominos is owned by Institutions and Public through different funds!

April 29, 2025 at 5:56 AM

I appreciate protesting for anti-choice stance!

the original founder sold off the company back in 1998!

now Dominos is owned by Institutions and Public through different funds!

the original founder sold off the company back in 1998!

now Dominos is owned by Institutions and Public through different funds!

even after all the correction, VTI is still at last year's level, with PE ratio of a about ~20, it still looks costly... (assuming the tariffs will stay on)

April 23, 2025 at 1:52 PM

even after all the correction, VTI is still at last year's level, with PE ratio of a about ~20, it still looks costly... (assuming the tariffs will stay on)

markets were trending up by 10:12 AM already

April 7, 2025 at 9:03 PM

markets were trending up by 10:12 AM already

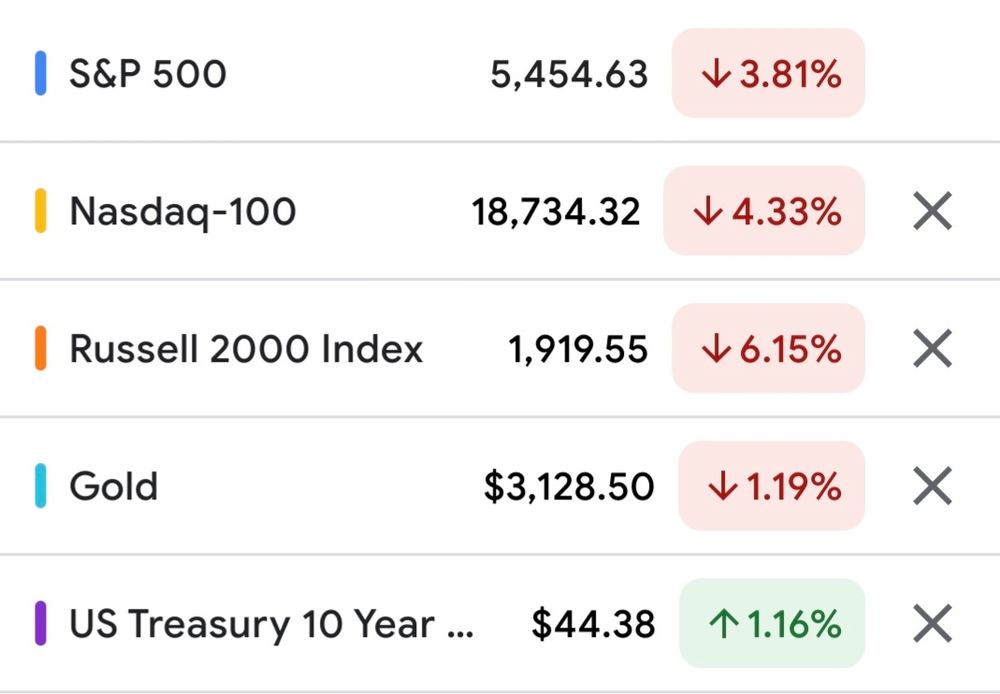

VIX about halfway to 2008 levels

April 4, 2025 at 8:55 PM

VIX about halfway to 2008 levels

April 4, 2025 at 8:50 PM

also looks like this

April 3, 2025 at 3:41 PM

also looks like this

"publicly funded" right on!

February 2, 2025 at 7:42 PM

"publicly funded" right on!