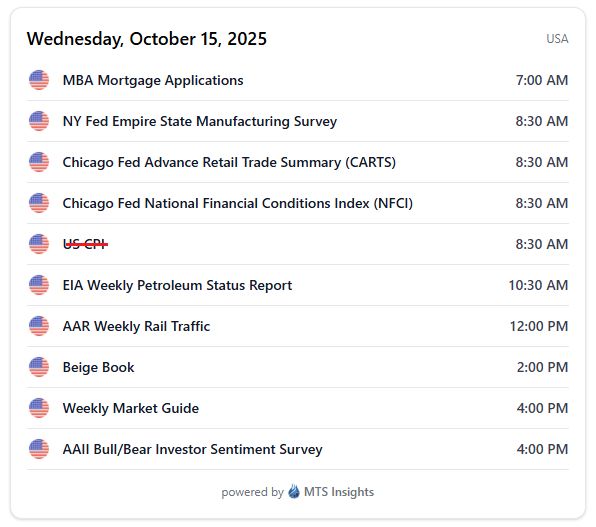

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

Full economic calendar here: www.mtsinsights.com/calendar/

Full economic calendar here: www.mtsinsights.com/calendar/

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

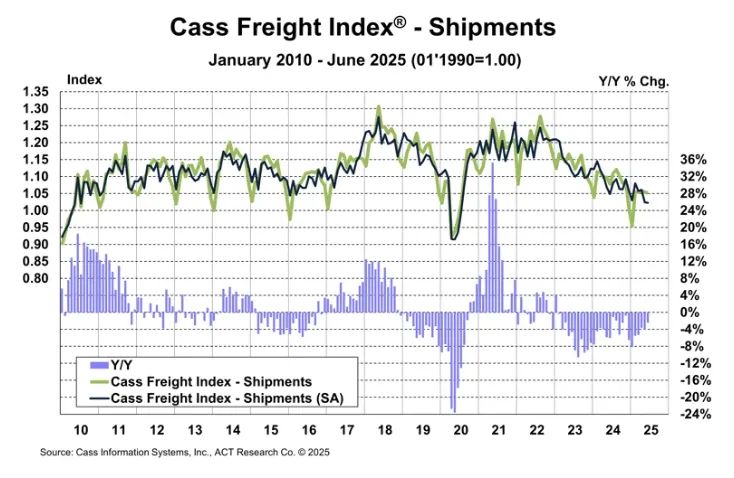

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

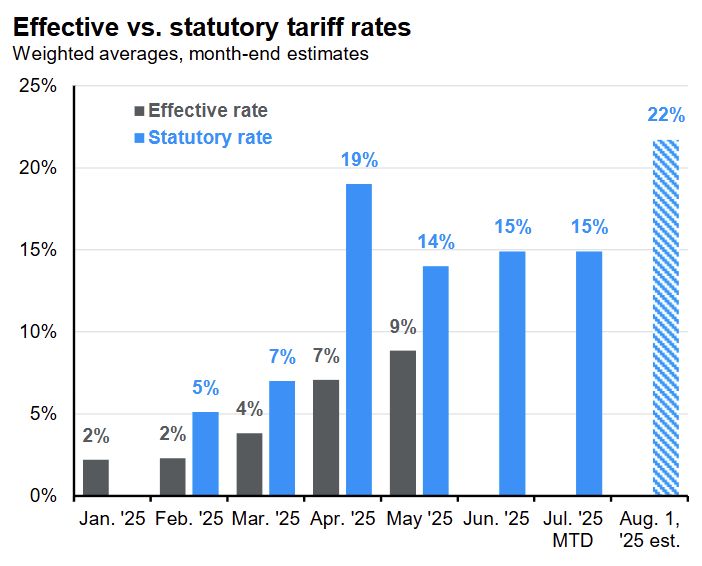

(chart via JPMorgan)

(chart via JPMorgan)

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

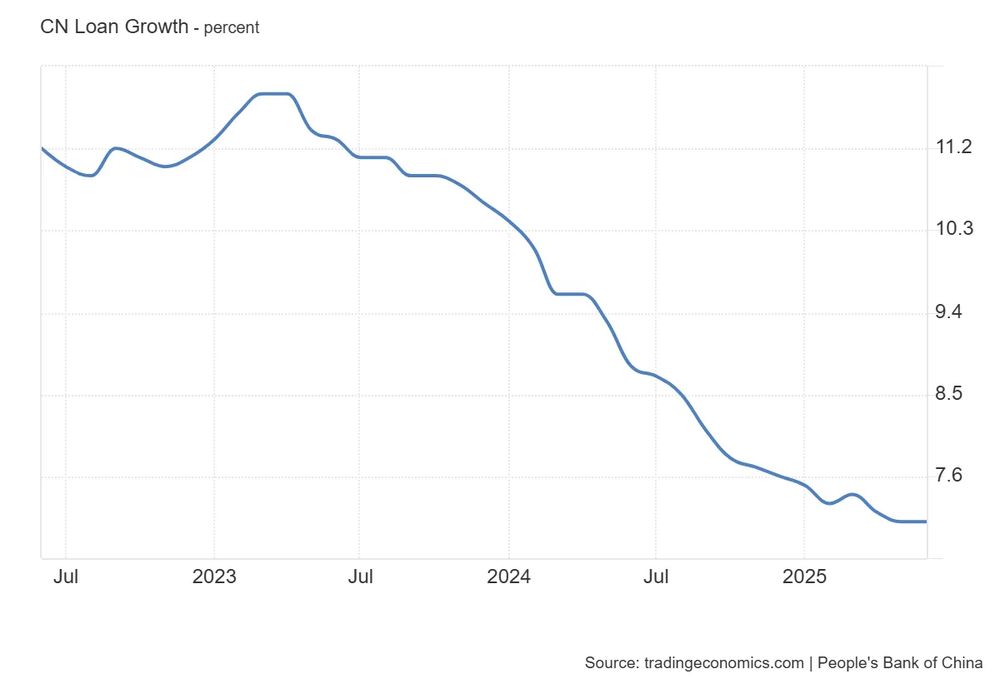

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

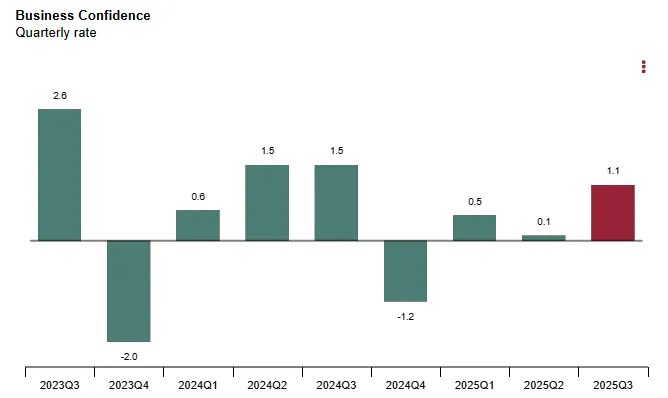

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

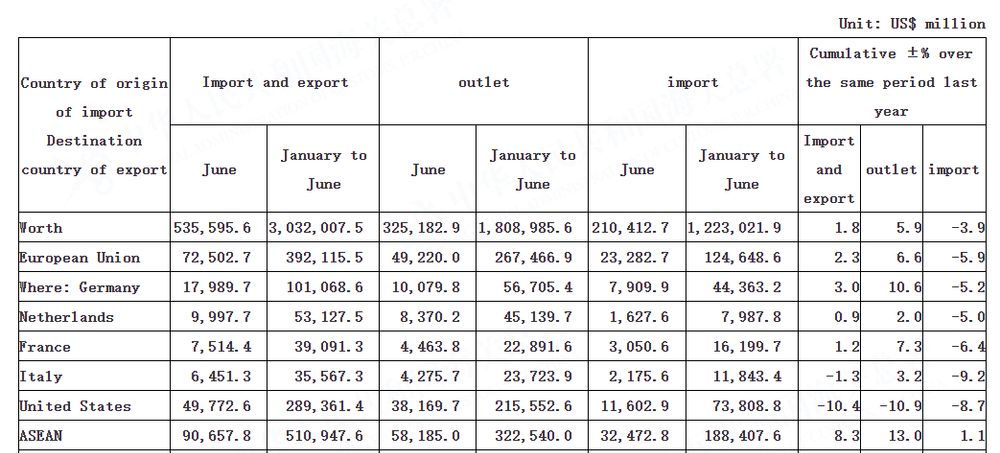

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

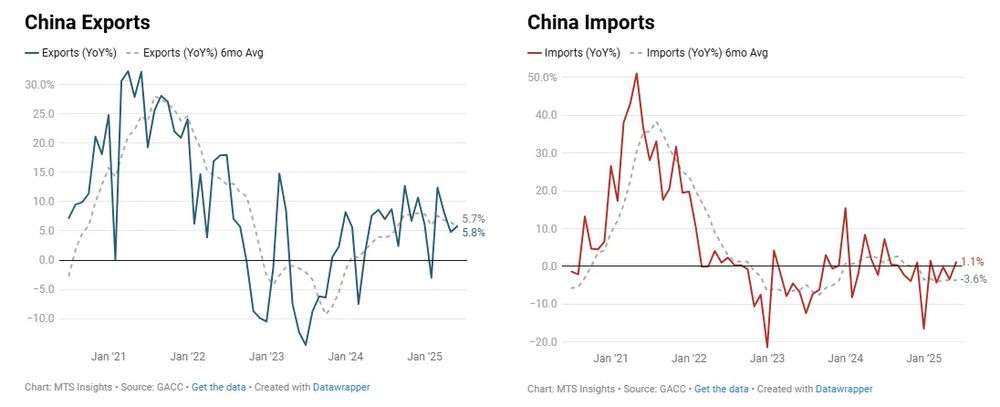

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

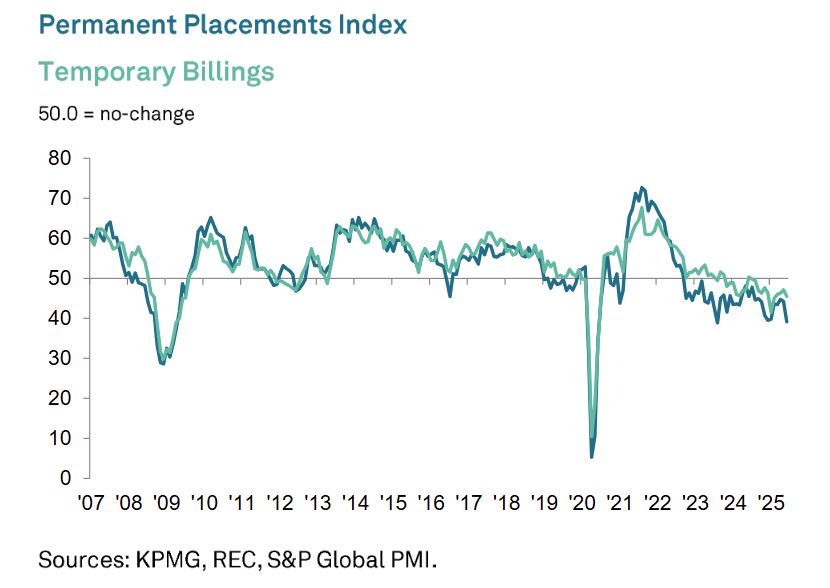

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

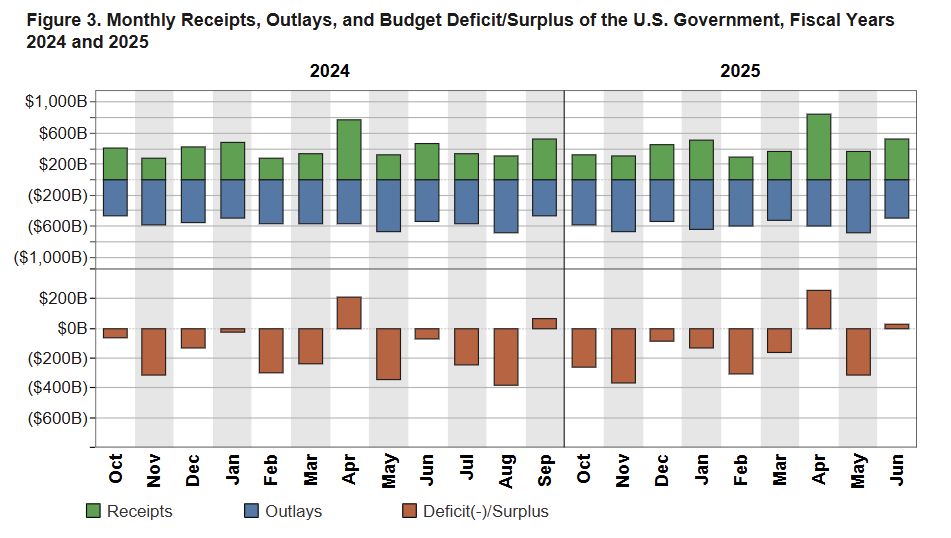

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

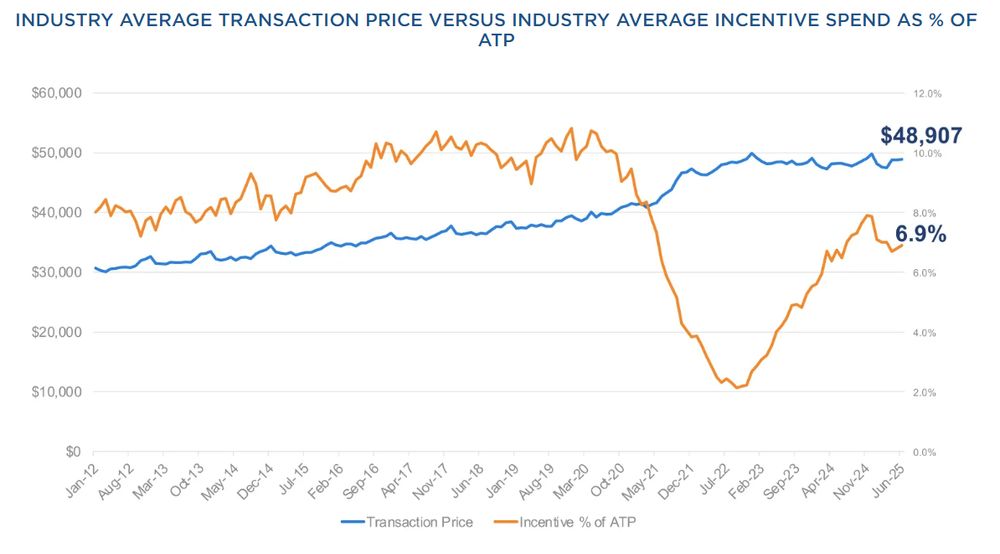

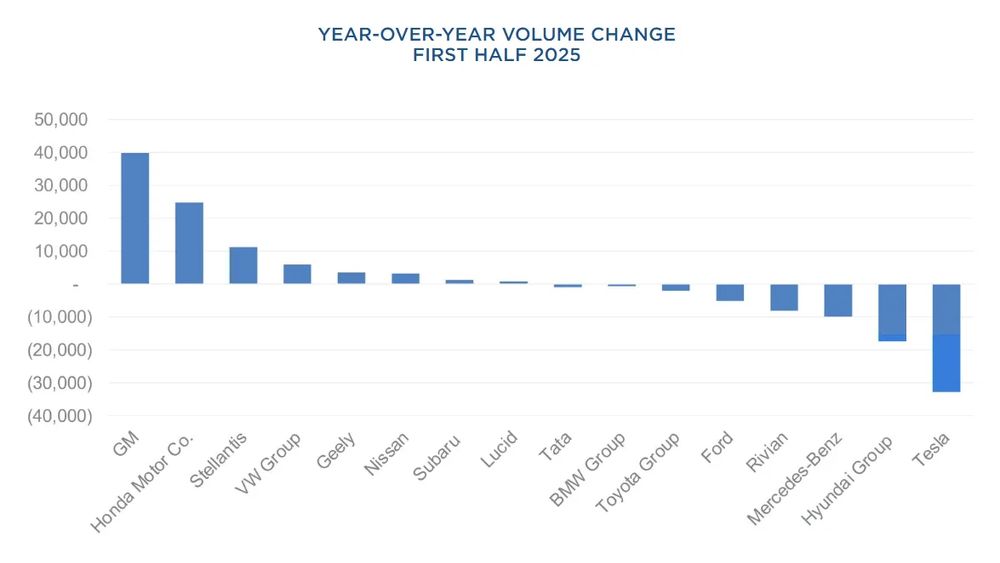

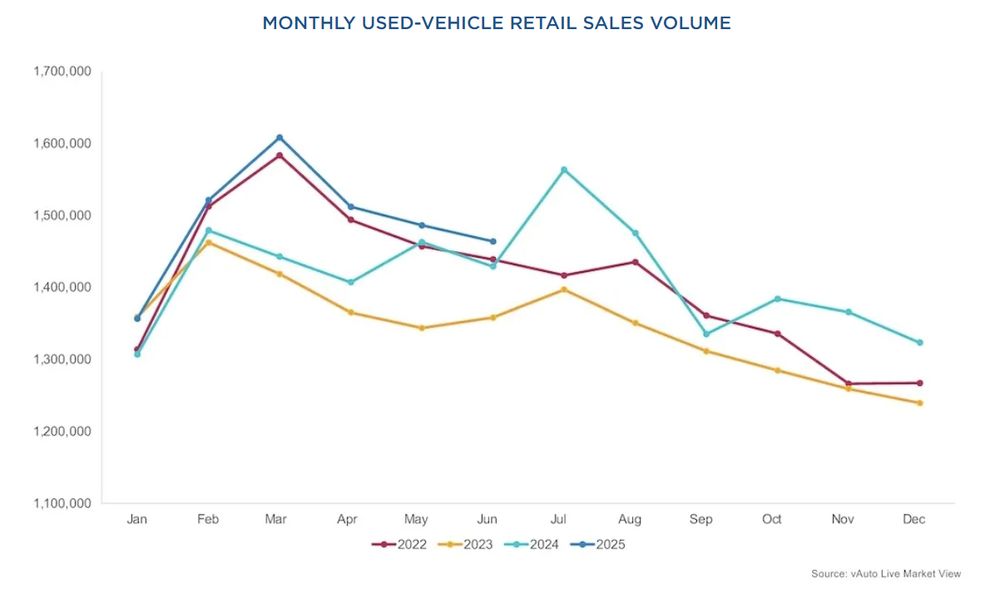

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.