t.co/12l09DdRnL

t.co/12l09DdRnL

– raise nearly $1B a year,

– barely affect commercial real estate because developers would “adjust,” and

– produce a “much larger number” of affordable homes than those lost to the tax’s impact.

– raise nearly $1B a year,

– barely affect commercial real estate because developers would “adjust,” and

– produce a “much larger number” of affordable homes than those lost to the tax’s impact.

t.co/fhbo3UOv4H

t.co/fhbo3UOv4H

🧵

🧵

2023: 593 units permitted

2024: 30 units permitted

Poorly designed transfer taxes kill housing.

2023: 593 units permitted

2024: 30 units permitted

Poorly designed transfer taxes kill housing.

- 9 projects

- 795 units

- Only 4 are under construction (started before ULA)

- Others have not pulled permits

- Avg cost $716K/unit

- Avg ULA subsidy $69K/unit

- 6 are Prop. HHH

- ULA is helping provide relief for increased costs

- 9 projects

- 795 units

- Only 4 are under construction (started before ULA)

- Others have not pulled permits

- Avg cost $716K/unit

- Avg ULA subsidy $69K/unit

- 6 are Prop. HHH

- ULA is helping provide relief for increased costs

- 9 projects have received ULA funds. Only 4 are under construction -- all started a year before ULA was in effect.

- The dip in sales has been persistent, even after the court challenges to ULA were lost

- 9 projects have received ULA funds. Only 4 are under construction -- all started a year before ULA was in effect.

- The dip in sales has been persistent, even after the court challenges to ULA were lost

So, yes, ULA lowers what builders can pay for land. But that won't lower prices, it will just help non-builders outbid them.

That’s not how you grow housing supply.

So, yes, ULA lowers what builders can pay for land. But that won't lower prices, it will just help non-builders outbid them.

That’s not how you grow housing supply.

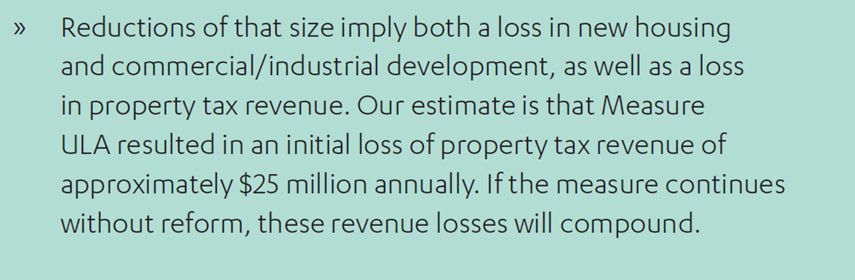

We estimate that sales >$5M drive approx. 40% of LA prop tax growth. Cutting those sales in half cuts growth proportionally.

That means less funding for schools and county safety-net services.

We estimate that sales >$5M drive approx. 40% of LA prop tax growth. Cutting those sales in half cuts growth proportionally.

That means less funding for schools and county safety-net services.

We estimate ULA has reduced commercial/industrial sales by over 50%.

LA needs adaptive reuse. ULA is discouraging it.

We estimate ULA has reduced commercial/industrial sales by over 50%.

LA needs adaptive reuse. ULA is discouraging it.

(Spolier Alert: That's no longer true for sales over the ULA threshold, though it's still true for sales below.)

Here's what that looks like for sales below the ULA threshold 👇

(Spolier Alert: That's no longer true for sales over the ULA threshold, though it's still true for sales below.)

Here's what that looks like for sales below the ULA threshold 👇

But the early evidence is sobering: transactions have collapsed, revenues have fallen far short, and housing projects are harder to build.

But the early evidence is sobering: transactions have collapsed, revenues have fallen far short, and housing projects are harder to build.