Mike Zaccardi, CFA, CMT

@mikezaccardi.bsky.social

Financial writer. Markets & charts. Open to freelance or full-time work.

Tariff dividend

November 11, 2025 at 12:29 PM

Tariff dividend

Trump net approval has gone from -6 to -11

November 11, 2025 at 12:28 PM

Trump net approval has gone from -6 to -11

Some AI headlines:

-Intel's AI chief Sachin Katti jumps ship to OpenAI

-Anthropic may turn a profit much faster than OpenAI

-Meta chief AI scientist LeCun plans to exit company

-Michael Burry accuses tech giants of inflating profits by stretching asset lifespans

-Intel's AI chief Sachin Katti jumps ship to OpenAI

-Anthropic may turn a profit much faster than OpenAI

-Meta chief AI scientist LeCun plans to exit company

-Michael Burry accuses tech giants of inflating profits by stretching asset lifespans

November 11, 2025 at 12:23 PM

Some AI headlines:

-Intel's AI chief Sachin Katti jumps ship to OpenAI

-Anthropic may turn a profit much faster than OpenAI

-Meta chief AI scientist LeCun plans to exit company

-Michael Burry accuses tech giants of inflating profits by stretching asset lifespans

-Intel's AI chief Sachin Katti jumps ship to OpenAI

-Anthropic may turn a profit much faster than OpenAI

-Meta chief AI scientist LeCun plans to exit company

-Michael Burry accuses tech giants of inflating profits by stretching asset lifespans

50-year mortgage: A game-changer or more pain for homebuyers?

no.

no.

November 11, 2025 at 12:20 PM

50-year mortgage: A game-changer or more pain for homebuyers?

no.

no.

Reposted by Mike Zaccardi, CFA, CMT

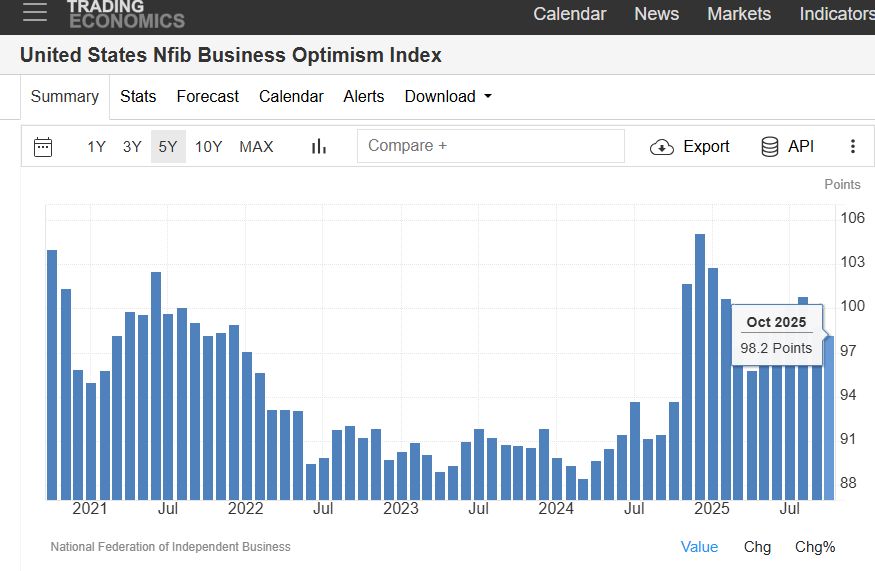

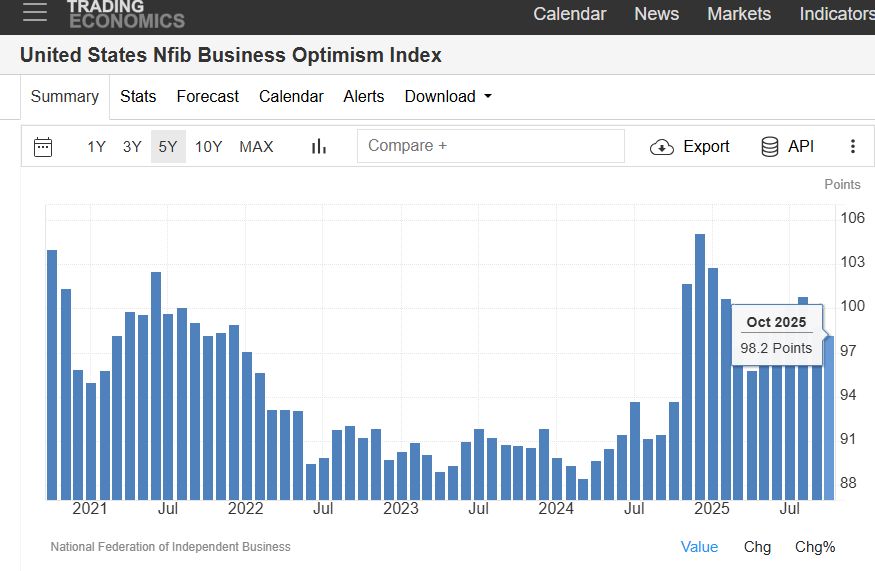

Small-business optimism index:

NFIB Oct slides to 98.2, worst since April @tEconomics

November 11, 2025 at 12:03 PM

Small-business optimism index:

Record cold across the Southeast right now. Awesome! @JimCantore @StephanieAbrams @MikeFirstAlert

November 11, 2025 at 12:17 PM

Record cold across the Southeast right now. Awesome! @JimCantore @StephanieAbrams @MikeFirstAlert

30s into south FL this morning.

19F dew point at my place, two miles from the ocean in northeast FL

19F dew point at my place, two miles from the ocean in northeast FL

November 11, 2025 at 12:16 PM

30s into south FL this morning.

19F dew point at my place, two miles from the ocean in northeast FL

19F dew point at my place, two miles from the ocean in northeast FL

Total Annual Health Insurance Payment per Family in the US: $26,993

Torsten at Apollo

Torsten at Apollo

November 11, 2025 at 12:04 PM

Total Annual Health Insurance Payment per Family in the US: $26,993

Torsten at Apollo

Torsten at Apollo

NFIB Oct slides to 98.2, worst since April @tEconomics

November 11, 2025 at 12:02 PM

NFIB Oct slides to 98.2, worst since April @tEconomics

TOM LEE: Year-end performance chase likely.

SPX aims for a third-straight 20% annual gain. @fundstrat

fsinsight.com/macro-...

SPX aims for a third-straight 20% annual gain. @fundstrat

fsinsight.com/macro-...

November 11, 2025 at 11:10 AM

TOM LEE: Year-end performance chase likely.

SPX aims for a third-straight 20% annual gain. @fundstrat

fsinsight.com/macro-...

SPX aims for a third-straight 20% annual gain. @fundstrat

fsinsight.com/macro-...

Reposted by Mike Zaccardi, CFA, CMT

At least SOMEONE isn’t printing the 2nd-worst consumer confidence since the 1970s. 😏 🇦🇺

Australia Consumer Confidence

Best since late 2021.

Best since late 2021.

November 11, 2025 at 10:58 AM

At least SOMEONE isn’t printing the 2nd-worst consumer confidence since the 1970s. 😏 🇦🇺

$CRWV -37% from its Oct rebound high

November 11, 2025 at 11:01 AM

$CRWV -37% from its Oct rebound high

19F dew point here in northeast FL. Nice!

November 11, 2025 at 10:58 AM

19F dew point here in northeast FL. Nice!

Australia Consumer Confidence

Best since late 2021.

Best since late 2021.

November 11, 2025 at 10:56 AM

Australia Consumer Confidence

Best since late 2021.

Best since late 2021.

The S&P 500 equity risk premium is steady near 2.4% @WisdomTreeFunds

November 11, 2025 at 10:52 AM

The S&P 500 equity risk premium is steady near 2.4% @WisdomTreeFunds

November 11, 2025 at 10:48 AM

$NVDA giving back some of yesterday's massive gain, $QQQ -0.4%

Gold up, bitcoin down

NVDA was +11.3% from Friday's low to the close Monday.

Gold up, bitcoin down

NVDA was +11.3% from Friday's low to the close Monday.

November 11, 2025 at 10:47 AM

$NVDA giving back some of yesterday's massive gain, $QQQ -0.4%

Gold up, bitcoin down

NVDA was +11.3% from Friday's low to the close Monday.

Gold up, bitcoin down

NVDA was +11.3% from Friday's low to the close Monday.

BofA: For our “core core” IG issuers ex. Finance, Energy and the Magnificent 7 we are tracking a healthy 7.4% YoY earnings growth and earnings surprise of 7.7%

November 11, 2025 at 10:44 AM

BofA: For our “core core” IG issuers ex. Finance, Energy and the Magnificent 7 we are tracking a healthy 7.4% YoY earnings growth and earnings surprise of 7.7%

GS on IEEPA tariffs: We expect a ruling in December 2025 or January 2026. If the court blocks the tariffs, we expect it would take several more months to refund the $115-145bn that would have been collected by then.

November 11, 2025 at 10:40 AM

GS on IEEPA tariffs: We expect a ruling in December 2025 or January 2026. If the court blocks the tariffs, we expect it would take several more months to refund the $115-145bn that would have been collected by then.

GS schedule of likely data releases.

Shutdown and delays may affect data accuracy. Payrolls data likely reliable; household survey and October CPI may be distorted or incomplete. November data quality expected to recover.

Shutdown and delays may affect data accuracy. Payrolls data likely reliable; household survey and October CPI may be distorted or incomplete. November data quality expected to recover.

November 11, 2025 at 10:39 AM

GS schedule of likely data releases.

Shutdown and delays may affect data accuracy. Payrolls data likely reliable; household survey and October CPI may be distorted or incomplete. November data quality expected to recover.

Shutdown and delays may affect data accuracy. Payrolls data likely reliable; household survey and October CPI may be distorted or incomplete. November data quality expected to recover.

GS: A notable decline in cash-to-assets for the five largest AI hyperscalers

November 11, 2025 at 10:35 AM

GS: A notable decline in cash-to-assets for the five largest AI hyperscalers

GS: US government reopening boosts risk appetite and potential for reflation

"We remain modestly pro-risk in our asset allocation (OW Equity, UW Credit, N Bonds/Commodity/Cash for 3m, OW Equity, UW Cash, N Bonds/Commodity/Credit for 12m)"

"We remain modestly pro-risk in our asset allocation (OW Equity, UW Credit, N Bonds/Commodity/Cash for 3m, OW Equity, UW Cash, N Bonds/Commodity/Credit for 12m)"

November 11, 2025 at 10:34 AM

GS: US government reopening boosts risk appetite and potential for reflation

"We remain modestly pro-risk in our asset allocation (OW Equity, UW Credit, N Bonds/Commodity/Cash for 3m, OW Equity, UW Cash, N Bonds/Commodity/Credit for 12m)"

"We remain modestly pro-risk in our asset allocation (OW Equity, UW Credit, N Bonds/Commodity/Cash for 3m, OW Equity, UW Cash, N Bonds/Commodity/Credit for 12m)"

GS Layoff Tracker: Highest in about 14 years

November 11, 2025 at 10:33 AM

GS Layoff Tracker: Highest in about 14 years

GS: The Share of Companies Mentioning Layoffs Has Ticked Up, Particularly in the Ongoing 2025Q3 Earnings Calls

November 11, 2025 at 10:32 AM

GS: The Share of Companies Mentioning Layoffs Has Ticked Up, Particularly in the Ongoing 2025Q3 Earnings Calls

GS: Challenger and WARN Notices (which are up) Lead Initial Jobless Claims by About 2 Months

November 11, 2025 at 10:32 AM

GS: Challenger and WARN Notices (which are up) Lead Initial Jobless Claims by About 2 Months