marcobellifemine.com

10/11

10/11

9/11

9/11

8/11

8/11

We select three real-life counties and conduct a model-based narrative analysis of the regional transmission mechanism of MP.

7/11

We select three real-life counties and conduct a model-based narrative analysis of the regional transmission mechanism of MP.

7/11

1. Counties that have a higher share of non-tradable employment or a higher MPC are more responsive to MP shocks.

2. MPCs and non-tradable employment interact positively in shaping this response.

6/11

1. Counties that have a higher share of non-tradable employment or a higher MPC are more responsive to MP shocks.

2. MPCs and non-tradable employment interact positively in shaping this response.

6/11

We make the data publicly available here: regionalkeynesiancross.com

5/11

We make the data publicly available here: regionalkeynesiancross.com

5/11

Result 2⃣: the national Keynesian cross, an analytical characterization of the national consumption response in terms of regional heterogeneity.

4/11

Result 2⃣: the national Keynesian cross, an analytical characterization of the national consumption response in terms of regional heterogeneity.

4/11

Result 1️⃣: the Regional Keynesian Cross. It characterizes a county's response to MP as a function of MPCs & non tradable income share.

At its heart: a regional Keynesian multiplier.

3/11

Result 1️⃣: the Regional Keynesian Cross. It characterizes a county's response to MP as a function of MPCs & non tradable income share.

At its heart: a regional Keynesian multiplier.

3/11

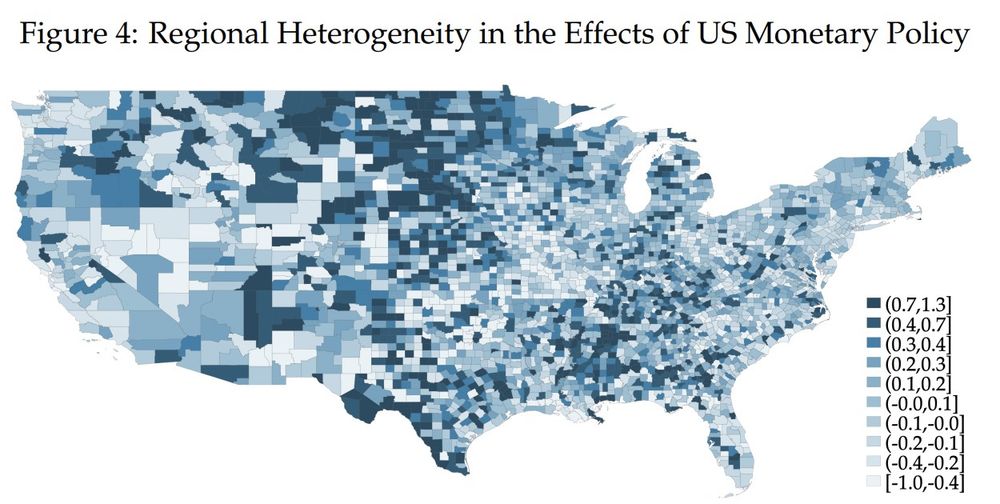

1. What can explain this?

2. Does it matter for the national transmission of monetary policy?

2/11

1. What can explain this?

2. Does it matter for the national transmission of monetary policy?

2/11

𝗧𝗵𝗲 𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗞𝗲𝘆𝗻𝗲𝘀𝗶𝗮𝗻 𝗖𝗿𝗼𝘀𝘀 - with

@adriencouturier.bsky.social & @rustamjamilov.bsky.social

Does regional heterogeneity matter for monetary policy? We provide a theoretical, empirical & quantitative investigation.

Link: dropbox.com/scl/fi/injql...

Thread🧵

1/11

#EconSky

𝗧𝗵𝗲 𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗞𝗲𝘆𝗻𝗲𝘀𝗶𝗮𝗻 𝗖𝗿𝗼𝘀𝘀 - with

@adriencouturier.bsky.social & @rustamjamilov.bsky.social

Does regional heterogeneity matter for monetary policy? We provide a theoretical, empirical & quantitative investigation.

Link: dropbox.com/scl/fi/injql...

Thread🧵

1/11

#EconSky