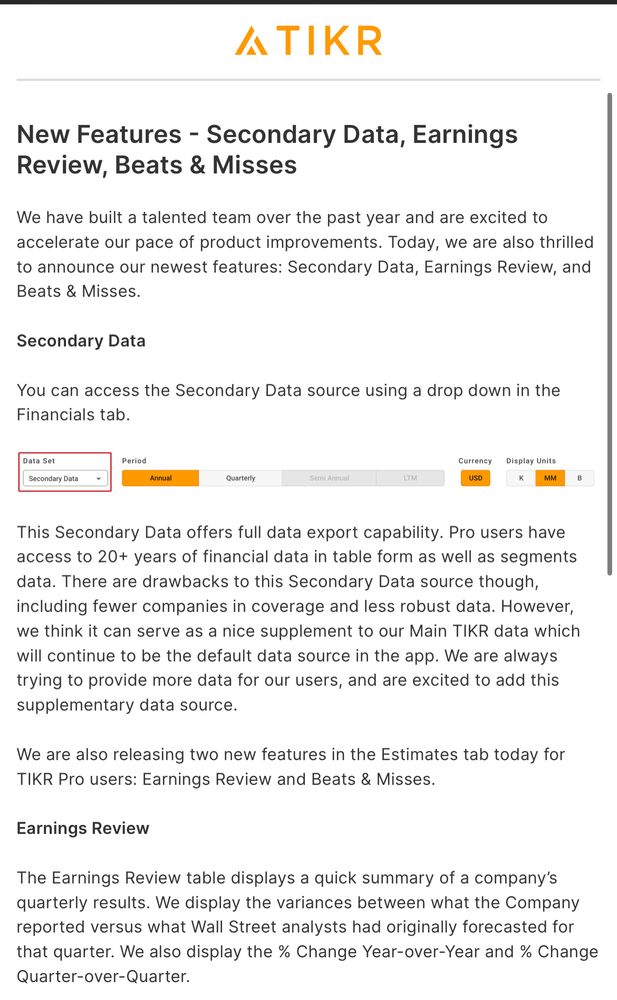

If you want to take a look at them, feel free to use my promo link:

tikr.com/mavix

If you want to take a look at them, feel free to use my promo link:

tikr.com/mavix

The ID5 ID also serves as a reliable and future-proof anchor for increasing publishers inventory by making it more addressable and valuable to buyers.

The ID5 ID also serves as a reliable and future-proof anchor for increasing publishers inventory by making it more addressable and valuable to buyers.

I am very grateful that I was able to achieve this with only 10 write-ups 😅. I really hope and plan to do more write-ups in the future for you, but in the past months I was a bit more busy than usually 😉

underfollowedstocks.substack.com

I am very grateful that I was able to achieve this with only 10 write-ups 😅. I really hope and plan to do more write-ups in the future for you, but in the past months I was a bit more busy than usually 😉

underfollowedstocks.substack.com

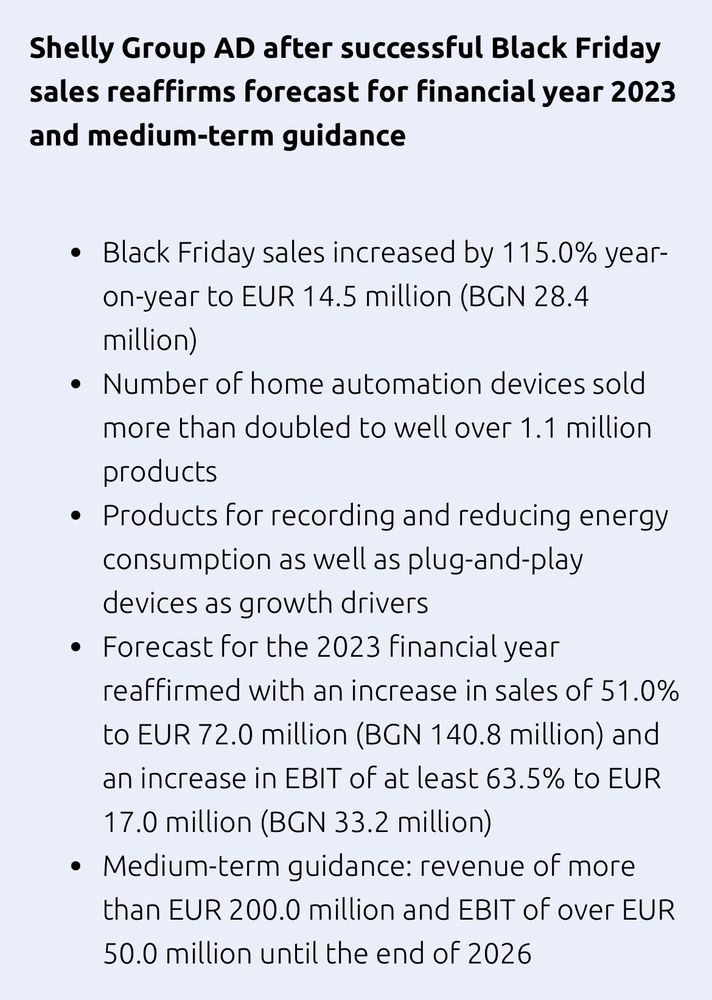

The number of devices sold have more than doubled to well over 1.1 million. Especially devices regarding energy consumption developed positively.

The number of devices sold have more than doubled to well over 1.1 million. Especially devices regarding energy consumption developed positively.

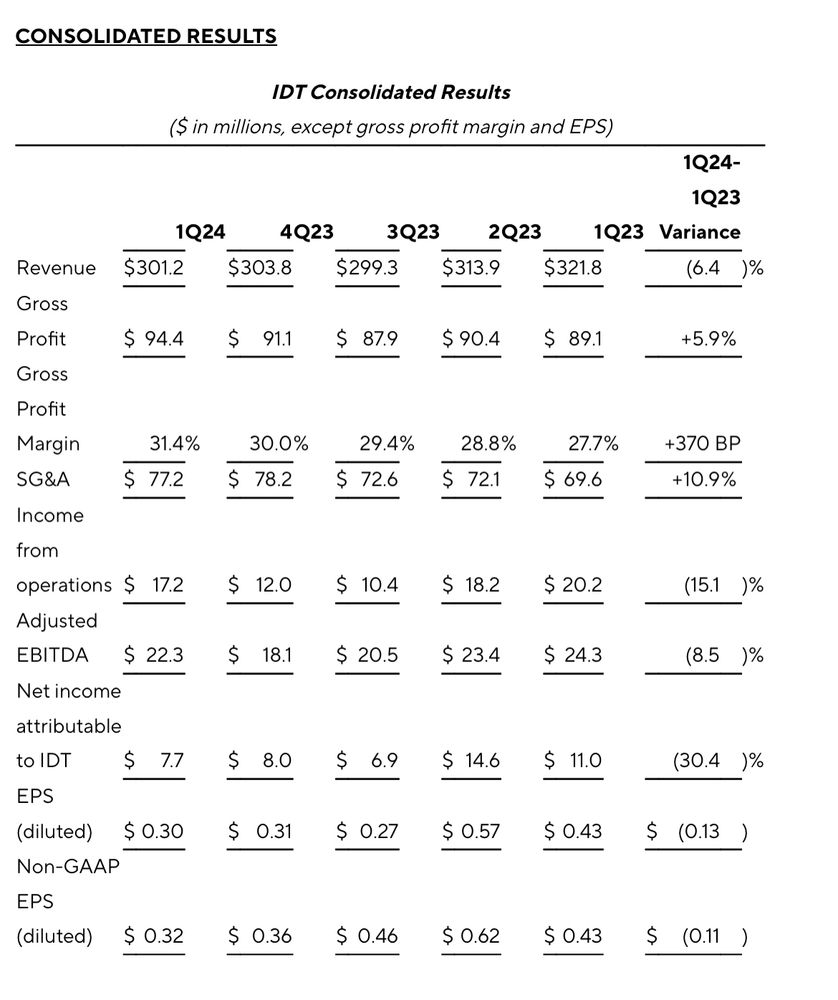

▫️Consolidated Revenue -6.4%

*NRS +24%

*net2phone +18%

*Fintech +34%

*Traditional -13%

▫️Adj. EBITDA -8%

▫️Operating income -15%

▫️Net income -30%

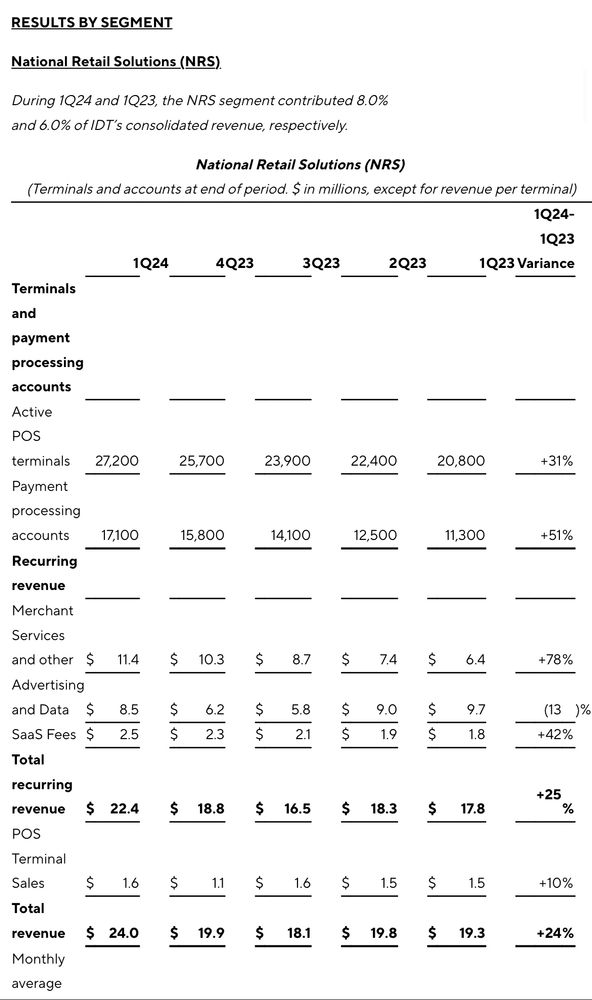

▫️NRS recurring revenue +25%

▫️1.500 new NRS POS terminals during the quarter

▫️Consolidated Revenue -6.4%

*NRS +24%

*net2phone +18%

*Fintech +34%

*Traditional -13%

▫️Adj. EBITDA -8%

▫️Operating income -15%

▫️Net income -30%

▫️NRS recurring revenue +25%

▫️1.500 new NRS POS terminals during the quarter

The Epsilon Smart series has already exceeded 100.000 subscriptions.

The Epsilon Smart series has already exceeded 100.000 subscriptions.

From now on drone garages will be distributed along the ÖBB’s rail network to provide valuable support in case of rockfall and storm damage on a railway.

From now on drone garages will be distributed along the ÖBB’s rail network to provide valuable support in case of rockfall and storm damage on a railway.

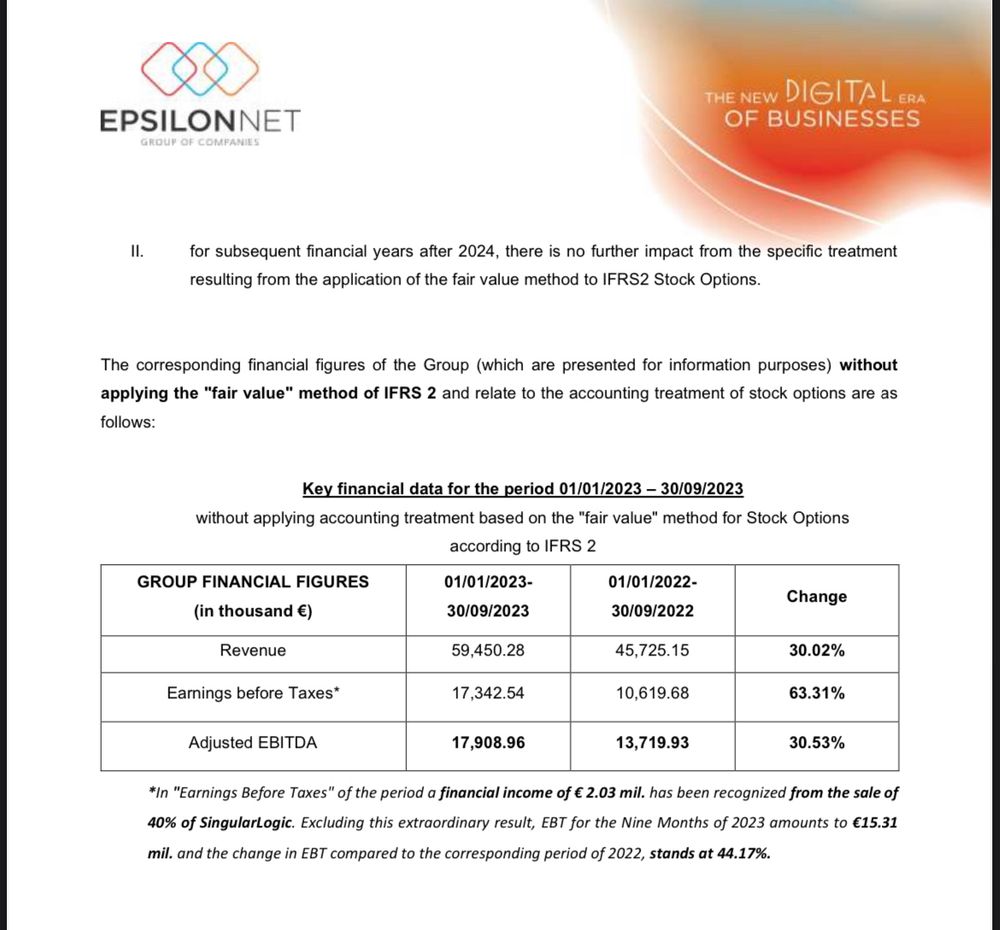

▫️Revenue +30%

*72% of these 30% growth are organic

▫️Adj. EBITDA +30%

▫️EBT +63% (incl. ~EUR 2m financial income for the sale of the stake in SingularLogic)

▫️Adj. EBT +44%

▫️Net Cash of EUR 5.3m (despite significant acquisitions)

▫️Revenue +30%

*72% of these 30% growth are organic

▫️Adj. EBITDA +30%

▫️EBT +63% (incl. ~EUR 2m financial income for the sale of the stake in SingularLogic)

▫️Adj. EBT +44%

▫️Net Cash of EUR 5.3m (despite significant acquisitions)

▫️Revenue +33%

▫️EBITDA +29%

▫️9M net profit fell to EUR 0.2 million (vs. 0.8m) due to higher costs related to the Nostemedia acquisition and the MediaMath insolvency

▫️Full Year Guidance confirmed ✅

▫️Outperformance of the European Digital Advertising market

▫️Revenue +33%

▫️EBITDA +29%

▫️9M net profit fell to EUR 0.2 million (vs. 0.8m) due to higher costs related to the Nostemedia acquisition and the MediaMath insolvency

▫️Full Year Guidance confirmed ✅

▫️Outperformance of the European Digital Advertising market

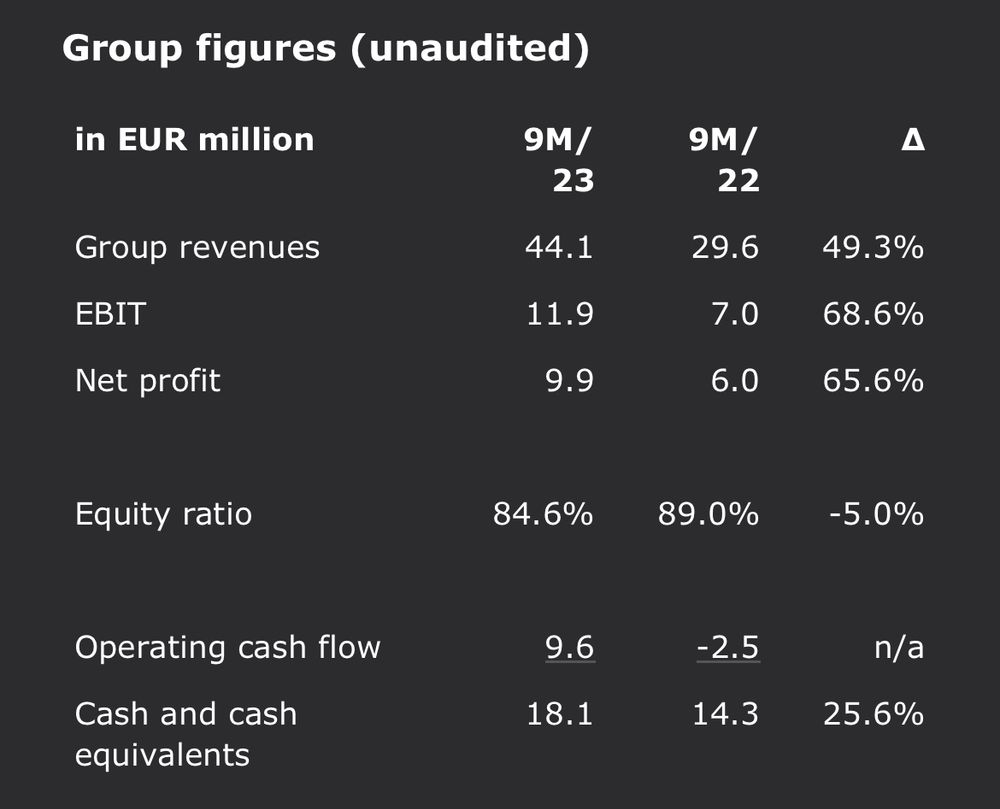

▫️Revenue +49.3%

▫️EBIT +68.6%

▫️Net Profit +65.6%

▫️OCF of EUR 9.6 million (vs. -2.5m)

▫️cloud user base +62.5%

▫️Outlook confirmed:

*Revenue growth of 51%

*EBIT growth of more than 63.5%

▫️Revenue +49.3%

▫️EBIT +68.6%

▫️Net Profit +65.6%

▫️OCF of EUR 9.6 million (vs. -2.5m)

▫️cloud user base +62.5%

▫️Outlook confirmed:

*Revenue growth of 51%

*EBIT growth of more than 63.5%

Singular Logic will receive shares of Epsilon‘s subsidiary Epsilon Singular Logic for the agreed amount of EUR 3 million.

Singular Logic will receive shares of Epsilon‘s subsidiary Epsilon Singular Logic for the agreed amount of EUR 3 million.

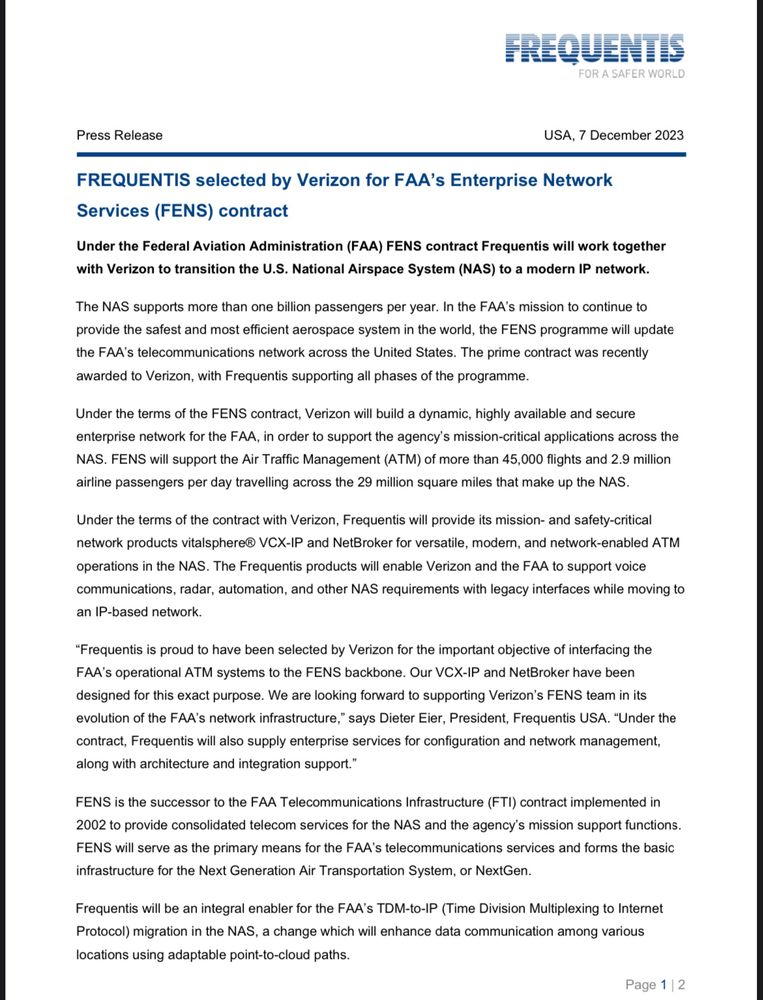

▫️Revenue of EUR 87.6 million (+13%)

▫️EBIT of EUR 5.7 million (-36%)

▫️increased investments in a highly secure cloud infrastructure

▫️unfavorable product mix compared to previous year

▫️order backlog +17%

▫️Revenue of EUR 87.6 million (+13%)

▫️EBIT of EUR 5.7 million (-36%)

▫️increased investments in a highly secure cloud infrastructure

▫️unfavorable product mix compared to previous year

▫️order backlog +17%

▫️Revenues +39% (23% organic)

*Media +49% (23% organic)

*Platform +20% (all organic)

▫️EBITDA +61%

▫️EBIT +173%

▫️EBIT-Margin of 21.2% (10.8%)

▫️EPS of €0.07 (vs. €0.01)

▫️AskGamblers revenues up 45% from run rate at take over

▫️Revenues +39% (23% organic)

*Media +49% (23% organic)

*Platform +20% (all organic)

▫️EBITDA +61%

▫️EBIT +173%

▫️EBIT-Margin of 21.2% (10.8%)

▫️EPS of €0.07 (vs. €0.01)

▫️AskGamblers revenues up 45% from run rate at take over

youtu.be/zyB9MqMwqI4?si=-fsQvH2qrPhSfZ8P

youtu.be/zyB9MqMwqI4?si=-fsQvH2qrPhSfZ8P

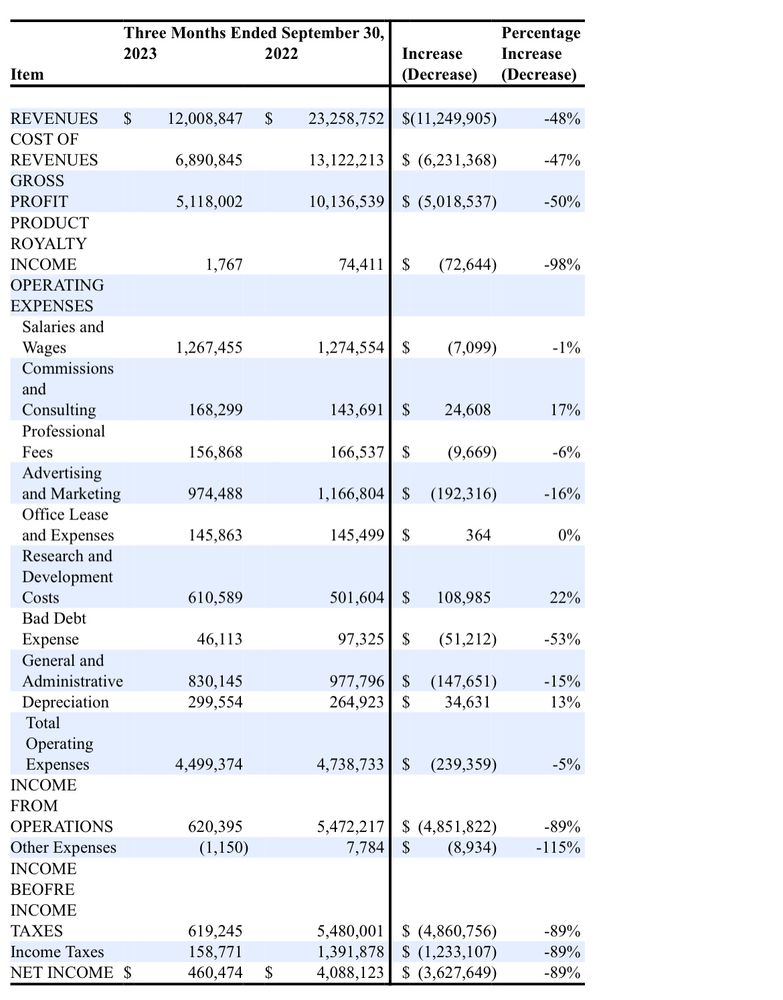

▫️Revenues -48%

*neck braces -63%

*body armor -48%

*helmets -34%

*others -54%

▫️operating income -89%

▫️Net income -89%

▫️operating cashflow +277%

▫️$10.8 million in Cash

▫️results continue to reflect constrained ordering patterns

▫️Revenues -48%

*neck braces -63%

*body armor -48%

*helmets -34%

*others -54%

▫️operating income -89%

▫️Net income -89%

▫️operating cashflow +277%

▫️$10.8 million in Cash

▫️results continue to reflect constrained ordering patterns