The fact that our existing FX reserves didn't require legislation doesn't make them less of a Strategic Reserve. And there was no change to the Treasury's stance that strong USD helps America.

👍

The fact that our existing FX reserves didn't require legislation doesn't make them less of a Strategic Reserve. And there was no change to the Treasury's stance that strong USD helps America.

👍

Assume the US Treasury starts buying 1M Bitcoin over 5 years at a starting price of $200k.

Assume US debt grows at 5% (vs. last 10 years 8% CAGR) & BTC price compounds at 25%.

Assume the US Treasury starts buying 1M Bitcoin over 5 years at a starting price of $200k.

Assume US debt grows at 5% (vs. last 10 years 8% CAGR) & BTC price compounds at 25%.

Still bullish

Link in reply⬇️

Still bullish

Link in reply⬇️

No bond issuance needed 🫡

No bond issuance needed 🫡

@elonmusk

@elonmusk

Currently, Long Mag 7 is considered the 'most crowded trade' (57%) followed by #2 long US dollar (15%), and #3 long Russell 2000 (6%).

Currently, Long Mag 7 is considered the 'most crowded trade' (57%) followed by #2 long US dollar (15%), and #3 long Russell 2000 (6%).

Fiscal Reckoning: If DOGE doesn't succeed, inflation risks loom.

Gold & Bitcoin: Inflation, fiscal uncertainty, & de-dollarization drive bull markets.

AI & Energy: Focus beyond tech—energy, infra, utilities.

India: Rapid growth = continued opportunity.

🧵

Fiscal Reckoning: If DOGE doesn't succeed, inflation risks loom.

Gold & Bitcoin: Inflation, fiscal uncertainty, & de-dollarization drive bull markets.

AI & Energy: Focus beyond tech—energy, infra, utilities.

India: Rapid growth = continued opportunity.

🧵

However, are they counting correctly?

Tron gives users free TRX as a rebate called bandwidth— We believe Token Terminal adds the “free rebate” as revenue we don’t since it’s not necessarily what end Tron users are “spending"

However, are they counting correctly?

Tron gives users free TRX as a rebate called bandwidth— We believe Token Terminal adds the “free rebate” as revenue we don’t since it’s not necessarily what end Tron users are “spending"

Looks like they do factor in the free bandwidth given to users in the revenue calculation.

tronscan.org/#/data/charts/…

Looks like they do factor in the free bandwidth given to users in the revenue calculation.

tronscan.org/#/data/charts/…

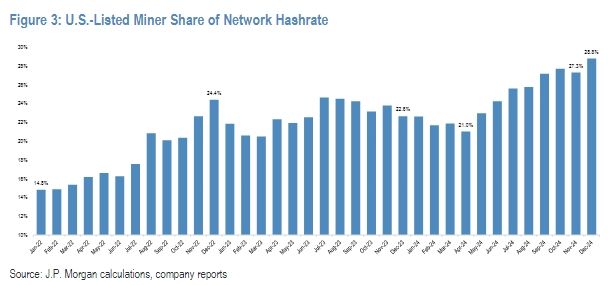

U.S.-listed miners added ~23 EH/s since the end of October (11% increase) vs a 6% increase in the broader network hashrate: JPM.

U.S.-listed miners added ~23 EH/s since the end of October (11% increase) vs a 6% increase in the broader network hashrate: JPM.

vaneck.com/us/en/blogs/di…

vaneck.com/us/en/blogs/di…

vaneck.com/us/en/blogs/di…

vaneck.com/us/en/blogs/di…

Will Close Inaugural Fund 1 in February

@Wyatt_Lonergan @0xlaguna

🧵for investment thesis

Will Close Inaugural Fund 1 in February

@Wyatt_Lonergan @0xlaguna

🧵for investment thesis

"In another unusual setup, Exxon’s plant would not be connected to the electric grid"

"In another unusual setup, Exxon’s plant would not be connected to the electric grid"

Core PCE, the Fed's "Preferred" Measure, Also Didn't Reach 2%, and that Series Understates Housing Costs, Americans' Top Concern.

They Are Cutting Rates Anyway & Laughing at You, Pleb.

#Bitcoin May Protect Against the Government Devaluing Your $.

Core PCE, the Fed's "Preferred" Measure, Also Didn't Reach 2%, and that Series Understates Housing Costs, Americans' Top Concern.

They Are Cutting Rates Anyway & Laughing at You, Pleb.

#Bitcoin May Protect Against the Government Devaluing Your $.