University of Oxford @ox.ac.uk

New research from So Hye Yoon (Princeton job market candidate) examines a key challenge: information asymmetry.

Cloe Garnache hosts this episode of The Property Pod 👇

New research from So Hye Yoon (Princeton job market candidate) examines a key challenge: information asymmetry.

Cloe Garnache hosts this episode of The Property Pod 👇

New episode The Property Pod with Brian Lancaster & Cameron LaPoint explores PACE financing.

YT: youtu.be/-uV8MleO080

Spotify: open.spotify.com/episode/04gq...

➡️

New episode The Property Pod with Brian Lancaster & Cameron LaPoint explores PACE financing.

YT: youtu.be/-uV8MleO080

Spotify: open.spotify.com/episode/04gq...

➡️

For example, on the topic of what kind of research I could possibly provide guidance for.

For example, on the topic of what kind of research I could possibly provide guidance for.

University of Zurich economist Harald Mayr (@haraldmayr.com) explores behavioral interventions in energy conservation.

1/2➡️

University of Zurich economist Harald Mayr (@haraldmayr.com) explores behavioral interventions in energy conservation.

1/2➡️

And to the FTC's guidance on solely-for-investment. www.ftc.gov/enforcement/...

And to the FTC's guidance on solely-for-investment. www.ftc.gov/enforcement/...

#wildfires #realestate

#wildfires #realestate

No better illustration than this Man United bond.

No better illustration than this Man United bond.

Find out in Episode 1 of our real estate podcast, The Property Pod

(Spotify t.ly/xNtFR , YT t.ly/3r2NO)

It discusses our Journal of Finance paper with David Sraer and David Thesmar🔗https://t.ly/REqNz

Find out in Episode 1 of our real estate podcast, The Property Pod

(Spotify t.ly/xNtFR , YT t.ly/3r2NO)

It discusses our Journal of Finance paper with David Sraer and David Thesmar🔗https://t.ly/REqNz

Now, the U.S. reminds BlackRock that anticompetitive effects of common ownership don't become legal when in the name of ESG.

Now, the U.S. reminds BlackRock that anticompetitive effects of common ownership don't become legal when in the name of ESG.

Spotify t.ly/GJyjZ

Youtube t.ly/Jo51P

Spotify t.ly/GJyjZ

Youtube t.ly/Jo51P

The chart shows the share of firms that have signed a recent opinion among the deregistered ones. 8/10➡️

The chart shows the share of firms that have signed a recent opinion among the deregistered ones. 8/10➡️

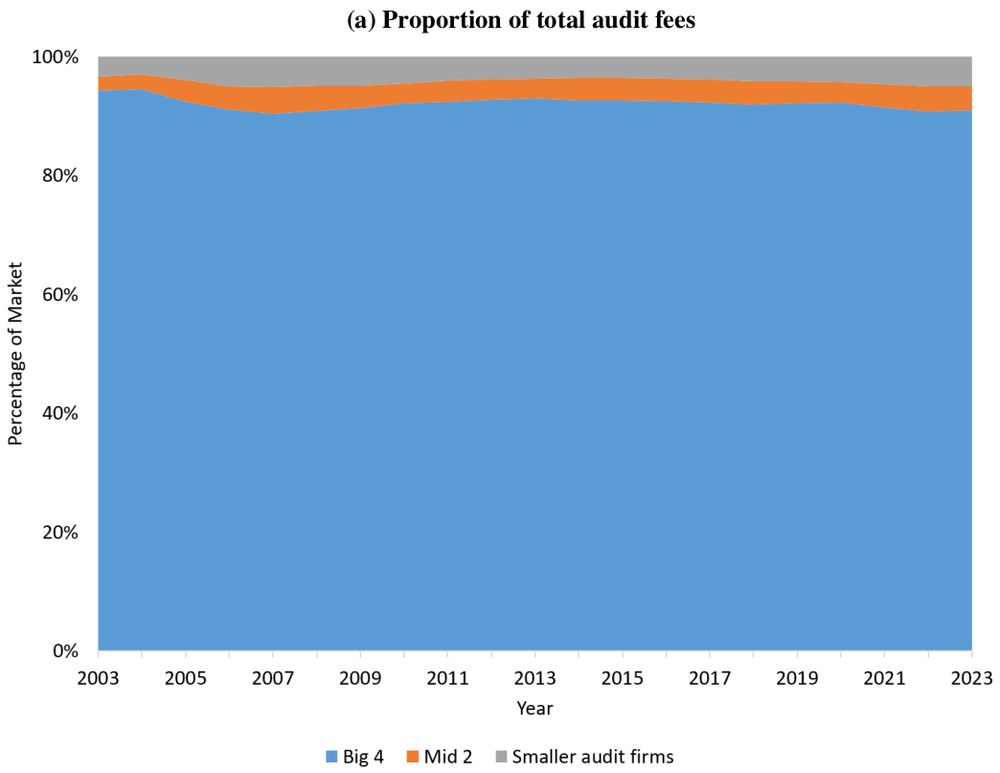

But the share of companies they audit is different 2/10➡️

But the share of companies they audit is different 2/10➡️

"As Warren [Buffett] helped me to understand, people too often justify their improper or misguided actions by reassuring themselves that everyone else is doing it too."

Meanwhile, Warren Buffett:

"As Warren [Buffett] helped me to understand, people too often justify their improper or misguided actions by reassuring themselves that everyone else is doing it too."

Meanwhile, Warren Buffett: