Madalsa

@madalsa.org

Assistant Professor, Rochester Institute of Technology. I study and teach carbon-constrained energy systems. Views mine.

https://madalsa.org/

https://madalsa.org/

caramelized onion + rosemary + balsamic dip topped with sumac edamame on toast for brekkie

November 11, 2025 at 3:15 PM

caramelized onion + rosemary + balsamic dip topped with sumac edamame on toast for brekkie

I'm hiring PhD students to start in Fall 2026!

Current research interests include energy affordability, integrating hyperscale demand in our electricity grids, and advancing sustainable mobility

Apply by Jan 15, 2026: www.rit.edu/study/sustai...

More info at madalsa.org

Current research interests include energy affordability, integrating hyperscale demand in our electricity grids, and advancing sustainable mobility

Apply by Jan 15, 2026: www.rit.edu/study/sustai...

More info at madalsa.org

November 7, 2025 at 8:27 PM

I'm hiring PhD students to start in Fall 2026!

Current research interests include energy affordability, integrating hyperscale demand in our electricity grids, and advancing sustainable mobility

Apply by Jan 15, 2026: www.rit.edu/study/sustai...

More info at madalsa.org

Current research interests include energy affordability, integrating hyperscale demand in our electricity grids, and advancing sustainable mobility

Apply by Jan 15, 2026: www.rit.edu/study/sustai...

More info at madalsa.org

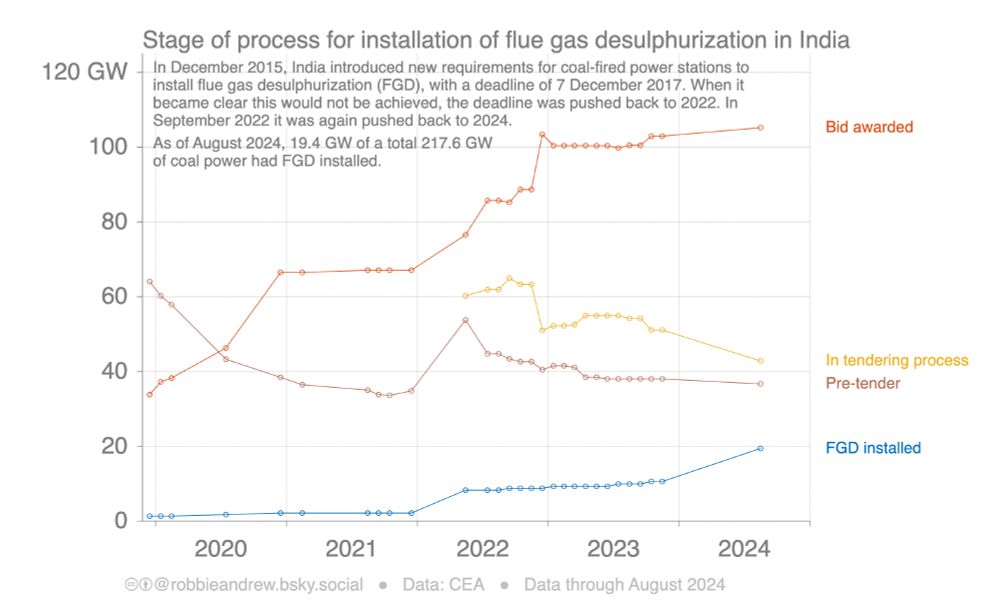

A depressing stat to balance (of course, it is India).

Less than 10% of coal capacity has installed flue gas desulphurization. Been a decade since it was mandated.

Less than 10% of coal capacity has installed flue gas desulphurization. Been a decade since it was mandated.

October 17, 2025 at 1:31 AM

A depressing stat to balance (of course, it is India).

Less than 10% of coal capacity has installed flue gas desulphurization. Been a decade since it was mandated.

Less than 10% of coal capacity has installed flue gas desulphurization. Been a decade since it was mandated.

More than 60% of auto-rickshaw sales in India were battery electric in 2025

Chart from @robbieandrew.bsky.social

Chart from @robbieandrew.bsky.social

October 17, 2025 at 1:25 AM

More than 60% of auto-rickshaw sales in India were battery electric in 2025

Chart from @robbieandrew.bsky.social

Chart from @robbieandrew.bsky.social

And then, if we manage to find an ideal efficient rate, how do we make sure people can respond to the price signals. Right now, customers with DER can use the “flexibility premium“ but about others? (Remember griddy?).

October 14, 2025 at 11:08 PM

And then, if we manage to find an ideal efficient rate, how do we make sure people can respond to the price signals. Right now, customers with DER can use the “flexibility premium“ but about others? (Remember griddy?).

There’s also a technocratic and epistemic question - what is marginal and how do we calculate it?

Should it be forward looking, backward looking? What’s “marginal”? what’s the time-frame?

This was our attempt to delineate.

Should it be forward looking, backward looking? What’s “marginal”? what’s the time-frame?

This was our attempt to delineate.

October 14, 2025 at 11:03 PM

There’s also a technocratic and epistemic question - what is marginal and how do we calculate it?

Should it be forward looking, backward looking? What’s “marginal”? what’s the time-frame?

This was our attempt to delineate.

Should it be forward looking, backward looking? What’s “marginal”? what’s the time-frame?

This was our attempt to delineate.

Before I dig in : the plots and data in this perspective provide a nice snapshot of what was happening to electricity prices until 2023 — no demand surge and macroeconomic uncertainty.

October 14, 2025 at 10:52 PM

Before I dig in : the plots and data in this perspective provide a nice snapshot of what was happening to electricity prices until 2023 — no demand surge and macroeconomic uncertainty.

New perspective : How do we design electricity prices that reflect changing system costs but also not hurt people’s bill?

Balancing efficiency & equity in rate design can be tricky. We provide ideas to operationalize it and challenges along the way

Open access: iopscience.iop.org/article/10.1...

Balancing efficiency & equity in rate design can be tricky. We provide ideas to operationalize it and challenges along the way

Open access: iopscience.iop.org/article/10.1...

October 14, 2025 at 10:49 PM

New perspective : How do we design electricity prices that reflect changing system costs but also not hurt people’s bill?

Balancing efficiency & equity in rate design can be tricky. We provide ideas to operationalize it and challenges along the way

Open access: iopscience.iop.org/article/10.1...

Balancing efficiency & equity in rate design can be tricky. We provide ideas to operationalize it and challenges along the way

Open access: iopscience.iop.org/article/10.1...

At the Nicholas Roerich Museum, since I can’t go to the Himalayas.

September 27, 2025 at 8:56 PM

At the Nicholas Roerich Museum, since I can’t go to the Himalayas.

www.journals.uchicago.edu/doi/full/10....

Perhaps this analysis showing where electricity and natural gas are priced above (blue) and below (red) the social marginal costs? not quite retail though…

Perhaps this analysis showing where electricity and natural gas are priced above (blue) and below (red) the social marginal costs? not quite retail though…

September 23, 2025 at 12:17 PM

www.journals.uchicago.edu/doi/full/10....

Perhaps this analysis showing where electricity and natural gas are priced above (blue) and below (red) the social marginal costs? not quite retail though…

Perhaps this analysis showing where electricity and natural gas are priced above (blue) and below (red) the social marginal costs? not quite retail though…

- regimes exhibit tendencies to U-turn across liberal-authoritarian spectrum, i.e they bounce back to (largely) their original state

- past liberal democracies (LD) tended to skip intermediate electoral democracy (ED) stage & jumped straight to closed authoritarian regimes before reversion to LD

- past liberal democracies (LD) tended to skip intermediate electoral democracy (ED) stage & jumped straight to closed authoritarian regimes before reversion to LD

September 22, 2025 at 12:31 AM

- regimes exhibit tendencies to U-turn across liberal-authoritarian spectrum, i.e they bounce back to (largely) their original state

- past liberal democracies (LD) tended to skip intermediate electoral democracy (ED) stage & jumped straight to closed authoritarian regimes before reversion to LD

- past liberal democracies (LD) tended to skip intermediate electoral democracy (ED) stage & jumped straight to closed authoritarian regimes before reversion to LD

Quite interesting that despite having much more expensive electricity and gasoline, the average Californian resident spends less on energy than one in West Virginia.

[From EPRI's Energy Wallet: energywallet.epri.com/en/map.html]

[From EPRI's Energy Wallet: energywallet.epri.com/en/map.html]

September 19, 2025 at 3:08 PM

Quite interesting that despite having much more expensive electricity and gasoline, the average Californian resident spends less on energy than one in West Virginia.

[From EPRI's Energy Wallet: energywallet.epri.com/en/map.html]

[From EPRI's Energy Wallet: energywallet.epri.com/en/map.html]

Cool paper!

Only ~33% fast charging stations provide real-time data.

Making real-time data available for all highway fast chargers would raise the EV share of car sales by 8% in 2030; expand the total EV fleet by ~13% over baseline.

Easy, cheap, low-hanging fruit.

www.nber.org/system/files...

Only ~33% fast charging stations provide real-time data.

Making real-time data available for all highway fast chargers would raise the EV share of car sales by 8% in 2030; expand the total EV fleet by ~13% over baseline.

Easy, cheap, low-hanging fruit.

www.nber.org/system/files...

September 18, 2025 at 7:05 PM

Cool paper!

Only ~33% fast charging stations provide real-time data.

Making real-time data available for all highway fast chargers would raise the EV share of car sales by 8% in 2030; expand the total EV fleet by ~13% over baseline.

Easy, cheap, low-hanging fruit.

www.nber.org/system/files...

Only ~33% fast charging stations provide real-time data.

Making real-time data available for all highway fast chargers would raise the EV share of car sales by 8% in 2030; expand the total EV fleet by ~13% over baseline.

Easy, cheap, low-hanging fruit.

www.nber.org/system/files...

producing electrons — generation — is NOT what California IOUs (and POUs for that matter) are spending their increased revenues on

September 12, 2025 at 9:28 PM

producing electrons — generation — is NOT what California IOUs (and POUs for that matter) are spending their increased revenues on

To note: EU standards (EURO 6D,G) are almost 3.3x US standards (Tier 3). Of course this is all before 2025.

Me pre 2025: sure Europe has smaller cars, walkable cities, and free healthcare. US has EPA.

Me pre 2025: sure Europe has smaller cars, walkable cities, and free healthcare. US has EPA.

August 26, 2025 at 9:01 PM

To note: EU standards (EURO 6D,G) are almost 3.3x US standards (Tier 3). Of course this is all before 2025.

Me pre 2025: sure Europe has smaller cars, walkable cities, and free healthcare. US has EPA.

Me pre 2025: sure Europe has smaller cars, walkable cities, and free healthcare. US has EPA.

Folks from Cambridge looked at this for PM 10 and for tyres. Secondary literature overstates the PM10 emissions.

August 26, 2025 at 8:46 PM

Folks from Cambridge looked at this for PM 10 and for tyres. Secondary literature overstates the PM10 emissions.

We also discuss rate of return (money earned on capital) and return on equity (money given to shareholders). Profits and returns have bounced back to pre-wildfire.

Also, to note: 12 out of the last 15 years, SDG&E has earned more than its authorized ROR.

Also, to note: 12 out of the last 15 years, SDG&E has earned more than its authorized ROR.

August 18, 2025 at 8:04 PM

We also discuss rate of return (money earned on capital) and return on equity (money given to shareholders). Profits and returns have bounced back to pre-wildfire.

Also, to note: 12 out of the last 15 years, SDG&E has earned more than its authorized ROR.

Also, to note: 12 out of the last 15 years, SDG&E has earned more than its authorized ROR.

Few addenda (good to be back on Bluesky with research! So many cool comments)

A conclusion at the time of writing was the continued divergence between public and investor-owned utility prices due to wildfire-driven network costs. I'll be curious to see LADWP expenses/prices after Eaton Fire.

A conclusion at the time of writing was the continued divergence between public and investor-owned utility prices due to wildfire-driven network costs. I'll be curious to see LADWP expenses/prices after Eaton Fire.

August 18, 2025 at 7:56 PM

Few addenda (good to be back on Bluesky with research! So many cool comments)

A conclusion at the time of writing was the continued divergence between public and investor-owned utility prices due to wildfire-driven network costs. I'll be curious to see LADWP expenses/prices after Eaton Fire.

A conclusion at the time of writing was the continued divergence between public and investor-owned utility prices due to wildfire-driven network costs. I'll be curious to see LADWP expenses/prices after Eaton Fire.

CCAs, which have positioned themselves as an alternative to the IOUs, have had a limited ability to offer customers substantial bill savings in California.

While CCAs can set their own generation charges, they are assessed the same T&D charges as the parent IOU (shaded portions).

While CCAs can set their own generation charges, they are assessed the same T&D charges as the parent IOU (shaded portions).

August 18, 2025 at 5:00 PM

CCAs, which have positioned themselves as an alternative to the IOUs, have had a limited ability to offer customers substantial bill savings in California.

While CCAs can set their own generation charges, they are assessed the same T&D charges as the parent IOU (shaded portions).

While CCAs can set their own generation charges, they are assessed the same T&D charges as the parent IOU (shaded portions).

Operations and maintenance expenses of IOUs have a striking pattern.

Generation O&M (purchasing fuel/power, etc) increased due to higher natural gas costs, but the increase has been in historical ranges.

T&D O&M (vegetation management, powerline maintenance) increased 4-5x after wildfires.

Generation O&M (purchasing fuel/power, etc) increased due to higher natural gas costs, but the increase has been in historical ranges.

T&D O&M (vegetation management, powerline maintenance) increased 4-5x after wildfires.

August 18, 2025 at 5:00 PM

Operations and maintenance expenses of IOUs have a striking pattern.

Generation O&M (purchasing fuel/power, etc) increased due to higher natural gas costs, but the increase has been in historical ranges.

T&D O&M (vegetation management, powerline maintenance) increased 4-5x after wildfires.

Generation O&M (purchasing fuel/power, etc) increased due to higher natural gas costs, but the increase has been in historical ranges.

T&D O&M (vegetation management, powerline maintenance) increased 4-5x after wildfires.

Across power providers in California, capital expenses on generation have decreased (deregulation). But those on T&D have increased.

The increase is much higher in IOUs (2-4.5x) compared to POU (1.6-2x) in real terms.

Grid capital expenses of power providers are driven by wires, not generation.

The increase is much higher in IOUs (2-4.5x) compared to POU (1.6-2x) in real terms.

Grid capital expenses of power providers are driven by wires, not generation.

August 18, 2025 at 5:00 PM

Across power providers in California, capital expenses on generation have decreased (deregulation). But those on T&D have increased.

The increase is much higher in IOUs (2-4.5x) compared to POU (1.6-2x) in real terms.

Grid capital expenses of power providers are driven by wires, not generation.

The increase is much higher in IOUs (2-4.5x) compared to POU (1.6-2x) in real terms.

Grid capital expenses of power providers are driven by wires, not generation.

dispatch from upstate New York — my new base where I know no one — finding at least some dependable familiarity in the continued loss of public confidence in investor-owned utilities.

July 25, 2025 at 12:07 AM

dispatch from upstate New York — my new base where I know no one — finding at least some dependable familiarity in the continued loss of public confidence in investor-owned utilities.

Dang. CSU gave $17 million to OpenAI for ChatGPT during possibly the worst fiscal year for California's higher education.

July 9, 2025 at 1:52 PM

Dang. CSU gave $17 million to OpenAI for ChatGPT during possibly the worst fiscal year for California's higher education.