Transforming macro into charts one data point at a time

Formerly @stoneX @macrohive @themacrocompass

#finsky #econsky

Heres part of my work:

Macrodispatch.com

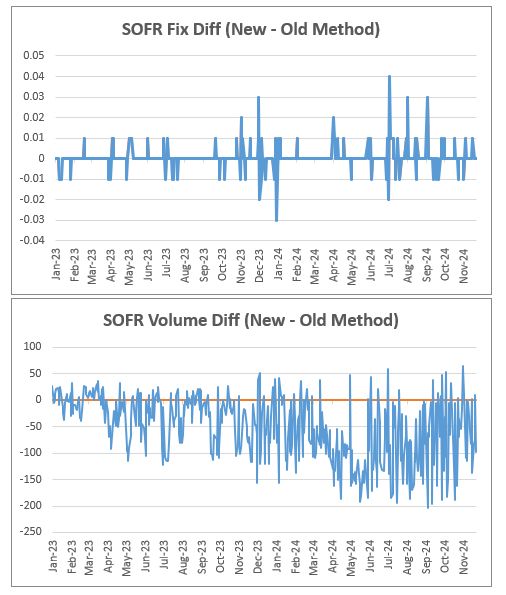

And month end fixes can be 1bp wider.

And month end fixes can be 1bp wider.

Lower specials impact

Ad-hoc affiliated institutions Triming,

=

Cleaner Read of repo conditions of money markets and not specific collateral demand.

Lower specials impact

Ad-hoc affiliated institutions Triming,

=

Cleaner Read of repo conditions of money markets and not specific collateral demand.

How was it before?

How was it before?

how you may ask?

how you may ask?

US Bonds Markets

With the OFR’s initiative, we gain a clearer view of the mechanisms behind the most liquid market in the world.

US Bonds Markets

With the OFR’s initiative, we gain a clearer view of the mechanisms behind the most liquid market in the world.

$175 million for Treasuries.

$209 million for non-Treasuries.

These margins are driven by offsetting transactions with rehypothecated collateral.

$175 million for Treasuries.

$209 million for non-Treasuries.

These margins are driven by offsetting transactions with rehypothecated collateral.

For example, dealers often reuse GC collateral in tri-party repos to raise cash.

That cash can then be lent into NCCBR and DVP markets.

For example, dealers often reuse GC collateral in tri-party repos to raise cash.

That cash can then be lent into NCCBR and DVP markets.

Here's what it uncovered:

65% of received collateral is rehypothecated.

This is below the Federal Reserve's Regulation T limit of 140%.

Here's what it uncovered:

65% of received collateral is rehypothecated.

This is below the Federal Reserve's Regulation T limit of 140%.

www.macrodispatch.com/weekly-energy/

www.macrodispatch.com/weekly-energy/