(@NationsWealth in other place)

cc @hussmanjp.bsky.social

(Money, Bank Credit, and Economic Cycles, J. Huerta De Soto)

cc @hussmanjp.bsky.social

(Money, Bank Credit, and Economic Cycles, J. Huerta De Soto)

We've been trained as monkeys for decades to not fight the Fed & buy any dip.

QT is done now. Soon QE will be back. Brrr.. I know 'until investors are not risk adverse... yada yada'

We've been trained as monkeys for decades to not fight the Fed & buy any dip.

QT is done now. Soon QE will be back. Brrr.. I know 'until investors are not risk adverse... yada yada'

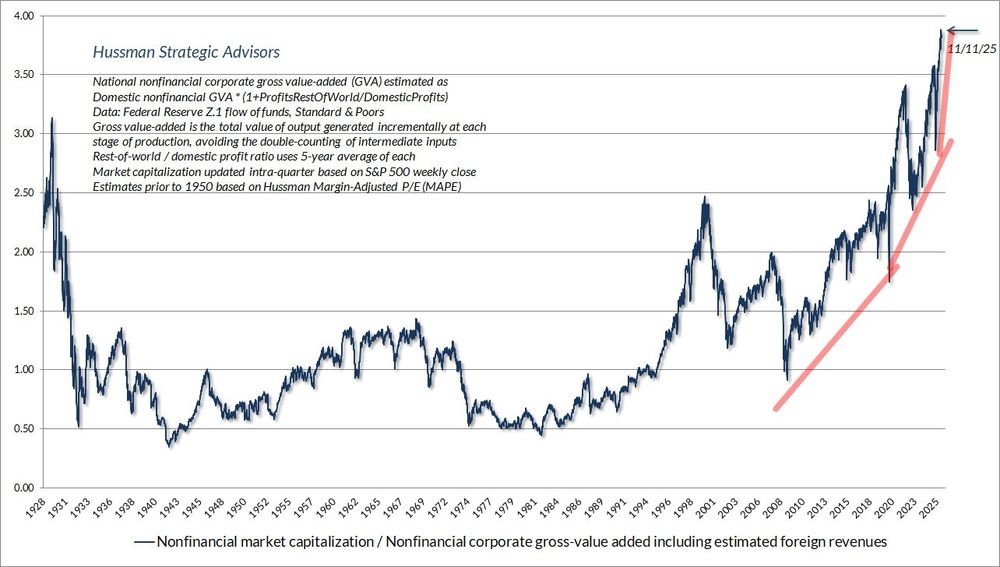

ps we got 14% over 12-year

pps I'm convinced this bubble will end but I have been very wrong for a very long time too

cc @hussmanjp.bsky.social

www.hussmanfunds.com/wmc/wmc13101...

ps we got 14% over 12-year

pps I'm convinced this bubble will end but I have been very wrong for a very long time too

cc @hussmanjp.bsky.social

www.hussmanfunds.com/wmc/wmc13101...

@hussmanjp.bsky.social

@hussmanjp.bsky.social

cc @hussmanjp.bsky.social

cc @hussmanjp.bsky.social

what about year 2 and 3? We hardly know when the recession starts and only with hindsight

what about year 2 and 3? We hardly know when the recession starts and only with hindsight