leoahrens.eu

@pavisuri.bsky.social

@pavisuri.bsky.social

doi.org/10.1080/1745...

polisky cpesky

doi.org/10.1080/1745...

polisky cpesky

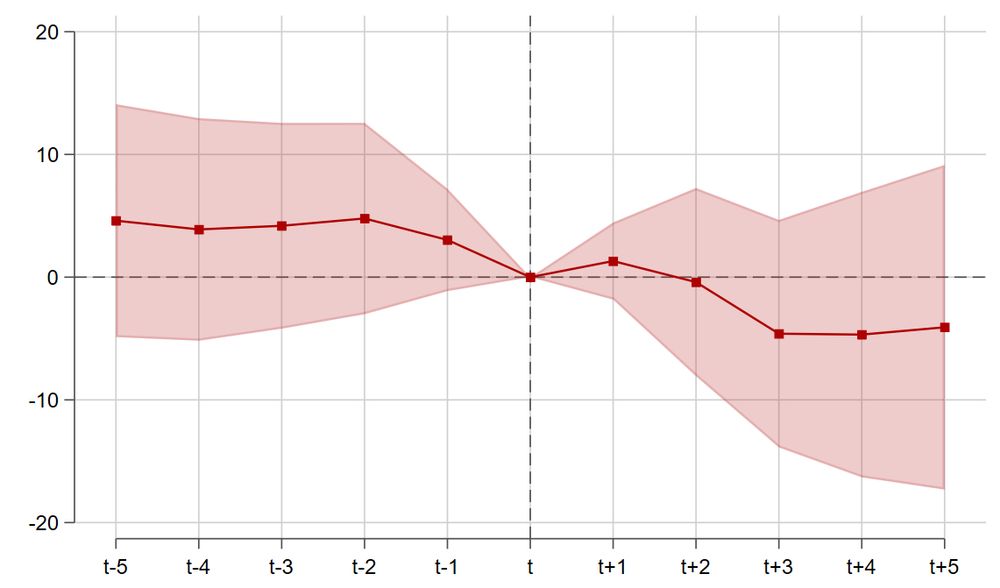

Below is a thread summarizing our findings.

Open access: doi.org/10.1016/j.el...

Below is a thread summarizing our findings.

Open access: doi.org/10.1016/j.el...

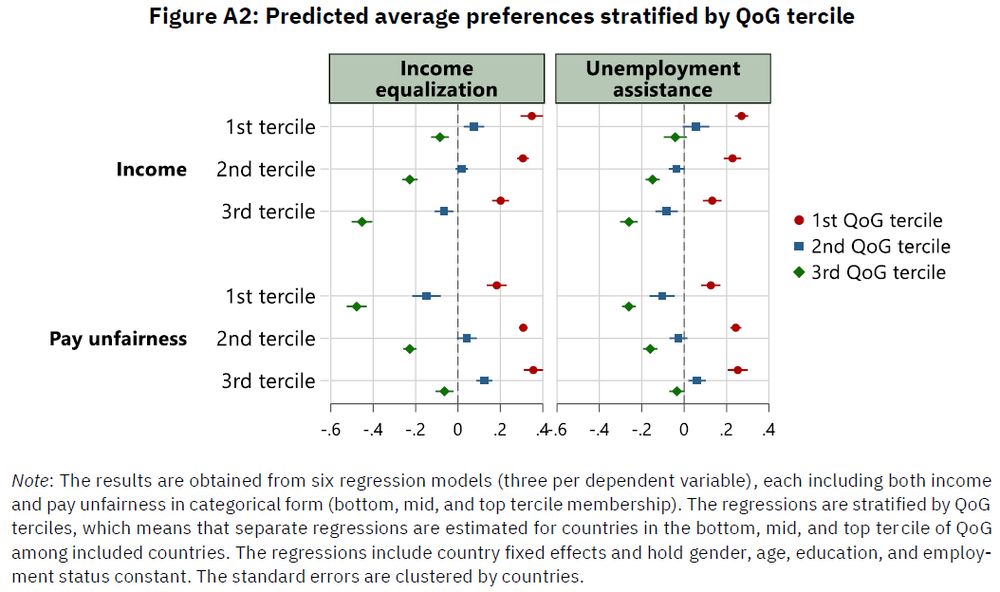

Open access: doi.org/10.1007/s413...

Open access: doi.org/10.1007/s413...

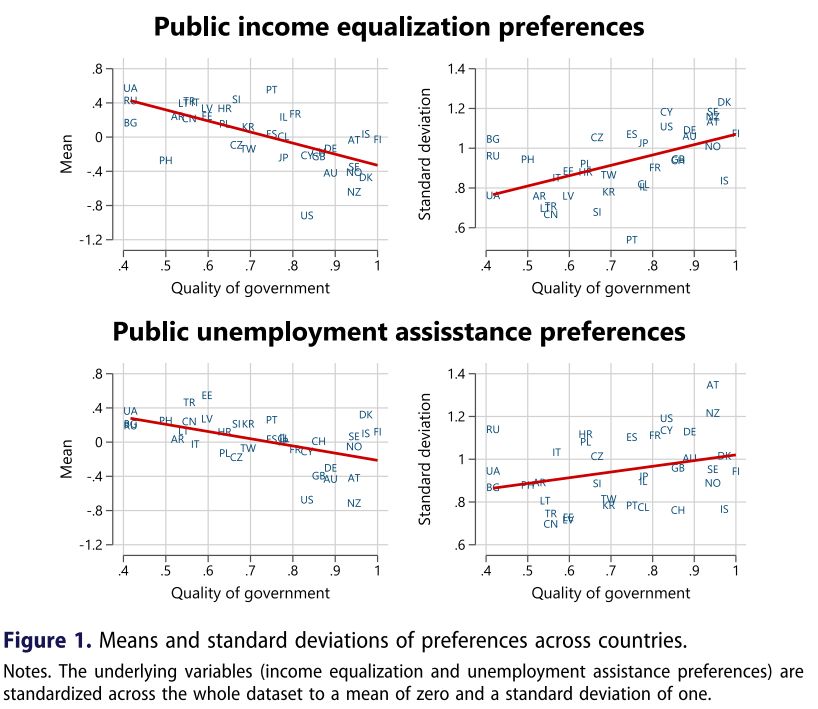

I only use pixelated images w/ opaque elements (eg the scatter points here). Why don't journal accept a vector file format that supports opacity, such as EMF?

I only use pixelated images w/ opaque elements (eg the scatter points here). Why don't journal accept a vector file format that supports opacity, such as EMF?