Lee Harris

@leeharris.ft.com

Journalist at the Financial Times

Contact: lee.harris@ft.com

Contact: lee.harris@ft.com

Tfw your credit ratings are very normal

November 10, 2025 at 1:02 PM

Tfw your credit ratings are very normal

The insurance industry has stepped up efforts to limit future payouts over for petrochemical disasters, following a record judgment by Sri Lanka’s supreme court over the world’s biggest recorded plastic spill. on.ft.com/4n49rvU

October 14, 2025 at 8:11 AM

The insurance industry has stepped up efforts to limit future payouts over for petrochemical disasters, following a record judgment by Sri Lanka’s supreme court over the world’s biggest recorded plastic spill. on.ft.com/4n49rvU

Thanks @matt-levine.bsky.social for featuring the story in Money Stuff :)

September 2, 2025 at 8:03 PM

Thanks @matt-levine.bsky.social for featuring the story in Money Stuff :)

Munich Re also criticized cat bond investors for being super selective, only taking on the most statistically improbable risks. By contrast, when it does this with its own clients, it’s to ensure prices stay high enough to earn a healthy profit, Munich Re told me:

September 2, 2025 at 8:02 PM

Munich Re also criticized cat bond investors for being super selective, only taking on the most statistically improbable risks. By contrast, when it does this with its own clients, it’s to ensure prices stay high enough to earn a healthy profit, Munich Re told me:

The world’s biggest reinsurer has warned that the growth of private investment in cat bonds could raise volatility in insurance markets, if hedge funds + other private investors suddenly pulled out. My story: on.ft.com/47piXpb

September 2, 2025 at 8:02 PM

The world’s biggest reinsurer has warned that the growth of private investment in cat bonds could raise volatility in insurance markets, if hedge funds + other private investors suddenly pulled out. My story: on.ft.com/47piXpb

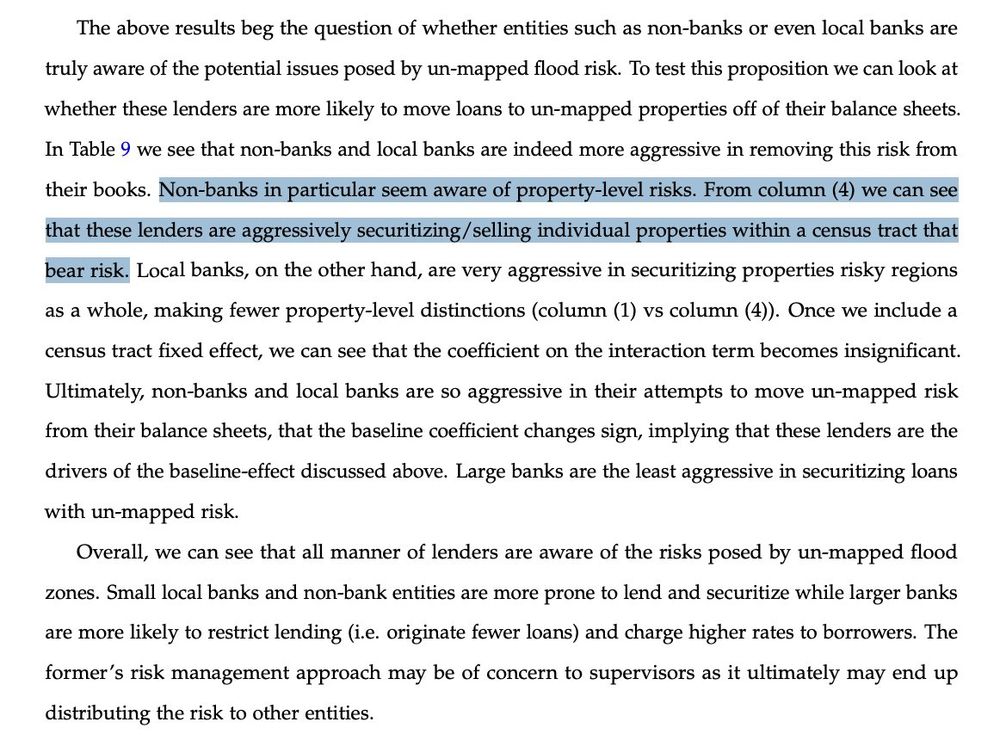

Interesting new study from NY Fed compares how lenders treat unmapped flood risk (due to FEMA’s outdated maps). Big banks are lending less and charging more in risky areas. Non-banks and local banks are still originating the loans but then securitizing or moving them off their balance sheet

August 7, 2025 at 4:58 PM

Interesting new study from NY Fed compares how lenders treat unmapped flood risk (due to FEMA’s outdated maps). Big banks are lending less and charging more in risky areas. Non-banks and local banks are still originating the loans but then securitizing or moving them off their balance sheet

NEW: The boss of the world’s biggest litigation funder has accused Chubb of abusing its market power, after the insurer said it would freeze out lawyers, bankers and asset managers who worked with the sector

May 27, 2025 at 12:35 PM

NEW: The boss of the world’s biggest litigation funder has accused Chubb of abusing its market power, after the insurer said it would freeze out lawyers, bankers and asset managers who worked with the sector

>Insurance regulator: Small credit rating agencies like Kroll are giving higher scores to private credit, vs bigger groups like Fitch

>Fitch calls attention to this

>Regulator retracts the study

>JPM note warns of “potential ratings inflation” in private credit 👀

>Fitch calls attention to this

>Regulator retracts the study

>JPM note warns of “potential ratings inflation” in private credit 👀

May 24, 2025 at 12:43 PM

>Insurance regulator: Small credit rating agencies like Kroll are giving higher scores to private credit, vs bigger groups like Fitch

>Fitch calls attention to this

>Regulator retracts the study

>JPM note warns of “potential ratings inflation” in private credit 👀

>Fitch calls attention to this

>Regulator retracts the study

>JPM note warns of “potential ratings inflation” in private credit 👀

NEW: US life insurers have shifted more than $1 trillion of liabilities offshore, offloading more risk despite regulators’ concerns about protections for retirement savings and broader financial stability.

May 21, 2025 at 3:41 PM

NEW: US life insurers have shifted more than $1 trillion of liabilities offshore, offloading more risk despite regulators’ concerns about protections for retirement savings and broader financial stability.

Chairman French Hill last month introduced a bill with Richie Torres, the Democrat from New York, making the case to end the nuclear taboo to help the west compete with China and Russia in exporting and financing the technology. on.ft.com/4if2SVD

March 9, 2025 at 10:39 AM

Chairman French Hill last month introduced a bill with Richie Torres, the Democrat from New York, making the case to end the nuclear taboo to help the west compete with China and Russia in exporting and financing the technology. on.ft.com/4if2SVD

African business leaders such as Charles Mensa, who ran Ghana’s biggest aluminium smelter, have long said nuclear should be an option — especially for energy-intensive industrial development where it could help boost broader growth on.ft.com/3DrSA5m

March 9, 2025 at 10:38 AM

African business leaders such as Charles Mensa, who ran Ghana’s biggest aluminium smelter, have long said nuclear should be an option — especially for energy-intensive industrial development where it could help boost broader growth on.ft.com/3DrSA5m

I wrote about ocean-based carbon removal startups—one that just shut down, and one that’s moving ahead with a commercial-scale facility.

The company that’s moving ahead makes green hydrogen as a “byproduct” of its carbon removal credit business:

on.ft.com/3VS5y2F

The company that’s moving ahead makes green hydrogen as a “byproduct” of its carbon removal credit business:

on.ft.com/3VS5y2F

June 22, 2024 at 11:30 AM

I wrote about ocean-based carbon removal startups—one that just shut down, and one that’s moving ahead with a commercial-scale facility.

The company that’s moving ahead makes green hydrogen as a “byproduct” of its carbon removal credit business:

on.ft.com/3VS5y2F

The company that’s moving ahead makes green hydrogen as a “byproduct” of its carbon removal credit business:

on.ft.com/3VS5y2F

A new tool from the Center for Active Stewardship shows how big companies cut emissions. For ex, Walmart and Target made headline cuts, but mostly through “trading”, or buying power purchase agreements and renewable energy credits, which can be lower-quality drivers. activestewardship.org/splice/

April 15, 2024 at 2:49 PM

A new tool from the Center for Active Stewardship shows how big companies cut emissions. For ex, Walmart and Target made headline cuts, but mostly through “trading”, or buying power purchase agreements and renewable energy credits, which can be lower-quality drivers. activestewardship.org/splice/

The co-founders of Unwritten, which looks to turn climate risks into company-level “cash flow” models, previously led a climate data team at Palantir. One told me there’s “a sense that we’ve pushed this carbon emissions thing really pretty far, and how much more can we get out of it.”

April 15, 2024 at 12:41 PM

The co-founders of Unwritten, which looks to turn climate risks into company-level “cash flow” models, previously led a climate data team at Palantir. One told me there’s “a sense that we’ve pushed this carbon emissions thing really pretty far, and how much more can we get out of it.”

December 2, 2023 at 5:43 PM

Truly sublime lineup at this year’s DERVOS

I’ll be moderating a panel on the politics of distributed energy resources, like solar panels and electric cars. Event is sold out, but join the livestream on Thursday:

www.eventbrite.com/e/dervos-liv...

I’ll be moderating a panel on the politics of distributed energy resources, like solar panels and electric cars. Event is sold out, but join the livestream on Thursday:

www.eventbrite.com/e/dervos-liv...

November 7, 2023 at 2:53 PM

Truly sublime lineup at this year’s DERVOS

I’ll be moderating a panel on the politics of distributed energy resources, like solar panels and electric cars. Event is sold out, but join the livestream on Thursday:

www.eventbrite.com/e/dervos-liv...

I’ll be moderating a panel on the politics of distributed energy resources, like solar panels and electric cars. Event is sold out, but join the livestream on Thursday:

www.eventbrite.com/e/dervos-liv...

Matt Frantzen, President of UAW Local 1268, on being invited to meet personally with Biden:

prospect.org/labor/11-02-...

prospect.org/labor/11-02-...

November 2, 2023 at 2:24 PM

Matt Frantzen, President of UAW Local 1268, on being invited to meet personally with Biden:

prospect.org/labor/11-02-...

prospect.org/labor/11-02-...

I wonder why this deal isn’t getting more attention from critics who point out that the US lacks sectoral bargaining. The construction industry is generally fragmented. But solar is concentrated—big opportunity to hash out a master agreement between EPCs, developers and labor.

October 23, 2023 at 2:06 PM

I wonder why this deal isn’t getting more attention from critics who point out that the US lacks sectoral bargaining. The construction industry is generally fragmented. But solar is concentrated—big opportunity to hash out a master agreement between EPCs, developers and labor.

One like = one prayer for @70sbachchan.bsky.social

October 6, 2023 at 9:31 PM

One like = one prayer for @70sbachchan.bsky.social

Bluesky will feel real to me when Albert Pinto arrives. REPOST or type AMEN in the comments to tell @70sbachchan.bsky.social to get over here!

October 6, 2023 at 9:30 PM

Bluesky will feel real to me when Albert Pinto arrives. REPOST or type AMEN in the comments to tell @70sbachchan.bsky.social to get over here!