No timeline was announced for the consolidation of larger deferred pots. But the Minister for Pensions did indicate this could happen in the future

No timeline was announced for the consolidation of larger deferred pots. But the Minister for Pensions did indicate this could happen in the future

Good to see that they will consider how this platform could build on the work done for Pensions Dashboard.

Good to see that they will consider how this platform could build on the work done for Pensions Dashboard.

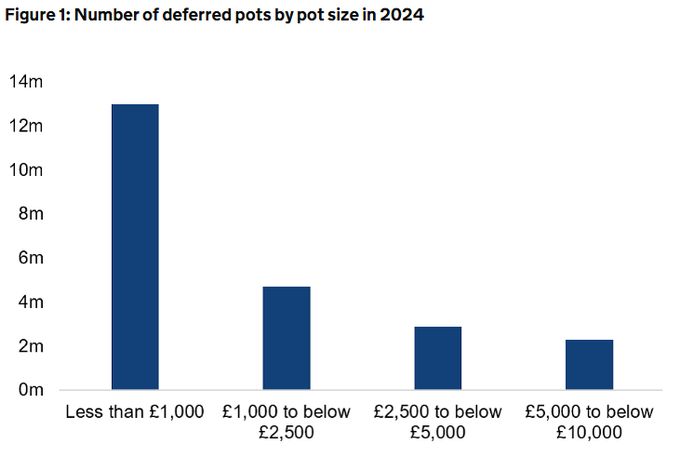

Plus another 10 million pots worth between £1k and £10k.

Plus another 10 million pots worth between £1k and £10k.

The magnitude of the increase is consistent with studies from other countries.

We compare the employment responses for different groups of women to shed light on the key drivers.

The magnitude of the increase is consistent with studies from other countries.

We compare the employment responses for different groups of women to shed light on the key drivers.

The female ERA increased from 60 to 66 between 2010 and 2020.

The female ERA increased from 60 to 66 between 2010 and 2020.