At its core, this approach involves estimating elasticity parameters using in-sample price & quantity data, using them to simulate out-of-sample quantities under optimal prices

At its core, this approach involves estimating elasticity parameters using in-sample price & quantity data, using them to simulate out-of-sample quantities under optimal prices

Industrial policy is justified because the marginal return to adding resources (VMPL) differs across units. Otherwise, there's no rationale for policy. Hence, contexts where industrial policy is warranted are inevitably characterized by HTE.

Industrial policy is justified because the marginal return to adding resources (VMPL) differs across units. Otherwise, there's no rationale for policy. Hence, contexts where industrial policy is warranted are inevitably characterized by HTE.

(a) SUTVA violation

By design, industrial policy reallocates factors to treated units by drawing them from non-treated units. So, spillover effects are inherent to the policy itself.

(a) SUTVA violation

By design, industrial policy reallocates factors to treated units by drawing them from non-treated units. So, spillover effects are inherent to the policy itself.

The measurement issue arises because VMPL is unobserved, while welfare evaluation boils down to whether the policy reallocates factors to high-VMPL sectors and firms or not

The measurement issue arises because VMPL is unobserved, while welfare evaluation boils down to whether the policy reallocates factors to high-VMPL sectors and firms or not

a) *ex post* evaluations using design-based methods such as DiD

b) *ex ante* model-based evaluations of optimally designed policies

a) *ex post* evaluations using design-based methods such as DiD

b) *ex ante* model-based evaluations of optimally designed policies

a. Trade introduces a *siphoning effect* where taxes paid by domestic households are partially used to subsidize consumption abroad via exports.

b. Industrial policy distorts relative trade prices ---> disrupts the gains from trade

a. Trade introduces a *siphoning effect* where taxes paid by domestic households are partially used to subsidize consumption abroad via exports.

b. Industrial policy distorts relative trade prices ---> disrupts the gains from trade

In such cases, the *constrained-optimal* policy depends on the upstreamness of the targeted industries.

In such cases, the *constrained-optimal* policy depends on the upstreamness of the targeted industries.

If industrial policy promotes upstream sectors operating below their efficient scale, it would generate larger gains.

If industrial policy promotes upstream sectors operating below their efficient scale, it would generate larger gains.

Contrary to common instinct, the optimal policy is *newtrok-blind* and *demand-blind*. It only depends on the size of the distortion wedge.

Contrary to common instinct, the optimal policy is *newtrok-blind* and *demand-blind*. It only depends on the size of the distortion wedge.

---> Welfare can be improved by reallocating resources from low-VMPL to high-VMPL sectors.

---> Welfare can be improved by reallocating resources from low-VMPL to high-VMPL sectors.

It offers a unified framework for analyzing IP effects and survey evidence from both ex post event studies and ex ante model-based evaluations of IP.

🧵thread on key takeaways (link below)

It offers a unified framework for analyzing IP effects and survey evidence from both ex post event studies and ex ante model-based evaluations of IP.

🧵thread on key takeaways (link below)

We’ve made it open access:

doi.org/10.1016/j.ji...

We’ve made it open access:

doi.org/10.1016/j.ji...

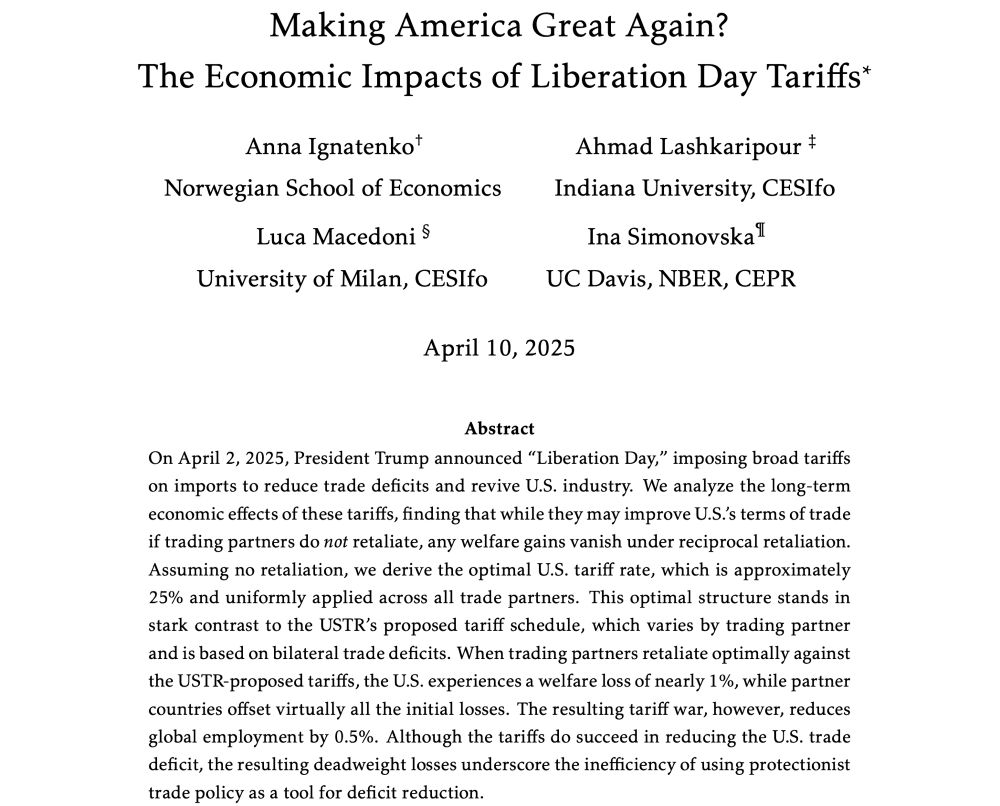

Even in the most favorable scenario, tariffs would finance only about 5-6.5% of the federal budget. Under retaliation, this drops to just 3%.

Even in the most favorable scenario, tariffs would finance only about 5-6.5% of the federal budget. Under retaliation, this drops to just 3%.

Remarkably, collective retaliation by all partners would offset nearly all of their initial welfare losses.

Remarkably, collective retaliation by all partners would offset nearly all of their initial welfare losses.

In summary: while these tariffs may help reduce the trade deficit, they will impose significant costs on the U.S. economy after retaliation by trade partners.

In summary: while these tariffs may help reduce the trade deficit, they will impose significant costs on the U.S. economy after retaliation by trade partners.

“Can Trade Policy Mitigate Climate Change?"

alashkar.pages.iu.edu/Farrokhi_Las...

“Can Trade Policy Mitigate Climate Change?"

alashkar.pages.iu.edu/Farrokhi_Las...

Recent events with Mexico & Canada suggest it is trying. But our latest research indicates these attempts will likely fail and isolate the US economy.

Here's why:👇

Recent events with Mexico & Canada suggest it is trying. But our latest research indicates these attempts will likely fail and isolate the US economy.

Here's why:👇

I’ll be updating it soon with the latest data.

alashkar.pages.iu.edu/GlobalTariff...

I’ll be updating it soon with the latest data.

alashkar.pages.iu.edu/GlobalTariff...

Malta, for example, could lose up to 15% of its GDP in a global tariff war scenario.

Malta, for example, could lose up to 15% of its GDP in a global tariff war scenario.

My estimates shows that the potential economic damage from a global tariff war doubled during the 2000-2014 period alone.

My estimates shows that the potential economic damage from a global tariff war doubled during the 2000-2014 period alone.

Also, a tariff war would not lead to autarky, which is why this estimate does not mirror the “gains from trade” estimated by Costinot & Rodriguez-Clare.

Also, a tariff war would not lead to autarky, which is why this estimate does not mirror the “gains from trade” estimated by Costinot & Rodriguez-Clare.