Klaudia Prodani

@kprodani.bsky.social

Political ecology of asset manager capitalism | Biodiversity metric contestations in green finance | Performativity of nature-related financial risk modelling by central banks

papers: https://scholar.google.com/citations?user=S6mUi94AAAAJ&hl=en

papers: https://scholar.google.com/citations?user=S6mUi94AAAAJ&hl=en

Mapping these along the palm oil supply chain shows that the Big Three are mainly invested in the downstream players (Unilever etc.) whereas “Fama’s quasi-laboratory” in the upstream criminal plantations. Unilever will likely be fine, so let's not put our hopes on the promise of universal ownership.

September 24, 2025 at 12:29 PM

Mapping these along the palm oil supply chain shows that the Big Three are mainly invested in the downstream players (Unilever etc.) whereas “Fama’s quasi-laboratory” in the upstream criminal plantations. Unilever will likely be fine, so let's not put our hopes on the promise of universal ownership.

We screen their portfolios against a civil society dataset (Profundo 2024) that lists 6,770 companies publicly excluded by other financial institutions for ESG reasons. We focus on investments in those excluded for all ESG reasons, environmental, biodiversity, deforestation, and palm oil in SE Asia.

September 24, 2025 at 12:29 PM

We screen their portfolios against a civil society dataset (Profundo 2024) that lists 6,770 companies publicly excluded by other financial institutions for ESG reasons. We focus on investments in those excluded for all ESG reasons, environmental, biodiversity, deforestation, and palm oil in SE Asia.

To understand the role that index providers might have in facilitating and decoupling environmental harm in SE Asia from related financial risks, we compare the geographic allocation, diversification, and “uniqueness” (i.e. no. companies the others don’t hold) of Dimensional (DFA) and the Big Three.

September 24, 2025 at 12:29 PM

To understand the role that index providers might have in facilitating and decoupling environmental harm in SE Asia from related financial risks, we compare the geographic allocation, diversification, and “uniqueness” (i.e. no. companies the others don’t hold) of Dimensional (DFA) and the Big Three.

🚨New article🚨 Why has the promise of universal ownership been broken, as @benbraun.bsky.social has suggested?

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

September 24, 2025 at 12:29 PM

🚨New article🚨 Why has the promise of universal ownership been broken, as @benbraun.bsky.social has suggested?

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

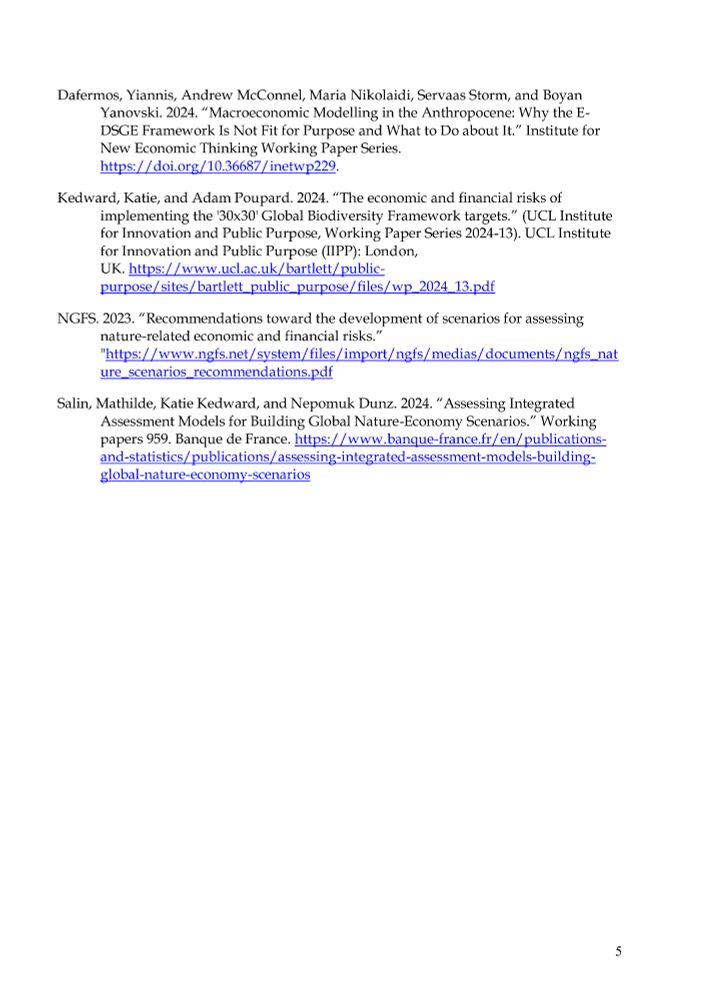

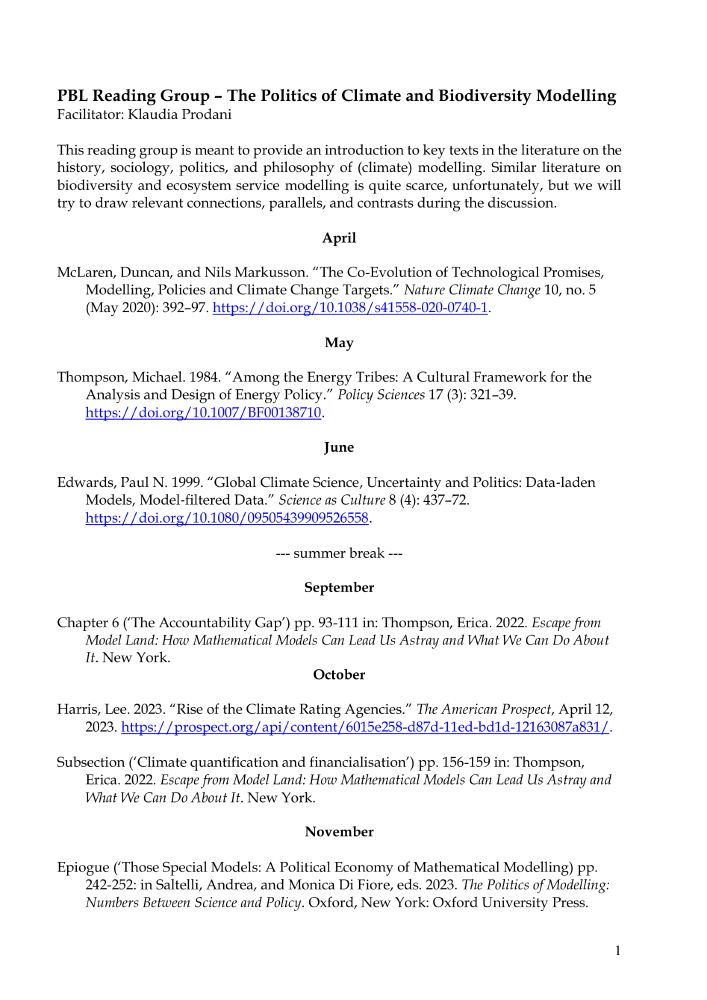

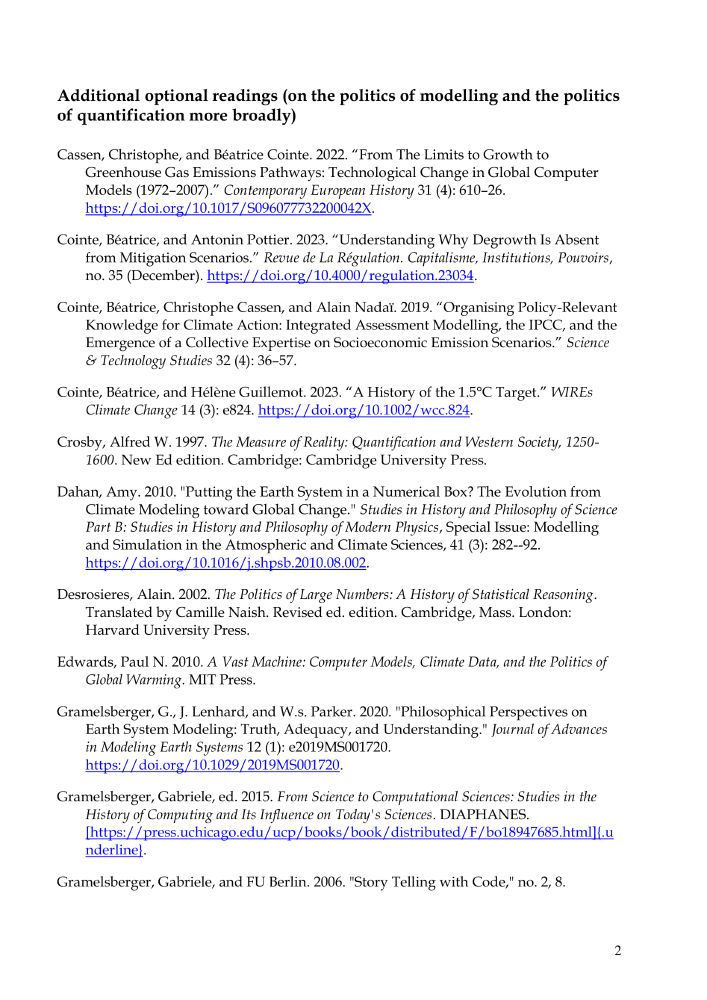

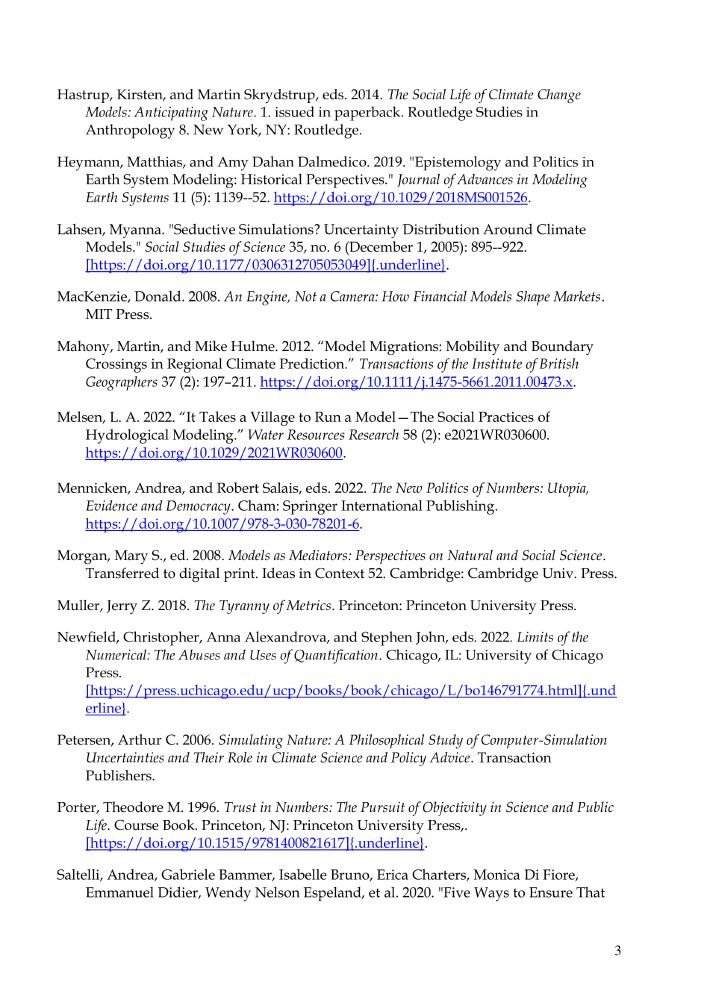

📚 I'm sharing here the reading list we'll be using at the Dutch Environmental Assessment Agency for our reading group on the politics of modelling nature.

See below an overview of key literature on the politics, history, sociology, and philosophy of climate and biodiversity modelling.

See below an overview of key literature on the politics, history, sociology, and philosophy of climate and biodiversity modelling.

March 31, 2025 at 9:19 AM

📚 I'm sharing here the reading list we'll be using at the Dutch Environmental Assessment Agency for our reading group on the politics of modelling nature.

See below an overview of key literature on the politics, history, sociology, and philosophy of climate and biodiversity modelling.

See below an overview of key literature on the politics, history, sociology, and philosophy of climate and biodiversity modelling.