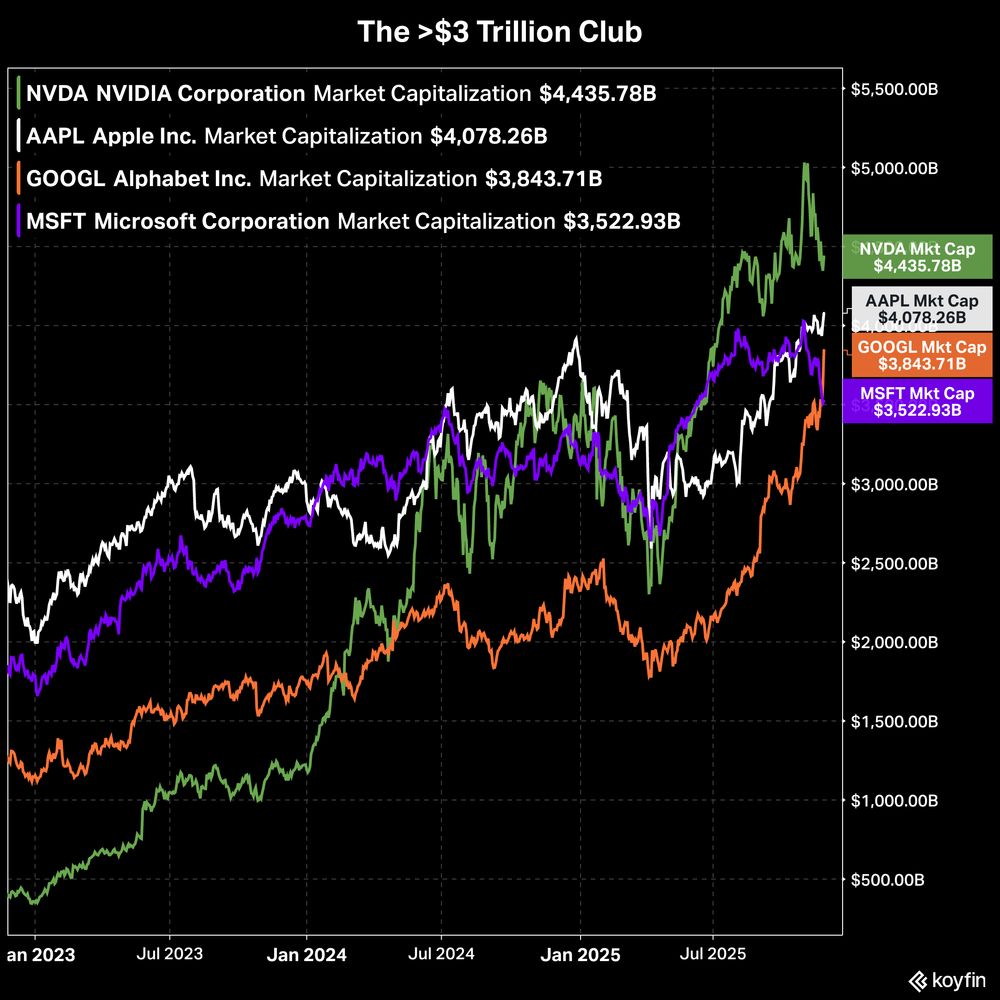

1. Nvidia 🇺🇸

2. Apple 🇺🇸

3. Alphabet 🇺🇸

4. Microsoft 🇺🇸

5. Amazon 🇺🇸

1. Nvidia 🇺🇸

2. Apple 🇺🇸

3. Alphabet 🇺🇸

4. Microsoft 🇺🇸

5. Amazon 🇺🇸

1. ASML Holding 🇳🇱

2. LVMH 🇫🇷

3. Roche Holding 🇨🇭

4. AstraZeneca 🇬🇧

5. SAP SE 🇩🇪

1. ASML Holding 🇳🇱

2. LVMH 🇫🇷

3. Roche Holding 🇨🇭

4. AstraZeneca 🇬🇧

5. SAP SE 🇩🇪

$APPL $GOOGL $MSFT $NVDA

$APPL $GOOGL $MSFT $NVDA

$GOOGL Alphabet's market cap has expanded by $2 trillion in less than 8 months.

$GOOGL Alphabet's market cap has expanded by $2 trillion in less than 8 months.

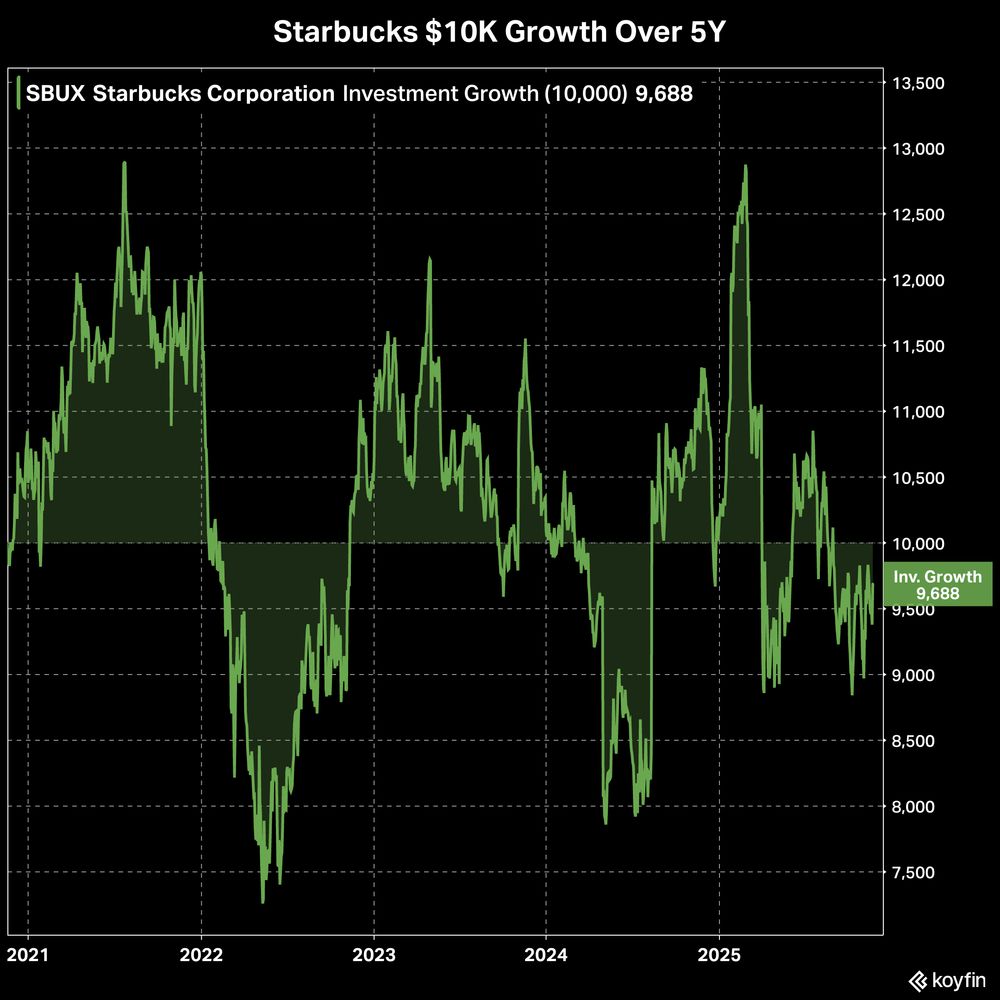

$SBUX

$SBUX

Both $PEP (12.6%) and $KO (11.5%) have remarkable CAGRs over that period.

Pepsi demonstrates how impactful a few percentage points can be when compounded over the long term.

Both $PEP (12.6%) and $KO (11.5%) have remarkable CAGRs over that period.

Pepsi demonstrates how impactful a few percentage points can be when compounded over the long term.

Apple sports the highest (27.6x) multiple of the bunch.

$AAPL 27.6x

$AMZN 25.5x

$GOOGL 24.0x

$MSFT 22.8x

$NVDA 21.5x

$META 18.0x

Apple sports the highest (27.6x) multiple of the bunch.

$AAPL 27.6x

$AMZN 25.5x

$GOOGL 24.0x

$MSFT 22.8x

$NVDA 21.5x

$META 18.0x

AUM for $GLD fell 10% from the recent high before recovering ~half of the losses.

Meanwhile AUM for $IBIT is down 34% (~$34.1 billion) from it's high of $99.4 billion in October.

AUM for $GLD fell 10% from the recent high before recovering ~half of the losses.

Meanwhile AUM for $IBIT is down 34% (~$34.1 billion) from it's high of $99.4 billion in October.

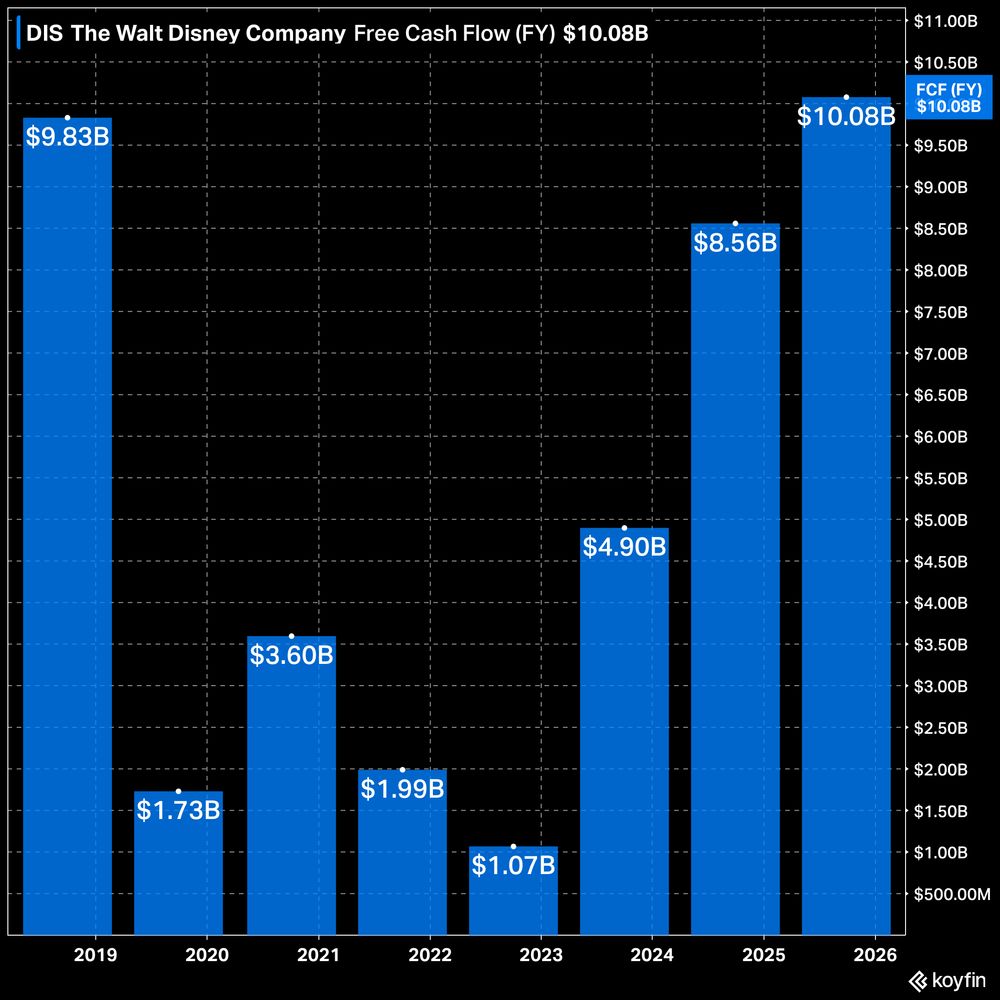

Analysts are forecasting that FY26 free cash flows will decline 4% to ~$9.7 billion (consensus average).

Analysts are forecasting that FY26 free cash flows will decline 4% to ~$9.7 billion (consensus average).