www.bruegel.org/dataset/euro...

www.bruegel.org/dataset/euro...

-increasing record seasonal LNG imports levels

www.bruegel.org/dataset/euro...

-increasing record seasonal LNG imports levels

www.bruegel.org/dataset/euro...

www.bruegel.org/dataset/euro...

www.bruegel.org/dataset/euro...

-weekly gas imports decreased driven by lower NO flows (maintenance);

-LNG volumes remain at the highest seasonal levels;

-LNG regas >90% in PL, NL and LT;

-Reverse gas flows to UA remain high;

-Gas storage: 81% in EU, 24% in UA.

www.bruegel.org/dataset/euro...

-weekly gas imports decreased driven by lower NO flows (maintenance);

-LNG volumes remain at the highest seasonal levels;

-LNG regas >90% in PL, NL and LT;

-Reverse gas flows to UA remain high;

-Gas storage: 81% in EU, 24% in UA.

www.bruegel.org/dataset/euro...

In August:

-America's LNG made 70% of LNG imports.

Weekly flows:

-LNG at record seasonal highs, NO down (maintenance), RU Turkstream at seasonal records

-Regas >90% in LT, NL, PL

-High reverse flows to UA

-EU storage at 66%, UA 15%.

www.bruegel.org/dataset/euro...

In August:

-America's LNG made 70% of LNG imports.

Weekly flows:

-LNG at record seasonal highs, NO down (maintenance), RU Turkstream at seasonal records

-Regas >90% in LT, NL, PL

-High reverse flows to UA

-EU storage at 66%, UA 15%.

www.bruegel.org/dataset/euro...

-Deployment

-Manufacturing

-Trade

-Jobs

Explore cross-technology comparisons, 8 technology-focused views and country-specific insights.

🔗ECTT european-clean-tech-tracker.bruegel.org

📰FT on.ft.com/3VvKEW8

-Deployment

-Manufacturing

-Trade

-Jobs

Explore cross-technology comparisons, 8 technology-focused views and country-specific insights.

🔗ECTT european-clean-tech-tracker.bruegel.org

📰FT on.ft.com/3VvKEW8

-weekly gas imports have slown down driven by LNG;

-RU gas flows via Turkstream at highest seasonal level;

-LNG regas: 96% in PL, 85% in HR;

-Reverse gas flows to UA above seasonal levels;

-Gas storage: 66% in EU, 15% in UA.

www.bruegel.org/dataset/euro...

-weekly gas imports have slown down driven by LNG;

-RU gas flows via Turkstream at highest seasonal level;

-LNG regas: 96% in PL, 85% in HR;

-Reverse gas flows to UA above seasonal levels;

-Gas storage: 66% in EU, 15% in UA.

www.bruegel.org/dataset/euro...

-Q2 2025 imports reached the highest quarterly level since Q3 2023, driven by record-high US imports

-June LNG imports: America's volumes remain relatively high, Middle East hits record low, Russia at highest level in 4 months

www.bruegel.org/dataset/euro...

-Q2 2025 imports reached the highest quarterly level since Q3 2023, driven by record-high US imports

-June LNG imports: America's volumes remain relatively high, Middle East hits record low, Russia at highest level in 4 months

www.bruegel.org/dataset/euro...

-weekly LNG imports remain relatively high

-RU gas flows via Turkstream resumed after maintenance

-LNG regasification >90% in HR, PL and NL

-Reverse gas flows to UA above seasonal levels

-Gas storage: 57% in EU, 10% in UA

www.bruegel.org/dataset/euro...

-weekly LNG imports remain relatively high

-RU gas flows via Turkstream resumed after maintenance

-LNG regasification >90% in HR, PL and NL

-Reverse gas flows to UA above seasonal levels

-Gas storage: 57% in EU, 10% in UA

www.bruegel.org/dataset/euro...

-weekly LNG imports remain relatively high;

-RU gas flows via Turkstream dropped due to maintenance;

-LNG regasification 99% in HR, 96% in PL;

-Reverse gas flows to UA above seasonal levels;

-Gas storage: 54% in EU, 9% in UA.

www.bruegel.org/dataset/euro...

-weekly LNG imports remain relatively high;

-RU gas flows via Turkstream dropped due to maintenance;

-LNG regasification 99% in HR, 96% in PL;

-Reverse gas flows to UA above seasonal levels;

-Gas storage: 54% in EU, 9% in UA.

www.bruegel.org/dataset/euro...

-weekly gas imports above 2023/24 levels driven by record seasonal LNG imports;

-LNG regasification >90% in PL, HR, IT;

-Reverse gas flows to UA above seasonal levels;

-Gas storage: 51% in EU, 8%(record seasonal low) in UA.

www.bruegel.org/dataset/euro...

-weekly gas imports above 2023/24 levels driven by record seasonal LNG imports;

-LNG regasification >90% in PL, HR, IT;

-Reverse gas flows to UA above seasonal levels;

-Gas storage: 51% in EU, 8%(record seasonal low) in UA.

www.bruegel.org/dataset/euro...

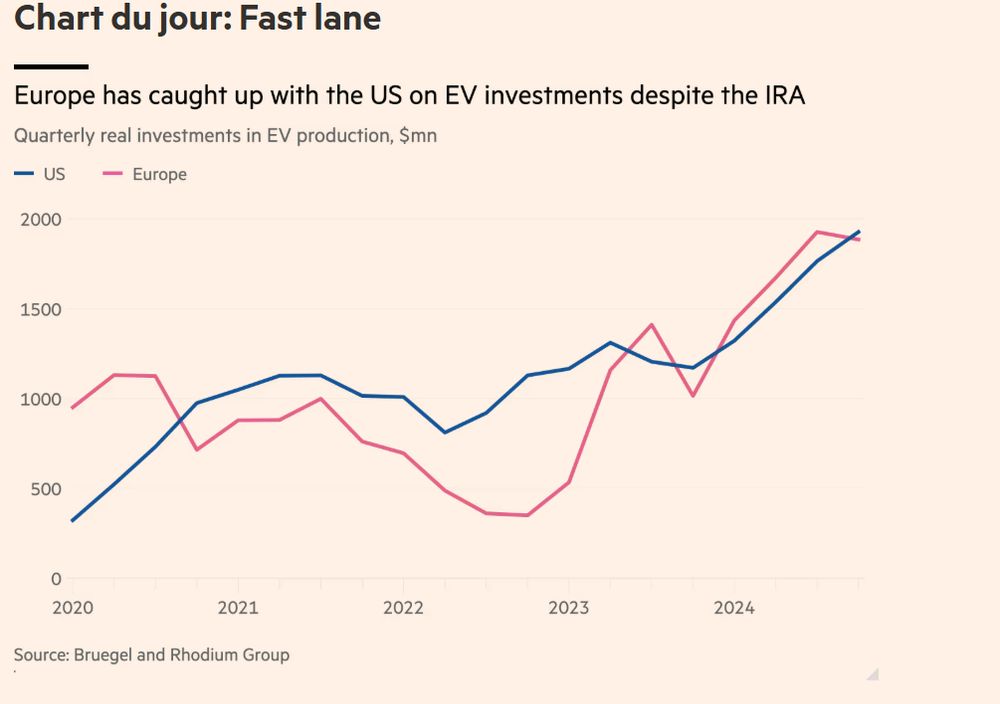

-Investments in EV manufacturing grow steadily on both sides of the Atlantic;

-Europe leads in EV production capacity;

See more on EV investment, manufacturing and sales trends:

www.bruegel.org/analysis/tra...

@bruegel.bsky.social @rhg.com

-Investments in EV manufacturing grow steadily on both sides of the Atlantic;

-Europe leads in EV production capacity;

See more on EV investment, manufacturing and sales trends:

www.bruegel.org/analysis/tra...

@bruegel.bsky.social @rhg.com

-High May LNG imports driven by record US LNG flows. RU LNG remain at high levels;

-Weekly gas imports increased sharply, driven by LNG and NO;

-Reverse flows to UA above the seasonal levels;

-Gas storage: 49% in EU, 7% UA.

www.bruegel.org/dataset/euro...

-High May LNG imports driven by record US LNG flows. RU LNG remain at high levels;

-Weekly gas imports increased sharply, driven by LNG and NO;

-Reverse flows to UA above the seasonal levels;

-Gas storage: 49% in EU, 7% UA.

www.bruegel.org/dataset/euro...

-weekly gas imports further decreased, driven by NO, AZ and UK;

-reverse gas flows to UA continue to be above seasonal levels;

-LNG regasification at 92% in IT and HR;

-storage: EU at 46% capacity, UA 6%.

www.bruegel.org/dataset/euro...

-weekly gas imports further decreased, driven by NO, AZ and UK;

-reverse gas flows to UA continue to be above seasonal levels;

-LNG regasification at 92% in IT and HR;

-storage: EU at 46% capacity, UA 6%.

www.bruegel.org/dataset/euro...

-April LNG: record imports driven by highest-ever US LNG. RU LNG increased compared to March;

-weekly gas imports decreased. LNG imports above weekly seasonal levels, AZ and ALGR are below;

-storage: EU at 42% capacity, UA 4%.

www.bruegel.org/dataset/euro...

-April LNG: record imports driven by highest-ever US LNG. RU LNG increased compared to March;

-weekly gas imports decreased. LNG imports above weekly seasonal levels, AZ and ALGR are below;

-storage: EU at 42% capacity, UA 4%.

www.bruegel.org/dataset/euro...

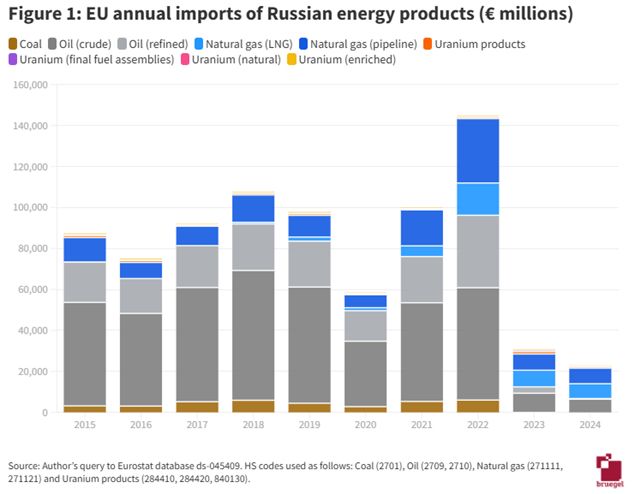

The EU continues to rely on RU uranium, which presents four key risks:

1) energy security;

2) political division;

3) defence entanglement;

4) sanctions loopholes.

A phased, legally backed strategy is needed to end imports and reduce Rosatom’s influence.

www.bruegel.org/analysis/end...

The EU continues to rely on RU uranium, which presents four key risks:

1) energy security;

2) political division;

3) defence entanglement;

4) sanctions loopholes.

A phased, legally backed strategy is needed to end imports and reduce Rosatom’s influence.

www.bruegel.org/analysis/end...

The EU banned RU coal (Aug ‘22), crude oil (Dec ‘22) and oil products (Feb ‘23)

• direct EU imports from RU replaced (crude oil: by the US, NO, KZ, SA; diesel: SA, IN, the US)

• CZ, HU, SK continue to import oil via Druzhba

www.bruegel.org/dataset/russ...

new.forum-energii.eu/en/towards-s...

The EU banned RU coal (Aug ‘22), crude oil (Dec ‘22) and oil products (Feb ‘23)

• direct EU imports from RU replaced (crude oil: by the US, NO, KZ, SA; diesel: SA, IN, the US)

• CZ, HU, SK continue to import oil via Druzhba

www.bruegel.org/dataset/russ...

new.forum-energii.eu/en/towards-s...

Import tariffs on RU gas

• prevent RU from causing division

• generate revenue, potentially used to support affected countries/industries

• pressure Russia to lower its gas prices

• be implemented by qualified majority, unlike an embargo, requiring unanimity

www.bruegel.org/analysis/eur...

Import tariffs on RU gas

• prevent RU from causing division

• generate revenue, potentially used to support affected countries/industries

• pressure Russia to lower its gas prices

• be implemented by qualified majority, unlike an embargo, requiring unanimity

www.bruegel.org/analysis/eur...

Despite the 2022 gas supply shock, EU countries failed to develop an urgently needed unified strategy for RU gas at the EU level. In 2024, RU gas made up 18% of EU gas imports. Fragmented national policies weaken the bloc’s collective response.

Gas import data

www.bruegel.org/dataset/euro...

Despite the 2022 gas supply shock, EU countries failed to develop an urgently needed unified strategy for RU gas at the EU level. In 2024, RU gas made up 18% of EU gas imports. Fragmented national policies weaken the bloc’s collective response.

Gas import data

www.bruegel.org/dataset/euro...

-weekly gas imports rose, led by NO & UK

-LNG imports above seasonal levels

-Regas rates: PL & HR at 91%, FR 84%

-EU storage injections beginning, led by FR

-EU storage at 36% capacity; UA at 2% (0.8 bcm)–lowest in 2 years

www.bruegel.org/dataset/euro...

-weekly gas imports rose, led by NO & UK

-LNG imports above seasonal levels

-Regas rates: PL & HR at 91%, FR 84%

-EU storage injections beginning, led by FR

-EU storage at 36% capacity; UA at 2% (0.8 bcm)–lowest in 2 years

www.bruegel.org/dataset/euro...

📊March LNG+Q1 2025 data by source

•Q1 2025: NO top EU supplier; US at record high; RU at lowest

•March LNG: record imports driven by highest-ever US LNG

•April weekly LNG: remains above seasonal levels

•Storage: EU 35%, UA 3%

www.bruegel.org/dataset/euro...

📊March LNG+Q1 2025 data by source

•Q1 2025: NO top EU supplier; US at record high; RU at lowest

•March LNG: record imports driven by highest-ever US LNG

•April weekly LNG: remains above seasonal levels

•Storage: EU 35%, UA 3%

www.bruegel.org/dataset/euro...

While reopening Yamal is unlikely, TurkStream’s capacity is fully utilised, two options remain: restoring transit via Ukraine (~100 bcm capacity) or using an undamaged Nord Stream 2 pipe (28 bcm capacity).

While reopening Yamal is unlikely, TurkStream’s capacity is fully utilised, two options remain: restoring transit via Ukraine (~100 bcm capacity) or using an undamaged Nord Stream 2 pipe (28 bcm capacity).

In 2021, Russia supplied about half of the EU’s gas imports via four pipelines and LNG shipments. By 2024, Russian gas imports had fallen to 54 bcm, accounting for 18% of the EU's gas imports, primarily driven by Russian supply cuts.

In 2021, Russia supplied about half of the EU’s gas imports via four pipelines and LNG shipments. By 2024, Russian gas imports had fallen to 54 bcm, accounting for 18% of the EU's gas imports, primarily driven by Russian supply cuts.