Jens van 't Klooster 💸💸💸

@jvtk.bsky.social

Political Economy, the ESG anthropocene, technocracy, legitimacy and more | “Non-profit finfluencer” | @UvA_AISSR @Politics_UvA

At some point you have to ask whether it's economic policy or performance art

October 22, 2025 at 6:42 PM

At some point you have to ask whether it's economic policy or performance art

We don't talk nearly enough about this (Bayoumi 2018)

September 22, 2025 at 2:39 PM

We don't talk nearly enough about this (Bayoumi 2018)

Draghi's vision of competitive polluting is a great opportunity to rethink tobacco red tape, big gdp boost and cost savings from lower life expectancy

September 19, 2025 at 6:49 AM

Draghi's vision of competitive polluting is a great opportunity to rethink tobacco red tape, big gdp boost and cost savings from lower life expectancy

Thank you @elsevierconnect.bsky.social, really helpful AI-generated clarification of the term "face"

August 19, 2025 at 1:47 PM

Thank you @elsevierconnect.bsky.social, really helpful AI-generated clarification of the term "face"

Great @politico.eu coverage on the battle inside the ECB on unstable shitcoins as a means to internationalise the euro

www.politico.eu/article/laga...

www.politico.eu/article/laga...

August 12, 2025 at 9:22 AM

Great @politico.eu coverage on the battle inside the ECB on unstable shitcoins as a means to internationalise the euro

www.politico.eu/article/laga...

www.politico.eu/article/laga...

Thanks to the consultants of EY for helping firms orchestrate another round of sellers' inflation www.ey.com/en_be/insigh...

August 12, 2025 at 6:43 AM

Thanks to the consultants of EY for helping firms orchestrate another round of sellers' inflation www.ey.com/en_be/insigh...

Ha-Joon Chang on the neglect of climate and the environment in today's economics degree @financialtimes.com

www.ft.com/content/9aab...

www.ft.com/content/9aab...

July 24, 2025 at 9:09 AM

Ha-Joon Chang on the neglect of climate and the environment in today's economics degree @financialtimes.com

www.ft.com/content/9aab...

www.ft.com/content/9aab...

It's happening: very lively @dezernatzukunft.bsky.social EMPN panel lays out the feasibility and immense EU and global benefits of euro internationalisation - @maxkrahe.bsky.social @shahinvallee.bsky.social @apsmolenska.bsky.social and Eric Monnet

June 24, 2025 at 12:47 PM

It's happening: very lively @dezernatzukunft.bsky.social EMPN panel lays out the feasibility and immense EU and global benefits of euro internationalisation - @maxkrahe.bsky.social @shahinvallee.bsky.social @apsmolenska.bsky.social and Eric Monnet

For the European Parliament, Eric Monnet, @edomartino.bsky.social and I wrote on USD stablecoins:

Will Donald Trump get rich selling his private $$$ coins to EU residents? Probably not, but stablecoins may still uproot the global monetary order.

www.europarl.europa.eu/cmsdata/2964...

Will Donald Trump get rich selling his private $$$ coins to EU residents? Probably not, but stablecoins may still uproot the global monetary order.

www.europarl.europa.eu/cmsdata/2964...

June 18, 2025 at 2:27 PM

For the European Parliament, Eric Monnet, @edomartino.bsky.social and I wrote on USD stablecoins:

Will Donald Trump get rich selling his private $$$ coins to EU residents? Probably not, but stablecoins may still uproot the global monetary order.

www.europarl.europa.eu/cmsdata/2964...

Will Donald Trump get rich selling his private $$$ coins to EU residents? Probably not, but stablecoins may still uproot the global monetary order.

www.europarl.europa.eu/cmsdata/2964...

Striking back hard at MAGA's Miran/Bessent plans, @steffenmurau.bsky.social and I propose a SUERF User's guide for euro internationalisation (based on our recent JEPP article)

www.suerf.org/publications...

www.suerf.org/publications...

June 13, 2025 at 2:11 PM

Striking back hard at MAGA's Miran/Bessent plans, @steffenmurau.bsky.social and I propose a SUERF User's guide for euro internationalisation (based on our recent JEPP article)

www.suerf.org/publications...

www.suerf.org/publications...

This seems like an extremely expensive way to boost the international role of the euro... www.ecb.europa.eu/press/key/da...

May 26, 2025 at 6:17 PM

This seems like an extremely expensive way to boost the international role of the euro... www.ecb.europa.eu/press/key/da...

We explain functional equivalence earlier on

May 12, 2025 at 3:25 PM

We explain functional equivalence earlier on

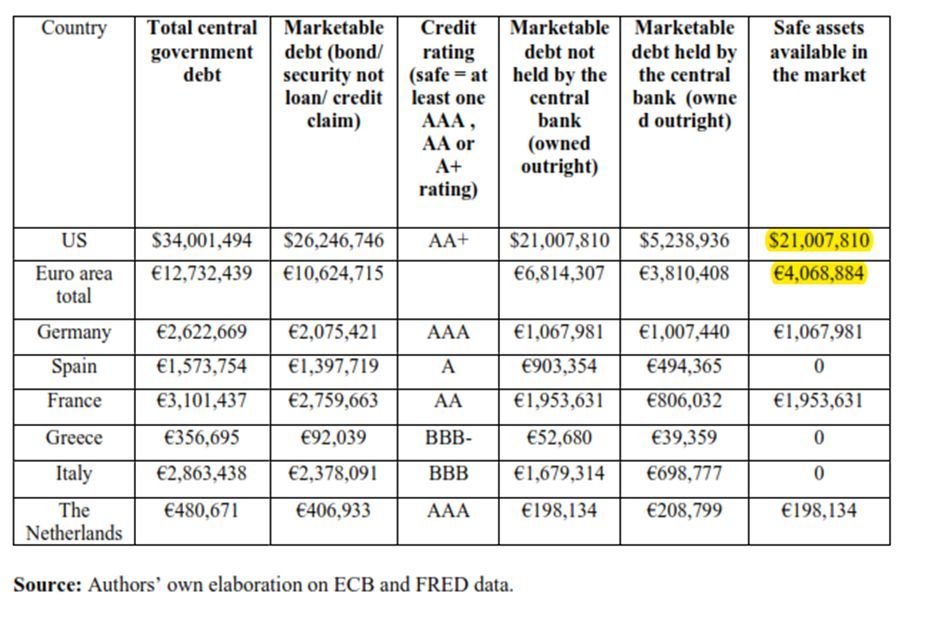

Lack of euro denominated safe asset reflects dumb EU debt rules, but also monetary policy choices and the ECB’s insane reliance on sovereign credit ratings, resulting in a minuscule €4.1 trillion in euro denominated safe assets compared to $21 trillion US safe assets.

May 12, 2025 at 10:21 AM

Lack of euro denominated safe asset reflects dumb EU debt rules, but also monetary policy choices and the ECB’s insane reliance on sovereign credit ratings, resulting in a minuscule €4.1 trillion in euro denominated safe assets compared to $21 trillion US safe assets.

We do a deep dive into the theory of currency internationalization. From the 1990s onwards, the EU thought of money mostly as a store of value and medium of exchange, neglecting money creation, in particular offshore - a bias that reflected a distorted reading of 1980s IPE scholarship.

May 12, 2025 at 10:21 AM

We do a deep dive into the theory of currency internationalization. From the 1990s onwards, the EU thought of money mostly as a store of value and medium of exchange, neglecting money creation, in particular offshore - a bias that reflected a distorted reading of 1980s IPE scholarship.

The Fed and the Treasury have boosted the dollar’s international status since the 1950s. The EU wanted a “multipolar monetary regime” (1990) but had barely a strategy: "market-led" internationalization building on the ECB’s reputation for… price stability. Why?

May 12, 2025 at 10:21 AM

The Fed and the Treasury have boosted the dollar’s international status since the 1950s. The EU wanted a “multipolar monetary regime” (1990) but had barely a strategy: "market-led" internationalization building on the ECB’s reputation for… price stability. Why?

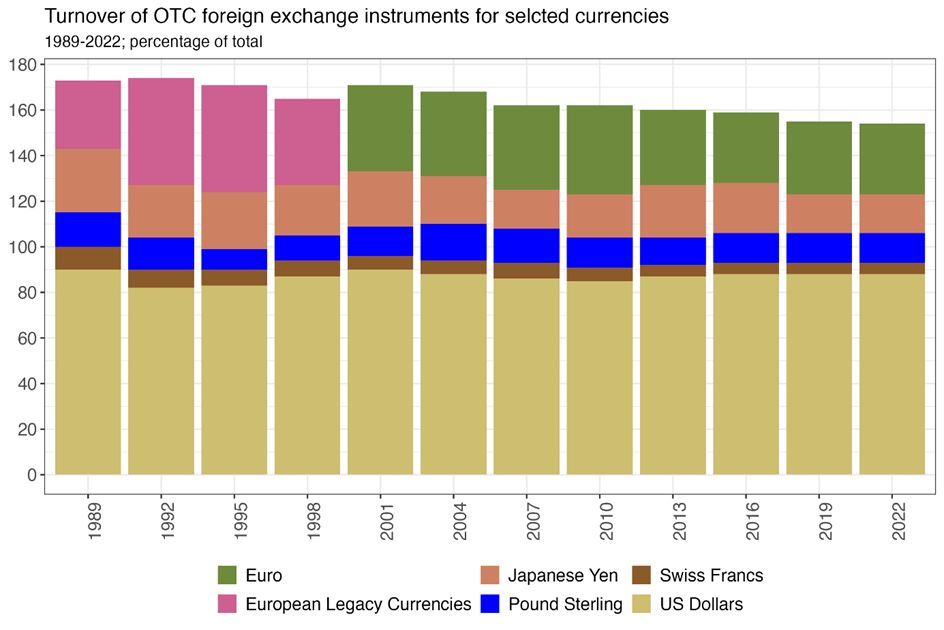

The failure of euro internationalizing is baffling. We show that the euro is used in just 31% of FX transactions—barely more than the D-mark before the euro launched. Even European firms often prefer to trade in dollars.

May 12, 2025 at 10:21 AM

The failure of euro internationalizing is baffling. We show that the euro is used in just 31% of FX transactions—barely more than the D-mark before the euro launched. Even European firms often prefer to trade in dollars.

Perfect Hélène Rey debunking the pervasive and unshakable belief that currency hegemony necessitates current account deficits www.ft.com/content/5bc0...

May 10, 2025 at 12:17 PM

Perfect Hélène Rey debunking the pervasive and unshakable belief that currency hegemony necessitates current account deficits www.ft.com/content/5bc0...

Must read SUERF blog by Eric Monnet on a potential US strategy promoting USD stablecoins to maintain dollar supremacy, potentially increasing global dependence on the US dollar and weakening monetary sovereignty everywhere else

www.suerf.org/publications...

www.suerf.org/publications...

April 18, 2025 at 12:02 PM

Must read SUERF blog by Eric Monnet on a potential US strategy promoting USD stablecoins to maintain dollar supremacy, potentially increasing global dependence on the US dollar and weakening monetary sovereignty everywhere else

www.suerf.org/publications...

www.suerf.org/publications...

Now comes the rub: In 2008 and later in 2022 a story could be concocted where "QE" pursued price stability.

Today, Jerome Powell again warned about inflation, perhaps oblivious to the corner and where the paint is. /5

Today, Jerome Powell again warned about inflation, perhaps oblivious to the corner and where the paint is. /5

April 17, 2025 at 1:15 PM

Now comes the rub: In 2008 and later in 2022 a story could be concocted where "QE" pursued price stability.

Today, Jerome Powell again warned about inflation, perhaps oblivious to the corner and where the paint is. /5

Today, Jerome Powell again warned about inflation, perhaps oblivious to the corner and where the paint is. /5

Then in 2008 monetary financing became necessary again and central bankers discovered QE: government debt purchases dressed up as inflation targeting measures. /4

April 17, 2025 at 1:15 PM

Then in 2008 monetary financing became necessary again and central bankers discovered QE: government debt purchases dressed up as inflation targeting measures. /4