📍 Stanford GSB | 📅 Feb 27–28, 2026

📝 Submit papers by Sept 15, 2025

🔗 Call for papers: t.co/9dDtnqQ9ub

@gcaproject.bsky.social

📍 Stanford GSB | 📅 Feb 27–28, 2026

📝 Submit papers by Sept 15, 2025

🔗 Call for papers: t.co/9dDtnqQ9ub

@gcaproject.bsky.social

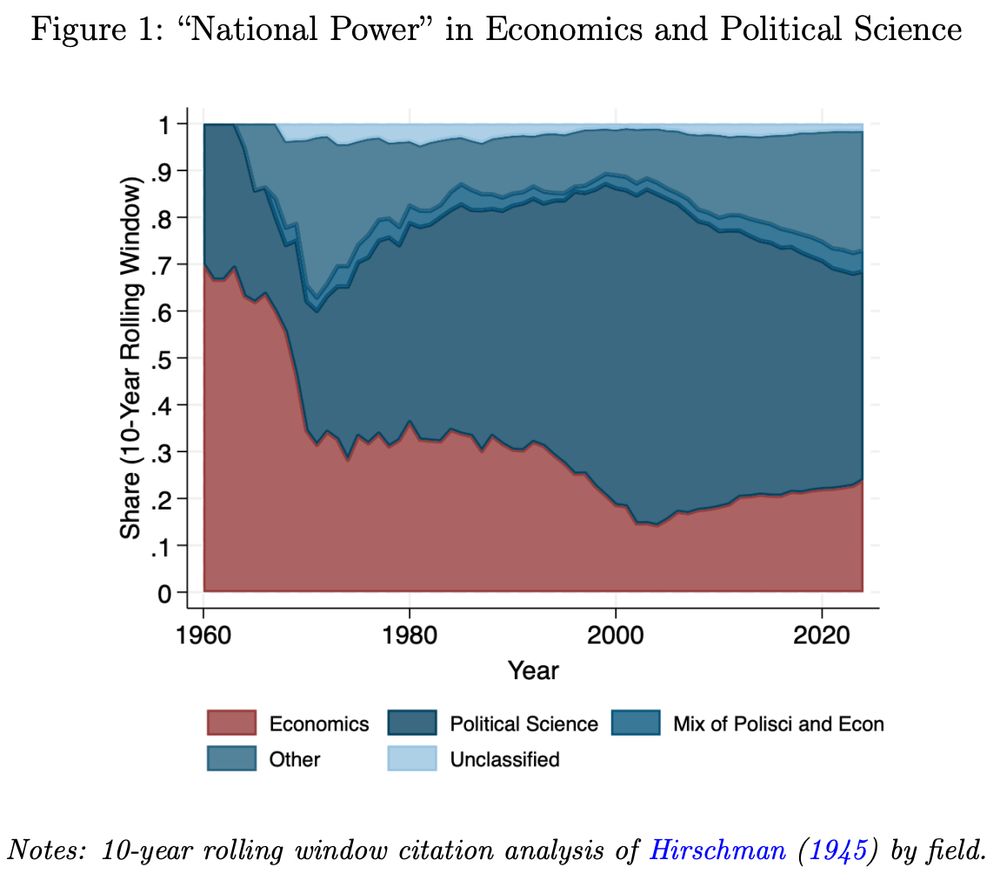

doi.org/10.1016/j.ji...

doi.org/10.1016/j.ji...

Read the article: shorturl.at/2iD7R

Read the article: shorturl.at/2iD7R

By @chris-d-clayton.bsky.social @mmaggiori.bsky.social @jesseschreger.bsky.social

Article: shorturl.at/F85P3

Paper: shorturl.at/rAfvV

GCAP research: globalcapitalallocation.com/research

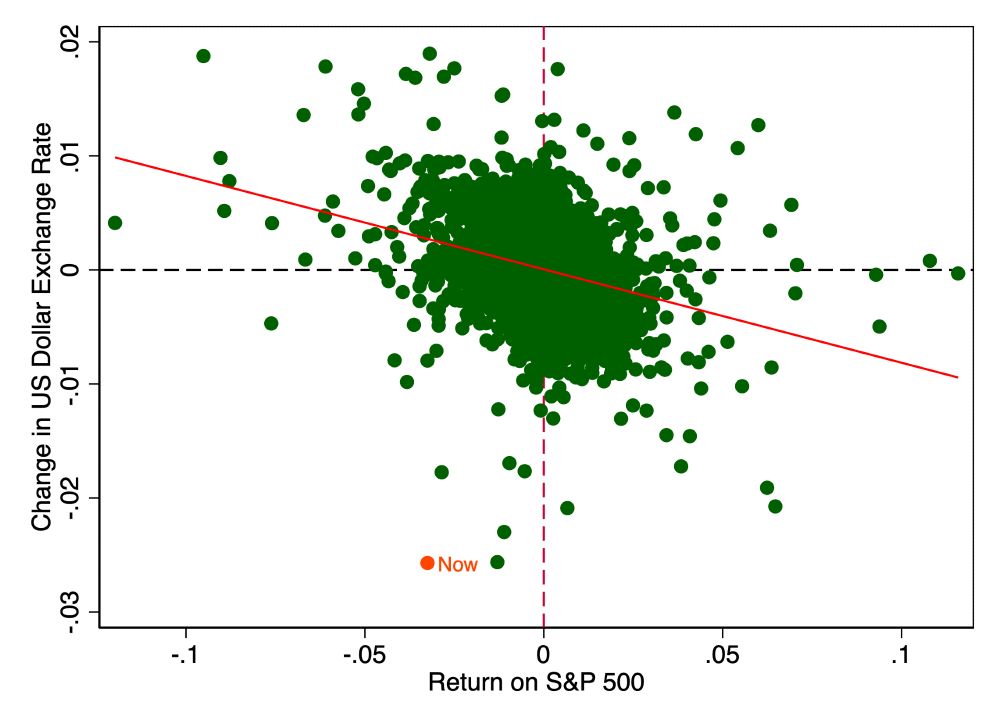

By @chris-d-clayton.bsky.social @mmaggiori.bsky.social @jesseschreger.bsky.social

Article: shorturl.at/F85P3

Paper: shorturl.at/rAfvV

GCAP research: globalcapitalallocation.com/research

Read our brief on economic coercion, by Christopher Clayton, @mmaggiori.bsky.social, and @jesseschreger.bsky.social:

shorturl.at/kvXac

https://www.ft.com/content/2d30ba8e-40e9-4387-864f-a81f77386a2d

Read our brief on economic coercion, by Christopher Clayton, @mmaggiori.bsky.social, and @jesseschreger.bsky.social:

shorturl.at/kvXac

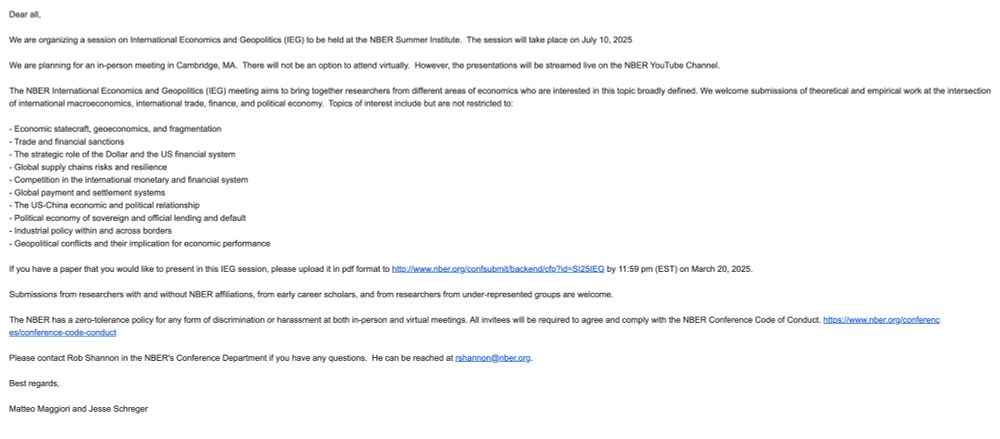

International Economics and Geopolitics meeting at NBER Summer Institute

See call for submission below

submit at:

www.nber.org/confsubmit/b... by 11:59 pm (EST) on March 20, 2025.

International Economics and Geopolitics meeting at NBER Summer Institute

See call for submission below

submit at:

www.nber.org/confsubmit/b... by 11:59 pm (EST) on March 20, 2025.

Full article: shorturl.at/lsmuG

Non-technical brief on our findings: shorturl.at/TckUS

Full article: shorturl.at/lsmuG

Non-technical brief on our findings: shorturl.at/TckUS

So happy 🥳

(link below 👇)

So happy 🥳

By Christopher Clayton, @mmaggiori.bsky.social and @jesseschreger.bsky.social

Read here: shorturl.at/mAKVL

Video presentation: shorturl.at/evt5b

By Christopher Clayton, @mmaggiori.bsky.social and @jesseschreger.bsky.social

Read here: shorturl.at/mAKVL

Video presentation: shorturl.at/evt5b

Read the newsletter: shorturl.at/EZM17

Subscribe: shorturl.at/qU0Ia

Read the newsletter: shorturl.at/EZM17

Subscribe: shorturl.at/qU0Ia