Jason Furman

@jasonfurman.bsky.social

Professor at Harvard. Teaches Ec 10, some posts might be educational. Also Senior Fellow @PIIE.com & contributor

@nytopinion.nytimes.com. Was Chair of President Obama's CEA.

@nytopinion.nytimes.com. Was Chair of President Obama's CEA.

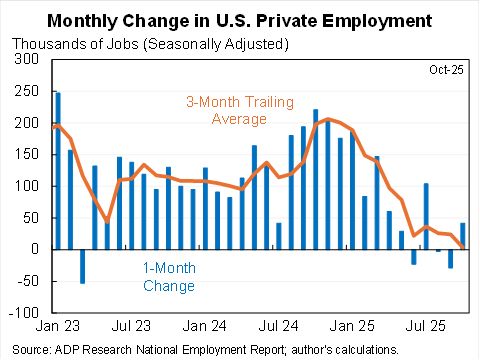

Jobs numbers, per ADP. Back in the black but not by much--and 3-month moving average basically zero.

November 5, 2025 at 2:57 PM

Jobs numbers, per ADP. Back in the black but not by much--and 3-month moving average basically zero.

People post too many memes.

October 28, 2025 at 10:33 PM

People post too many memes.

Being an Anglo-Saxon country not great for borrowing costs right now.

October 27, 2025 at 7:15 PM

Being an Anglo-Saxon country not great for borrowing costs right now.

This graph may or may not say a lot about the world over the last decade.

October 27, 2025 at 12:58 PM

This graph may or may not say a lot about the world over the last decade.

CEO pay has stagnated for the last quarter century.

October 26, 2025 at 5:41 PM

CEO pay has stagnated for the last quarter century.

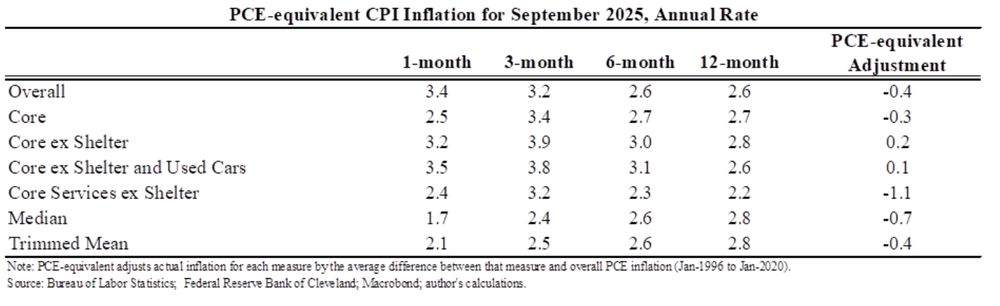

Median and trimmed mean looked fine in September suggesting outliers were driving the overall increase.

October 26, 2025 at 2:45 PM

Median and trimmed mean looked fine in September suggesting outliers were driving the overall increase.

The CPI-based ecumenical underlying inflation measure was 2.7% in September, up 0.1pp from August (and the same as the PCE-based measure for August).

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

October 26, 2025 at 2:45 PM

The CPI-based ecumenical underlying inflation measure was 2.7% in September, up 0.1pp from August (and the same as the PCE-based measure for August).

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

In Ec10 we discuss some of the theory and evidence on the effect of the minimum wage on employment. And also talk about how the employment effect is not the only factor in evaluating ones view on it. That slide is attached.

October 26, 2025 at 2:29 PM

In Ec10 we discuss some of the theory and evidence on the effect of the minimum wage on employment. And also talk about how the employment effect is not the only factor in evaluating ones view on it. That slide is attached.

And this is compares minimum wages to median wages by country.

October 26, 2025 at 2:29 PM

And this is compares minimum wages to median wages by country.

This is how U.S. minimum wages compare to other countries in US dollars. Note Massachusetts is $15/hour, which is about in the middle of states that have set rates higher than the Federal government.

October 26, 2025 at 2:29 PM

This is how U.S. minimum wages compare to other countries in US dollars. Note Massachusetts is $15/hour, which is about in the middle of states that have set rates higher than the Federal government.

As a result, while the inflation-adjusted federal minimum wage is nearly the lowest it has ever been, the average of the state and federal minimum wages is nearly the highest.

(You might want to productivity adjust, in which case federal well below its historical values.)

(You might want to productivity adjust, in which case federal well below its historical values.)

October 26, 2025 at 2:28 PM

As a result, while the inflation-adjusted federal minimum wage is nearly the lowest it has ever been, the average of the state and federal minimum wages is nearly the highest.

(You might want to productivity adjust, in which case federal well below its historical values.)

(You might want to productivity adjust, in which case federal well below its historical values.)

At the same time that the Federal minimum has effectively disappeared, over the last twenty-five years states have regularly set minimums above the federal government. Now the majority of states have higher minimum wages than the federal government.

October 26, 2025 at 2:28 PM

At the same time that the Federal minimum has effectively disappeared, over the last twenty-five years states have regularly set minimums above the federal government. Now the majority of states have higher minimum wages than the federal government.

The Federal minimum wage was established in 1938.

It was in effect for about 85 years.

It has now, for better or worse, been effectively abolished.

It was in effect for about 85 years.

It has now, for better or worse, been effectively abolished.

October 26, 2025 at 2:28 PM

The Federal minimum wage was established in 1938.

It was in effect for about 85 years.

It has now, for better or worse, been effectively abolished.

It was in effect for about 85 years.

It has now, for better or worse, been effectively abolished.

If you call a bubble early you're not prescient, you're wrong.

If you bought the stock market on the day Alan Greenspan announced "irrational exuberance" you would have made money no matter what day you ended up selling.

(Don't @ me about inflation adjustment.)

If you bought the stock market on the day Alan Greenspan announced "irrational exuberance" you would have made money no matter what day you ended up selling.

(Don't @ me about inflation adjustment.)

October 24, 2025 at 1:47 PM

If you call a bubble early you're not prescient, you're wrong.

If you bought the stock market on the day Alan Greenspan announced "irrational exuberance" you would have made money no matter what day you ended up selling.

(Don't @ me about inflation adjustment.)

If you bought the stock market on the day Alan Greenspan announced "irrational exuberance" you would have made money no matter what day you ended up selling.

(Don't @ me about inflation adjustment.)

Overall inflation even higher than core because of a big increase in gasoline plus a moderate one in food.

October 24, 2025 at 1:30 PM

Overall inflation even higher than core because of a big increase in gasoline plus a moderate one in food.

The key part of core services is shelter. It has come down but no where near what the models using spot rents were predicting.

October 24, 2025 at 1:30 PM

The key part of core services is shelter. It has come down but no where near what the models using spot rents were predicting.

The most helpful visualization of the persistent and, to some degree, resurgence of core inflation is this. Four straight months of strong core goods inflation largely due to tariffs. Plus services inflation remains reasonably strong.

October 24, 2025 at 1:30 PM

The most helpful visualization of the persistent and, to some degree, resurgence of core inflation is this. Four straight months of strong core goods inflation largely due to tariffs. Plus services inflation remains reasonably strong.

Here are the full set of numbers.

October 24, 2025 at 1:30 PM

Here are the full set of numbers.

The government made the reasonable decision to release CPI data because needed to calculate Social Security COLAs.

Quick summary, core CPI annual rate:

1 month: 2.8%

3 months: 3.6%

6 months: 3.0%

12 months: 3.0%

Quick summary, core CPI annual rate:

1 month: 2.8%

3 months: 3.6%

6 months: 3.0%

12 months: 3.0%

October 24, 2025 at 1:30 PM

The government made the reasonable decision to release CPI data because needed to calculate Social Security COLAs.

Quick summary, core CPI annual rate:

1 month: 2.8%

3 months: 3.6%

6 months: 3.0%

12 months: 3.0%

Quick summary, core CPI annual rate:

1 month: 2.8%

3 months: 3.6%

6 months: 3.0%

12 months: 3.0%

CBO is as good as it gets. But the world is hard to predict.

October 23, 2025 at 12:15 AM

CBO is as good as it gets. But the world is hard to predict.

If you're not surprised & puzzled about Treasuries being <4% then you're either a seer, incurious or have better things to wonder about.

Large deficits (albeit smaller than expected), capital demand, Fed independence risk, persistent inflation, uncertainty, all go the other way.

Large deficits (albeit smaller than expected), capital demand, Fed independence risk, persistent inflation, uncertainty, all go the other way.

October 20, 2025 at 10:43 PM

If you're not surprised & puzzled about Treasuries being <4% then you're either a seer, incurious or have better things to wonder about.

Large deficits (albeit smaller than expected), capital demand, Fed independence risk, persistent inflation, uncertainty, all go the other way.

Large deficits (albeit smaller than expected), capital demand, Fed independence risk, persistent inflation, uncertainty, all go the other way.

The other day a student asked me about the prevalence of insider trading in prediction markets. I now have an answer.

October 10, 2025 at 11:19 AM

The other day a student asked me about the prevalence of insider trading in prediction markets. I now have an answer.

Core PCE inflation rising lately, running ~3% annual rate.

But core PCE inflation ex portfolio services slowing lately, running just above 2% (when remeaned to reflect it usually runs low).

Some of the reinflation we've seen is rising stock prices counting as higher inflation.

But core PCE inflation ex portfolio services slowing lately, running just above 2% (when remeaned to reflect it usually runs low).

Some of the reinflation we've seen is rising stock prices counting as higher inflation.

October 6, 2025 at 8:05 PM

Core PCE inflation rising lately, running ~3% annual rate.

But core PCE inflation ex portfolio services slowing lately, running just above 2% (when remeaned to reflect it usually runs low).

Some of the reinflation we've seen is rising stock prices counting as higher inflation.

But core PCE inflation ex portfolio services slowing lately, running just above 2% (when remeaned to reflect it usually runs low).

Some of the reinflation we've seen is rising stock prices counting as higher inflation.

On 3, would help GOP.

Red states generally have a higher "cost of voting index" than blue ones. IF Presidential elections were determined by the national popular vote many of these states would liberalize their voting rules so they could have more say in the national election.

Red states generally have a higher "cost of voting index" than blue ones. IF Presidential elections were determined by the national popular vote many of these states would liberalize their voting rules so they could have more say in the national election.

October 5, 2025 at 4:05 PM

On 3, would help GOP.

Red states generally have a higher "cost of voting index" than blue ones. IF Presidential elections were determined by the national popular vote many of these states would liberalize their voting rules so they could have more say in the national election.

Red states generally have a higher "cost of voting index" than blue ones. IF Presidential elections were determined by the national popular vote many of these states would liberalize their voting rules so they could have more say in the national election.

In 2000 & 2016 the Dems won the Presidential popular vote but lost the electoral college.

Just chance the opposite hasn't happened. Eg 2004: Kerry came closer in the EC than the popular vote.

This is the pop vote vote margin Dems would have needed in past elections to win EC.

Just chance the opposite hasn't happened. Eg 2004: Kerry came closer in the EC than the popular vote.

This is the pop vote vote margin Dems would have needed in past elections to win EC.

October 5, 2025 at 4:05 PM

In 2000 & 2016 the Dems won the Presidential popular vote but lost the electoral college.

Just chance the opposite hasn't happened. Eg 2004: Kerry came closer in the EC than the popular vote.

This is the pop vote vote margin Dems would have needed in past elections to win EC.

Just chance the opposite hasn't happened. Eg 2004: Kerry came closer in the EC than the popular vote.

This is the pop vote vote margin Dems would have needed in past elections to win EC.