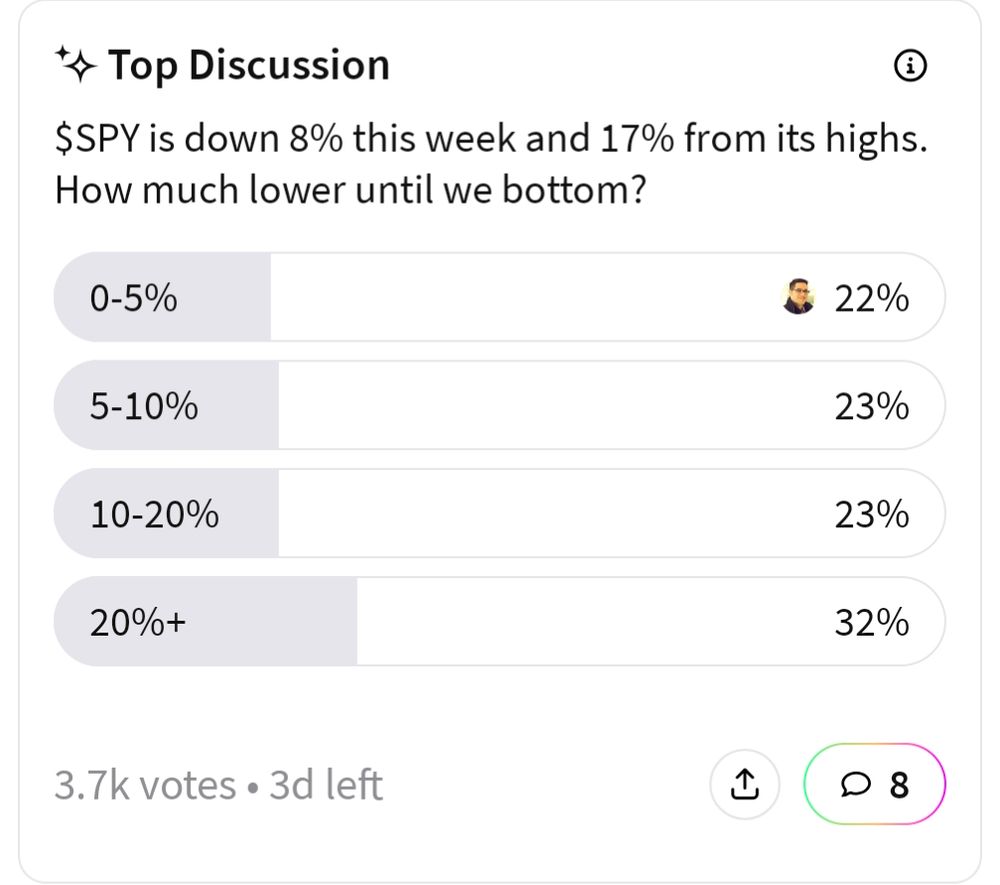

Remember if someone thinks the market is going down, and they put their money where their mouth is, they would have already sold their stocks.

If folks are done selling, the market goes back up.

Remember if someone thinks the market is going down, and they put their money where their mouth is, they would have already sold their stocks.

If folks are done selling, the market goes back up.

The stock whipsawed as they stopped being able to sell GLP-1 drugs, but they've now worked out a deal with $LLY.

Could be a Netflix-like moment here. HIMS and the other online drugstores are easier to use than Lilly's new site.

The stock whipsawed as they stopped being able to sell GLP-1 drugs, but they've now worked out a deal with $LLY.

Could be a Netflix-like moment here. HIMS and the other online drugstores are easier to use than Lilly's new site.

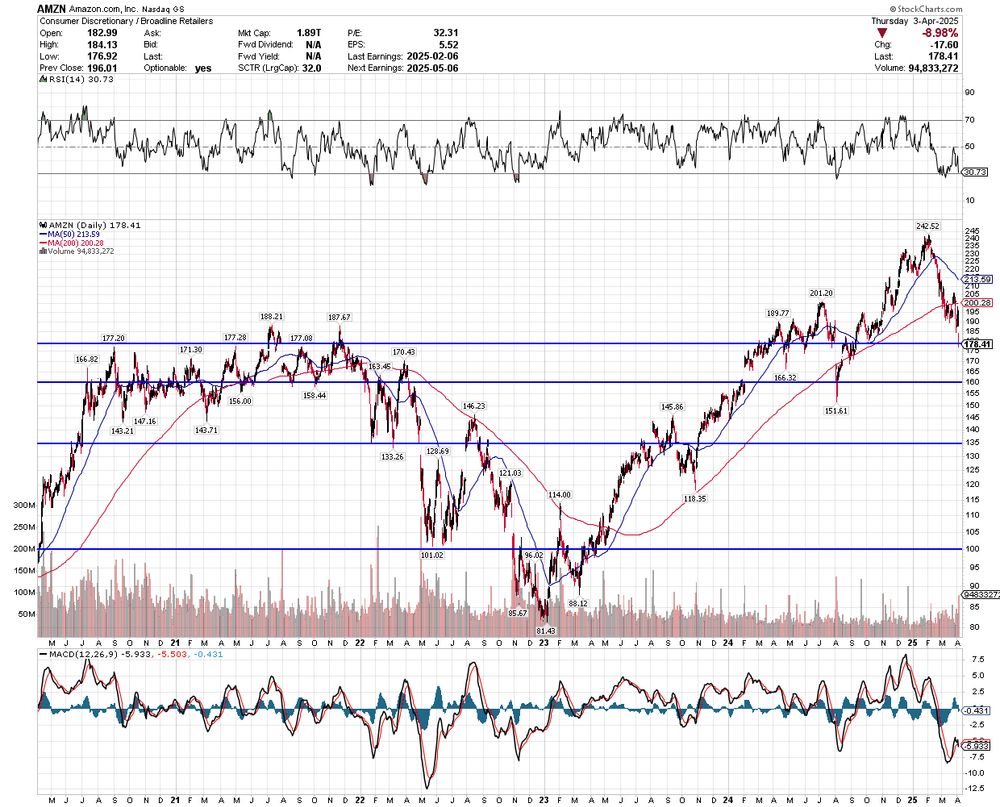

Support at $100, $75, $50.

Support at $100, $75, $50.

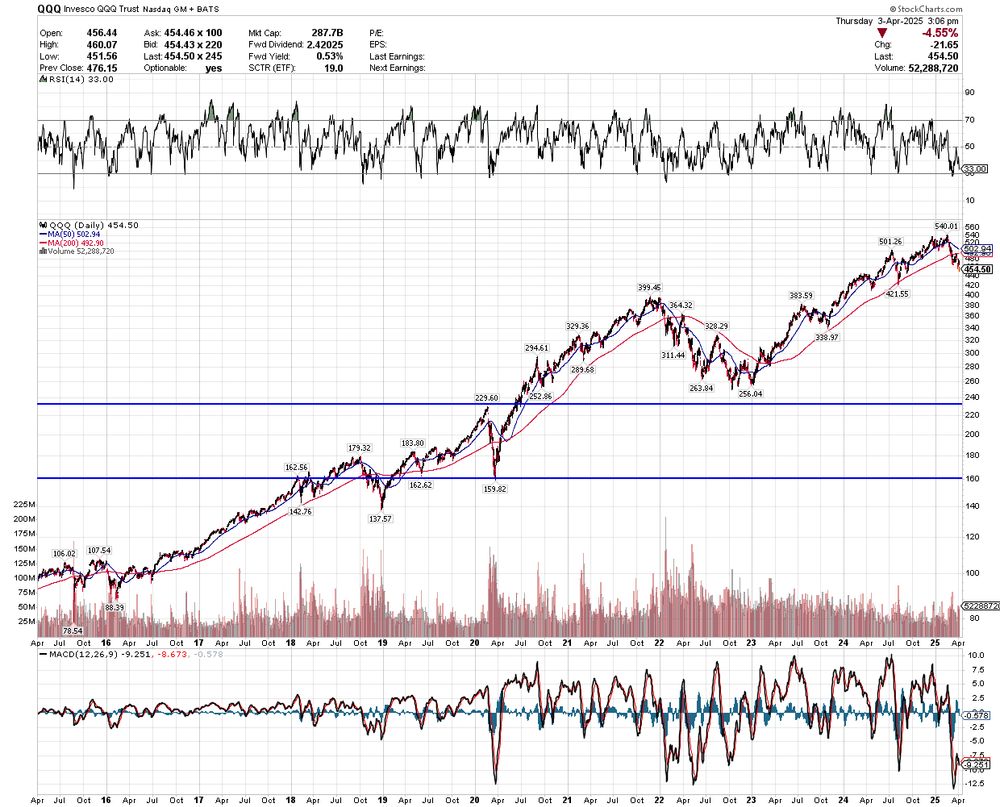

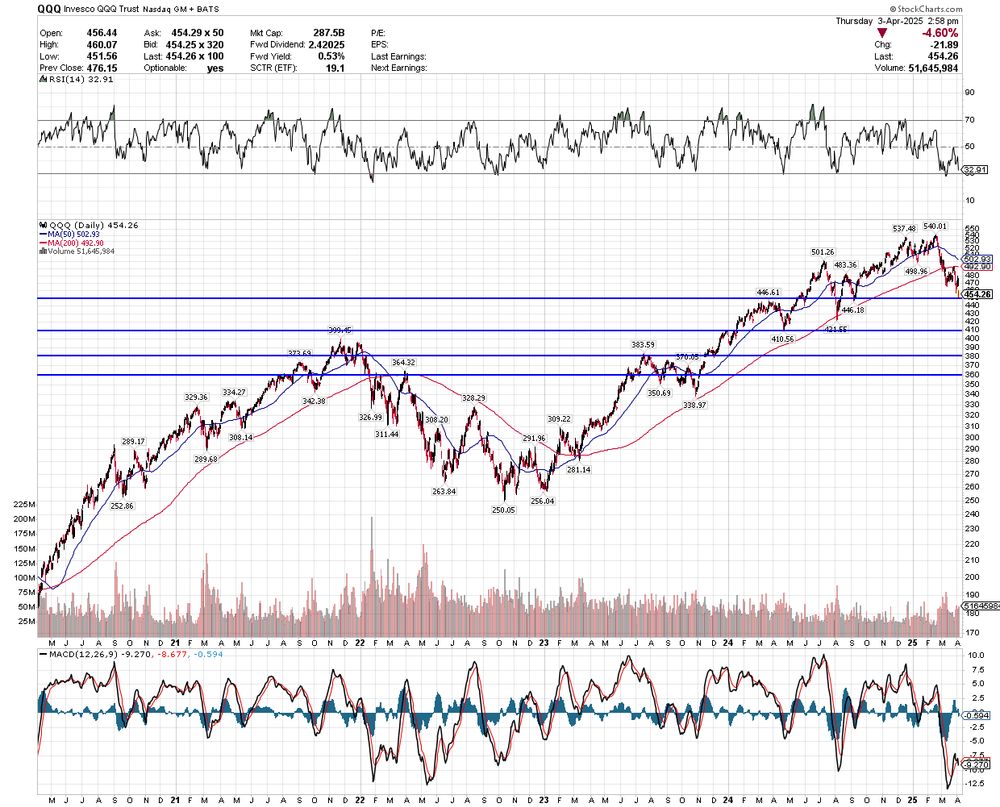

FWIW, the pre-COVID QQQ high was ~$230. The COVID low was ~$160.

FWIW, the pre-COVID QQQ high was ~$230. The COVID low was ~$160.

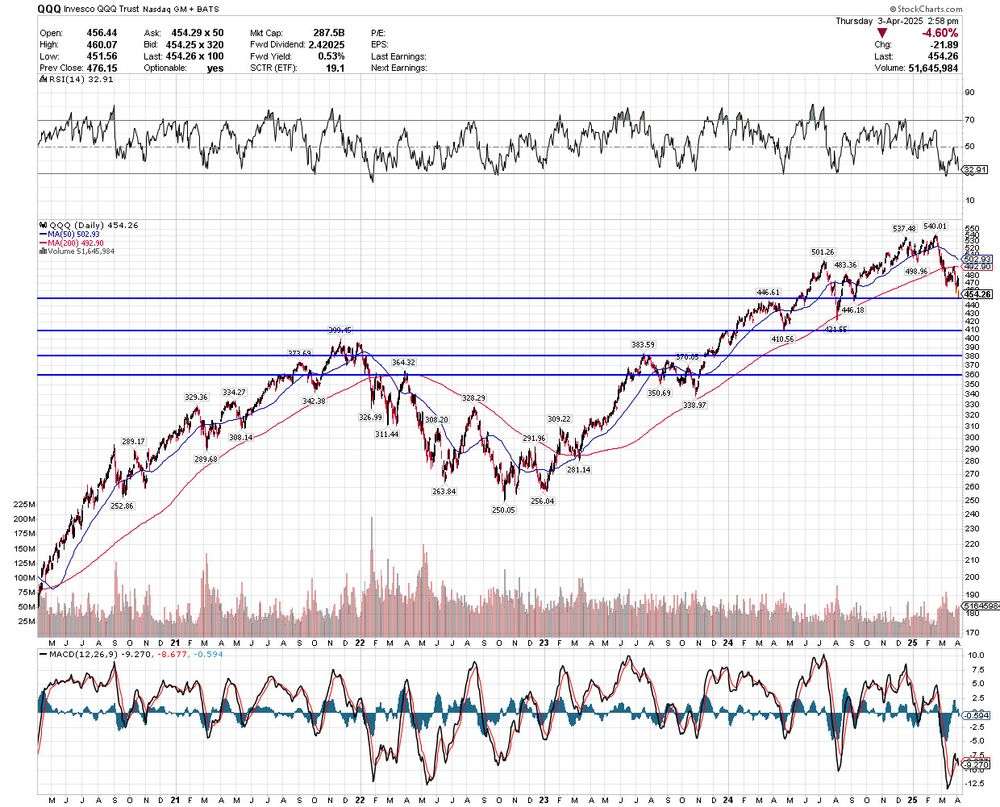

For the QQQ, there is nice support in this ~$450 range. So maybe a bounce coming.

After that, the ~$400 level (conveniently another 10% or so drop) is strong support at the pre-COVID top.

For the QQQ, there is nice support in this ~$450 range. So maybe a bounce coming.

After that, the ~$400 level (conveniently another 10% or so drop) is strong support at the pre-COVID top.