Jan Fichtner

@janfichtner.bsky.social

Senior Research Fellow SuFi Project @UniWH & @UvACorpnet | Global finance, age of passive investing, index providers, ESG, sustainable finance, greenwashing, decarbonization | www.jfichtner.net

🚨New publication with Kristijan Kotarski:

Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

October 30, 2025 at 1:15 PM

🚨New publication with Kristijan Kotarski:

Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

Enduring Structural Power? Assessing the Dominance of the Anglosphere in Global Finance Before the Trump Turn

Includes novel visualizations of global finance (banking, portfolio inv & FDI) showing persistent US centrality

hrcak.srce.hr/clanak/487488

Massive propaganda against the Digital Euro even before it is clear that it will come and how exactly it will be designed technically. Written by a guy who owns a precious metals firm - I bet he is one of the best experts on this topic! 🤣

October 25, 2025 at 12:28 PM

Massive propaganda against the Digital Euro even before it is clear that it will come and how exactly it will be designed technically. Written by a guy who owns a precious metals firm - I bet he is one of the best experts on this topic! 🤣

Lost place in Bonn (Germany).

September 28, 2025 at 2:28 PM

Lost place in Bonn (Germany).

Philosophy of the evening.

September 6, 2025 at 6:23 PM

Philosophy of the evening.

Found a new stunning place in Germany - Altschloss Felsen in the South-West close to the border with France.

July 26, 2025 at 7:27 PM

Found a new stunning place in Germany - Altschloss Felsen in the South-West close to the border with France.

This!

Seen in Berlin today

Seen in Berlin today

July 12, 2025 at 1:55 PM

This!

Seen in Berlin today

Seen in Berlin today

The Magnificent 7 are now 34% of the S&P 500 - unprecedented concentration!

June 20, 2025 at 4:56 PM

The Magnificent 7 are now 34% of the S&P 500 - unprecedented concentration!

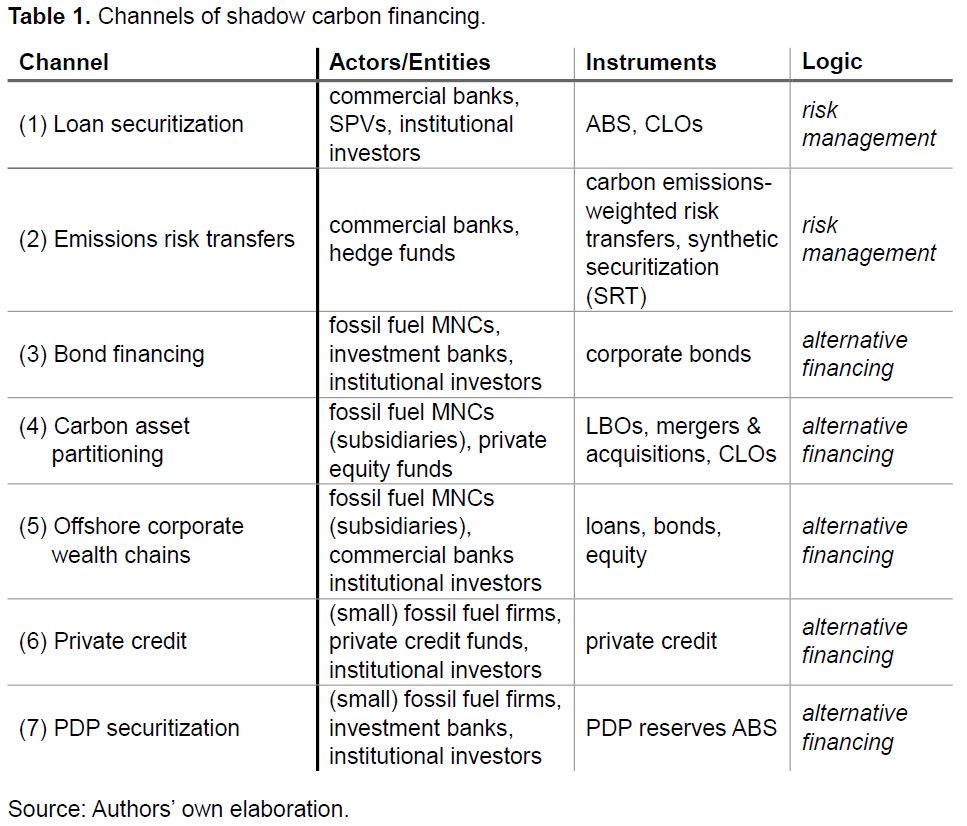

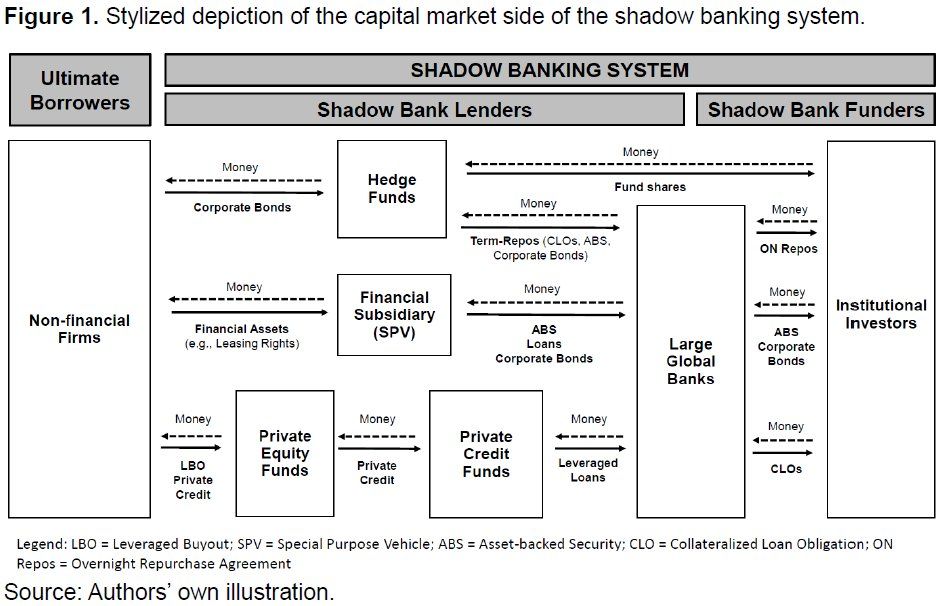

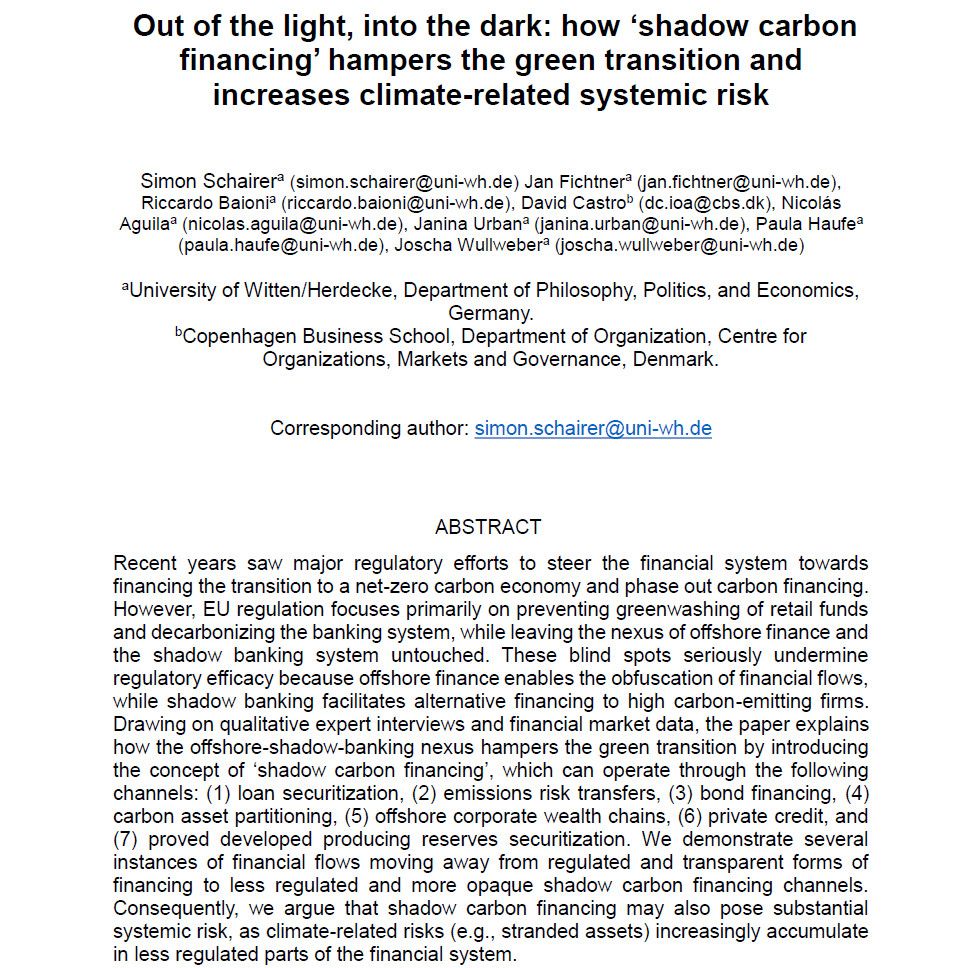

We argue that shadow carbon financing may increase climate-related systemic risks in various ways (see Figures). Consequently, financial regulation must address shadow carbon financing to avoid a "climate Minsky moment"

April 1, 2025 at 10:34 AM

We argue that shadow carbon financing may increase climate-related systemic risks in various ways (see Figures). Consequently, financial regulation must address shadow carbon financing to avoid a "climate Minsky moment"

Drawing on qualitative expert interviews and financial market data, the paper explains how the offshore-shadow-banking nexus hampers the green transition by introducing the concept of ‘shadow carbon financing’, which can operate through the following seven channels:

April 1, 2025 at 10:34 AM

Drawing on qualitative expert interviews and financial market data, the paper explains how the offshore-shadow-banking nexus hampers the green transition by introducing the concept of ‘shadow carbon financing’, which can operate through the following seven channels:

Recent years saw regulatory efforts to steer the financial system towards financing the transition to a net-zero economy and phase out carbon financing. However, EU regulation has left the nexus of offshore finance and the shadow banking system untouched.

April 1, 2025 at 10:34 AM

Recent years saw regulatory efforts to steer the financial system towards financing the transition to a net-zero economy and phase out carbon financing. However, EU regulation has left the nexus of offshore finance and the shadow banking system untouched.

🚨 New Working Paper published:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

April 1, 2025 at 10:34 AM

🚨 New Working Paper published:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

🌬️☀️🔌⏫🇩🇪

All-time high in new permisson of wind power in Germany in 2024! Plus new all-time high in new solar power installation - and record permission of electricity grid expansion.

Outstanding work by @bmwk.de & @robert-habeck.de that accelerates decarbonization in Germany massively.

All-time high in new permisson of wind power in Germany in 2024! Plus new all-time high in new solar power installation - and record permission of electricity grid expansion.

Outstanding work by @bmwk.de & @robert-habeck.de that accelerates decarbonization in Germany massively.

February 27, 2025 at 12:51 PM

🌬️☀️🔌⏫🇩🇪

All-time high in new permisson of wind power in Germany in 2024! Plus new all-time high in new solar power installation - and record permission of electricity grid expansion.

Outstanding work by @bmwk.de & @robert-habeck.de that accelerates decarbonization in Germany massively.

All-time high in new permisson of wind power in Germany in 2024! Plus new all-time high in new solar power installation - and record permission of electricity grid expansion.

Outstanding work by @bmwk.de & @robert-habeck.de that accelerates decarbonization in Germany massively.

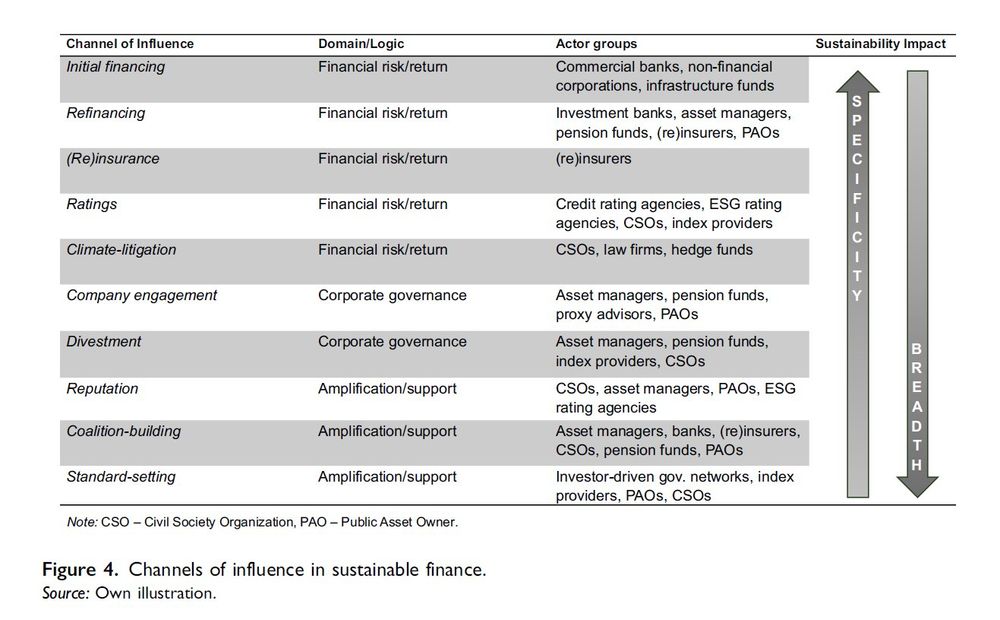

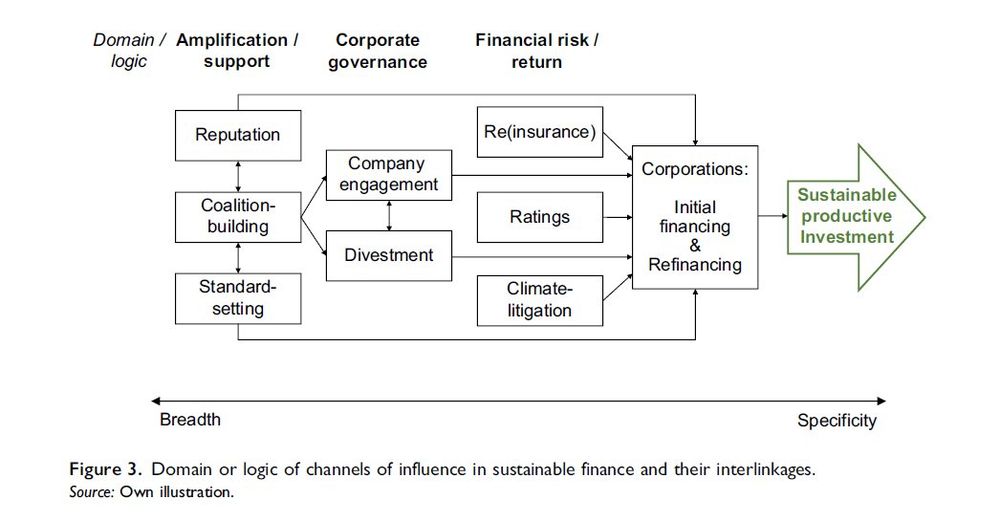

We provide a conceptualization of each channel of influence according to its domain or logic (financial risk–return, corporate governance, and amplification/support) and order them acc. to specificity versus breadth of their sustainability impact.

January 30, 2025 at 10:07 AM

We provide a conceptualization of each channel of influence according to its domain or logic (financial risk–return, corporate governance, and amplification/support) and order them acc. to specificity versus breadth of their sustainability impact.

We identify ten channels of influence concerning sustainable finance: (1) initial financing; (2) refinancing; (3) (re)insurance; (4) ratings; (5) climate-litigation; (6) company engagement; (7) divestment; (8) reputation; (9) coalition-building; and (10) standard-setting.

January 30, 2025 at 10:07 AM

We identify ten channels of influence concerning sustainable finance: (1) initial financing; (2) refinancing; (3) (re)insurance; (4) ratings; (5) climate-litigation; (6) company engagement; (7) divestment; (8) reputation; (9) coalition-building; and (10) standard-setting.

In fact, most sufi actors & instruments cannot directly advance sustainable productive investment.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

January 30, 2025 at 10:07 AM

In fact, most sufi actors & instruments cannot directly advance sustainable productive investment.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

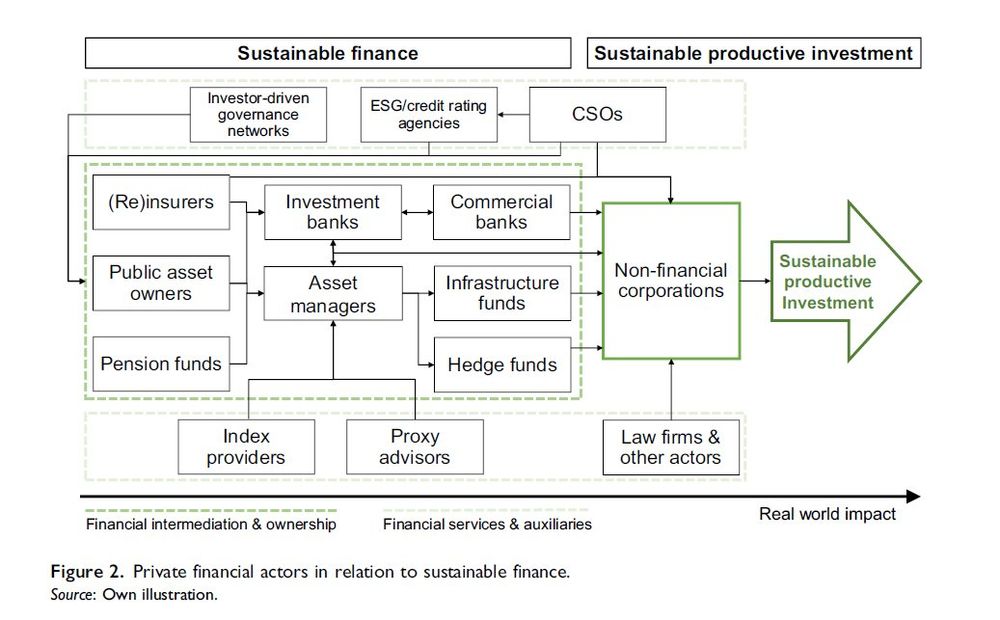

Since the Paris Agreement "sustainable finance" has grown rapidly. However, we don't see strong growth in real-world financial flows that mitigate climate change. Why?

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

January 30, 2025 at 10:07 AM

Since the Paris Agreement "sustainable finance" has grown rapidly. However, we don't see strong growth in real-world financial flows that mitigate climate change. Why?

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

🚨New paper by the Uni Witten SuFi Project in @finandsoc.bsky.social

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

January 30, 2025 at 10:07 AM

🚨New paper by the Uni Witten SuFi Project in @finandsoc.bsky.social

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

Channels of influence in sustainable finance:

A framework for conceptualizing how private actors shape the green transition

www.cambridge.org/core/journal...

A 🧵 on our main arguments:

In October I was in (Northern) Vietnam for two weeks - very friendly people, great landscapes, and fantastic coffee (incl a Viet Cong coffee chain!). Highly recommended! The only signs of Communism were red flags everywhere. All Western apps work, no 'big firewall'.

November 27, 2024 at 10:39 AM

In October I was in (Northern) Vietnam for two weeks - very friendly people, great landscapes, and fantastic coffee (incl a Viet Cong coffee chain!). Highly recommended! The only signs of Communism were red flags everywhere. All Western apps work, no 'big firewall'.

Bluesky now has over 10 million users, and I was #1.330.286!

September 23, 2024 at 3:13 PM

Bluesky now has over 10 million users, and I was #1.330.286!

6️⃣

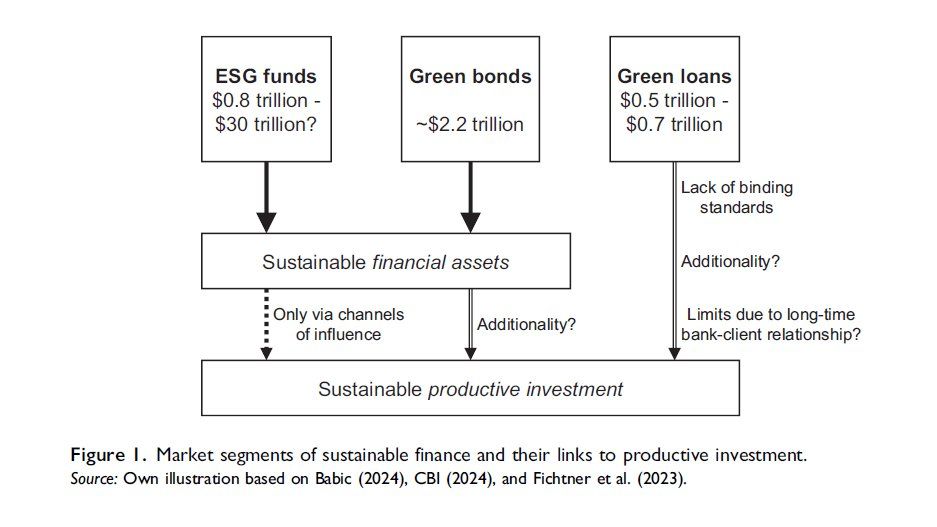

And btw, none of these funds create direct "additionality".

If you want to know more about the topic of ESG / sustainable investing & the lack of sustainability impact creation, take a look at a recent paper with

J. Petry & R. Jaspert:

onlinelibrary.wiley.com/doi/full/10....

🧵 end.

And btw, none of these funds create direct "additionality".

If you want to know more about the topic of ESG / sustainable investing & the lack of sustainability impact creation, take a look at a recent paper with

J. Petry & R. Jaspert:

onlinelibrary.wiley.com/doi/full/10....

🧵 end.

December 1, 2023 at 10:54 AM

6️⃣

And btw, none of these funds create direct "additionality".

If you want to know more about the topic of ESG / sustainable investing & the lack of sustainability impact creation, take a look at a recent paper with

J. Petry & R. Jaspert:

onlinelibrary.wiley.com/doi/full/10....

🧵 end.

And btw, none of these funds create direct "additionality".

If you want to know more about the topic of ESG / sustainable investing & the lack of sustainability impact creation, take a look at a recent paper with

J. Petry & R. Jaspert:

onlinelibrary.wiley.com/doi/full/10....

🧵 end.

5️⃣

The key problem for all data gathering attempts is that there are no hard standards (although there have been recent efforts by the industry).

Take US sustainable funds, for instance. GSIA says they are $8.4trillion, but according to Morningstar they manage just $300billion!

The key problem for all data gathering attempts is that there are no hard standards (although there have been recent efforts by the industry).

Take US sustainable funds, for instance. GSIA says they are $8.4trillion, but according to Morningstar they manage just $300billion!

December 1, 2023 at 10:51 AM

5️⃣

The key problem for all data gathering attempts is that there are no hard standards (although there have been recent efforts by the industry).

Take US sustainable funds, for instance. GSIA says they are $8.4trillion, but according to Morningstar they manage just $300billion!

The key problem for all data gathering attempts is that there are no hard standards (although there have been recent efforts by the industry).

Take US sustainable funds, for instance. GSIA says they are $8.4trillion, but according to Morningstar they manage just $300billion!

4️⃣

Investment strategies that focus on "corporate engagement and shareholder action" do have the potential to create a significant sustainability impact. Problem is: these funds do not commit to hard consistent standards & impact is hard to measure (engagement is mostly private)

Investment strategies that focus on "corporate engagement and shareholder action" do have the potential to create a significant sustainability impact. Problem is: these funds do not commit to hard consistent standards & impact is hard to measure (engagement is mostly private)

December 1, 2023 at 10:51 AM

4️⃣

Investment strategies that focus on "corporate engagement and shareholder action" do have the potential to create a significant sustainability impact. Problem is: these funds do not commit to hard consistent standards & impact is hard to measure (engagement is mostly private)

Investment strategies that focus on "corporate engagement and shareholder action" do have the potential to create a significant sustainability impact. Problem is: these funds do not commit to hard consistent standards & impact is hard to measure (engagement is mostly private)

3️⃣

First, look at 'ESG integration' - assets collapsed from $25trn to $5trn! This category is extremely vague and thus very prone to greenwashing. But also the screening strategies simply exclude a few baddies (eg coal) and otherwise look quite similar to conventional funds.

First, look at 'ESG integration' - assets collapsed from $25trn to $5trn! This category is extremely vague and thus very prone to greenwashing. But also the screening strategies simply exclude a few baddies (eg coal) and otherwise look quite similar to conventional funds.

December 1, 2023 at 10:50 AM

3️⃣

First, look at 'ESG integration' - assets collapsed from $25trn to $5trn! This category is extremely vague and thus very prone to greenwashing. But also the screening strategies simply exclude a few baddies (eg coal) and otherwise look quite similar to conventional funds.

First, look at 'ESG integration' - assets collapsed from $25trn to $5trn! This category is extremely vague and thus very prone to greenwashing. But also the screening strategies simply exclude a few baddies (eg coal) and otherwise look quite similar to conventional funds.

2️⃣

Wow, so just over $30 trillion - or 24% of all global fund assets - is sustainable, that's amazing. A quarter of all funds are sustainable and help decarbonization etc, right?

It sounds almost too good to be true - and that's because it is.

Wow, so just over $30 trillion - or 24% of all global fund assets - is sustainable, that's amazing. A quarter of all funds are sustainable and help decarbonization etc, right?

It sounds almost too good to be true - and that's because it is.

December 1, 2023 at 10:49 AM

2️⃣

Wow, so just over $30 trillion - or 24% of all global fund assets - is sustainable, that's amazing. A quarter of all funds are sustainable and help decarbonization etc, right?

It sounds almost too good to be true - and that's because it is.

Wow, so just over $30 trillion - or 24% of all global fund assets - is sustainable, that's amazing. A quarter of all funds are sustainable and help decarbonization etc, right?

It sounds almost too good to be true - and that's because it is.