Jacob Bastian

@jacobbastian.bsky.social

Rutgers Econ Ast Prof || NBER || Brookings || Council of Economic Advisers Senior Economist 2023-24 || PhD UMich || I research how public policy can help low income families || 2021 Child Tax Credit = 👍🏼 || 🏀📚🚲🥃 || 1st gen college || jacobbastian.com

Would love to see @zohrankmamdani.bsky.social keep this going—AFTER the election—with volunteer groups working together on good things

Community in real life is needed more and more, post-Covid, post-religion

www.nytimes.com/2025/11/04/n...

Community in real life is needed more and more, post-Covid, post-religion

www.nytimes.com/2025/11/04/n...

November 5, 2025 at 4:24 AM

Would love to see @zohrankmamdani.bsky.social keep this going—AFTER the election—with volunteer groups working together on good things

Community in real life is needed more and more, post-Covid, post-religion

www.nytimes.com/2025/11/04/n...

Community in real life is needed more and more, post-Covid, post-religion

www.nytimes.com/2025/11/04/n...

Such a pleasure to be on this panel. Great event at the Urban Institute

www.urban.org/events/cash-...

www.urban.org/events/cash-...

October 21, 2025 at 8:06 PM

Such a pleasure to be on this panel. Great event at the Urban Institute

www.urban.org/events/cash-...

www.urban.org/events/cash-...

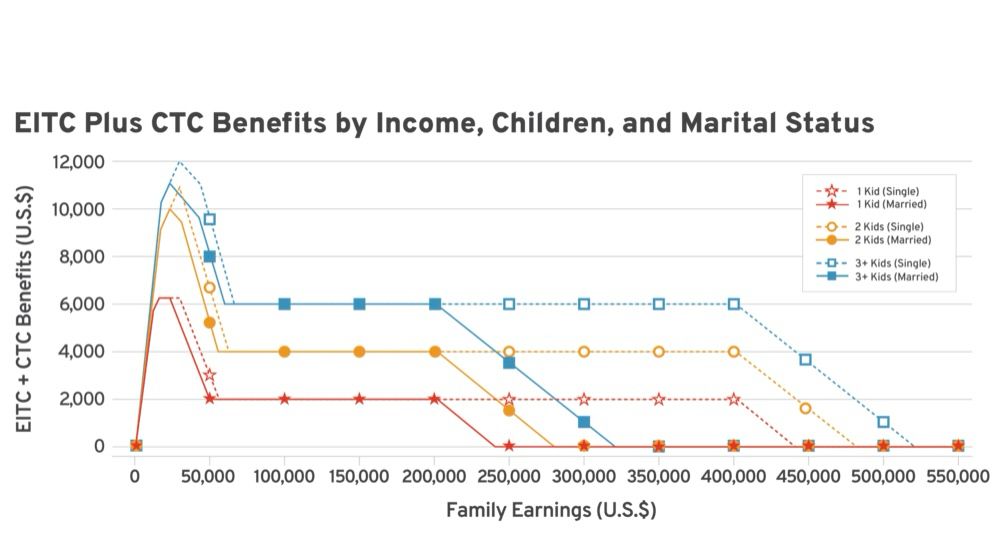

It is important for researchers and policymakers to think about the interaction of policies, not just one program at a time.

I wrote a short analysis of the US’s two most important tax credits

Here’s EITC+CTC combined by income, kids, marital status

www.rstreet.org/commentary/h...

I wrote a short analysis of the US’s two most important tax credits

Here’s EITC+CTC combined by income, kids, marital status

www.rstreet.org/commentary/h...

July 24, 2025 at 5:43 PM

It is important for researchers and policymakers to think about the interaction of policies, not just one program at a time.

I wrote a short analysis of the US’s two most important tax credits

Here’s EITC+CTC combined by income, kids, marital status

www.rstreet.org/commentary/h...

I wrote a short analysis of the US’s two most important tax credits

Here’s EITC+CTC combined by income, kids, marital status

www.rstreet.org/commentary/h...

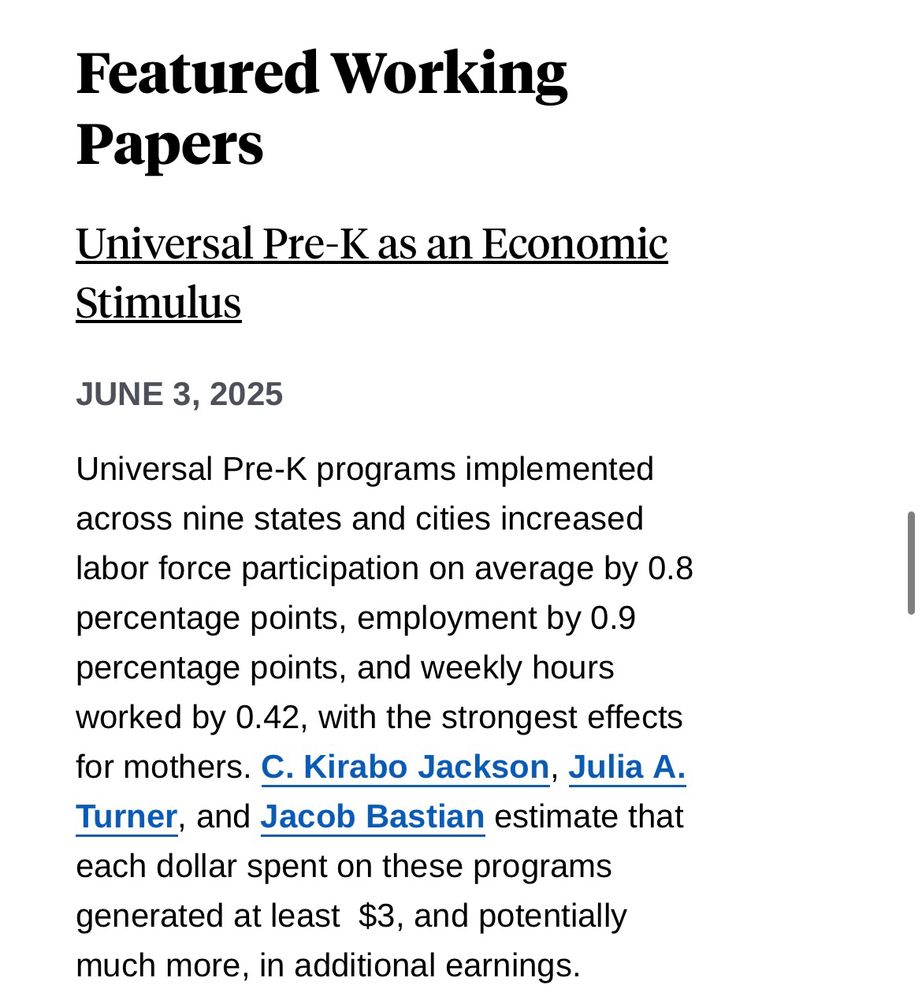

New research w/ @kirabojackson.bsky.social & @julia-turner.bsky.social on NBER homepage

“Universal Pre-K across 9 states & cities increased LFP by 0.8 pp, employment by 0.9 pp, & weekly hours worked by 0.42, with strongest effects for moms. Each $1 spent on UPK generated >$3 in additional earnings”

“Universal Pre-K across 9 states & cities increased LFP by 0.8 pp, employment by 0.9 pp, & weekly hours worked by 0.42, with strongest effects for moms. Each $1 spent on UPK generated >$3 in additional earnings”

June 3, 2025 at 4:30 PM

New research w/ @kirabojackson.bsky.social & @julia-turner.bsky.social on NBER homepage

“Universal Pre-K across 9 states & cities increased LFP by 0.8 pp, employment by 0.9 pp, & weekly hours worked by 0.42, with strongest effects for moms. Each $1 spent on UPK generated >$3 in additional earnings”

“Universal Pre-K across 9 states & cities increased LFP by 0.8 pp, employment by 0.9 pp, & weekly hours worked by 0.42, with strongest effects for moms. Each $1 spent on UPK generated >$3 in additional earnings”

Looking forward to talking about the earned income tax credit (EITC) as it turns 50 years old this year.

Will be a great event tomorrow at 10am EST at @brookings.edu

www.brookings.edu/events/the-e...

Will be a great event tomorrow at 10am EST at @brookings.edu

www.brookings.edu/events/the-e...

June 3, 2025 at 3:03 AM

Looking forward to talking about the earned income tax credit (EITC) as it turns 50 years old this year.

Will be a great event tomorrow at 10am EST at @brookings.edu

www.brookings.edu/events/the-e...

Will be a great event tomorrow at 10am EST at @brookings.edu

www.brookings.edu/events/the-e...

Today is the submission deadline for my favorite conference and I just submitted a few papers! Hope to see you in Boston in November

ntanet.org/2025/03/118t...

ntanet.org/2025/03/118t...

May 28, 2025 at 7:37 PM

Today is the submission deadline for my favorite conference and I just submitted a few papers! Hope to see you in Boston in November

ntanet.org/2025/03/118t...

ntanet.org/2025/03/118t...

Per-child increase in tax credits is $0 for poorest families, $400 for families earning below $20,000, $700 for families earning $20,000 to $40,000, $800 for families earning $40,000 to $60,000

For families with higher incomes—unaffected by EITC reductions—the increase is $1,200

For families with higher incomes—unaffected by EITC reductions—the increase is $1,200

December 8, 2024 at 12:52 AM

Per-child increase in tax credits is $0 for poorest families, $400 for families earning below $20,000, $700 for families earning $20,000 to $40,000, $800 for families earning $40,000 to $60,000

For families with higher incomes—unaffected by EITC reductions—the increase is $1,200

For families with higher incomes—unaffected by EITC reductions—the increase is $1,200

On net, CTC+EITC would increase for lower income families but would increase more for higher income families

(See figure)

(See figure)

December 8, 2024 at 12:52 AM

On net, CTC+EITC would increase for lower income families but would increase more for higher income families

(See figure)

(See figure)

The FSA CTC would provide $174 billion in benefits, with the cost largely offset by reductions in five other programs including reducing EITC payments to low-income families by $14.4 billion—shrinking the EITC by about a quarter from its current $57 billion total

December 8, 2024 at 12:52 AM

The FSA CTC would provide $174 billion in benefits, with the cost largely offset by reductions in five other programs including reducing EITC payments to low-income families by $14.4 billion—shrinking the EITC by about a quarter from its current $57 billion total

Better late than never (and only in Kursk, where Ukraine took over, so limited)

Important to hold onto that area to have something for potential negotiations and land swap

www.nytimes.com/2024/11/17/u...

Important to hold onto that area to have something for potential negotiations and land swap

www.nytimes.com/2024/11/17/u...

November 17, 2024 at 6:14 PM

Better late than never (and only in Kursk, where Ukraine took over, so limited)

Important to hold onto that area to have something for potential negotiations and land swap

www.nytimes.com/2024/11/17/u...

Important to hold onto that area to have something for potential negotiations and land swap

www.nytimes.com/2024/11/17/u...

I wrote up a short blog summarizing the benefits of the temporary 2021 expansion of the CTC.

This figure shows just how large this expansion was, especially for the lowest income families.

www.rstreet.org/commentary/s...

This figure shows just how large this expansion was, especially for the lowest income families.

www.rstreet.org/commentary/s...

November 17, 2024 at 4:15 PM

I wrote up a short blog summarizing the benefits of the temporary 2021 expansion of the CTC.

This figure shows just how large this expansion was, especially for the lowest income families.

www.rstreet.org/commentary/s...

This figure shows just how large this expansion was, especially for the lowest income families.

www.rstreet.org/commentary/s...

Impressive doc!

For example key referendums by topic

For example key referendums by topic

November 2, 2024 at 3:56 PM

Impressive doc!

For example key referendums by topic

For example key referendums by topic

Voted early!

Get out there and vote y’all

Get out there and vote y’all

October 30, 2024 at 8:44 PM

Voted early!

Get out there and vote y’all

Get out there and vote y’all

Economic Report to the President drops today!

Here’s a preview of Housing chapter I worked on:

Housing getting steadily more expensive since the 60s due to housing shortage, zoning rules, not building enough smaller/affordable units.

We can do better!

www.nytimes.com/2024/03/21/u...

Here’s a preview of Housing chapter I worked on:

Housing getting steadily more expensive since the 60s due to housing shortage, zoning rules, not building enough smaller/affordable units.

We can do better!

www.nytimes.com/2024/03/21/u...

March 21, 2024 at 11:45 AM

Economic Report to the President drops today!

Here’s a preview of Housing chapter I worked on:

Housing getting steadily more expensive since the 60s due to housing shortage, zoning rules, not building enough smaller/affordable units.

We can do better!

www.nytimes.com/2024/03/21/u...

Here’s a preview of Housing chapter I worked on:

Housing getting steadily more expensive since the 60s due to housing shortage, zoning rules, not building enough smaller/affordable units.

We can do better!

www.nytimes.com/2024/03/21/u...

What do I find?

Across 44 approaches and 5 decades of evidence, I find a mean and median elasticity of 0.33, with 25th to 75th pctiles of 0.23 and 0.41. Elasticities near 0 and above 0.6 are outliers

Unmarried mom employment elasticities are 0.3-0.4, on avg

See histogram:

Across 44 approaches and 5 decades of evidence, I find a mean and median elasticity of 0.33, with 25th to 75th pctiles of 0.23 and 0.41. Elasticities near 0 and above 0.6 are outliers

Unmarried mom employment elasticities are 0.3-0.4, on avg

See histogram:

February 20, 2024 at 6:30 PM

What do I find?

Across 44 approaches and 5 decades of evidence, I find a mean and median elasticity of 0.33, with 25th to 75th pctiles of 0.23 and 0.41. Elasticities near 0 and above 0.6 are outliers

Unmarried mom employment elasticities are 0.3-0.4, on avg

See histogram:

Across 44 approaches and 5 decades of evidence, I find a mean and median elasticity of 0.33, with 25th to 75th pctiles of 0.23 and 0.41. Elasticities near 0 and above 0.6 are outliers

Unmarried mom employment elasticities are 0.3-0.4, on avg

See histogram:

In a previous paper (Bastian 2023, forthcoming at NTJ) I show that the 2020-to-2021 CTC change would've led to large child poverty and deep poverty decreases, even under VERY large assumptions about elasticities (even >2.0 for unmar moms)

Paper link:

drive.google.com/file/d/122-y...

Paper link:

drive.google.com/file/d/122-y...

February 20, 2024 at 6:26 PM

In a previous paper (Bastian 2023, forthcoming at NTJ) I show that the 2020-to-2021 CTC change would've led to large child poverty and deep poverty decreases, even under VERY large assumptions about elasticities (even >2.0 for unmar moms)

Paper link:

drive.google.com/file/d/122-y...

Paper link:

drive.google.com/file/d/122-y...

In addition to raw emp changes, I also take emp estimates from EITC lit

In the paper (link below) I discuss various alternate approaches. I present many options and show the distribution of e

What do I find?

On average e = 0.35

0.2-0.5 is most common range of e

In the paper (link below) I discuss various alternate approaches. I present many options and show the distribution of e

What do I find?

On average e = 0.35

0.2-0.5 is most common range of e

February 7, 2024 at 3:41 PM

In addition to raw emp changes, I also take emp estimates from EITC lit

In the paper (link below) I discuss various alternate approaches. I present many options and show the distribution of e

What do I find?

On average e = 0.35

0.2-0.5 is most common range of e

In the paper (link below) I discuss various alternate approaches. I present many options and show the distribution of e

What do I find?

On average e = 0.35

0.2-0.5 is most common range of e

Figures show ATR & emp changes over time. EITC lowers ATRs and increases emp

I compare ATR & emp before vs after policy changes in 1975, 1986, 1990s, & 2009

With these 2 variables, I can calculate e

There are other ways to calculate e, but this is a simple way used in CTC lit

I compare ATR & emp before vs after policy changes in 1975, 1986, 1990s, & 2009

With these 2 variables, I can calculate e

There are other ways to calculate e, but this is a simple way used in CTC lit

February 7, 2024 at 3:40 PM

Figures show ATR & emp changes over time. EITC lowers ATRs and increases emp

I compare ATR & emp before vs after policy changes in 1975, 1986, 1990s, & 2009

With these 2 variables, I can calculate e

There are other ways to calculate e, but this is a simple way used in CTC lit

I compare ATR & emp before vs after policy changes in 1975, 1986, 1990s, & 2009

With these 2 variables, I can calculate e

There are other ways to calculate e, but this is a simple way used in CTC lit

Very good discussion. First ten minutes especially that discuss Israel Palestine Gaza policy

podcasts.apple.com/us/podcast/t...

podcasts.apple.com/us/podcast/t...

December 21, 2023 at 2:18 AM

Very good discussion. First ten minutes especially that discuss Israel Palestine Gaza policy

podcasts.apple.com/us/podcast/t...

podcasts.apple.com/us/podcast/t...

Cool to see POTUS walking around the office!

October 11, 2023 at 8:56 PM

Cool to see POTUS walking around the office!

Reminder that most of the 2017 GOP tax cuts went to higher income people

This is true in percent terms and is much more true in absolute dollar terms

Tax changes set to expire end of 2025; let's not extend these cuts for high-income people

t.co/0yW1cDhB6E

This is true in percent terms and is much more true in absolute dollar terms

Tax changes set to expire end of 2025; let's not extend these cuts for high-income people

t.co/0yW1cDhB6E

October 8, 2023 at 1:15 PM

Reminder that most of the 2017 GOP tax cuts went to higher income people

This is true in percent terms and is much more true in absolute dollar terms

Tax changes set to expire end of 2025; let's not extend these cuts for high-income people

t.co/0yW1cDhB6E

This is true in percent terms and is much more true in absolute dollar terms

Tax changes set to expire end of 2025; let's not extend these cuts for high-income people

t.co/0yW1cDhB6E

Public policy can improve lives!

Unconditional $$ reduces child abuse & neglect Implications for expanded CTC

Don’t overthink it. $$ improves lives of parents & kids

I’m all for some in-work benefits (e.g. EITC) but policy should have goals other than simply maximizing LFP

t.co/63RnovXclD

Unconditional $$ reduces child abuse & neglect Implications for expanded CTC

Don’t overthink it. $$ improves lives of parents & kids

I’m all for some in-work benefits (e.g. EITC) but policy should have goals other than simply maximizing LFP

t.co/63RnovXclD

October 8, 2023 at 1:09 PM

Public policy can improve lives!

Unconditional $$ reduces child abuse & neglect Implications for expanded CTC

Don’t overthink it. $$ improves lives of parents & kids

I’m all for some in-work benefits (e.g. EITC) but policy should have goals other than simply maximizing LFP

t.co/63RnovXclD

Unconditional $$ reduces child abuse & neglect Implications for expanded CTC

Don’t overthink it. $$ improves lives of parents & kids

I’m all for some in-work benefits (e.g. EITC) but policy should have goals other than simply maximizing LFP

t.co/63RnovXclD