graham steele

@grahamsteele.bsky.social

Focused on the law & politics of finance.

Currently Rock Center at Stanford Law School & Roosevelt Institute. Former Assistant Secretary, US Treasury Department & Democratic chief counsel, Senate Banking Committee.

https://law.stanford.edu/graham-steele/

Currently Rock Center at Stanford Law School & Roosevelt Institute. Former Assistant Secretary, US Treasury Department & Democratic chief counsel, Senate Banking Committee.

https://law.stanford.edu/graham-steele/

To be clear, I do not think this approach is unique to the Senators who voted for the deal. I think it's a dynamic that applies to a significant portion of the broader party apparatus.

November 10, 2025 at 5:26 PM

To be clear, I do not think this approach is unique to the Senators who voted for the deal. I think it's a dynamic that applies to a significant portion of the broader party apparatus.

Messaging about a set of values without actually delivering on the underlying policies helps paper over disagreements between constituencies in the D coalition.

But this strategy makes communications the ends not the means. It's a model that fails to meet the stakes & urgency of the current moment.

But this strategy makes communications the ends not the means. It's a model that fails to meet the stakes & urgency of the current moment.

November 10, 2025 at 5:26 PM

Messaging about a set of values without actually delivering on the underlying policies helps paper over disagreements between constituencies in the D coalition.

But this strategy makes communications the ends not the means. It's a model that fails to meet the stakes & urgency of the current moment.

But this strategy makes communications the ends not the means. It's a model that fails to meet the stakes & urgency of the current moment.

In my experience, you don’t get that many defections—or even negotiations in the first place—without leadership’s approval.

November 10, 2025 at 2:58 AM

In my experience, you don’t get that many defections—or even negotiations in the first place—without leadership’s approval.

OpenAI CFO clarifies that when she suggested the US government might “backstop the guarantee that allows the financing to happen,” she didn't really mean they're seeking a government backstop.

Either this was a trial balloon or she's just a bad communicator. I'd assume the former, but who's to say.

Either this was a trial balloon or she's just a bad communicator. I'd assume the former, but who's to say.

November 6, 2025 at 3:03 PM

OpenAI CFO clarifies that when she suggested the US government might “backstop the guarantee that allows the financing to happen,” she didn't really mean they're seeking a government backstop.

Either this was a trial balloon or she's just a bad communicator. I'd assume the former, but who's to say.

Either this was a trial balloon or she's just a bad communicator. I'd assume the former, but who's to say.

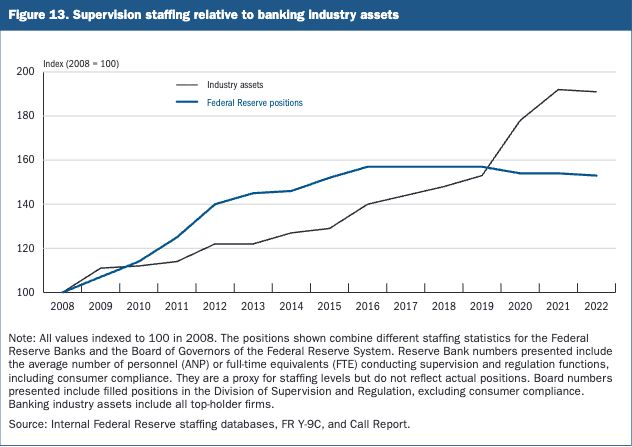

A timely explainer on the implications of weakening bank supervision.

bsky.app/profile/dday...

bsky.app/profile/dday...

We know that the Trump administration has pretty much ended bank regulation. But they've also quietly walked away from bank supervision, the obscure work of checking for risk that prevents financial collapse. Our friends at @revolvingdoordc.bsky.social have a nice reported look at this:

Making Banking Supervision Suck Again - The American Prospect

Bank supervision consists of two main prongs: risk management and compliance. On the compliance side, consumer protection laws are being enforced less than at any time since at least the Great Recessi...

prospect.org

October 31, 2025 at 2:42 PM

A timely explainer on the implications of weakening bank supervision.

bsky.app/profile/dday...

bsky.app/profile/dday...

From what I’ve heard, the announced cuts are just to S&R. Not clear to me what the impact will be on the regional banks.

October 31, 2025 at 2:40 PM

From what I’ve heard, the announced cuts are just to S&R. Not clear to me what the impact will be on the regional banks.

There's no mystery about the likely impact of these cuts.

For comparison, the Fed's post mortem on the Silicon Valley Bank failure noted that the headcount decline of 3% during the first Trump administration-a tenth of what's proposed now-strained the Fed's ability to address emerging risks.

For comparison, the Fed's post mortem on the Silicon Valley Bank failure noted that the headcount decline of 3% during the first Trump administration-a tenth of what's proposed now-strained the Fed's ability to address emerging risks.

October 30, 2025 at 8:24 PM

There's no mystery about the likely impact of these cuts.

For comparison, the Fed's post mortem on the Silicon Valley Bank failure noted that the headcount decline of 3% during the first Trump administration-a tenth of what's proposed now-strained the Fed's ability to address emerging risks.

For comparison, the Fed's post mortem on the Silicon Valley Bank failure noted that the headcount decline of 3% during the first Trump administration-a tenth of what's proposed now-strained the Fed's ability to address emerging risks.