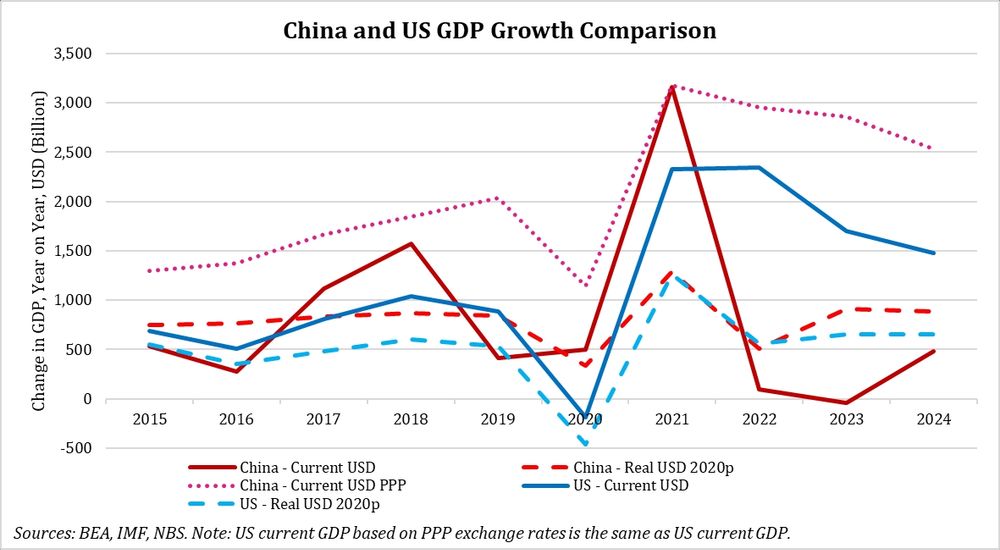

- Macro weakness

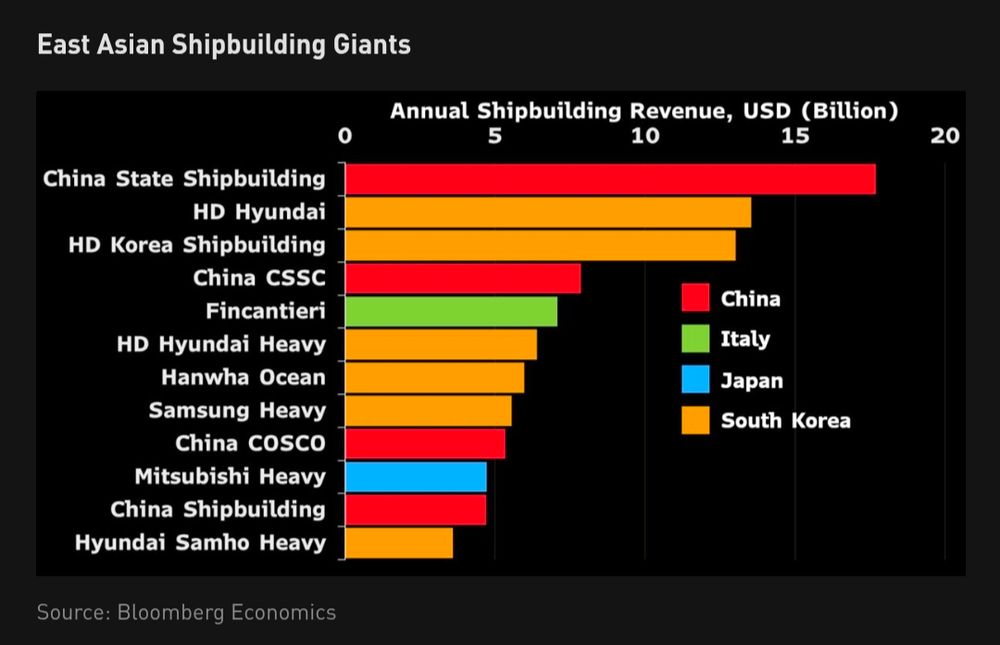

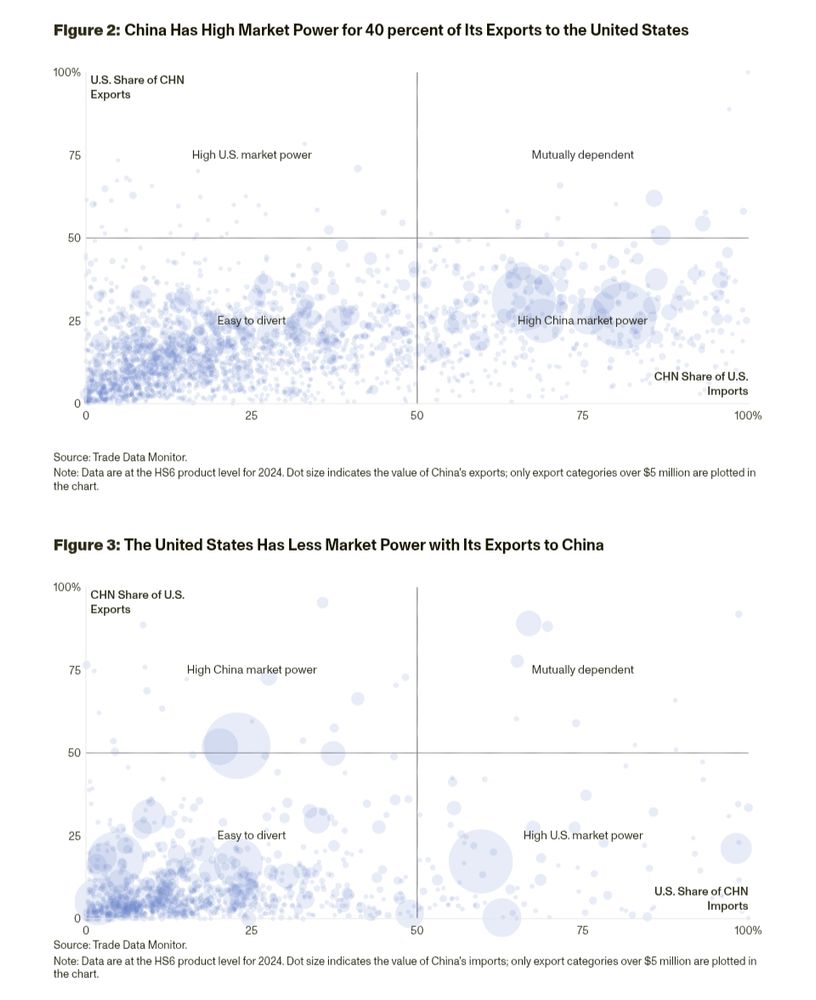

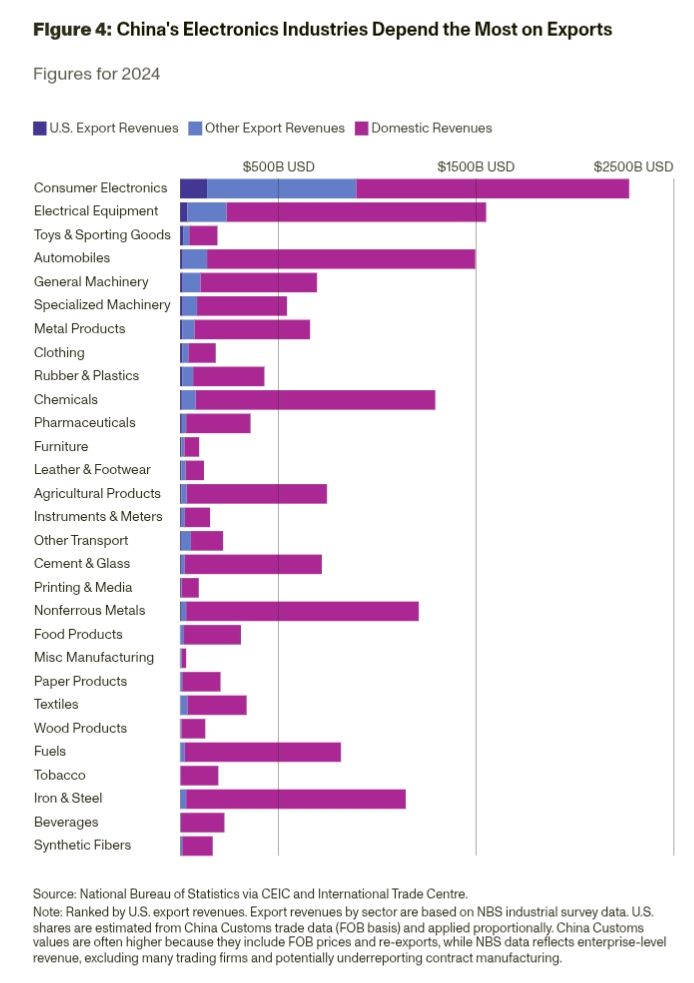

- Technological and industrial strength

They're both true! How? The "new economy" is a small share of the overall economy. I discuss in a new RAND Commentary.

www.rand.org/pubs/comment...

- Macro weakness

- Technological and industrial strength

They're both true! How? The "new economy" is a small share of the overall economy. I discuss in a new RAND Commentary.

www.rand.org/pubs/comment...

Perfect broth. NTD 200 ($6). 😋

Perfect broth. NTD 200 ($6). 😋