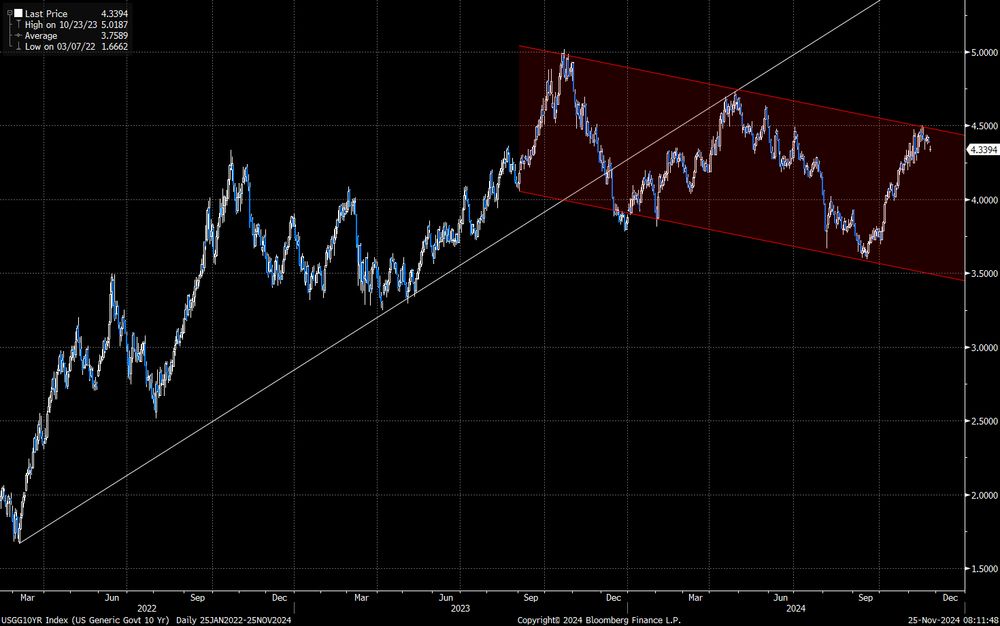

The Reeves budget outlays weren't mostly unfunded like the Kwarteng budget.

Gilts now have a large premium vs 2022. Real yields are 300bp higher, as inflation has halved.

To borrow from @darioperkins.bsky.social , no moron risk premium needed!

The Reeves budget outlays weren't mostly unfunded like the Kwarteng budget.

Gilts now have a large premium vs 2022. Real yields are 300bp higher, as inflation has halved.

To borrow from @darioperkins.bsky.social , no moron risk premium needed!

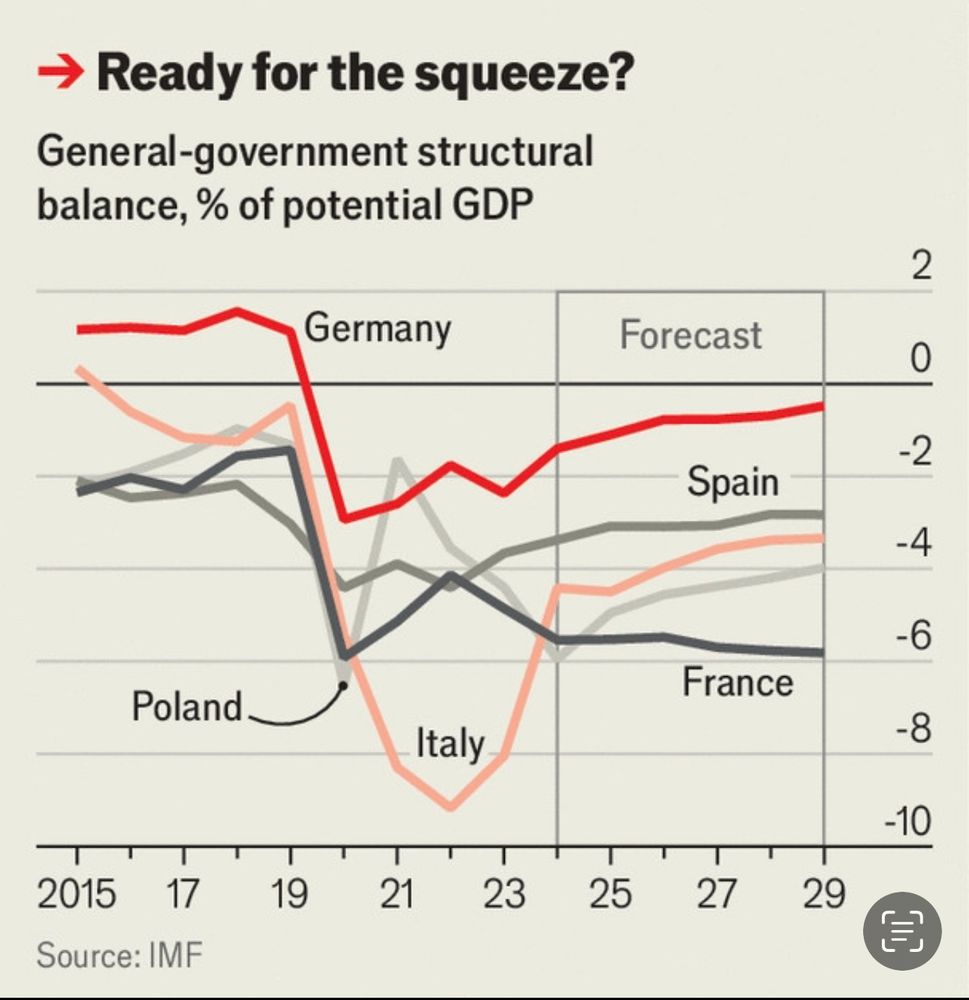

IMF’s forecasts suggest the trend continues.

Spain is swapping places with France in the Eurozone’s economic core.

Even Italy is projected to fare better.

Qu’est ce qu’il se passe???!!

IMF’s forecasts suggest the trend continues.

Spain is swapping places with France in the Eurozone’s economic core.

Even Italy is projected to fare better.

Qu’est ce qu’il se passe???!!

'Frankly the decline in industrial production in Germany appears to predate both the pandemic and the (very real) natural gas shock of 2022'

'Frankly the decline in industrial production in Germany appears to predate both the pandemic and the (very real) natural gas shock of 2022'

Renewable capacity addition has repeatedly confounded forecasts in recent years.

This could change a lot of assumptions about productivity, inflation and geopolitics, among other things.

Renewable capacity addition has repeatedly confounded forecasts in recent years.

This could change a lot of assumptions about productivity, inflation and geopolitics, among other things.