Francesco Furlanetto 🇺🇦

@furlanetto.bsky.social

Principal Researcher at Norges Bank. Living in Oslo, originally from Treviso (via Lausanne and Barcelona). https://www.norges-bank.no/en/topics/Research/economists/Furlanetto-Francesco/ I express only my views and not necessarily those of Norges Bank.

@francescoravazzolo.bsky.social and I did it again! 5th Dolomiti Macro Meeting, this time in Pera di Fassa. www.unibz.it/assets/Event...

June 23, 2025 at 10:30 PM

@francescoravazzolo.bsky.social and I did it again! 5th Dolomiti Macro Meeting, this time in Pera di Fassa. www.unibz.it/assets/Event...

Norges Bank Spring Institute 2025 with @helenerey.bsky.social: beautiful days in a non beautiful time 🇺🇦

March 1, 2025 at 10:51 AM

Norges Bank Spring Institute 2025 with @helenerey.bsky.social: beautiful days in a non beautiful time 🇺🇦

🥁🥁 NEW CONFERENCE ALERT 🥁🥁

Monetary Policy after the Inflation Surge

in Oslo on September 22-23 jointly organized with Deutsche Bundesbank and Danmarks Nationalbank. 12th Edition!

Keynote speakers: Corina Boar (NYU), Jordi Galí (CREI) and Vincent Sterk (UCL)

Submission deadline: March 16.

Monetary Policy after the Inflation Surge

in Oslo on September 22-23 jointly organized with Deutsche Bundesbank and Danmarks Nationalbank. 12th Edition!

Keynote speakers: Corina Boar (NYU), Jordi Galí (CREI) and Vincent Sterk (UCL)

Submission deadline: March 16.

February 17, 2025 at 5:49 PM

🥁🥁 NEW CONFERENCE ALERT 🥁🥁

Monetary Policy after the Inflation Surge

in Oslo on September 22-23 jointly organized with Deutsche Bundesbank and Danmarks Nationalbank. 12th Edition!

Keynote speakers: Corina Boar (NYU), Jordi Galí (CREI) and Vincent Sterk (UCL)

Submission deadline: March 16.

Monetary Policy after the Inflation Surge

in Oslo on September 22-23 jointly organized with Deutsche Bundesbank and Danmarks Nationalbank. 12th Edition!

Keynote speakers: Corina Boar (NYU), Jordi Galí (CREI) and Vincent Sterk (UCL)

Submission deadline: March 16.

Herman van Dijk was a familiar face and a leading example for all of us at Norges Bank. Herman has been a giant in Bayesian econometrics but also a great mentor. We went skiing, we had good dinners, we even wrote a paper together. Herman liked coming to Oslo and will be deeply missed.

January 28, 2025 at 11:01 PM

Herman van Dijk was a familiar face and a leading example for all of us at Norges Bank. Herman has been a giant in Bayesian econometrics but also a great mentor. We went skiing, we had good dinners, we even wrote a paper together. Herman liked coming to Oslo and will be deeply missed.

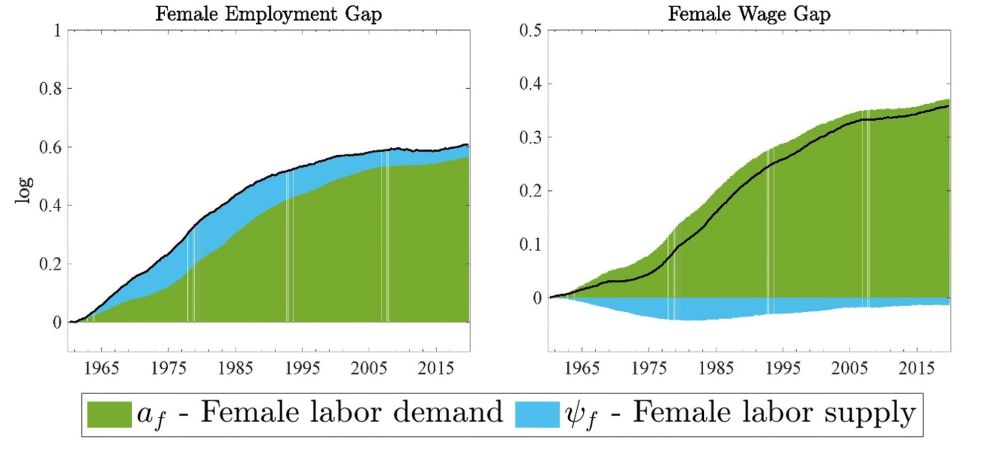

Bonus result I: the gender convergence is driven mainly by labor demand factors but labor supply factors become more important once we control for skills. There has been a large shock to the supply of skilled females over time. 8/N

November 28, 2024 at 1:48 PM

Bonus result I: the gender convergence is driven mainly by labor demand factors but labor supply factors become more important once we control for skills. There has been a large shock to the supply of skilled females over time. 8/N

We find that the trends driving the gender convergence (in green and light blue) have played a big role. During the 1970s, 80s and 90s, they account for 30-50% of trend GDP growth, 20-40% of trend productivity growth, and almost all the increase in trend employment. 3/N

November 28, 2024 at 1:48 PM

We find that the trends driving the gender convergence (in green and light blue) have played a big role. During the 1970s, 80s and 90s, they account for 30-50% of trend GDP growth, 20-40% of trend productivity growth, and almost all the increase in trend employment. 3/N

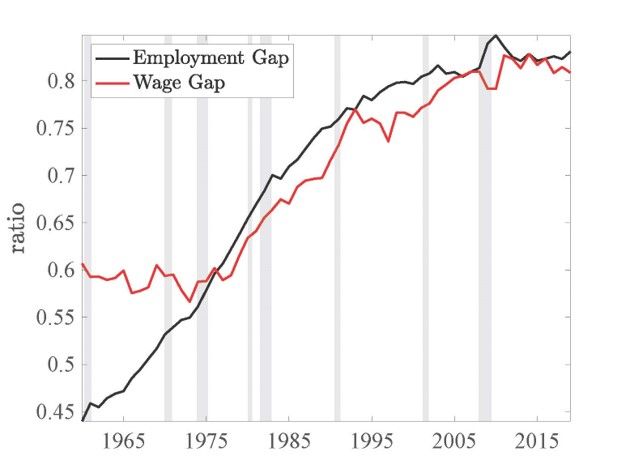

Female-to-male ratios on employment rates and wages have increased substantially over time. However, this “grand convergence” stopped around 2000. Our key question:

Is the gender convergence important for the US macroeconomy? 2/N

Is the gender convergence important for the US macroeconomy? 2/N

November 28, 2024 at 1:48 PM

Female-to-male ratios on employment rates and wages have increased substantially over time. However, this “grand convergence” stopped around 2000. Our key question:

Is the gender convergence important for the US macroeconomy? 2/N

Is the gender convergence important for the US macroeconomy? 2/N

🥁🥁 NEW PAPER ALERT 🥁🥁

“Macroeconomic Effects of the Gender Revolution”

joint with @dragobergholt.bsky.social and @fossoluca.bsky.social

Gender matters for macro! The quiet revolution had important effects on economic growth, productivity and employment. 1/N

www.norges-bank.no/contentasset...

“Macroeconomic Effects of the Gender Revolution”

joint with @dragobergholt.bsky.social and @fossoluca.bsky.social

Gender matters for macro! The quiet revolution had important effects on economic growth, productivity and employment. 1/N

www.norges-bank.no/contentasset...

November 28, 2024 at 1:37 PM

🥁🥁 NEW PAPER ALERT 🥁🥁

“Macroeconomic Effects of the Gender Revolution”

joint with @dragobergholt.bsky.social and @fossoluca.bsky.social

Gender matters for macro! The quiet revolution had important effects on economic growth, productivity and employment. 1/N

www.norges-bank.no/contentasset...

“Macroeconomic Effects of the Gender Revolution”

joint with @dragobergholt.bsky.social and @fossoluca.bsky.social

Gender matters for macro! The quiet revolution had important effects on economic growth, productivity and employment. 1/N

www.norges-bank.no/contentasset...

The right tails of the distributions are very cyclical as in @fatihguvenen @serdarozkanEN et al However, poor households remain largely insulated from macro fluctuations, in stark contrast with results for the US. The tax and transfer system act as automatic stabilizers. 7/N

November 19, 2024 at 1:46 PM

The right tails of the distributions are very cyclical as in @fatihguvenen @serdarozkanEN et al However, poor households remain largely insulated from macro fluctuations, in stark contrast with results for the US. The tax and transfer system act as automatic stabilizers. 7/N

Our third result is that all measures of inequality are procyclical but this tendency is much more pronounced for disposable income and consumption. This is the case both unconditionally and in response to major business cycle shocks. Inequality is higher in good times! 6/N

November 19, 2024 at 1:46 PM

Our third result is that all measures of inequality are procyclical but this tendency is much more pronounced for disposable income and consumption. This is the case both unconditionally and in response to major business cycle shocks. Inequality is higher in good times! 6/N

Our second result is that the level of consumption inequality is high in Norway. It is comparable to the level of earnings inequality and substantially higher than the level of disposable income inequality. In our sample, the ratio P90/P10 is on average around 3.6. 4/N

November 19, 2024 at 1:46 PM

Our second result is that the level of consumption inequality is high in Norway. It is comparable to the level of earnings inequality and substantially higher than the level of disposable income inequality. In our sample, the ratio P90/P10 is on average around 3.6. 4/N

Our first result is that all inequality measures are rather stable in Norway, unlike in the US. Stable inequality does not mean that people do not move in the distributions. We find substantial mobility, especially in the short run. 3/N

November 19, 2024 at 1:46 PM

Our first result is that all inequality measures are rather stable in Norway, unlike in the US. Stable inequality does not mean that people do not move in the distributions. We find substantial mobility, especially in the short run. 3/N

The paper is preliminary. We document some facts about inequality in Norway following what @heathcote.bsky.social F. Perri and G.Violante did for the US. We combine administrative data on income with debit card transactions data that cover around 80 percent of domestic consumption. 2/N

November 19, 2024 at 1:46 PM

The paper is preliminary. We document some facts about inequality in Norway following what @heathcote.bsky.social F. Perri and G.Violante did for the US. We combine administrative data on income with debit card transactions data that cover around 80 percent of domestic consumption. 2/N

First post on Bluesky to share a first draft of “A Tale of Procyclical Inequality: Facts and Implications” joint with me and @DBergholt and Lorenzo Mori sites.google.com/view/lorenzo...

One line summary: consumption inequality is high, stable and procyclical in Norway. 1/N

One line summary: consumption inequality is high, stable and procyclical in Norway. 1/N

November 19, 2024 at 1:46 PM

First post on Bluesky to share a first draft of “A Tale of Procyclical Inequality: Facts and Implications” joint with me and @DBergholt and Lorenzo Mori sites.google.com/view/lorenzo...

One line summary: consumption inequality is high, stable and procyclical in Norway. 1/N

One line summary: consumption inequality is high, stable and procyclical in Norway. 1/N