@TNLookout- @statesnewsroom and for @ProPublica's Local Reporting Network | 615.249.8509 or DM me | "Reporter of less cool news."

via @tennesseelookout.com

www.newsfromthestates.com/article/tenn...

via @tennesseelookout.com

www.newsfromthestates.com/article/tenn...

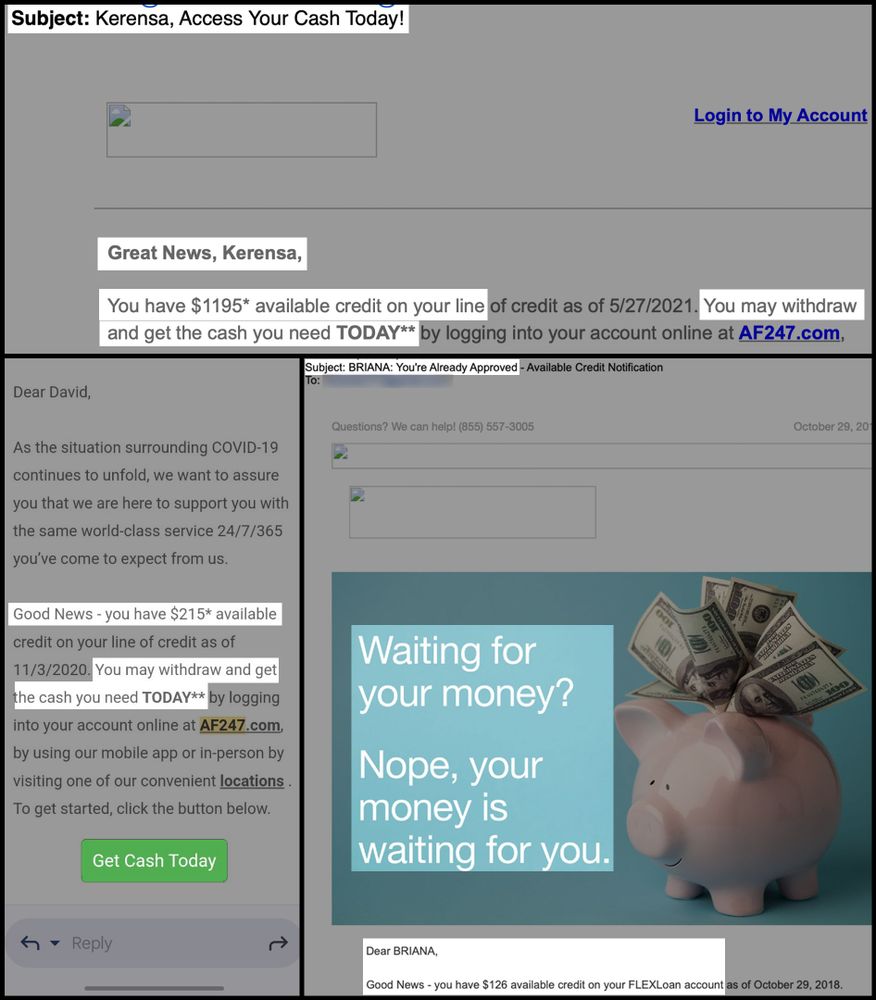

More than a dozen borrowers told @tennesseelookout.com and ProPublica that Advance Financial encouraged them through emails and notifications to borrow back the value of almost all of the payments they made: propub.li/3ZXaVPY

More than a dozen borrowers told @tennesseelookout.com and ProPublica that Advance Financial encouraged them through emails and notifications to borrow back the value of almost all of the payments they made: propub.li/3ZXaVPY

and @propublica.org that Advance Financial encouraged them to borrow more money after making minimum payments. The Tennessee lender went on to sue them once they couldn’t pay back the loan.By @friedmanadam5.bsky.social.

and @propublica.org that Advance Financial encouraged them to borrow more money after making minimum payments. The Tennessee lender went on to sue them once they couldn’t pay back the loan.By @friedmanadam5.bsky.social.

and @propublica.org that Advance Financial encouraged them to borrow more money after making minimum payments. The Tennessee lender went on to sue them once they couldn’t pay back the loan. Great work by @friedmanadam5.bsky.social

and @propublica.org that Advance Financial encouraged them to borrow more money after making minimum payments. The Tennessee lender went on to sue them once they couldn’t pay back the loan. Great work by @friedmanadam5.bsky.social

@friedmanadam5.bsky.social @tennesseelookout.com

@friedmanadam5.bsky.social @tennesseelookout.com

By @friedmanadam5.bsky.social

www.newsfromthestates.com/article/tenn...

By @friedmanadam5.bsky.social

www.newsfromthestates.com/article/tenn...

@friedmanadam5.bsky.social @tennesseelookout.com @propublica.org

tennesseelookout.com/2025/06/26/t...

@friedmanadam5.bsky.social @tennesseelookout.com @propublica.org

tennesseelookout.com/2025/06/26/t...

The lender went on to sue them once they couldn’t pay back the loan.

By @friedmanadam5.bsky.social

The lender went on to sue them once they couldn’t pay back the loan.

By @friedmanadam5.bsky.social

In one county, where nearly half the households make less than $50,000, the company has filed one case for every 32 residents in that time, @tennesseelookout.com and ProPublica found.

By @friedmanadam5.bsky.social

In one county, where nearly half the households make less than $50,000, the company has filed one case for every 32 residents in that time, @tennesseelookout.com and ProPublica found.

By @friedmanadam5.bsky.social

To share your experience, call or text reporter Adam Friedman (@friedmanadam5.bsky.social) at 615-249-8509.

To share your experience, call or text reporter Adam Friedman (@friedmanadam5.bsky.social) at 615-249-8509.

Have you been sued by a flex loan lender?

Call or text reporter @friedmanadam5.bsky.social at 615-249-8509 to share your experience.

Have you been sued by a flex loan lender?

Call or text reporter @friedmanadam5.bsky.social at 615-249-8509 to share your experience.

By @friedmanadam5.bsky.social, w/ @tennesseelookout.com

By @friedmanadam5.bsky.social, w/ @tennesseelookout.com

Advance lobbied lawmakers to create the loan to avoid federal consumer protection regulations. @friedmanadam5.bsky.social @tennesseelookout.com

Advance lobbied lawmakers to create the loan to avoid federal consumer protection regulations. @friedmanadam5.bsky.social @tennesseelookout.com

Imagine filling the University of Tennessee's Neyland Stadium...and then still needing more seats.

That's how many lawsuits Advance Financial has filed against its borrowers.

From @friedmanadam5.bsky.social for @tennesseelookout.com+ @propublica.org: www.propublica.org/article/flex...

Imagine filling the University of Tennessee's Neyland Stadium...and then still needing more seats.

That's how many lawsuits Advance Financial has filed against its borrowers.

From @friedmanadam5.bsky.social for @tennesseelookout.com+ @propublica.org: www.propublica.org/article/flex...

The Tennessee Lookout and @propublica.org are continuing to report on flex loans. To share your experience, call or text reporter @friedmanadam5.bsky.social at 615-249-8509.

In the 10 years since getting approval for it, the company has sued over 110,000 borrowers.

With @tennesseelookout.com

The Tennessee Lookout and @propublica.org are continuing to report on flex loans. To share your experience, call or text reporter @friedmanadam5.bsky.social at 615-249-8509.

In the 10 years since getting approval for it, the company has sued over 110,000 borrowers.

With @tennesseelookout.com

In the 10 years since getting approval for it, the company has sued over 110,000 borrowers.

With @tennesseelookout.com

In the 10 years since getting approval for it, the company has sued over 110,000 borrowers.

With @tennesseelookout.com

In the 10 years since getting approval for it, the company has sued over 110,000 borrowers.

www.propublica.org/article/flex...

In the 10 years since getting approval for it, the company has sued over 110,000 borrowers.

www.propublica.org/article/flex...

It’s owned by a major GOP donor. But one of the most powerful men in the country recently moved in: House Speaker Mike Johnson. www.propublica.org/article/mike...

It’s owned by a major GOP donor. But one of the most powerful men in the country recently moved in: House Speaker Mike Johnson. www.propublica.org/article/mike...