8/9

8/9

6/9

6/9

budgetlab.yale.edu/r...

5/9

budgetlab.yale.edu/r...

5/9

Net out imports though, & the contribution falls to ~0.5pp. Still big! But just enough to offset tariffs.

3/9

Net out imports though, & the contribution falls to ~0.5pp. Still big! But just enough to offset tariffs.

3/9

5/7

5/7

9/10

9/10

8/10

8/10

7/10

7/10

6/10

6/10

5/10

5/10

4/10

4/10

2/10

2/10

In brief...

1/10

In brief...

1/10

4. The effective tariff rate would be 6.8%, still the highest since 1969.

11/12

4. The effective tariff rate would be 6.8%, still the highest since 1969.

11/12

1. IEEPA tariffs make up ~70% of the 2025 tariffs to date.

2. Revenues shrink to $700B over 2026-2035.

10/12

1. IEEPA tariffs make up ~70% of the 2025 tariffs to date.

2. Revenues shrink to $700B over 2026-2035.

10/12

9/12

9/12

8/12

8/12

7/12

7/12

The unemployment rate rises 0.3pp by the end of 2025, & 0.7pp by end-2026.

6/12

The unemployment rate rises 0.3pp by the end of 2025, & 0.7pp by end-2026.

6/12

5/12

5/12

4/12

4/12

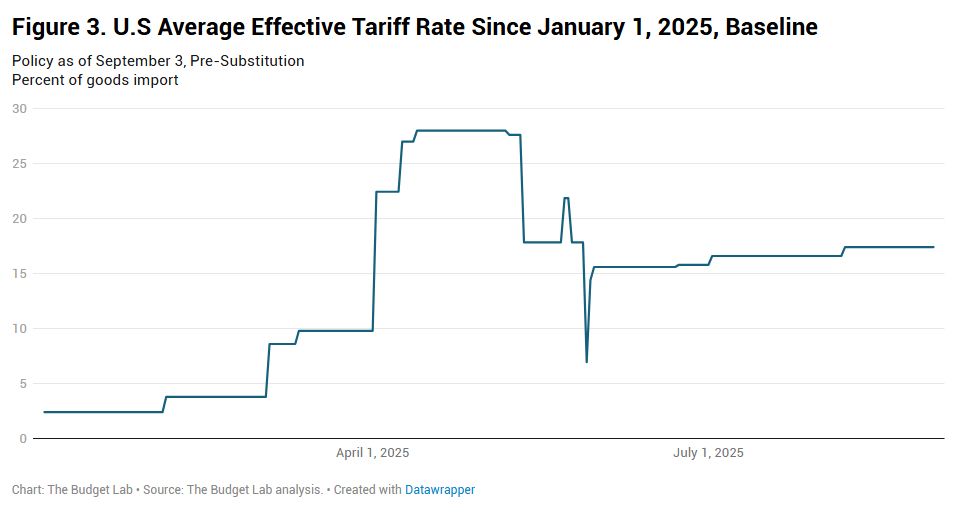

Under our all-tariff baseline, consumers face an effective tariff rate of 17.4%, a 15.0pp increase from 2024 & the highest since 1935. After shifts in spending in reaction to the tariffs, the effective tariff rate will be 16.4%, a 13.9pp increase & the highest since 1936

2/12

Under our all-tariff baseline, consumers face an effective tariff rate of 17.4%, a 15.0pp increase from 2024 & the highest since 1935. After shifts in spending in reaction to the tariffs, the effective tariff rate will be 16.4%, a 13.9pp increase & the highest since 1936

2/12

• incorporate higher assumptions about Canada & Mexico tariff-free import shares;

• show 2 scenarios: all tariffs & no IEEPA tariffs after Jun 2026.

In brief...

1/12

• incorporate higher assumptions about Canada & Mexico tariff-free import shares;

• show 2 scenarios: all tariffs & no IEEPA tariffs after Jun 2026.

In brief...

1/12