Erik Öberg

@erikoberg.bsky.social

In making this course, I've borrowed a lot of material from other teachers. Thanks to all of you who makes your teaching material publicly available!

June 4, 2025 at 1:31 PM

In making this course, I've borrowed a lot of material from other teachers. Thanks to all of you who makes your teaching material publicly available!

I also have quite a few exam questions and problem sets to share to anyone who wants to teach similar material. Just email me if you want them.

June 4, 2025 at 1:31 PM

I also have quite a few exam questions and problem sets to share to anyone who wants to teach similar material. Just email me if you want them.

The course covers business-cycle frameworks (RBC and NK), Frictional Labor Markets (McCall, Burdett-Mortensen, DMP) and consumption-savings dynamics with incomplete asset markets (both partial and general equilibrium).

June 4, 2025 at 1:31 PM

The course covers business-cycle frameworks (RBC and NK), Frictional Labor Markets (McCall, Burdett-Mortensen, DMP) and consumption-savings dynamics with incomplete asset markets (both partial and general equilibrium).

This is very helpful - thx a lot!

January 31, 2025 at 11:53 AM

This is very helpful - thx a lot!

Yes, numerous measurement issues. I was thinking about how to start exploring this. I learnt today that there were some nice efforts in the 90's to clean "Solow residuals" from labor utilization (exploiting some optimality conditions and firm data on other firm inputs). E.g. Basu-Kimball (1997)

January 30, 2025 at 1:45 PM

Yes, numerous measurement issues. I was thinking about how to start exploring this. I learnt today that there were some nice efforts in the 90's to clean "Solow residuals" from labor utilization (exploiting some optimality conditions and firm data on other firm inputs). E.g. Basu-Kimball (1997)

She has several other interesting papers and projects too, e.g., about in-house hiring vs staffing agencies, misallocation across firms and wealth inequality. See her webpage for more.

sites.google.com/view/agnetab...

sites.google.com/view/agnetab...

January 27, 2025 at 1:32 PM

She has several other interesting papers and projects too, e.g., about in-house hiring vs staffing agencies, misallocation across firms and wealth inequality. See her webpage for more.

sites.google.com/view/agnetab...

sites.google.com/view/agnetab...

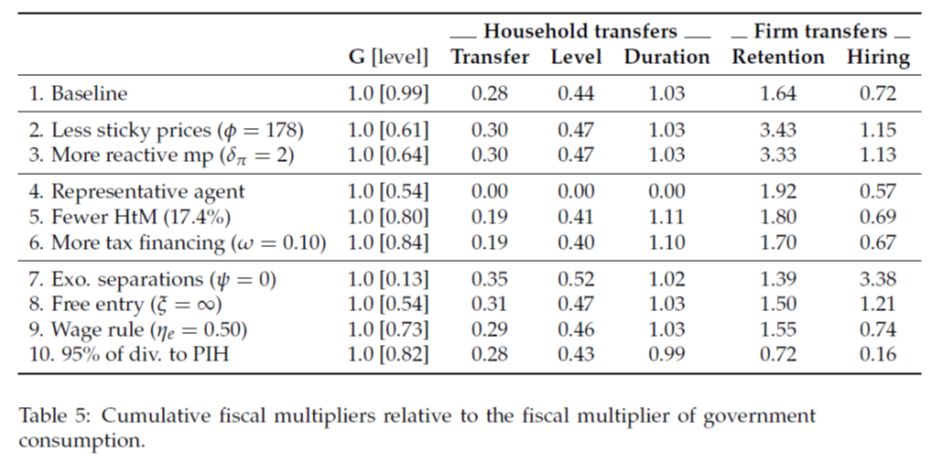

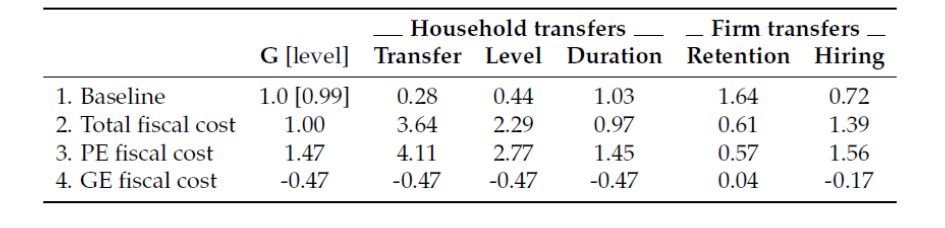

Table heading missing. The table shows fiscal multipliers and fiscal cost normalized with the counterpart numbers from a pure government spending shock.

January 16, 2025 at 10:19 AM

Table heading missing. The table shows fiscal multipliers and fiscal cost normalized with the counterpart numbers from a pure government spending shock.

Two closely related papers are Wolf (2024) and Ferriere-Navarro (2024). Be sure to check them out.

economics.mit.edu/sites/defaul...

axelleferriere.github.io/files/FN_IMF...

economics.mit.edu/sites/defaul...

axelleferriere.github.io/files/FN_IMF...

economics.mit.edu

January 16, 2025 at 9:58 AM

Two closely related papers are Wolf (2024) and Ferriere-Navarro (2024). Be sure to check them out.

economics.mit.edu/sites/defaul...

axelleferriere.github.io/files/FN_IMF...

economics.mit.edu/sites/defaul...

axelleferriere.github.io/files/FN_IMF...

We also identify some key parameters/moments that do make a difference for these conclusions. One of them is the marginal propensity to consume out of profit income, for which we need more evidence. In our view, these findings paint an agenda for future research.

January 16, 2025 at 9:58 AM

We also identify some key parameters/moments that do make a difference for these conclusions. One of them is the marginal propensity to consume out of profit income, for which we need more evidence. In our view, these findings paint an agenda for future research.

Importantly, these conclusions are insensitive to changes to a big part of the model parameter space, as per the reasoning above. For details about this, see the paper.

January 16, 2025 at 9:58 AM

Importantly, these conclusions are insensitive to changes to a big part of the model parameter space, as per the reasoning above. For details about this, see the paper.

This feature gives a double dividend: saving a job is cheap relative to creating to new one. Moreover, saving a job avoids vacancy-depletion effects (as in Coles-Kelishomi (2018)), and reduces the unemployment risk that households face a lot.

January 16, 2025 at 9:58 AM

This feature gives a double dividend: saving a job is cheap relative to creating to new one. Moreover, saving a job avoids vacancy-depletion effects (as in Coles-Kelishomi (2018)), and reduces the unemployment risk that households face a lot.

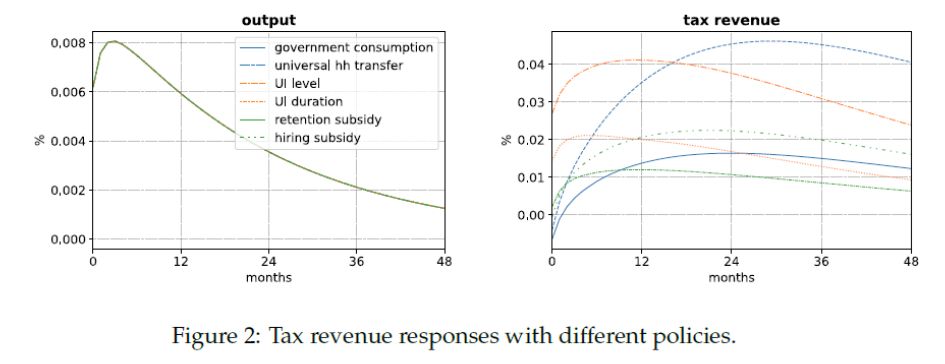

Retention subsidies are effective relative to other firm transfers b/c the data supports fairly elastic separations, and relatively inelastic vacancy creation.

January 16, 2025 at 9:58 AM

Retention subsidies are effective relative to other firm transfers b/c the data supports fairly elastic separations, and relatively inelastic vacancy creation.

UI duration extensions are effective relative to other household transfers b/c the data supports limited insurance with respect to long-term unemployment. At the margin, we can stimulate household consumption a lot by insuring them against this.

January 16, 2025 at 9:58 AM

UI duration extensions are effective relative to other household transfers b/c the data supports limited insurance with respect to long-term unemployment. At the margin, we can stimulate household consumption a lot by insuring them against this.

Untargeted transfers to households are, in general, quite ineffective, whereas targeted transfers to the unemployed, like UI duration extensions, and job-saving retention subsidies give a lot of bang for the buck.

January 16, 2025 at 9:58 AM

Untargeted transfers to households are, in general, quite ineffective, whereas targeted transfers to the unemployed, like UI duration extensions, and job-saving retention subsidies give a lot of bang for the buck.

We find that fiscal multipliers vary greatly across different common policy interventions, from 0.3 to 1.6. You cannot compare stimulus packages by just counting dollars spent, you must look under the hood at the actual design!

January 16, 2025 at 9:58 AM

We find that fiscal multipliers vary greatly across different common policy interventions, from 0.3 to 1.6. You cannot compare stimulus packages by just counting dollars spent, you must look under the hood at the actual design!

Quantitatively, we use a state-of-the-art calibration of the model, building on our previous work and that of Rohan Kekre.

www.dropbox.com/scl/fi/wf5fw...

sites.google.com/site/rohanke...

www.dropbox.com/scl/fi/wf5fw...

sites.google.com/site/rohanke...

January 16, 2025 at 9:58 AM

Quantitatively, we use a state-of-the-art calibration of the model, building on our previous work and that of Rohan Kekre.

www.dropbox.com/scl/fi/wf5fw...

sites.google.com/site/rohanke...

www.dropbox.com/scl/fi/wf5fw...

sites.google.com/site/rohanke...

Intermezzo: Special thanks to @aauclert.bsky.social-Bardoczy-Rognlie-@ludwigstraub.bsky.social and Boppart-Krusell-Mitman for teaching us to think about models in sequence space.

January 16, 2025 at 9:58 AM

Intermezzo: Special thanks to @aauclert.bsky.social-Bardoczy-Rognlie-@ludwigstraub.bsky.social and Boppart-Krusell-Mitman for teaching us to think about models in sequence space.

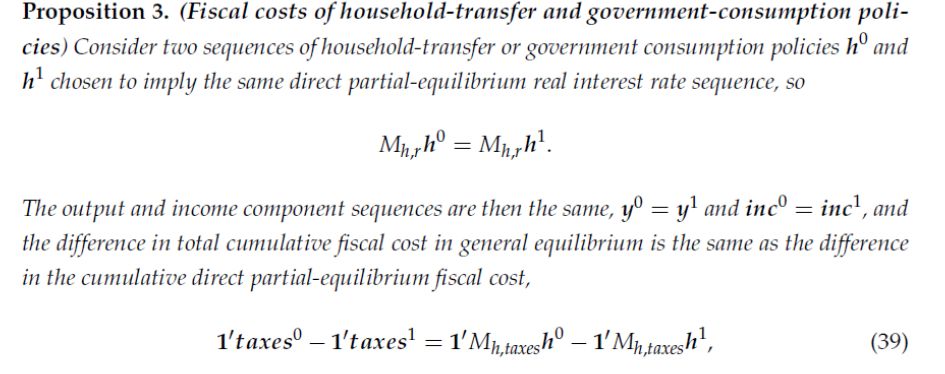

We exploit these properties to investigate which parameters (and features of the model) are important for determining the relative effectiveness of a variety of different stimulus designs.

January 16, 2025 at 9:58 AM

We exploit these properties to investigate which parameters (and features of the model) are important for determining the relative effectiveness of a variety of different stimulus designs.

A direct implication is that for comparing the fiscal multipliers of two different policies that achieve the same output effect, in many cases we don’t need to know all the parameters of the model, but only the parameters relating to the policy-specific direct effect.

January 16, 2025 at 9:58 AM

A direct implication is that for comparing the fiscal multipliers of two different policies that achieve the same output effect, in many cases we don’t need to know all the parameters of the model, but only the parameters relating to the policy-specific direct effect.