www.nytimes.com/2025/04/15/o...

www.nytimes.com/2025/04/15/o...

www.nytimes.com/2025/04/15/o...

www.nytimes.com/2025/04/15/o...

Aviva has engaged with a broad portfolio of policy issues, most recently as acting assistant secretary for tax policy at Treasury, equipping her lead The Hamilton Project during this critical time.

22/23

22/23

1/23

Short version: (1) critical to include govt for accounting identities but (2) can debate welfare-relevant metric or best forecasting "signal".

A 🧵.

Short version: (1) critical to include govt for accounting identities but (2) can debate welfare-relevant metric or best forecasting "signal".

A 🧵.

www.wsj.com/business/ene...

www.wsj.com/business/ene...

Paper: tinyurl.com/yvy2jt93

Paper: tinyurl.com/yvy2jt93

Last week, @jasonfurman.bsky.social argued that real US infrastructure investment has fallen since the pandemic.

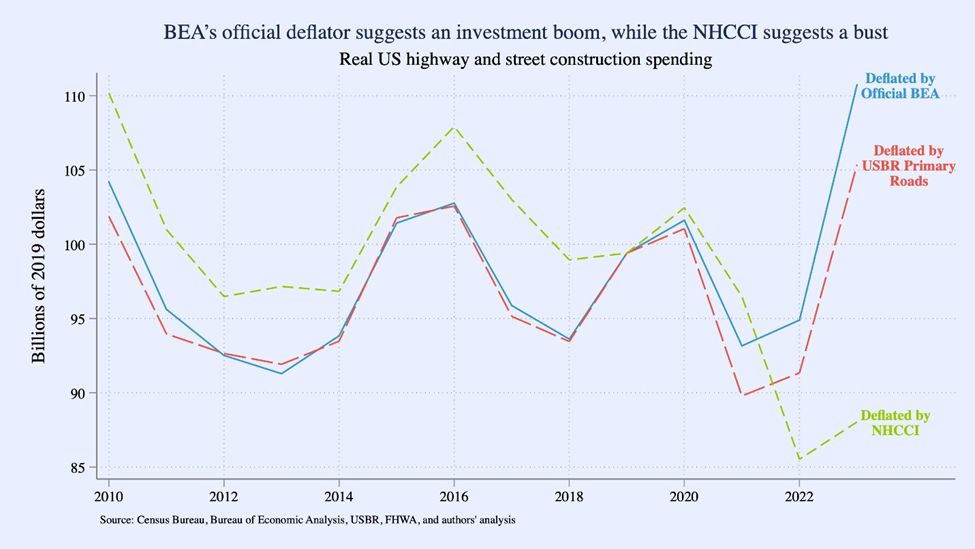

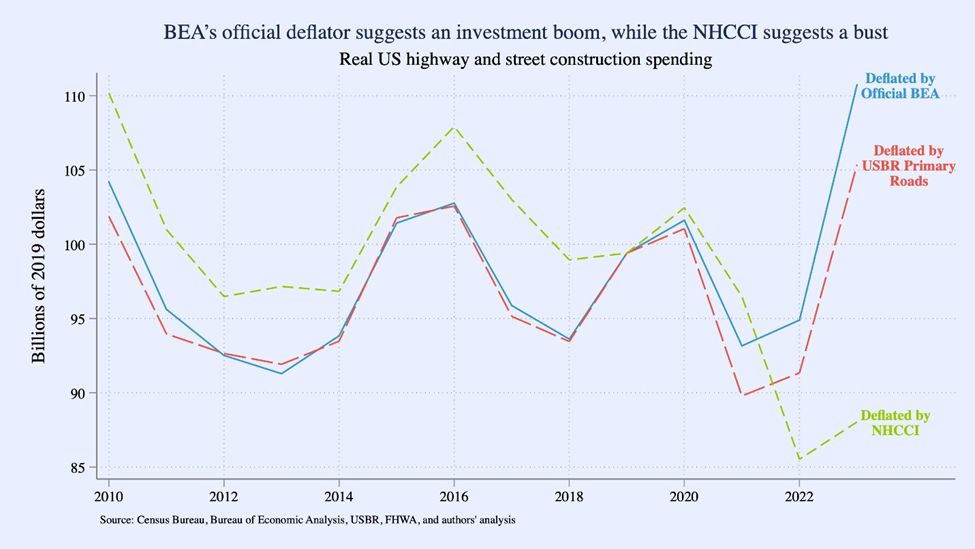

Eric & I find however that using BEA’s deflator, real highway spending is up 11% since 2019.

1/11

Last week, @jasonfurman.bsky.social argued that real US infrastructure investment has fallen since the pandemic.

Eric & I find however that using BEA’s deflator, real highway spending is up 11% since 2019.

1/11

Last week, @jasonfurman.bsky.social argued that real US infrastructure investment has fallen since the pandemic.

Eric & I find however that using BEA’s deflator, real highway spending is up 11% since 2019.

1/11