https://ihatemoney.beehiiv.com

Berkshire holders Monday at the open

Berkshire holders Monday at the open

“Overall, we see 10 buyers for every property, and we expect that to continue.”

“Also, the other question is how developers expect to profit by buying homes 10-20% below market when their labor costs and materials far exceed this discount.”

“Overall, we see 10 buyers for every property, and we expect that to continue.”

“Also, the other question is how developers expect to profit by buying homes 10-20% below market when their labor costs and materials far exceed this discount.”

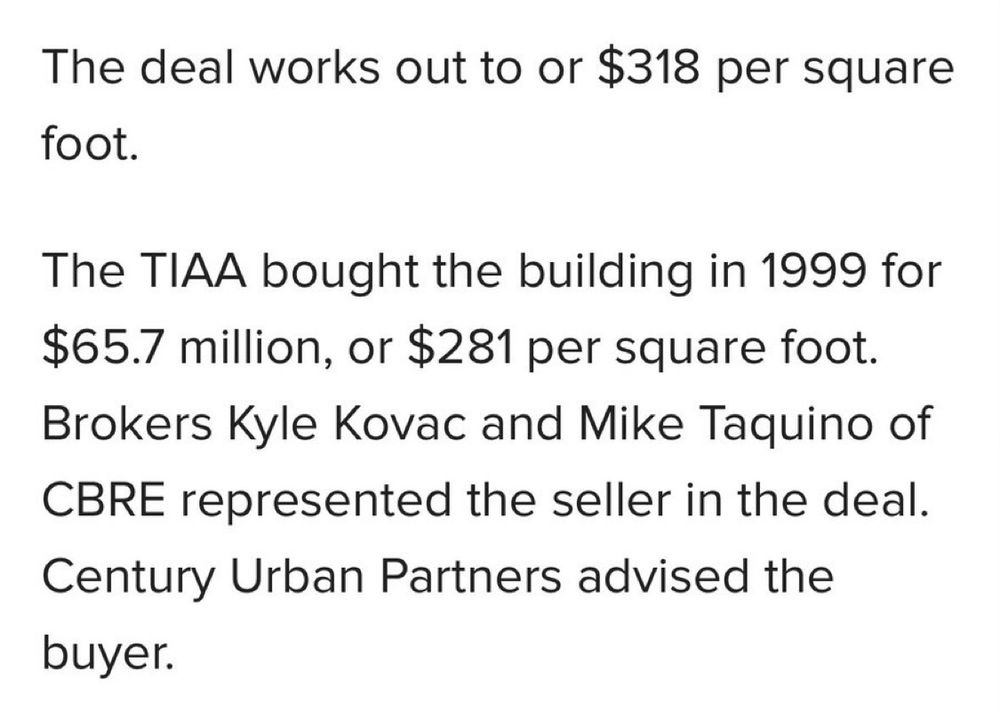

Assume avg 50% leverage, so $10T unleveraged (assume largely non institutional assets/owners?) and $6T leveraged (inst'l assets)

Brookfield and Blackstone alone have $600B CRE AUM

2 firms = 10% of institutional equity

Assume avg 50% leverage, so $10T unleveraged (assume largely non institutional assets/owners?) and $6T leveraged (inst'l assets)

Brookfield and Blackstone alone have $600B CRE AUM

2 firms = 10% of institutional equity