www.edinburghfinancialanalytics.com

Chart shows 1y fwd equity returns split by EFA signal strength.

We’re now in the 2nd decile, where average returns & vol are typically low but negatively skewed with fat tails. Fragility not stability. What's the catalyst?

Chart shows 1y fwd equity returns split by EFA signal strength.

We’re now in the 2nd decile, where average returns & vol are typically low but negatively skewed with fat tails. Fragility not stability. What's the catalyst?

Those decisions feed through to model performance quarter by quarter.

Over time, a disciplined process delivers consistent results.

Those decisions feed through to model performance quarter by quarter.

Over time, a disciplined process delivers consistent results.

We rank investable equity indices using behavioural signals (to improve your odds). Right now, Asia sits at the top of the rankings.

Passive exposure isn’t neutral when concentration is extreme. Time to diversify?

Link in reply.

We rank investable equity indices using behavioural signals (to improve your odds). Right now, Asia sits at the top of the rankings.

Passive exposure isn’t neutral when concentration is extreme. Time to diversify?

Link in reply.

If 10y yields continue to slide, the risk is drifting firmly into that top-left quadrant.

That’s the one where growth stalls — and unpleasant things start happening to the real economy.

If 10y yields continue to slide, the risk is drifting firmly into that top-left quadrant.

That’s the one where growth stalls — and unpleasant things start happening to the real economy.

Bear steepeners (top right):

Long-end yields selling off faster.

These tend to coincide with strong bank performance.

This is the “growth is robust” version of steepening.

Bear steepeners (top right):

Long-end yields selling off faster.

These tend to coincide with strong bank performance.

This is the “growth is robust” version of steepening.

But is it actually true?

The chart below plots banks’ relative performance across the four classic curve regimes:

• bear / bull

• flattening / steepening

Green = good. Red = bad.

But is it actually true?

The chart below plots banks’ relative performance across the four classic curve regimes:

• bear / bull

• flattening / steepening

Green = good. Red = bad.

To isolate the issue, we rebuilt the dot-plots using only the most liquid global markets (core).

Left chart = core markets (recent orange & red warnings)

Right chart = broad coverage (nothing recently)

Very different picture.

To isolate the issue, we rebuilt the dot-plots using only the most liquid global markets (core).

Left chart = core markets (recent orange & red warnings)

Right chart = broad coverage (nothing recently)

Very different picture.

Divergence is everywhere.

Plenty of stocks are rising, plenty are falling. Breadth is fractured across markets.

And searches for the Hindenburg Omen hit a 5-year high!

Divergence is everywhere.

Plenty of stocks are rising, plenty are falling. Breadth is fractured across markets.

And searches for the Hindenburg Omen hit a 5-year high!

[4/7]

[4/7]

No surprises: S&P 500, private equity, and crypto (especially Bitcoin) sit right at the vulnerable end of the spectrum.

[3/7]

No surprises: S&P 500, private equity, and crypto (especially Bitcoin) sit right at the vulnerable end of the spectrum.

[3/7]

[6/8]

[6/8]

[3/8]

[3/8]

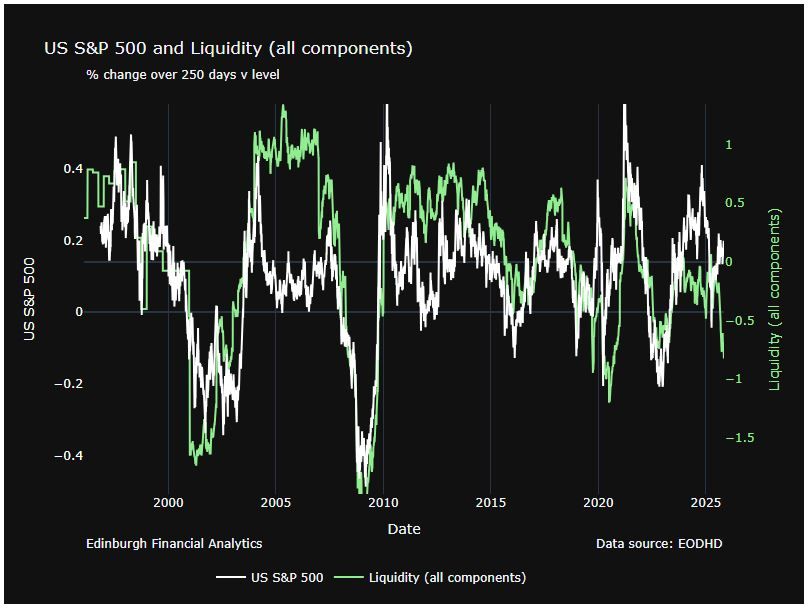

Liquidity is taking centre stage in markets right now.

A US shutdown hits in two key ways...

But first here's a chart of SPX (yoy) v our (falling) index of liquidity (green).

#Markets #USEconomy #Liquidity #AssetAllocation

[1/6]

Liquidity is taking centre stage in markets right now.

A US shutdown hits in two key ways...

But first here's a chart of SPX (yoy) v our (falling) index of liquidity (green).

#Markets #USEconomy #Liquidity #AssetAllocation

[1/6]

The setup has flipped.

[4/5]

The setup has flipped.

[4/5]

This is what it’s currently saying about global equities - for the next 6 months 👇

Not looking great. The forecast distribution is on the right, compare it with the typical distribution on the left.

[3/5]

This is what it’s currently saying about global equities - for the next 6 months 👇

Not looking great. The forecast distribution is on the right, compare it with the typical distribution on the left.

[3/5]

Our 𝐟𝐫𝐞𝐞 weekly Chart Pack distils behavioural & macro signals into a few key visuals, for investors who prefer signal to noise.

🔗https://edinburghfinancialanalytics.com/#sign_up

#BehaviouralFinance #MarketInsights #Investing #CatsOfBluesky

🧵[1/5]

Our 𝐟𝐫𝐞𝐞 weekly Chart Pack distils behavioural & macro signals into a few key visuals, for investors who prefer signal to noise.

🔗https://edinburghfinancialanalytics.com/#sign_up

#BehaviouralFinance #MarketInsights #Investing #CatsOfBluesky

🧵[1/5]

How did Edinburgh Financial Analytics’ models fare this quarter?

Here’s the breakdown ⬇️

#PerformanceReview #Investing

How did Edinburgh Financial Analytics’ models fare this quarter?

Here’s the breakdown ⬇️

#PerformanceReview #Investing

In Q1 this year we did not see divergence at the peak. With hindsight we can see the market was driven by events (Liberation day).

However, the SKEW index has now fallen from 180 to below 150 and divergence shows up on 2 timescales.

The model interprets this as negative.

In Q1 this year we did not see divergence at the peak. With hindsight we can see the market was driven by events (Liberation day).

However, the SKEW index has now fallen from 180 to below 150 and divergence shows up on 2 timescales.

The model interprets this as negative.

#SKEW often diverges with price at peaks.

Initially when the market goes up the SKEW index will rise as investors pay more attention to left tail risks.

But as investors become complacent the pricing of downside options becomes less aggressive.

Chart 2018 to 2023.

#SKEW often diverges with price at peaks.

Initially when the market goes up the SKEW index will rise as investors pay more attention to left tail risks.

But as investors become complacent the pricing of downside options becomes less aggressive.

Chart 2018 to 2023.

The model gives us a distribution expectation (right) for the market over the next 6 months.

It suggests anything from a 10% rally to a 15% fall with a definite negative bias compared to average (left).

Notice that the mean and median expectation has fallen to -5%.

The model gives us a distribution expectation (right) for the market over the next 6 months.

It suggests anything from a 10% rally to a 15% fall with a definite negative bias compared to average (left).

Notice that the mean and median expectation has fallen to -5%.

Our volatility model (using #VIX, #SKEW & #GAMMA) shows us where in the past conditions in #options activity are like today.

The most similar period is the end of 2021 closely followed by the pre-covid peak in early 2020.

#Markets #Equities #Volatility #QuantFinance

Our volatility model (using #VIX, #SKEW & #GAMMA) shows us where in the past conditions in #options activity are like today.

The most similar period is the end of 2021 closely followed by the pre-covid peak in early 2020.

#Markets #Equities #Volatility #QuantFinance

The model gives us this distribution expectation (light green) for the market over the next 6 months.

It suggests anything from a 10% rally to a 15% fall with a definite negative bias compared to average conditions.

#equities #volatility #gamma #riskmanagement

The model gives us this distribution expectation (light green) for the market over the next 6 months.

It suggests anything from a 10% rally to a 15% fall with a definite negative bias compared to average conditions.

#equities #volatility #gamma #riskmanagement