https://sites.google.com/site/davidwiczer/

bsky.app/profile/did:...

bsky.app/profile/did:...

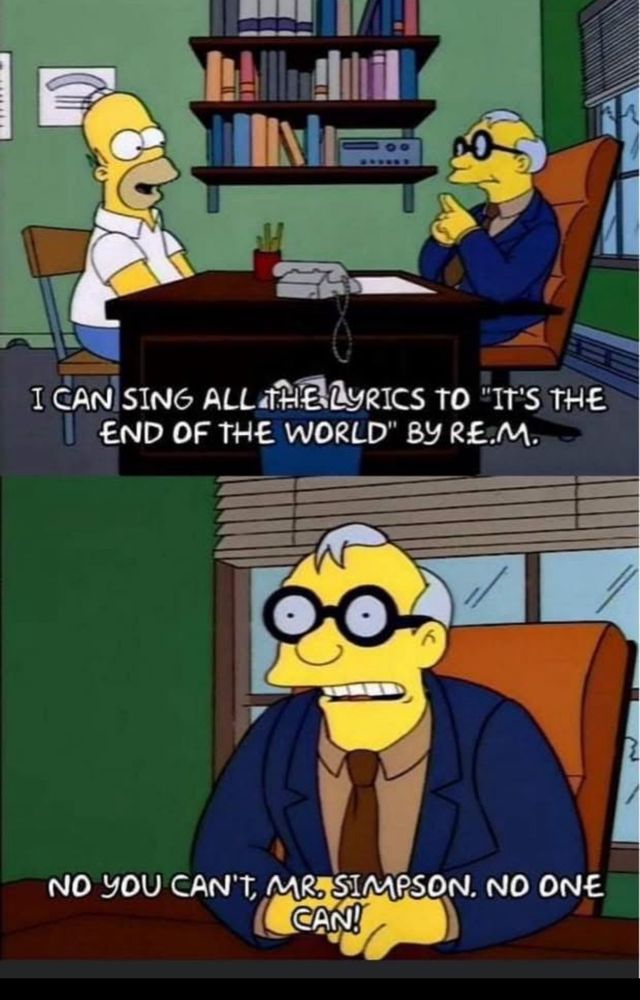

Ugh, I know it's cliche for an economist to complain about this in medical stats... I also think the music of my youth was better 😉

Ugh, I know it's cliche for an economist to complain about this in medical stats... I also think the music of my youth was better 😉

But I hear you: so instead of price-elasticity consumer substituion, it's more important to look at production substituion or intermediate input/ capital. I'm good with that.

But I hear you: so instead of price-elasticity consumer substituion, it's more important to look at production substituion or intermediate input/ capital. I'm good with that.