David Beckworth

@davidbeckworth.bsky.social

Senior Research Fellow at the Mercatus Center || Podcast Host at http://macromusings.libsyn.com || Former U.S. Treasury Economist || Micah 6:8

Reposted by David Beckworth

A brilliantly clear-eyed view on how dollar stablecoins might impact the Fed’s operations: @davidbeckworth.bsky.social Barbarians at the Fed's Gate: Stablecoins are knocking and the Fed is letting them inside

macroeconomicpolicynexus.substack.com/p/barbarians...

macroeconomicpolicynexus.substack.com/p/barbarians...

Barbarians at the Fed's Gate

Stablecoins are knocking and the Fed is letting them inside.

macroeconomicpolicynexus.substack.com

October 30, 2025 at 2:56 PM

A brilliantly clear-eyed view on how dollar stablecoins might impact the Fed’s operations: @davidbeckworth.bsky.social Barbarians at the Fed's Gate: Stablecoins are knocking and the Fed is letting them inside

macroeconomicpolicynexus.substack.com/p/barbarians...

macroeconomicpolicynexus.substack.com/p/barbarians...

Should the Fed adopt an inflation range target? open.substack.com/pub/macroeco...

Home, Home on the (Inflation) Range, Where the Hawks and Doves Roam

The case for--and the surprising implications of--an inflation range target

open.substack.com

October 16, 2025 at 4:02 PM

Should the Fed adopt an inflation range target? open.substack.com/pub/macroeco...

Two recent Fed speeches suggest cracks are emerging in the FOMC's support of its ample reserve system! My latest: tinyurl.com/36d45t3h

From Floors to Ceilings: The Fed’s Quiet Turning Point?

Why Michelle Bowman and Lorie Logan may be setting the stage for a leaner balance sheet and a demand-driven ceiling system

tinyurl.com

October 3, 2025 at 2:17 PM

Two recent Fed speeches suggest cracks are emerging in the FOMC's support of its ample reserve system! My latest: tinyurl.com/36d45t3h

Reposted by David Beckworth

My chat today with Kaleb Nygaard on the changing borders of the Fed's districts and what it may mean for a politicized Fed today. macroeconomicpolicynexus.substack.com/p/changing-t...

Changing the Federal Reserve Districts

A conversation on the dynamic history of the Fed's geographical boundaries and its implications for today

macroeconomicpolicynexus.substack.com

September 18, 2025 at 8:07 PM

My chat today with Kaleb Nygaard on the changing borders of the Fed's districts and what it may mean for a politicized Fed today. macroeconomicpolicynexus.substack.com/p/changing-t...

My chat today with Kaleb Nygaard on the changing borders of the Fed's districts and what it may mean for a politicized Fed today. macroeconomicpolicynexus.substack.com/p/changing-t...

Changing the Federal Reserve Districts

A conversation on the dynamic history of the Fed's geographical boundaries and its implications for today

macroeconomicpolicynexus.substack.com

September 18, 2025 at 8:07 PM

My chat today with Kaleb Nygaard on the changing borders of the Fed's districts and what it may mean for a politicized Fed today. macroeconomicpolicynexus.substack.com/p/changing-t...

Can the Fed’s Board of Governors redraw and recreate its districts? Could this power be abused by the White House? Join

Kaleb Nygaard and me as we discuss live at 1 pm ET here: open.substack.com/live-stream/...

Kaleb Nygaard and me as we discuss live at 1 pm ET here: open.substack.com/live-stream/...

LIVE SOON: Changing the Federal Reserve Districts

Starting Sep 18 at 1:00 PM EDT

open.substack.com

September 18, 2025 at 4:34 PM

Can the Fed’s Board of Governors redraw and recreate its districts? Could this power be abused by the White House? Join

Kaleb Nygaard and me as we discuss live at 1 pm ET here: open.substack.com/live-stream/...

Kaleb Nygaard and me as we discuss live at 1 pm ET here: open.substack.com/live-stream/...

How much power does the Fed's Board of Governors have to redraw, eliminate, and create new Fed Districts? macroeconomicpolicynexus.substack.com/p/redrawing-...

Redrawing Monetary Geography

How Section 2 of the FRA reshaped the Federal Reserve’s district map over the past century

macroeconomicpolicynexus.substack.com

September 12, 2025 at 4:14 PM

How much power does the Fed's Board of Governors have to redraw, eliminate, and create new Fed Districts? macroeconomicpolicynexus.substack.com/p/redrawing-...

Some questions for the aspiring Fed Governor at his Senate hearing this week. substack.com/home/post/p-...

Questions for Stephen Miran

Policy-Focused Questions for the Fed Governor Nominee

substack.com

September 3, 2025 at 12:45 PM

Some questions for the aspiring Fed Governor at his Senate hearing this week. substack.com/home/post/p-...

The Fed’s Independence on Trial. The full video and transcript of my livestream with @petercontibrown.bsky.social macroeconomicpolicynexus.substack.com/p/the-feds-i...

The Fed’s Independence on Trial

Trump’s firing of Lisa Cook sparks a showdown over who really controls America’s central bank.

macroeconomicpolicynexus.substack.com

September 2, 2025 at 9:40 PM

The Fed’s Independence on Trial. The full video and transcript of my livestream with @petercontibrown.bsky.social macroeconomicpolicynexus.substack.com/p/the-feds-i...

Reposted by David Beckworth

Great discussion between @davidbeckworth.bsky.social & @robin-j-brooks.bsky.social on the ways in which stablecoins are likely to increase, rather than undermine, dollar hegemony:

bsky.app/profile/davi...

bsky.app/profile/davi...

August 31, 2025 at 7:13 PM

Great discussion between @davidbeckworth.bsky.social & @robin-j-brooks.bsky.social on the ways in which stablecoins are likely to increase, rather than undermine, dollar hegemony:

bsky.app/profile/davi...

bsky.app/profile/davi...

Latest newsletter: macroeconomicpolicynexus.substack.com/p/dollar-dom...

Dollar Dominance in an Age of Stablecoins

Robin Brooks and I discuss why dollar dominance endures and how stablecoins may deepen it

macroeconomicpolicynexus.substack.com

August 31, 2025 at 2:58 PM

Latest newsletter: macroeconomicpolicynexus.substack.com/p/dollar-dom...

Fed independence is under serious threat.

🚨Tune in next Tuesday at 12pm ET to my

Substack Live Stream with @petercontibrown.bsky.social 🚨

We will discuss the firing of Federal Reserve Governor Lisa Cook, the future of Fed independence, and much more.

Link: open.substack.com/live-stream/...

🚨Tune in next Tuesday at 12pm ET to my

Substack Live Stream with @petercontibrown.bsky.social 🚨

We will discuss the firing of Federal Reserve Governor Lisa Cook, the future of Fed independence, and much more.

Link: open.substack.com/live-stream/...

August 29, 2025 at 7:44 PM

Fed independence is under serious threat.

🚨Tune in next Tuesday at 12pm ET to my

Substack Live Stream with @petercontibrown.bsky.social 🚨

We will discuss the firing of Federal Reserve Governor Lisa Cook, the future of Fed independence, and much more.

Link: open.substack.com/live-stream/...

🚨Tune in next Tuesday at 12pm ET to my

Substack Live Stream with @petercontibrown.bsky.social 🚨

We will discuss the firing of Federal Reserve Governor Lisa Cook, the future of Fed independence, and much more.

Link: open.substack.com/live-stream/...

Reposted by David Beckworth

Here's this morning's live stream on Stablecoins with @davidbeckworth.bsky.social who runs the Macro Musings podcast at the Mercatus Center at GMU. We debate if Stablecoins can boost demand for Dollars and thus could boost Dollar hegemony still further...

robinjbrooks.substack.com/p/live-strea...

robinjbrooks.substack.com/p/live-strea...

Live stream with David Beckworth, Senior Research Fellow at the Mercatus Center at GMU, on: “Will Stablecoins help or hurt the Dollar?”

A recording from Robin J Brooks's live video

robinjbrooks.substack.com

August 29, 2025 at 3:06 PM

Here's this morning's live stream on Stablecoins with @davidbeckworth.bsky.social who runs the Macro Musings podcast at the Mercatus Center at GMU. We debate if Stablecoins can boost demand for Dollars and thus could boost Dollar hegemony still further...

robinjbrooks.substack.com/p/live-strea...

robinjbrooks.substack.com/p/live-strea...

Reposted by David Beckworth

Also, per @tracyalloway.bsky.social, the real discussions at Jackson Hole this week will be about Fed independence. Some may invoke independence definitions (1) and (2) below in their conversations, but I think (4) is the real concern as I explain here: shorturl.at/Je7zB (2/2)

August 17, 2025 at 4:18 PM

Also, per @tracyalloway.bsky.social, the real discussions at Jackson Hole this week will be about Fed independence. Some may invoke independence definitions (1) and (2) below in their conversations, but I think (4) is the real concern as I explain here: shorturl.at/Je7zB (2/2)

New conversation on the importance of relationship building at Jackson Hole and other CB gatherings. When metrics aren't reliable and collateral values uncertain, CB relationships become paramount in financial crisis management, as shown by Aditi Sahasrabuddhe. (1/2)

youtube.com/shorts/ZgR1l...

youtube.com/shorts/ZgR1l...

Would you give someone a loan you didn’t like? | Macro Musings

YouTube video by Mercatus Center

youtube.com

August 19, 2025 at 2:55 PM

New conversation on the importance of relationship building at Jackson Hole and other CB gatherings. When metrics aren't reliable and collateral values uncertain, CB relationships become paramount in financial crisis management, as shown by Aditi Sahasrabuddhe. (1/2)

youtube.com/shorts/ZgR1l...

youtube.com/shorts/ZgR1l...

Reposted by David Beckworth

Since it is Jackson Hole week, my outlook and hope for the big reveal of the Fed's new framework. And my hopes for a few other Fed reforms: shorturl.at/tFW9f (1/2)

A Whole Lot of Fed and a Little Bit of Bitcoin

Strengthening U.S. monetary policy, from Jackson Hole to the blockchain.

shorturl.at

August 17, 2025 at 4:18 PM

Since it is Jackson Hole week, my outlook and hope for the big reveal of the Fed's new framework. And my hopes for a few other Fed reforms: shorturl.at/tFW9f (1/2)

Since it is Jackson Hole week, my outlook and hope for the big reveal of the Fed's new framework. And my hopes for a few other Fed reforms: shorturl.at/tFW9f (1/2)

A Whole Lot of Fed and a Little Bit of Bitcoin

Strengthening U.S. monetary policy, from Jackson Hole to the blockchain.

shorturl.at

August 17, 2025 at 4:18 PM

Since it is Jackson Hole week, my outlook and hope for the big reveal of the Fed's new framework. And my hopes for a few other Fed reforms: shorturl.at/tFW9f (1/2)

Latest newsletter

macroeconomicpolicynexus.substack.com/p/the-rise-a...

macroeconomicpolicynexus.substack.com/p/the-rise-a...

The Rise and Redemption of Stablecoins

From panic over Libra to a possible solution to the global financial cycle

macroeconomicpolicynexus.substack.com

August 8, 2025 at 5:24 PM

Latest newsletter

macroeconomicpolicynexus.substack.com/p/the-rise-a...

macroeconomicpolicynexus.substack.com/p/the-rise-a...

Reposted by David Beckworth

Yesterday I taped a Macro Musings episode with @davidbeckworth.bsky.social to discuss the global tariff war, why the US backed down against China in April, US reserve currency status plus secondary tariffs and sanctions on Russia’s shadow fleet. Episode will air on August 25. Huge thanks to David…

August 8, 2025 at 3:02 PM

Yesterday I taped a Macro Musings episode with @davidbeckworth.bsky.social to discuss the global tariff war, why the US backed down against China in April, US reserve currency status plus secondary tariffs and sanctions on Russia’s shadow fleet. Episode will air on August 25. Huge thanks to David…

Delighted to have @rashad-ahmed.bsky.social on the show this week to discuss the macro implications of crypto, including the potential dollarization of Europe via stablecoins, Fed's global role via stablecoins, tbill yields relationship to stablecoins, and more! (1/2) www.youtube.com/shorts/GrNsG...

How will US Dollar Stablecoins Effect the Global Impact of the Dollar? | Macro Musings

YouTube video by Mercatus Center

www.youtube.com

August 4, 2025 at 3:53 PM

Delighted to have @rashad-ahmed.bsky.social on the show this week to discuss the macro implications of crypto, including the potential dollarization of Europe via stablecoins, Fed's global role via stablecoins, tbill yields relationship to stablecoins, and more! (1/2) www.youtube.com/shorts/GrNsG...

Reposted by David Beckworth

@davidbeckworth.bsky.social 's interview with Paul Kupiec is really interesting. A major point is the fact that just some of the Regional Fed are losing money, not all

Paul Kupiec on Problems with the Fed’s Balance Sheet and Calls to End Interest on Reserves

Macro Musings with David Beckworth · Episode

open.spotify.com

August 3, 2025 at 8:20 PM

@davidbeckworth.bsky.social 's interview with Paul Kupiec is really interesting. A major point is the fact that just some of the Regional Fed are losing money, not all

🎙️Think you know Fed's balance sheet issues? Wait to you hear the Paul Kupiec show!🎙️

-Fed losses not shared by all Fed banks. Some still profitable!

-Fed can require private member banks to help recapitalize Fed's BS.

-The SOMA portfolio gets allocated across Fed banks.

youtu.be/Cxbx-mLF8bQ (1/2)

-Fed losses not shared by all Fed banks. Some still profitable!

-Fed can require private member banks to help recapitalize Fed's BS.

-The SOMA portfolio gets allocated across Fed banks.

youtu.be/Cxbx-mLF8bQ (1/2)

Paul Tupiec on the allocation of the Fed's SOMA portfolio across the Fed banks.

YouTube video by David Beckworth

youtu.be

July 28, 2025 at 7:24 PM

🎙️Think you know Fed's balance sheet issues? Wait to you hear the Paul Kupiec show!🎙️

-Fed losses not shared by all Fed banks. Some still profitable!

-Fed can require private member banks to help recapitalize Fed's BS.

-The SOMA portfolio gets allocated across Fed banks.

youtu.be/Cxbx-mLF8bQ (1/2)

-Fed losses not shared by all Fed banks. Some still profitable!

-Fed can require private member banks to help recapitalize Fed's BS.

-The SOMA portfolio gets allocated across Fed banks.

youtu.be/Cxbx-mLF8bQ (1/2)

My latest newsletter: macroeconomicpolicynexus.substack.com/p/the-consol...

The Consolidated Government Budget Constraint Does Not Care About Your Fed Independence Feelings

Missing the Fiscal Forest for the Trump Trees

macroeconomicpolicynexus.substack.com

July 25, 2025 at 6:37 PM

My latest newsletter: macroeconomicpolicynexus.substack.com/p/the-consol...

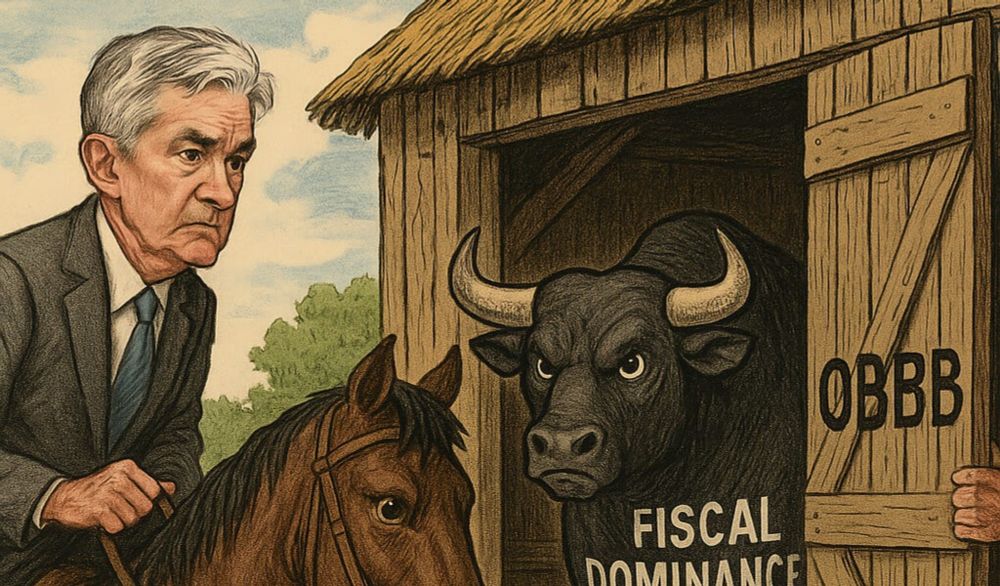

Latest newsletter on the drift to fiscal dominance in the United States. macroeconomicpolicynexus.substack.com/p/drifting-t...

Drifting Toward Fiscal Dominance

Why America's mounting debt, political rhetoric, and quiet regulatory shifts suggest we are on a journey to fiscal dominance.

macroeconomicpolicynexus.substack.com

July 16, 2025 at 8:12 PM

Latest newsletter on the drift to fiscal dominance in the United States. macroeconomicpolicynexus.substack.com/p/drifting-t...

Reposted by David Beckworth

New BIS Bulletin out!

“Retail investors in private credit”, with S Doerr & K Todorov, taking stock of the push pf PC towards retail, with a focus on BDCs & ETFs, & drawing implications

www.bis.org/publ/bisbull...

“Retail investors in private credit”, with S Doerr & K Todorov, taking stock of the push pf PC towards retail, with a focus on BDCs & ETFs, & drawing implications

www.bis.org/publ/bisbull...

Retail investors in private credit

Private credit is poised for wider participation from retail investors through the rapid growth of business development companies and, more recently, private credit exchange-traded funds (ETFs). ETFs ...

www.bis.org

July 9, 2025 at 11:59 AM

New BIS Bulletin out!

“Retail investors in private credit”, with S Doerr & K Todorov, taking stock of the push pf PC towards retail, with a focus on BDCs & ETFs, & drawing implications

www.bis.org/publ/bisbull...

“Retail investors in private credit”, with S Doerr & K Todorov, taking stock of the push pf PC towards retail, with a focus on BDCs & ETFs, & drawing implications

www.bis.org/publ/bisbull...