The @oppinsights.bsky.social WP: opportunityinsights.org/paper/credi...

Our non-technical summary: opportunityinsights.org/wp-content/...

And watch Nathan present LIVE TODAY at 10:45AM ET in the @NBER.org SI Household Finance session!

www.youtube.com/@NBERvideos...

The @oppinsights.bsky.social WP: opportunityinsights.org/paper/credi...

Our non-technical summary: opportunityinsights.org/wp-content/...

And watch Nathan present LIVE TODAY at 10:45AM ET in the @NBER.org SI Household Finance session!

www.youtube.com/@NBERvideos...

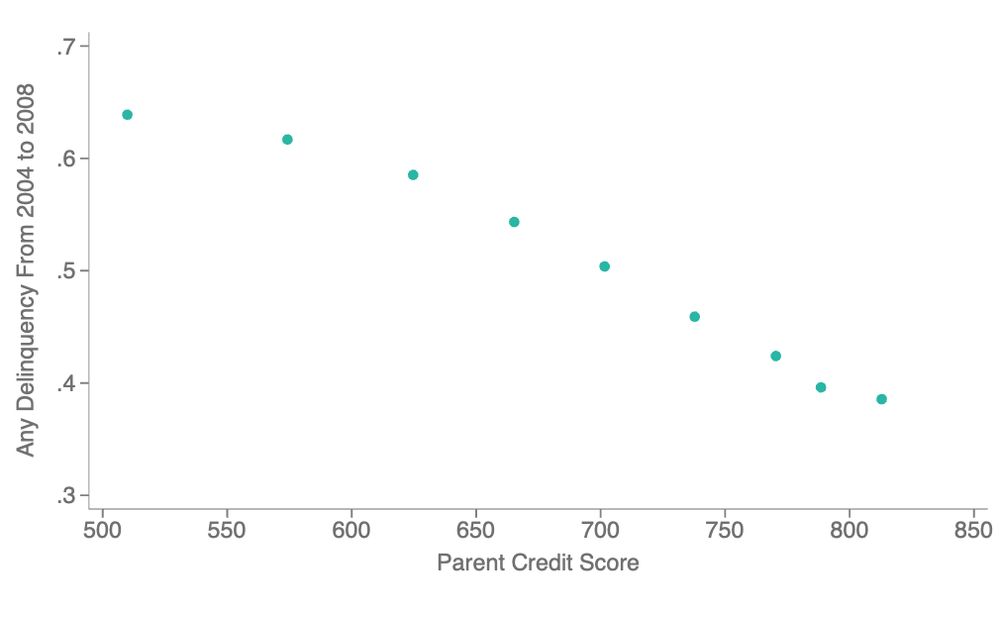

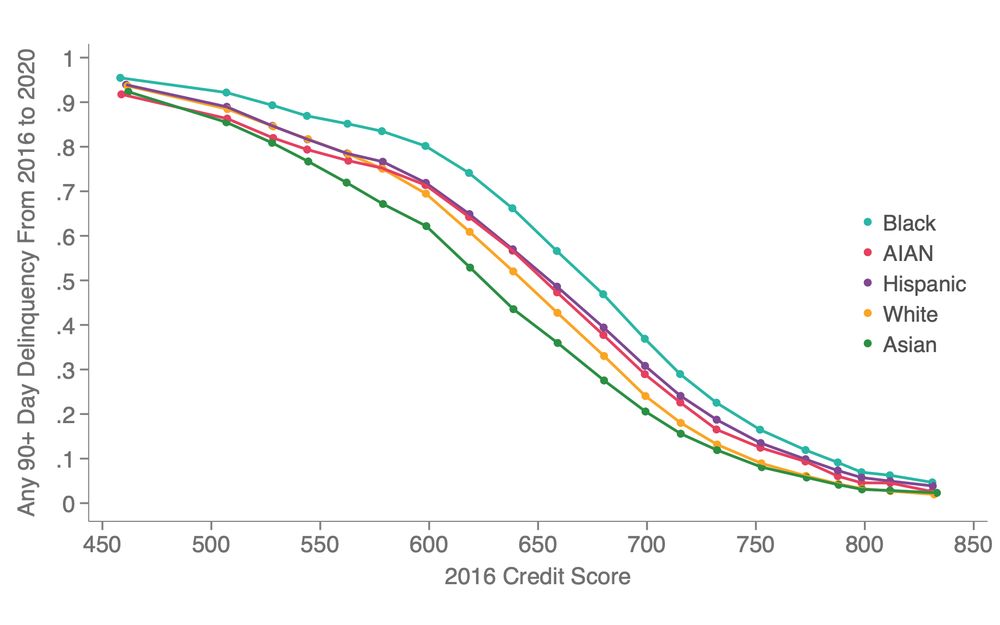

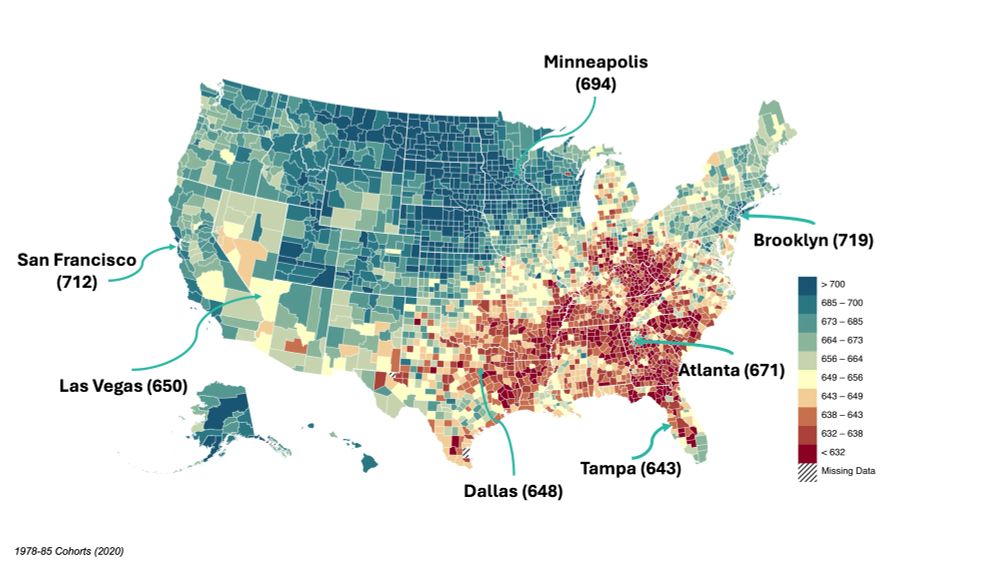

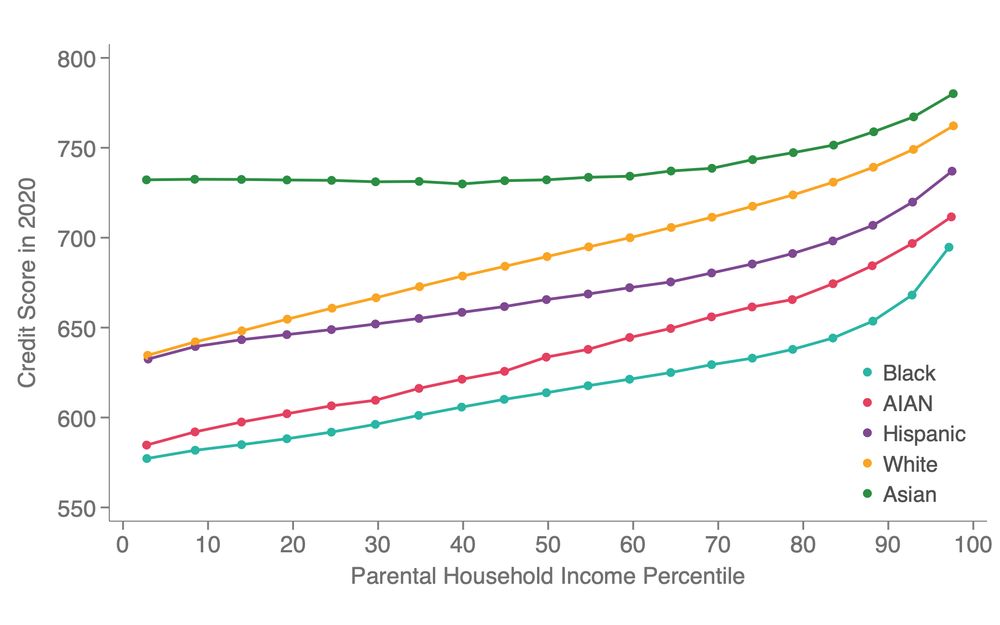

Consider credit scores—a metric lenders use to judge creditworthiness...

Consider credit scores—a metric lenders use to judge creditworthiness...

And thanks for the thoughtful feedback! The comments are much appreciated :)

And thanks for the thoughtful feedback! The comments are much appreciated :)