Henry Curr

@curr.bsky.social

Economics editor @TheEconomist. Visiting Fellow of Nuffield College, Oxford. Views mine only. www.henrycurr.com

If you think inflation was "truly transitory", do you think that interest rates should have followed the June 2021 SEP, which projected they would still be at 0.6% at the end of 2023 on the basis of the "transitory" theory?

Or even 1.6% at the end of 2023, which was the December 2021 SEP view?

Or even 1.6% at the end of 2023, which was the December 2021 SEP view?

November 6, 2025 at 7:45 PM

If you think inflation was "truly transitory", do you think that interest rates should have followed the June 2021 SEP, which projected they would still be at 0.6% at the end of 2023 on the basis of the "transitory" theory?

Or even 1.6% at the end of 2023, which was the December 2021 SEP view?

Or even 1.6% at the end of 2023, which was the December 2021 SEP view?

I agree with @marketscalpel.bsky.social , @martinsandbu.ft.com . The trust fund outgoings aren't interest. However, for argument's sake, this metric is still going way out of historical bounds:

October 23, 2025 at 6:42 PM

I agree with @marketscalpel.bsky.social , @martinsandbu.ft.com . The trust fund outgoings aren't interest. However, for argument's sake, this metric is still going way out of historical bounds:

Federal net interest payments minus Fed profits is already the highest on a record going back to 1962

October 23, 2025 at 4:15 PM

Federal net interest payments minus Fed profits is already the highest on a record going back to 1962

"Stop worrying about public debt" says @martinsandbu.ft.com, citing US gross federal interest payments / GDP as being in the middle of the historical range.

But that measure includes interest the govt pays to itself.

Net interest / GDP is near historical highs. And then look at the forecast...

But that measure includes interest the govt pays to itself.

Net interest / GDP is near historical highs. And then look at the forecast...

October 23, 2025 at 11:20 AM

"Stop worrying about public debt" says @martinsandbu.ft.com, citing US gross federal interest payments / GDP as being in the middle of the historical range.

But that measure includes interest the govt pays to itself.

Net interest / GDP is near historical highs. And then look at the forecast...

But that measure includes interest the govt pays to itself.

Net interest / GDP is near historical highs. And then look at the forecast...

Trade deficits just don’t measure what President Trump thinks they do. Why the tariffs are among the most profound and harmful economic policy mistakes of the modern era ⬇️

April 6, 2025 at 11:53 AM

Trade deficits just don’t measure what President Trump thinks they do. Why the tariffs are among the most profound and harmful economic policy mistakes of the modern era ⬇️

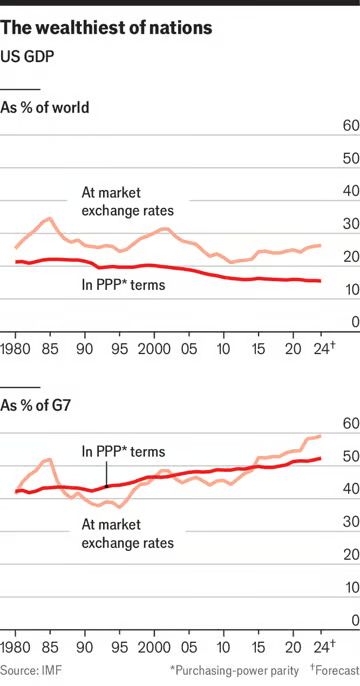

You're right at market exchange-rates. But (most people think) the market exchange rates, ie dollar strength, reflect US hegemony, so the logic is circular. At PPP the decline is clear

March 27, 2025 at 12:57 PM

You're right at market exchange-rates. But (most people think) the market exchange rates, ie dollar strength, reflect US hegemony, so the logic is circular. At PPP the decline is clear

If the ageing population was the first budget shock for which British politics was unprepared, the next is the loss of the peace dividend:

February 18, 2025 at 9:35 AM

If the ageing population was the first budget shock for which British politics was unprepared, the next is the loss of the peace dividend:

The earlier working paper was the most striking bit of research we reported on our cover in 2019.

"Inequality could be lower than you think"

www.economist.com/leaders/2019...

"Economist are rethinking the numbers on inequality"

www.economist.com/briefing/201...

(Second piece more technical.)

"Inequality could be lower than you think"

www.economist.com/leaders/2019...

"Economist are rethinking the numbers on inequality"

www.economist.com/briefing/201...

(Second piece more technical.)

November 19, 2023 at 4:44 PM

The earlier working paper was the most striking bit of research we reported on our cover in 2019.

"Inequality could be lower than you think"

www.economist.com/leaders/2019...

"Economist are rethinking the numbers on inequality"

www.economist.com/briefing/201...

(Second piece more technical.)

"Inequality could be lower than you think"

www.economist.com/leaders/2019...

"Economist are rethinking the numbers on inequality"

www.economist.com/briefing/201...

(Second piece more technical.)

Economists Gerald Auten and David Splinter find essentially *no change* in the share of income, after tax, going to America's top 1% since the 1960s. It's forthcoming in one of the top 5 economics journals (JPE).

Ie, one of the ideas behind a lot of 2010s political discourse could be wrong.

Ie, one of the ideas behind a lot of 2010s political discourse could be wrong.

November 19, 2023 at 4:42 PM

Economists Gerald Auten and David Splinter find essentially *no change* in the share of income, after tax, going to America's top 1% since the 1960s. It's forthcoming in one of the top 5 economics journals (JPE).

Ie, one of the ideas behind a lot of 2010s political discourse could be wrong.

Ie, one of the ideas behind a lot of 2010s political discourse could be wrong.