y/y change (as per Quarterly data)

Men's clothing -0.1% - Women's clothing +2.6%

Men's shoes -1.8% - Women's shoes +5.4%

Maybe more women should start wearing men's cloths and shoes.

y/y change (as per Quarterly data)

Men's clothing -0.1% - Women's clothing +2.6%

Men's shoes -1.8% - Women's shoes +5.4%

Maybe more women should start wearing men's cloths and shoes.

July CPI > than expctd 2.8%

But 3-month avg (tracks well w/ qtrly data)

CPI 2.3%

Core 2.4%

Core stable & below midpoint of target

Likely moderate mkt f'cast of rate cuts

Unlikely cause major shift in RBA's thinking

Underscores why RBA surprised & held rates in Jul

July CPI > than expctd 2.8%

But 3-month avg (tracks well w/ qtrly data)

CPI 2.3%

Core 2.4%

Core stable & below midpoint of target

Likely moderate mkt f'cast of rate cuts

Unlikely cause major shift in RBA's thinking

Underscores why RBA surprised & held rates in Jul

It's all been about the increase in female propensity to engage in the labour force.

It's all been about the increase in female propensity to engage in the labour force.

NSW +1.3%

QLD +1.9%

Also...Queensland Trend employment breaks through 3 million for the first time.

NSW +1.3%

QLD +1.9%

Also...Queensland Trend employment breaks through 3 million for the first time.

Both house prices and rents are now up 60% since 2016.

Unit rent increases are still about 10% above price gains.

Both house prices and rents are now up 60% since 2016.

Unit rent increases are still about 10% above price gains.

Juvenile crime in QLD peaked back at the end of 2022 and has been falling virtually ever since. #QLD

Juvenile crime in QLD peaked back at the end of 2022 and has been falling virtually ever since. #QLD

3-month averages of the monthly data show CPI 2.4% and Trimmed Mean 2.7%...both unchanged from March.

No reason here for RBA *not* to cut further, but no reason for urgency either!

3-month averages of the monthly data show CPI 2.4% and Trimmed Mean 2.7%...both unchanged from March.

No reason here for RBA *not* to cut further, but no reason for urgency either!

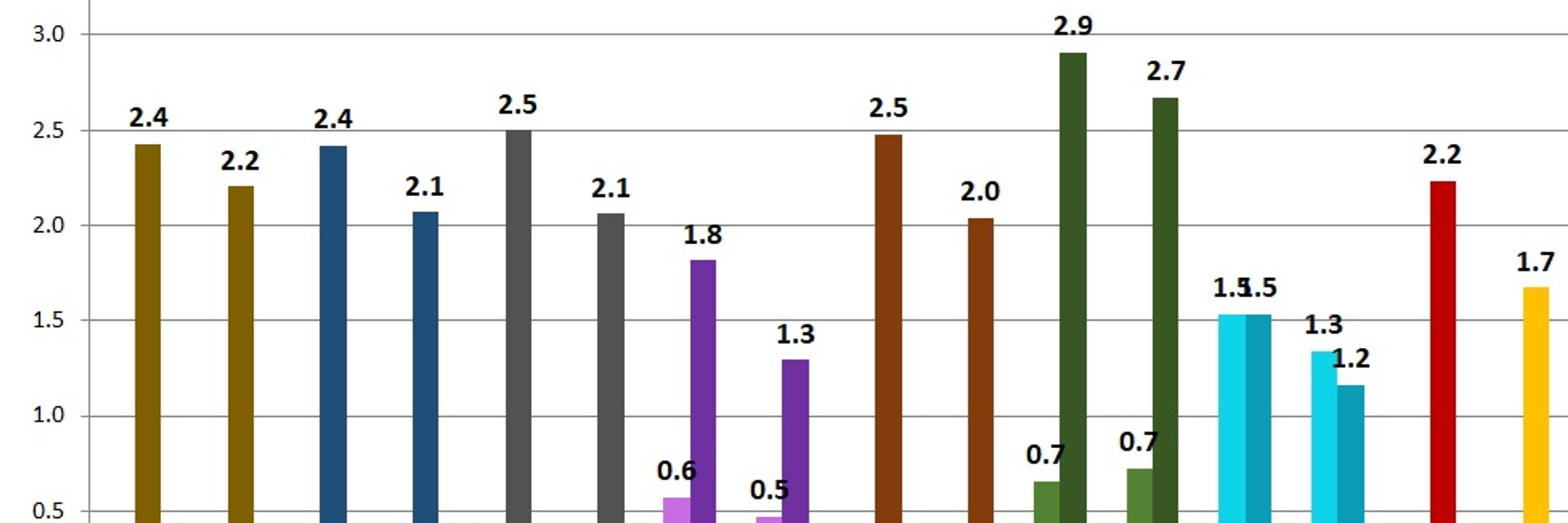

CPI +0.9% / +2.4%

Trimmed Mean +0.7% / +2.9%

Tradables -0.4% / +0.9%

Non-tradables +1.6% / +3.2%

Discretionary -0.2% / +2.5%

Non-discretionary +1.8% / +2.3%

CPI +0.9% / +2.4%

Trimmed Mean +0.7% / +2.9%

Tradables -0.4% / +0.9%

Non-tradables +1.6% / +3.2%

Discretionary -0.2% / +2.5%

Non-discretionary +1.8% / +2.3%

However, an avg of 100 approvals/month is clearly nowhere near enough for either region!

However, an avg of 100 approvals/month is clearly nowhere near enough for either region!

AUS -8.4%

NSW -7.3%

VIC -18.2%

QLD -2.5%

SA -10.2%

WA -14.0%

TAS -12.5%

NT +11.2%

ACT -13.4%

AUS -8.4%

NSW -7.3%

VIC -18.2%

QLD -2.5%

SA -10.2%

WA -14.0%

TAS -12.5%

NT +11.2%

ACT -13.4%

Area under cane up

Number of businesses down (consolidation)

Total production down (poor season)

But.......Total value up HUGE (sugar prices!)

Area under cane up

Number of businesses down (consolidation)

Total production down (poor season)

But.......Total value up HUGE (sugar prices!)

WPI +3.2% y/y

CPI +2.4% y/y

Trimmed Mean +3.2% y/y

Here's your reminder of what all that means with some long term context.

WPI +3.2% y/y

CPI +2.4% y/y

Trimmed Mean +3.2% y/y

Here's your reminder of what all that means with some long term context.

Trend

Unemployment rate AUS 4.0% (unch), QLD 3.9% (unch)

The long-term male/female PR gap closing

Employment growth running well ahead of population. AUS +3.0%, QLD +3.5%

Trend

Unemployment rate AUS 4.0% (unch), QLD 3.9% (unch)

The long-term male/female PR gap closing

Employment growth running well ahead of population. AUS +3.0%, QLD +3.5%