(www.dallasfed.org/research/sur...)

(www.dallasfed.org/research/sur...)

Going into 2024, they told investors that the good times were here to stay.

So how has it worked out? My latest for IEEFA:

ieefa.org/resources/an...

Going into 2024, they told investors that the good times were here to stay.

So how has it worked out? My latest for IEEFA:

ieefa.org/resources/an...

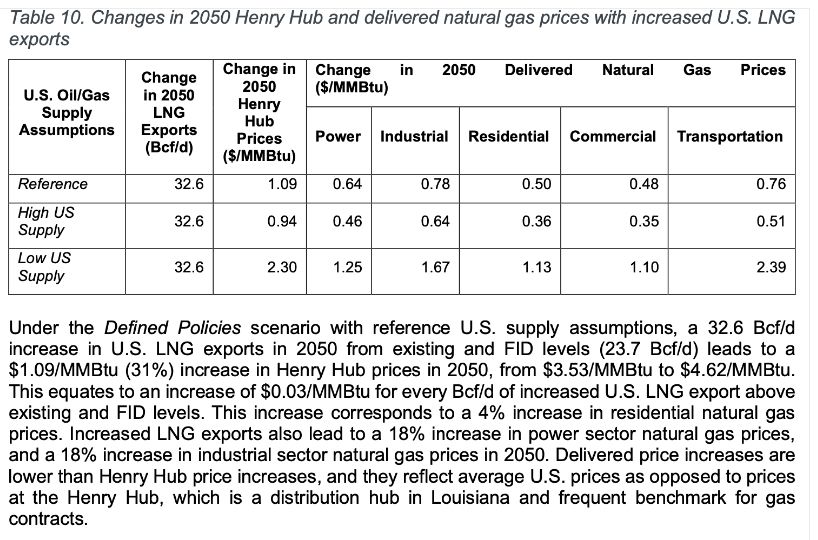

www.energy.gov/sites/defaul...

www.energy.gov/sites/defaul...

x.com/ArnabDatta32...

x.com/ArnabDatta32...

Our new report, out today from IEEFA: ieefa.org/resources/pa...

(Enjoy, EnergySky and ClimateSky friends 🔌💡!)

Our new report, out today from IEEFA: ieefa.org/resources/pa...

(Enjoy, EnergySky and ClimateSky friends 🔌💡!)